Highlights for the first quarter of 2024 as compared to the

first quarter of 2023:

- Revenue increased by 20%.

- Operating income increased by 42%.

- Net income attributable to the Company increased by 34%.

The St. Joe Company (NYSE: JOE) (the “Company,” “We,” or “Our”)

today reports first quarter 2024 results.

Jorge Gonzalez, the Company’s President and Chief Executive

Officer, said, “St. Joe continues to show solid organic growth

following record performance in 2023. Hospitality revenue grew by

60% with new hotels and increased Watersound Club memberships.

Leasing revenue grew by 21% with over 1,000 leased multi-family and

senior living units as of March 31, 2024. Residential real estate

revenue grew by 10%. We sold 216 homesites in the first quarter of

2024 with a higher average base sales price of $117,000 and

increased margins year over year. The Latitude Margaritaville

Watersound unconsolidated joint venture continued to expand with

177 completed home sales in the quarter.”

Mr. Gonzalez concluded, “We are building a diverse portfolio of

complementary businesses. The growth of our hospitality segment

exposes more visitors to and helps grow our residential

communities, which in turn creates more customers for and helps

grow our commercial leasing portfolio. As our commercial leasing

portfolio grows, more shopping and entertainment opportunities

arise, which further drives increased visitation. Our profits and

the value of our surrounding lands are expected to increase with

each development. We believe our future is bright, and we have just

started to scratch the surface.”

Consolidated First Quarter 2024 Results

Revenue for the first quarter of 2024 increased by 20% to $87.8

million as compared to $73.0 million for the first quarter of 2023.

Hospitality revenue increased by 60% to $39.3 million and leasing

revenue increased by 21% to $14.3 million. Residential real estate

revenue increased by 10% to $30.8 million due to increased average

sales price and mix of sales from different communities. Commercial

and forestry real estate revenue decreased from $5.9 million to

$1.4 million as the Company continues to lease and operate more

assets and sell less undeveloped land.

Over the past several years, the Company entered into joint

ventures which are unconsolidated and accounted for using the

equity method. For the three months ended March 31, 2024, these

unconsolidated joint ventures had $95.8 million of revenue, as

compared to $81.8 million for the same period in 2023. The

Company’s economic interests in its unconsolidated joint ventures

resulted in $7.4 million in equity in income from unconsolidated

joint ventures in the first quarter of 2024, as compared to $3.7

million in the first quarter of 2023. Although these business

ventures are not included as revenue in the Company’s financial

statements, they are part of the core business strategy which

generates substantial financial returns for the Company.

Net income attributable to the Company for the first quarter of

2024 increased by 34% to $13.9 million, or $0.24 per share, as

compared to net income of $10.4 million, or $0.18 per share, for

the same period in 2023.

Earnings before interest, taxes, depreciation and amortization

(“EBITDA”), a non-GAAP financial measure, for the three months

ended March 31, 2024, increased by 43% to $34.9 million, as

compared to $24.4 million for the same period in 2023. Depreciation

is a non-cash, GAAP expense which is amortized over an asset’s

prescribed life, while maintenance and repair expenses are period

costs and expensed as incurred. See Financial Data below for

additional information, including a reconciliation of EBITDA to net

income attributable to the Company.

On April 24, 2024, the Board of Directors declared a cash

dividend of $0.12 per share on the Company’s common stock, payable

on June 13, 2024, to shareholders of record as of the close of

business on May 15, 2024.

Real Estate

Total real estate revenue decreased by 7% to $34.2 million in

the first quarter of 2024, as compared to $36.7 million in the

first quarter of 2023. Residential real estate revenue increased by

10% to $30.8 million for the first quarter of 2024, as compared to

$28.0 million for the first quarter of 2023. Commercial and

forestry real estate revenue totaled $1.4 million in the first

quarter of 2024, as compared to $5.9 for the first quarter of

2023.

The Company sold 216 homesites at an average base price of

approximately $117,000 and gross margin of 50.0%, in the first

quarter of 2024, as compared to 327 homesites (including 100

entitled but undeveloped homesites in the Company’s SouthWood

community, located in Tallahassee, Florida) at an average base

price of approximately $62,000 and gross margin of 41.0% in the

first quarter of 2023. Excluding the sale of the 100 entitled but

undeveloped homesites in the Company’s SouthWood community, the

average sales price per homesite in the first quarter of 2023 was

approximately $80,000. The differences in the average sales price,

number of homesite closings and gross margin period over period

were due to the mix of sales in different communities.

