MarineMax Announces New Stock Repurchase Program

11 Março 2024 - 9:00AM

Business Wire

MarineMax, Inc. (NYSE: HZO), the world’s largest recreational

boat, yacht and superyacht services company, today announced that

its Board of Directors approved a new stock repurchase plan. Under

the plan, the Company is authorized to repurchase up to $100

million of its common stock during the period beginning today and

ending March 31, 2026. This plan replaces the March 2020 plan (the

“2020 plan”), as amended, which authorized the repurchase of up to

10 million shares and which was set to expire on March 31, 2024.

Approximately 1,080,000 shares had been repurchased under the 2020

plan as of March 5, 2024.

The new stock repurchase program allows MarineMax to purchase

common stock from time to time in the open market or in privately

negotiated block purchase transactions. The number of shares

purchased and the timing of any purchases will depend upon a number

of factors, including the price and availability of the Company’s

stock and general market conditions. The Company intends to

repurchase shares to mitigate the dilutive effect of restricted

stock, and shares repurchased may be reserved for later reissue in

connection with employee benefit plans and other general corporate

purposes.

As of March 5, 2024, the Company had 22,299,588 shares of common

stock outstanding.

About MarineMax As the world’s largest lifestyle retailer

of recreational boats and yachts, as well as yacht concierge and

superyacht services, MarineMax (NYSE: HZO) is United by Water. We

have over 130 locations worldwide, including 83 dealerships and 66

marina and storage facilities. Our integrated business includes IGY

Marinas, which operates luxury marinas in yachting and sport

fishing destinations around the world; Fraser Yachts Group and

Northrop & Johnson, leading superyacht brokerage and luxury

yacht services companies; Cruisers Yachts, one of the world’s

premier manufacturers of premium sport yachts and motor yachts; and

Intrepid Powerboats, a premier manufacturer of powerboats. To

enhance and simplify the customer experience, we provide financing

and insurance services as well as leading digital technology

products that connect boaters to a network of preferred marinas,

dealers, and marine professionals through Boatyard and Boatzon. In

addition, we operate MarineMax Vacations in Tortola, British Virgin

Islands, which offers our charter vacation guests the luxury

boating adventures of a lifetime. Land comprises 29% of the earth’s

surface. We’re focused on the other 71%. Learn more at

www.marinemax.com.

Forward Looking Statement Certain statements in this

press release are forward-looking as defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements include those regarding the Company’s potential

repurchases of its common stock and the means by which such

repurchases are made. These statements involve certain risks and

uncertainties that may cause actual results to differ materially

from expectations as of the date of this release. These risks

include significant changes in the price and availability of the

Company’s stock, general economic conditions, as well as those

within our industry, and numerous other factors identified in the

Company’s Form 10-K for the fiscal year ended September 30, 2023

and other filings with the Securities and Exchange Commission. The

Company disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240308070512/en/

Investors: Michael H. McLamb Chief Financial Officer

727-531-1700 investors@marinemax.com

Scott Solomon or Laura Resag Sharon Merrill Advisors

investors@marinemax.com 617-542-5300

Media: Abbey Heimensen Abbey.Heimensen@marinemax.com

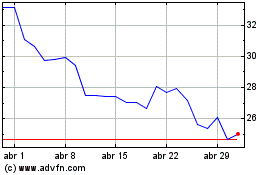

MarineMax (NYSE:HZO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

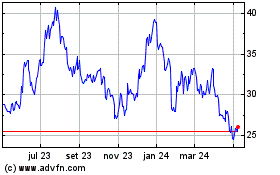

MarineMax (NYSE:HZO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024