Specialty Closures for Use in Carbon Capture

and Storage Systems

Sypris Technologies, Inc., a subsidiary of Sypris Solutions,

Inc. (Nasdaq/GM: SYPR), announced today that it has recently

received an award to supply specialty high-pressure closures for

use in the Gorgon Project to support the optimization of the

existing carbon capture and storage facilities. Shipments under

this award are anticipated to be completed by year-end 2024. Terms

of the order were not disclosed.

The Gorgon Project is one of the world’s largest natural gas

projects. The project is located on Barrow Island, Australia and is

comprised of three trains with a combined capacity of 15.6 million

tonnes of gas per annum, and a domestic gas plant, according to

news sources. This project is expected to be an important pillar of

the Australian economy for decades to come. Unlocking this energy

is expected to put Australia in a prime position to meet future

demand and provide a clean-burning fuel, both at home and

overseas.

The project includes CO2 injection and is poised to reach a

significant milestone at its Gorgon LNG facility, injecting and

trapping five million tonnes of greenhouse gas (carbon dioxide

equivalent, CO2e) into a giant sandstone formation two kilometers

under Barrow Island, since safely starting the system in August

2019, according to news sources. The milestone would represent the

largest volume of injection achieved within this timeframe by any

environmental carbon capture and storage system of comparable

specifications. Injecting five million tonnes of CO2 is equivalent

to taking more than 1.6 million passenger vehicles off Australia’s

roads for a year.

Sypris has agreed to manufacture and supply its Tube

Turns®-branded specialty, high-pressure Tool-less® closures for use

on the filtration systems for the project. These closures will be

44 inches in diameter, will be rated to a pressure of 710 psi and

include full wetted surface overlay with Inconel Alloy 625, a

nickel-based superalloy that possesses high strength properties and

resistance to elevated temperatures.

Brett Keener, General Manager, commented, "Sypris continues to

be a leader in supplying high-pressure specialty closures to

support energy projects globally. By leveraging our extensive

engineering design and manufacturing expertise, we believe we are

uniquely qualified to support these types of demanding

requirements. We are proud to be a part of a project with a goal to

help provide clean, reliable energy and reduce the world’s carbon

footprint."

Sypris Technologies, Inc., Tube Turns Products, is a global

leader in the manufacture of custom engineered products for high

pressure critical applications serving multiple industries such as

the oil and gas pipeline, hydrocarbon and petrochemical processing,

food, pharmaceutical, water and utility since 1927. Headquartered

in Louisville, Kentucky, the Company's products are marketed

worldwide, and can be found in projects ranging from the

Trans-Alaska Pipeline and Strategic Petroleum Reserve in the U.S.

to the Tengiz Oil Field in Kazakhstan and the Bonny Island Gas

Field in Nigeria. For more information about the Company, visit its

Web site at www.sypris.com.

Forward-Looking Statements

This press release contains “forward-looking” statements

within the meaning of the federal securities laws. Forward-looking

statements include our plans and expectations of future financial

and operational performance. Each forward-looking statement herein

is subject to risks and uncertainties, as detailed in our most

recent Form 10-K and Form 10-Q and other SEC filings. Briefly,

we currently believe that such risks also include the following:

our failure to achieve profitability on a timely basis by steadily

increasing our revenues from profitable contracts with a

diversified group of customers, which would cause us to continue to

use existing cash resources or require us to sell assets to fund

operating losses; the fees, costs and supply of, or access to,

debt, equity capital, or other sources of liquidity; risks of

foreign operations, including foreign currency exchange rate risk

exposure, which could impact our operating results; cost, quality

and availability or lead times of raw materials such as steel,

component parts , natural gas or utilities including increased cost

relating to inflation; dependence on, retention or recruitment of

key employees and highly skilled personnel and distribution of our

human capital; the cost and availability of full-time accounting

personnel with technical accounting knowledge to execute, review

and approve all aspects of the financial statement close and

reporting process; the cost, quality, timeliness, efficiency and

yield of our operations and capital investments, including the

impact of inflation, tariffs, product recalls or related

liabilities, employee training, working capital, production

schedules, cycle times, scrap rates, injuries, wages, overtime

costs, freight or expediting costs; volatility of our customers’

forecasts and our contractual obligations to meet current

scheduling demands and production levels, which may negatively

impact our operational capacity and our effectiveness to integrate

new customers or suppliers, and in turn cause increases in our

inventory and working capital levels; our failure to successfully

complete final contract negotiations with regard to our announced

contract “orders”, “wins” or “awards”; significant delays or

reductions due to a prolonged continuing resolution or U.S.

government shut down reducing the spending on products and

services; adverse impacts of new technologies or other competitive

pressures which increase our costs or erode our margins;

breakdowns, relocations or major repairs of machinery and

equipment, especially in our Toluca Plant; the termination or

non-renewal of existing contracts by customers; the costs and

supply of insurance on acceptable terms and with adequate coverage;

the costs of compliance with regulatory or contractual obligations;

pension valuation, health care or other benefit costs; our reliance

on revenues from customers in the oil and gas and automotive

markets, with increasing consumer pressure for reductions in

environmental impacts attributed to greenhouse gas emissions and

increased vehicle fuel economy; our failure to successfully win new

business or develop new or improved products or new markets for our

products; war, geopolitical conflict, terrorism, political

uncertainty, or disruptions resulting from the Russia-Ukraine war

or the Israel and Gaza conflict, including arising out of

international sanctions, foreign currency fluctuations and other

economic impacts; our reliance on a few key customers, third party

vendors and sub-suppliers; inventory valuation risks including

excessive or obsolescent valuations or price erosions of raw

materials or component parts on hand or other potential

impairments, non-recoverability or write-offs of assets or deferred

costs; disputes or litigation involving governmental, supplier,

customer, employee, creditor, stockholder, product liability,

warranty or environmental claims; failure to adequately insure or

to identify product liability, environmental or other insurable

risks; unanticipated or uninsured product liability claims,

disasters, public health crises, losses or business risks; labor

relations; strikes; union negotiations; costs associated with

environmental claims relating to properties previously owned; our

inability to patent or otherwise protect our inventions or other

intellectual property rights from potential competitors or fully

exploit such rights which could materially affect our ability to

compete in our chosen markets; changes in licenses, or other legal

rights to operate, manage our work force or import and export as

needed; cyber security threats and disruptions, including

ransomware attacks on our systems and the systems of third-party

vendors and other parties with which we conduct business, all of

which may become more pronounced in the event of geopolitical

conflicts and other uncertainties, such as the conflict in Ukraine;

our ability to maintain compliance with the Nasdaq listing

standards minimum closing bid price; risks related to owning our

common stock, including increased volatility; possible public

policy response to a public health emergency, including U. S or

foreign government legislation or restrictions that may impact our

operations or supply chain; or unknown risks and uncertainties and

the risk factors disclosed in Item 1A of our Annual Report on Form

10-K for the fiscal year ended December 31, 2022. We undertake no

obligation to update our forward-looking statements, except as may

be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240304630972/en/

Brett H. Keener General Manager (502)

774-6271

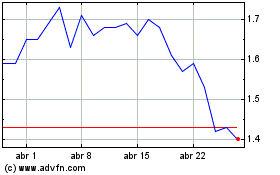

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

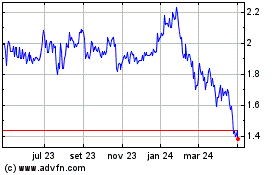

Sypris Solutions (NASDAQ:SYPR)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024