As of March 31, 2024, the Company had 1,335 residential

homesites under contract, which are expected to result in revenue

of approximately $119.8 million, plus residuals, over the next

several years, as compared to 1,915 residential homesites under

contract for $165.0 million, plus residuals, as of March 31, 2023.

The change in homesites under contract is due to increased homesite

closing transactions during 2023 and the first quarter of 2024 and

the amount of remaining homesites in current phases of residential

communities. The Company’s residential homesite pipeline has over

21,000 homesites in various stages of development, engineering,

permitting or concept planning.

The Latitude Margaritaville Watersound unconsolidated joint

venture, planned for 3,500 residential homes, had 130 net sale

contracts executed in the first quarter of 2024. Since the start of

sales in 2021, there have been 1,743 home contracts. For the first

quarter of 2024, there were 177 completed home sales bringing the

community to 1,181 occupied homes. The 562 homes under contract as

of March 31, 2024, with an average sales price of approximately

$541,000, are expected to result in sales value of approximately

$303.9 million at completion, as compared to 679 homes under

contract as of March 31, 2023, with an average sales price of

approximately $497,000.

Hospitality

Hospitality revenue increased by 60% to $39.3 million in the

first quarter of 2024, as compared to $24.5 million in the first

quarter of 2023. Hospitality revenue continues to benefit from the

growth of the Watersound Club membership program and the opening of

five hotels throughout 2023. As of March 31, 2024, the Company had

3,433 club members, as compared to 2,653 club members as of March

31, 2023, an increase of 780 net new members. As of March 31, 2024,

the Company owned (individually by the Company or through

consolidated and unconsolidated joint ventures) eleven hotels with

1,177 operational hotel rooms, as compared to seven hotels with 616

rooms as of March 31, 2023. 2024 will be the first full year of

operations for five new hotels. In addition, a new Residence Inn by

Marriott hotel with 121 rooms opened in April 2024, bringing the

Company’s current total to twelve hotels with 1,298 rooms.

Leasing

Leasing revenue from commercial, office, retail, multi-family,

senior living, self-storage and other properties increased by 21%

to $14.3 million in the first quarter of 2024, as compared to the

same period in 2023. As of March 31, 2024, the Company

(individually by the Company or through consolidated and

unconsolidated joint ventures) had 1,383 leasable multi-family and

senior living units.

Rentable space as of March 31, 2024, consisted of approximately

1,082,000 square feet, of which approximately 1,046,000, or 97%,

was leased, as compared to approximately 1,034,000 square feet as

of March 31, 2023, of which approximately 1,005,000, or 97%, was

leased. As of March 31, 2024, the Company had an additional 98,000

square feet of leasable space under construction. The Company is

focused on commercial leasing space at the Watersound Town Center,

Watersound West Bay Center and the FSU/TMH Medical Campus. These

three centers have the potential for over 1.2 million square feet

of leasable space. The Company, wholly or through joint ventures,

also owns or operates commercial and hospitality businesses on real

estate that could otherwise be leased to others or sold.

Corporate and Other Operating Expenses

The Company’s corporate and other operating expenses for the

three months ended March 31, 2024, increased by $1.4 million to

$7.1 million, as compared to $5.7 million for the same period in

2023. Corporate and operating expenses were approximately 8% of

revenue for each of the three months ended March 31, 2024, and

March 31, 2023.

Investments, Liquidity and Debt

In the first quarter of 2024, the Company funded $31.5 million

in capital expenditures. In addition, the Company paid $7.0 million

in cash dividends. As of March 31, 2024, the Company had $89.8

million in cash, cash equivalents and other liquid investments, as

compared to $80.0 million as of March 31, 2023, an increase of $9.8

million. As of March 31, 2024, the Company had $276.3 million

invested in development property, which, when complete, will be

added to operating property or sold. As of March 31, 2024, the

weighted average effective interest rate of outstanding debt was

5.3% with an average remaining life of 17.0 years. 66% of the

Company’s outstanding debt had a fixed or swapped interest rate.

The remaining 34% of debt has interest rates that vary with SOFR.

Company debt as of March 31, 2024, is approximately 29% of the

Company’s total assets.

Additional Information and Where to Find It

Additional information with respect to the Company’s results for

the first quarter 2024 will be available in a Form 10-Q that will

be filed with the Securities and Exchange Commission (“SEC”) and

can be found at www.joe.com and at the SEC’s website www.sec.gov.

We recommend studying the Company’s latest Form 10-K and Form 10-Q

before making an investment decision.

FINANCIAL DATA SCHEDULES

Financial data schedules in this press release include

consolidated results, summary balance sheets, corporate and other

operating expenses and the reconciliation of earnings before

interest, taxes, depreciation and amortization (EBITDA), a non-GAAP

financial measure, for the first quarter 2024 and 2023,

respectively.

