- Hospitality revenue increased by 17% for the third quarter of

2024 to $55.4 million from $47.4 million and increased 34% for the

first nine months of 2024 to $157.0 million from $117.0 million.

Hospitality gross margin increased to 34.1% in the third quarter of

2024 as compared to 23.8% in the third quarter of 2023 and

increased to 33.3% for the first nine months of 2024 as compared to

21.0% for the first nine months of 2023.

- Leasing revenue increased by 19% for the third quarter of 2024

to $15.6 million from $13.1 million and increased 20% for the first

nine months of 2024 to $44.7 million from $37.2 million. The

leasable square feet increased by 9% to 1,179,000 square feet with

the percentage leased at 96% as of September 30, 2024.

- Real estate revenue decreased by 32% for the third quarter of

2024 to $28.0 million from $40.9 million and decreased by 35% for

the first nine months of 2024 to $96.7 from $148.3 million.

- Total revenue for the third quarter of 2024 decreased by 2% to

$99.0 million from $101.4 million. Operating income for the third

quarter of 2024 increased by 4% to $21.2 million from $20.3

million. Net income attributable to the Company decreased by 13% to

$16.8 million from $19.4 million during the third quarter of 2024,

primarily due to timing of homesite closings and product mix of

sales in different residential communities and a reduction in

equity in income from unconsolidated joint ventures, partially

offset by growth in hospitality and leasing revenue.

- Over 22,000 homesites are in various stages of planning or

development. As of September 30, 2024, there were 1,381 residential

homesites under contract, which are expected to result in revenue

of approximately $122.3 million.

The St. Joe Company (NYSE: JOE) (the “Company,” “We,” or “Our”)

today reports third quarter and first nine months of 2024

results.

Jorge Gonzalez, the Company’s President and Chief Executive

Officer, said, “On behalf of all Directors, I want to thank Bruce

for his leadership and commitment to The St. Joe Company and wish

him well in his well-deserved retirement from the Board of

Directors.

“As for the quarter, we continue to focus on growing recurring

revenue, as evidenced by the 17% growth in hospitality revenue and

19% growth in leasing revenue for the third quarter of 2024. In

addition to growing recurring revenue, we also continue to become

more efficient in hospitality operations with an increase in gross

margin to 34.1% from 23.8% for the same period. Real estate revenue

decreased 32% for the third quarter of 2024, primarily due to the

timing and product mix of closings in our residential communities.

The ‘seeding and harvesting’ cycle of residential homesite

development and sales is not linear and therefore not ideal for

quarter-to-quarter comparisons like hospitality and leasing

revenue. Demand for homesites remains strong with every homebuilder

being ahead of or on schedule with their required contractual

obligations. Because of the demand, we continue to ‘seed’ homesites

for future ‘harvesting’ with 1,381 residential homesites under

contract and over 22,000 homesites in the residential homesite

pipeline in various stages of planning, permitting, or

development.”

Mr. Gonzalez, continued, “After many years of vision and

planning, we are pleased to report that in the third quarter of

2024, the first phase of the FSU/TMH Medical Campus became

operational, where a 78,670 square foot medical office building was

completed with new clinical practices opening in primary care,

urgent care, cardiology, and pulmonology. According to the

clinicians, demand for these practices is exceeding expectations.

Clinical practices in orthopedics, OBGYN, and others, as well as

the four room ambulatory surgery center are planned to open in the

next few months. Future phases of the medical campus being planned

include a hospital and a research facility. In addition to

increasing health care options in our area, the medical campus has

the potential to generate high wage jobs in the health care sector

that will attract new professionals to the region.”

Mr. Gonzalez concluded, “We continue to see migration into our

region and demand for housing across a wide range of pricing,

products, and lifestyles from individuals to families looking for a

high quality of life, safety, natural beauty, and great

schools.”

Consolidated Third Quarter and First Nine Months of 2024

Results

Total consolidated revenue for the third quarter of 2024

decreased by 2% to $99.0 million as compared to $101.4 million for

the third quarter of 2023. Hospitality revenue increased by 17% to

$55.4 million and leasing revenue increased by 19% to $15.6

million. Real estate revenue decreased by 32% to $28.0 million due

to a mix of sales from different communities and timing of

homebuilder contractual closing obligations.

