Angel Oak’s Conversions Bring New Opportunities

to Advisors, Investors Seeking Actively Managed ETFs in Structured

Credit and High Yield

Angel Oak Capital Advisors, LLC, an investment management firm

that specializes in value-driven structured credit investing,

announced the completed conversions of two of its mutual funds to

exchange-traded funds. The Angel Oak High Yield Opportunities Fund,

which, as of 1/31/24, received a 5-Star Overall Morningstar Rating

based on risk-adjusted returns out of 614 high yield bond funds,

and the Angel Oak Total Return Bond Fund are ETFs as of February

16. The funds’ new names are Angel Oak High Yield Opportunities ETF

(NYSE: AOHY) and Angel Oak Mortgage-Backed Securities ETF (NYSE:

MBS), respectively.

The conversion underscores the positive momentum for Angel Oak’s

ETF platform since launching in November of 2022. MBS and AOHY

recently joined Angel Oak’s Income ETF (NYSE: CARY) and UltraShort

Income ETF (NYSE: UYLD). The firm’s four ETFs combined have

approximately $350 million in assets under management, and the

firm’s ETF platform, including its sub-advisory services, has

approximately $500 million in AUM. Angel Oak plans to broaden the

new ETFs’ availability to its core investor audience; both MBS and

AOHY will be available on major custodial platforms as well as

wirehouse and independent broker-dealer platforms.

“We continue to be pleased with the response of our actively

managed ETF products, and the latest conversions show our

commitment to providing investors with unique options for

income-driven solutions within the structured credit space,” said

Sreeni Prabhu, managing partner and group chief investment officer

for Angel Oak. “As leaders in structured credit investing, we’re

dedicated to aligning our leading-edge solutions with investors’

goals.”

The MBS ETF will be an actively managed, pure-play residential

mortgage credit ETF seeking to deliver stable income and price

appreciation through both agency and non-agency residential

mortgage-backed securities (RMBS). The specific RMBS focus

separates this ETF from others in the market whose exposure to

residential credit, if any, is typically offered via passive

exposure to agency mortgage-backed securities. The fund is backed

by Angel Oak’s team of RMBS experts, which has been investing in

this area for more than 15 years.

The AOHY ETF has a strong track record, spanning approximately

15 years, of providing investors with a differentiated approach in

the high-yield sector. This actively managed ETF seeks to invest in

higher-quality, high-yield corporate bonds and securitized credit

assets — a rarity among high-yield ETFs, which tend to be

homogenous and benchmark trackers. Angel Oak has appointed a

seasoned team of portfolio managers to lead the fund. They have

more than 25 years of experience navigating corporate and

securitized debt and have overseen the firm’s five-star

Morningstar-rated high-yield bond fund since 2009.

“The successful conversion of these ETFs demonstrates Angel

Oak’s emerging leadership in both the ETF landscape and,

critically, in securitized credit investing,” said Ward Bortz, ETF

portfolio manager and the head of distribution for U.S. wealth for

Angel Oak. “Investors coming over the hill of the recent bond bear

market acknowledge the increased appeal of securitized credit and

its potential returns, driving forward demand for these strategies.

The debut of MBS and AOHY ETFs is Angel Oak’s next step forward in

bringing our top-of-the-line, innovative strategies to investors in

the market for accessible, liquid investment vehicles.”

To learn more about Angel Oak’s ETF offerings, click here.

About Angel Oak Capital Advisors, LLC

Angel Oak is an investment management firm focused on providing

compelling fixed-income investment solutions to its clients. Backed

by a value-driven approach, Angel Oak seeks to deliver attractive,

risk-adjusted returns through a combination of stable current

income and price appreciation. Its experienced investment team

seeks the best opportunities in fixed income, with a specialization

in mortgage-backed securities and other areas of structured

credit.

Net Total Returns as of 12/31/23

1 YR

3 YR

5 YR

10 YR

Angel Oak High Yield Opportunities Fund

Instl. (ANHIX)

12.54%

3.32%

5.73%

4.95%

Bloomberg U.S. Corporate High Yield

Index

13.44%

1.98%

5.37%

4.60%

Current performance may be lower or higher than performance data

quoted. Performance quoted is past performance and is no guarantee

of future results. The investment return and principal value of an

investment in a fund will fluctuate so that an investor’s shares,

when redeemed, may be worth more or less than their original cost.

Current performance to the most recent month end can be obtained by

calling 855-751-4324 or by visiting angeloakcapital.com.

The Angel Oak High Yield Opportunities ETF is the Successor Fund

to The Angel Oak High Yield Opportunities Fund, which was

reorganized into the ETF on 2/16/24. As a result of the conversion,

the Fund adopted the accounting and performance history of its

predecessor mutual fund. Performance results shown prior to

2/16/24, reflect the performance of the predecessor mutual fund.

The NAV returns shown prior to 2/16/24 reflects the NAV of

predecessor mutual fund’s Institutional shares. Performance for the

mutual fund has not been adjusted to reflect the ETF’s expenses.

Had the mutual fund been structured as an ETF, its performance may

have differed. The ETF has the same investment objective and

investment strategy as the mutual fund, and performance of the ETF

may differ from that of the Fund. On 12/31/22, changes were made to

the Fund’s investment strategies; performance during period prior

to this date may have differed had the Fund’s current strategies

been in place at those times.