FINANCIAL DATA Consolidated

Results (Unaudited) ($ in millions except share and per share

amounts)

Quarter

Ended

March

31,

2024

2023

Revenue

Real estate revenue

$34.2

$36.7

Hospitality revenue

39.3

24.5

Leasing revenue

14.3

11.8

Total revenue

87.8

73.0

Expenses

Cost of real estate revenue

16.0

20.4

Cost of hospitality revenue

30.3

22.9

Cost of leasing revenue

7.2

5.4

Corporate and other operating expenses

7.1

5.7

Depreciation, depletion and

amortization

11.2

7.3

Total expenses

71.8

61.7

Operating income

16.0

11.3

Investment income, net

3.4

2.9

Interest expense

(8.5

)

(6.2

)

Equity in income from unconsolidated joint

ventures

7.4

3.7

Other (expense) income, net

(0.5

)

1.2

Income before income taxes

17.8

12.9

Income tax expense

(4.7

)

(3.4

)

Net income

13.1

9.5

Net loss attributable to non-controlling

interest

0.8

0.9

Net income attributable to the Company

$13.9

$10.4

Basic net income per share attributable to

the Company

$0.24

$0.18

Basic weighted average shares

outstanding

58,320,489

58,309,093

Summary Balance Sheet

(Unaudited) ($ in millions)

March

31, 2024

December

31, 2023

Assets

Investment in real estate, net

$1,022.9

$1,018.6

Investment in unconsolidated joint

ventures

71.2

66.4

Cash and cash equivalents

89.8

86.1

Other assets

84.9

82.2

Property and equipment, net

65.1

66.0

Investments held by special purpose

entities

203.8

204.2

Total assets

$1,537.7

$1,523.5

Liabilities and Equity

Debt, net

$452.0

$453.6

Accounts payable and other liabilities

65.4

58.6

Deferred revenue

64.5

62.8

Deferred tax liabilities, net

72.6

71.8

Senior Notes held by special purpose

entity

178.3

178.2

Total liabilities

832.8

825.0

Total equity

704.9

698.5

Total liabilities and equity

$1,537.7

$1,523.5

Corporate and Other Operating

Expenses (Unaudited) ($ in millions)

Quarter

Ended

March

31,

2024

2023

Employee costs

$3.7

$2.7

Property taxes and insurance

1.5

1.4

Professional fees

1.0

1.0

Marketing and owner association costs

0.2

0.2

Occupancy, repairs and maintenance

0.2

0.1

Other miscellaneous

0.5

0.3

Total corporate and other operating

expenses

$7.1

$5.7

Reconciliation of Non-GAAP

Financial Measures (Unaudited) ($ in millions)

Earnings before interest, taxes,

depreciation and amortization (“EBITDA”) is a non-GAAP financial

measure, which management believes assists investors by providing

insight into operating performance of the Company across periods on

a consistent basis and, when viewed in combination with the Company

results prepared in accordance with GAAP, provides a more complete

understanding of factors and trends affecting the Company. However,

EBITDA has limitations as an analytical tool and should not be

considered in isolation or as a substitute for analysis of results

reported under GAAP. EBITDA is calculated by adjusting “Interest

expense,” “Investment income, net,” “Income tax expense,”

“Depreciation, depletion and amortization” to “Net income

attributable to the Company.”

Quarter

Ended

March

31,

2024

2023

Net income attributable to the Company

$13.9

$10.4

Plus: Interest expense

8.5

6.2

Less: Investment income, net

(3.4)

(2.9)

Plus: Income tax expense

4.7

3.4

Plus: Depreciation, depletion and

amortization

11.2

7.3

EBITDA

$34.9

$24.4

Important Notice Regarding

Forward-Looking Statements

Certain statements contained in this press release, as well as

other information provided from time to time by the Company or its

employees, may contain forward-looking statements that involve

risks and uncertainties that could cause actual results to differ

materially from those in the forward-looking statements. You can

identify forward-looking statements by the fact that they do not

relate strictly to historical or current facts. These statements

may include words such as “guidance,” “anticipate,” “estimate,”

“expect,” “forecast,” “project,” “plan,” “intend,” “believe,”

“confident,” “may,” “should,” “can have,” “likely,” “future” and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events. Examples of forward-looking statements

in this press release include statements regarding our growth

prospects; expansion of operational assets such as increases in

hotel rooms; plans to maintain an efficient cost structure; our

capital allocation initiatives, including the payment of our

quarterly dividend; plans regarding our joint venture developments;

and the timing of current developments and new projects in 2024 and

beyond. These statements involve risks and uncertainties, and

actual results may differ materially from any future results

expressed or implied by the forward-looking statements.