For the nine months ended September 30, 2024, total consolidated

revenue decreased by 1% to $298.4 million, as compared to $302.5

million for the first nine months of 2023. Hospitality revenue

increased by 34% to $157.0 million and leasing revenue increased by

20% to $44.7 million. Real estate revenue decreased by 35% to $96.7

million due to mix of sales from different residential communities

and timing of homebuilder contractual closing obligations, as

compared to the same period in 2023.

Over the past several years, the Company has entered into joint

ventures which are unconsolidated and accounted for using the

equity method. For the three months ended September 30, 2024, these

unconsolidated joint ventures had $109.2 million of revenue, as

compared to $100.3 million for the same period in 2023. The

Company’s economic interests in its unconsolidated joint ventures

for the three months ended September 30, 2024, resulted in $6.8

million of equity in income from unconsolidated joint ventures, as

compared to $8.7 million for the three months ended September 30,

2023. The decrease is due to the impact of lease-up, depreciation

and interest costs of the Watersound Fountains Independent Living

JV and the opening costs of the Residence Inn Panama City Beach

Pier Park hotel by the Pier Park RI JV. For the first nine months

of 2024, these unconsolidated joint ventures had $299.1 million of

revenue, as compared to $270.9 million for the first nine months of

2023. The Company’s economic interests in unconsolidated joint

ventures resulted in $19.5 million of equity in income from

unconsolidated joint ventures for the first nine months of 2024, as

compared to $18.4 million for the first nine months of 2023.

Although these business ventures are not included as revenue in the

Company’s financial statements, they are part of the core business

strategy, which generates substantial financial returns for the

Company.

Net income attributable to the Company for the third quarter of

2024 decreased by 13% to $16.8 million, or $0.29 per share, as

compared to net income of $19.4 million, or $0.33 per share, for

the same period in 2023. Net income for the first nine months of

2024 decreased by 14% to $55.3 million, or $0.95 per share, as

compared to net income of $64.5 million, or $1.11 per share, for

the same period in 2023.

Earnings before interest, taxes, depreciation and amortization

(“EBITDA”), a non-GAAP financial measure, for the three months

ended September 30, 2024, decreased by 4% to $39.9 million, as

compared to $41.7 million for the same period in 2023. EBITDA for

the nine months ended September 30, 2024, was $124.1 million as

compared to $125.7 million for the first nine months of 2023.

Depreciation is a non-cash, GAAP expense which is amortized over an

asset’s prescribed life, while maintenance and repair expenses are

period costs and expensed as incurred. See Financial Data below for

additional information, including a reconciliation of EBITDA to net

income attributable to the Company.

On October 23, 2024, the Board of Directors declared a cash

dividend of $0.14 per share on the Company’s common stock, payable

on December 6, 2024, to shareholders of record as of the close of

business on November 7, 2024.

Real Estate

Total real estate revenue decreased by 32% to $28.0 million in

the third quarter of 2024, as compared to $40.9 million in the

third quarter of 2023. The quarter-to-quarter homesite sales and

margin results depend largely on the timing of completion of

development and product mix.

The Company sold 179 homesites at an average base price of

approximately $86,000 and gross margin of 39.1%, in the third

quarter of 2024, as compared to 254 homesites at an average base

price of approximately $103,000 and gross margin of 44.6% in the

third quarter of 2023. The differences in the average sales price,

number of homesite closings and gross margin period-over-period

were due to the mix of sales in different communities.

As of September 30, 2024, the Company had 1,381 residential

homesites under contract, which are expected to result in revenue

of approximately $122.3 million, plus residuals, over the next

several years, as compared to 1,575 residential homesites under

contract for $135.5 million, plus residuals, as of September 30,

2023. The change in homesites under contract is due to increased

homesite closing transactions during the fourth quarter of 2023 and

the first nine months of 2024 and the amount of remaining homesites

in current phases of residential communities. The Company’s

residential homesite pipeline has over 22,000 homesites in various

stages of development, engineering, permitting or concept

planning.

The Latitude Margaritaville Watersound unconsolidated joint

venture, planned for 3,500 residential homes, had 81 net sale

contracts executed in the third quarter of 2024. Since the start of

sales in 2021, there have been 1,959 home contracts. For the third

quarter of 2024, there were 189 completed home sales bringing the

community to 1,533 occupied homes. The 426 homes under contract as

of September 30, 2024, with an average sales price of approximately

$597,000, are expected to result in sales value of approximately

$254.4 million at completion, as compared to 632 homes under

contract as of September 30, 2023, with an average sales price of

approximately $523,000.