The inception date of the High Yield Opportunities Fund I Class

(ANHIX) was 3/31/09. Gross and net expense ratios (0.99% and 0.56%,

respectively) are reported as of the 5/31/23 prospectus. The

Adviser has contractually agreed to waive its fees to limit the

Total Annual Fund Operating Expenses After Fee Waiver/Expense

Reimbursement to 0.55% of the Fund’s average daily net assets

through 5/31/24.

AOHY

MBS

Gross Expense Ratio*

0.55%

0.79%

Net Expense Ratio*

0.55%

0.49%

*Gross and net expense ratios are reported as of the 1/19/24

prospectus. For MBS, the Adviser has contractually agreed to waive

its fees to limit the Total Annual Fund Operating Expenses After

Fee Waiver/Expense Reimbursement to 0.49% of the Fund’s average

daily net assets through 9/30/25.

As of 1/31/24, the Angel Oak High Yield Opportunities Fund

(ANHIX) received a Morningstar rating based on risk-adjusted

returns of 5 stars overall, 4 stars for the three-year period, 4

stars for the five-year period, and 5 stars for the ten-year period

among 614, 614, 581, and 434 high yield bond funds. The Morningstar

Rating™ for funds, or “star rating”, is calculated for managed

products (including mutual funds, variable annuity and variable

life subaccounts, exchange-traded funds, closed-end funds, and

separate accounts) with at least a three-year history.

Exchange-traded funds and open-ended mutual funds are considered a

single population for comparative purposes. It is calculated based

on a Morningstar Risk-Adjusted Return measure that accounts for

variation in a managed product's monthly excess performance,

placing more emphasis on downward variations and rewarding

consistent performance. The Morningstar Rating does not include any

adjustment for sales loads. The top 10% of products in each product

category receive 5 stars, the next 22.5% receive 4 stars, the next

35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom

10% receive 1 star. The Overall Morningstar Rating for a managed

product is derived from a weighted average of the performance

figures associated with its three-, five-, and 10-year (if

applicable) Morningstar Rating metrics. The weights are: 100%

three-year rating for 36-59 months of total returns, 60% five-year

rating/40% three-year rating for 60-119 months of total returns,

and 50% 10-year rating/30% five-year rating/20% three-year rating

for 120 or more months of total returns. While the 10-year overall

star rating formula seems to give the most weight to the 10- year

period, the most recent three-year period actually has the greatest

impact because it is included in all three rating periods.

Bloomberg U.S. Corporate High Yield Index: An unmanaged

market value-weighted index that covers the universe of fixed-rate,

non-investment grade debt.

Investors should carefully consider the investment

objectives, risks, charges and expenses of the funds. This and

other important information about the funds is contained in the

Prospectus which can be obtained by calling Shareholder Services at

855-751-4324 or from www.angeloakcapital.com. The Prospectus should

be read carefully before investing.

Investing involves risk; principal loss is possible.

Investments in debt securities typically decrease when interest

rates rise. This risk is usually greater for longer-term debt

securities. Investments in lower-rated and nonrated securities

present a greater risk of loss to principal and interest than

higher-rated securities do. Investments in asset-backed and

mortgage-backed securities include additional risks that investors

should be aware of, including credit risk, prepayment risk,

possible illiquidity, and default, as well as increased

susceptibility to adverse economic developments. Derivatives

involve risks different from—and in certain cases, greater than—the

risks presented by more traditional investments. Derivatives may

involve certain costs and risks such as illiquidity, interest rate,

market, credit, management, and the risk that a position could not

be closed when most advantageous. Investing in derivatives could

lead to losses that are greater than the amount invested. The Fund

may use leverage, which may exaggerate the effect of any increase

or decrease in the value of securities in the Fund’s portfolio or

higher and duplicative expenses when it invests in mutual funds,

ETFs, and other investment companies. The Funds are a recently

organized investment company with limited operating history. As a

result, prospective investors have a limited track record or

history on which to base their investment decisions. For more

information on these risks and other risks of the Fund, please see

the Prospectus.

ETFs may trade at a premium or discount to NAV. Shares of any

ETF are bought and sold at market prices (not NAV) and are not

individually redeemed from the Fund. Brokerage commissions will

reduce returns. The Fund is an actively managed ETF, which is a

fund that trades like other publicly-traded securities. The Fund is

not an index fund and does not seek to replicate the performance of

a specified index.

The Angel Oak Funds are distributed by Quasar Distributors,

LLC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240220285735/en/

Media: Trevor Davis, Gregory FCA for Angel Oak Capital Advisors

443-248-0359 trevor@gregoryfca.com

Company: Randy Chrisman, Chief Marketing and Corporate IR

Officer, Angel Oak Capital Advisors 404-953-4969

randy.chrisman@angeloakcapital.com

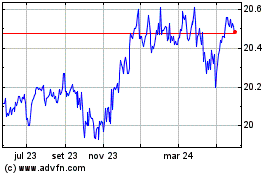

Angel Oak Income ETF (AMEX:CARY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

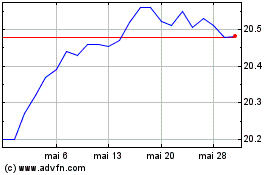

Angel Oak Income ETF (AMEX:CARY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025