The Company wishes to caution readers that, although we believe

any forward-looking statements are based on reasonable assumptions,

certain important factors may have affected and could in the future

affect the Company’s actual financial results and could cause the

Company’s actual financial results for subsequent periods to differ

materially from those expressed in any forward-looking statement

made by or on behalf of the Company, including: our ability to

successfully implement our strategic objectives; new or increased

competition across our business units; any decline in general

economic conditions, particularly in our primary markets; interest

rate fluctuations; inflation; financial institution disruptions;

supply chain disruptions; geopolitical conflicts (such as the

conflict between Russia and Ukraine, the conflict in the Gaza Strip

and the general unrest in the Middle East) and political

uncertainty and the corresponding impact on the global economy; our

ability to successfully execute or integrate new business endeavors

and acquisitions; our ability to yield anticipated returns from our

developments and projects; our ability to effectively manage our

real estate assets, as well as the ability for us or our joint

venture partners to effectively manage the day-to-day activities of

our projects; our ability to complete construction and development

projects within expected timeframes; the interest of prospective

guests in our hotels, including the new hotels we have opened since

the beginning of 2023; reductions in travel and other risks

inherent to the hospitality industry; the illiquidity of all real

estate assets; financial risks, including risks relating to

currency fluctuations, credit risks, and fluctuations in the market

value of our investment portfolio; any potential negative impact of

our longer-term property development strategy, including losses and

negative cash flows for an extended period of time if we continue

with the self-development of granted entitlements; our dependence

on homebuilders; mix of sales from different communities and the

corresponding impact on sales period over period; the financial

condition of our commercial tenants; regulatory and insurance risks

associated with our senior living facilities; public health

emergencies; any reduction in the supply of mortgage loans or

tightening of credit markets; our dependence on strong migration

and population expansion in our regions of development,

particularly Northwest Florida; our ability to fully recover from

natural disasters and severe weather conditions; the actual or

perceived threat of climate change; the seasonality of our

business; our ability to obtain adequate insurance for our

properties or rising insurance costs; our dependence on certain

third party providers; the inability of minority shareholders to

influence corporate matters, due to concentrated ownership of

largest shareholder; the impact of unfavorable legal proceedings or

government investigations; the impact of complex and changing laws

and regulations in the areas we operate; changes in tax rates, the

adoption of new U.S. tax legislation, and exposure to additional

tax liabilities, including with respect to Qualified Opportunity

Zone program; new litigation; our ability to attract and retain

qualified employees, particularly in our hospitality business; our

ability to protect our information technology infrastructure and

defend against cyber-attacks; increased media, political, and

regulatory scrutiny could negatively impact our reputation; our

ability to maintain adequate internal controls; risks associated

with our financing arrangements, including our compliance with

certain restrictions and limitations; our ability to pay our

quarterly dividend; and the potential volatility of our common

stock. More information on these risks and other potential factors

that could affect the Company’s business and financial results is

included in the Company’s filings with the SEC, including in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s most recently filed periodic reports on Form 10-K and

subsequent filings. The discussion of these risks is specifically

incorporated by reference into this press release.

Any forward-looking statement made by us in this press release

speaks only as of the date on which it is made, and we do not

undertake to update these statements other than as required by

law.

About The St. Joe

Company

The St. Joe Company is a real estate development, asset

management and operating company with real estate assets and

operations in Northwest Florida. The Company intends to use

existing assets for residential, hospitality and commercial

ventures. St. Joe has significant residential and commercial

land-use entitlements. The Company actively seeks higher and better

uses for its real estate assets through a range of development

activities. More information about the Company can be found on its

website at www.joe.com.

© 2024, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking

Flight” Design®, “St. Joe (and Taking Flight Design)®”, and other

amenity names used herein are the registered service marks of The

St. Joe Company or its affiliates or others.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424592833/en/

St. Joe Investor Relations Contact: Marek Bakun Chief Financial

Officer 1-866-417-7132 Marek.Bakun@Joe.com

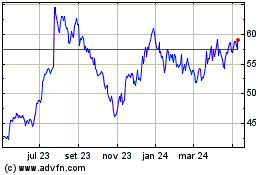

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

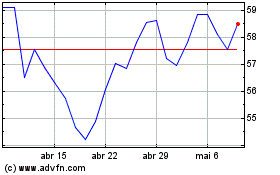

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024