Form 8-K - Current report

11 Março 2024 - 5:00PM

Edgar (US Regulatory)

false000105706000010570602024-03-112024-03-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 11, 2024 |

MarineMax, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Florida |

1-14173 |

59-3496957 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2600 McCormick Drive Suite 200 |

|

Clearwater, Florida |

|

33759 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 727 531-1700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $.001 per share |

|

HZO |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On March 11, 2024, the Company issued a press release announcing a new stock repurchase program. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

Press release of MarineMax, Inc. dated March 11, 2024.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

MarineMax, Inc. |

|

|

|

|

Date: |

March 11, 2024 |

By: |

/s/ Michael H. McLamb |

|

|

|

Name: Michael H. McLamb

Title: Executive Vice President, Chief Financial Officer and Secretary

|

Exhibit 99.1

MarineMax Announces New Stock Repurchase Program

Clearwater, Florida, March 11, 2024 – MarineMax, Inc. (NYSE: HZO), the world’s largest recreational boat, yacht and superyacht services company, today announced that its Board of Directors approved a new stock repurchase plan. Under the plan, the Company is authorized to repurchase up to $100 million of its common stock during the period beginning today and ending March 31, 2026. This plan replaces the March 2020 plan (the “2020 plan”), as amended, which authorized the repurchase of up to 10 million shares and which was set to expire on March 31, 2024. Approximately 1,080,000 shares had been repurchased under the 2020 plan as of March 5, 2024.

The new stock repurchase program allows MarineMax to purchase common stock from time to time in the open market or in privately negotiated block purchase transactions. The number of shares purchased and the timing of any purchases will depend upon a number of factors, including the price and availability of the Company’s stock and general market conditions. The Company intends to repurchase shares to mitigate the dilutive effect of restricted stock, and shares repurchased may be reserved for later reissue in connection with employee benefit plans and other general corporate purposes.

As of March 5, 2024, the Company had 22,299,588 shares of common stock outstanding.

About MarineMax

As the world’s largest lifestyle retailer of recreational boats and yachts, as well as yacht concierge and superyacht services, MarineMax (NYSE: HZO) is United by Water. We have over 130 locations worldwide, including 83 dealerships and 66 marina and storage facilities. Our integrated business includes IGY Marinas, which operates luxury marinas in yachting and sport fishing destinations around the world; Fraser Yachts Group and Northrop & Johnson, leading superyacht brokerage and luxury yacht services companies; Cruisers Yachts, one of the world’s premier manufacturers of premium sport yachts and motor yachts; and Intrepid Powerboats, a premier manufacturer of powerboats. To enhance and simplify the customer experience, we provide financing and insurance services as well as leading digital technology products that connect boaters to a network of preferred marinas, dealers, and marine professionals through Boatyard and Boatzon. In addition, we operate MarineMax Vacations in Tortola, British Virgin Islands, which offers our charter vacation guests the luxury boating adventures of a lifetime. Land comprises 29% of the earth’s surface. We’re focused on the other 71%. Learn more at www.marinemax.com.

Forward-Looking Statement

Certain statements in this press release are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include those regarding the Company’s potential repurchases of its common stock and the means by which such repurchases are made. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this release. These risks include significant changes in the price and availability of the Company’s stock, general economic conditions, as well as those within our industry, and numerous other factors identified in the Company’s Form 10-K for the fiscal year ended September 30, 2023 and other filings with the Securities and Exchange Commission. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

|

Contacts |

|

|

Investors: |

Michael H. McLamb |

|

|

Chief Financial Officer |

|

|

MarineMax, Inc. |

|

|

727-531-1700 |

|

|

investors@marinemax.com |

|

|

|

|

|

Scott Solomon or Laura Resag |

|

|

Sharon Merrill Associates, Inc. |

|

|

investors@marinemax.com |

|

|

|

|

Media: |

Abbey Heimensen |

|

|

Abbey.Heimensen@marinemax.com |

|

|

|

|

v3.24.0.1

Document And Entity Information

|

Mar. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 11, 2024

|

| Entity Registrant Name |

MarineMax, Inc.

|

| Entity Central Index Key |

0001057060

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

1-14173

|

| Entity Incorporation, State or Country Code |

FL

|

| Entity Tax Identification Number |

59-3496957

|

| Entity Address, Address Line One |

2600 McCormick Drive

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Clearwater

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33759

|

| City Area Code |

727

|

| Local Phone Number |

531-1700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.001 per share

|

| Trading Symbol |

HZO

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

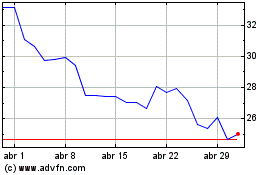

MarineMax (NYSE:HZO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

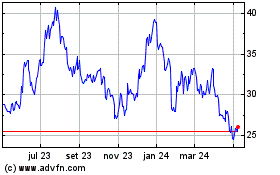

MarineMax (NYSE:HZO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024