Hospitality

Hospitality revenue increased by 17% to $55.4 million in the

third quarter of 2024, as compared to $47.4 million in the third

quarter of 2023. Hospitality revenue continues to benefit from the

growth of the Watersound Club membership program and the opening of

five hotels throughout 2023. As of September 30, 2024, the Company

had 3,532 club members, as compared to 3,088 club members as of

September 30, 2023, an increase of 444 net new members. As of

September 30, 2024, the Company owned (individually by the Company

or through consolidated and unconsolidated joint ventures) 12

hotels with 1,298 operational hotel rooms, as compared to 11 hotels

with 1,177 rooms as of September 30, 2023.

Leasing

Leasing revenue from commercial, office, retail, multi-family,

senior living, self-storage and other properties increased by 19%

to $15.6 million in the third quarter of 2024, as compared to the

same period in 2023. As of September 30, 2024, the Company

(individually by the Company or through consolidated and

unconsolidated joint ventures) had 1,383 rentable multi-family and

senior living units.

Leasable space as of September 30, 2024, consisted of

approximately 1,179,000 square feet, of which approximately

1,130,000, or 96%, was leased, as compared to approximately

1,082,000 square feet as of September 30, 2023, of which

approximately 1,036,000, or 96%, was leased. The Company is focused

on commercial leasing space at the Watersound Town Center,

Watersound West Bay Center and the FSU/TMH Medical Campus. These

three centers, and others in the planning stage, have the potential

to more than double the Company’s total current leasable commercial

space. The Company, wholly or through joint ventures, also owns

significant hospitality businesses that may otherwise be leased to

others.

Corporate and Other Operating Expenses

The Company’s corporate and other operating expenses for the

three months ended September 30, 2024, decreased by $0.2 million to

$6.0 million, as compared to $6.2 million for the same period in

2023. For the first nine months of 2024, corporate and other

operating expenses increased by $1.5 million to $18.9 million, as

compared to $17.4 million for the first nine months of 2023.

Investments, Liquidity and Debt

In the third quarter of 2024, the Company funded $34.8 million

in capital expenditures. In addition, the Company paid $8.2 million

in cash dividends and repaid a net of $4.2 million of debt. For the

first nine months of 2024, the Company funded $98.7 million of

capital expenditures, paid $22.2 million in cash dividends and

repaid a net of $11.0 million of debt. As of September 30, 2024,

the Company had $82.7 million in cash, cash equivalents and other

liquid investments, as compared to $86.1 million as of December 31,

2023. As of September 30, 2024, the Company had $261.7 million

invested in development property, which, when complete, will be

added to operating property or sold. As of September 30, 2024, the

weighted average effective interest rate of outstanding debt was

5.1% with an average remaining life of 16.8 years. 67% of the

Company’s outstanding debt had a fixed or swapped interest rate.

The remaining 33% of debt has interest rates that vary with SOFR.

Company debt as of September 30, 2024, is approximately 29% of the

Company’s total assets.

Additional Information and Where to Find It

Additional information with respect to the Company’s results for

the third quarter and first nine months of 2024 will be available

in a Form 10-Q that will be filed with the Securities and Exchange

Commission (“SEC”) and can be found at www.joe.com and at the SEC’s

website www.sec.gov. We recommend studying the Company’s latest

Form 10-K and Form 10-Q before making an investment decision.

FINANCIAL DATA SCHEDULES

Financial data schedules in this press release include

consolidated results, summary balance sheets, corporate and other

operating expenses and the reconciliation of earnings before

interest, taxes, depreciation and amortization (EBITDA), a non-GAAP

financial measure, for the third quarter and first nine months of

2024 and 2023, respectively.

FINANCIAL DATA

Consolidated Results

(Unaudited)

($ in millions except share

and per share amounts)

Quarter

Ended September

30,

Nine

Months Ended September

30,

2024

2023

2024

2023

Revenue

Real estate revenue

$28.0

$40.9

$96.7

$148.3

Hospitality revenue

55.4

47.4

157.0

117.0

Leasing revenue

15.6

13.1

44.7

37.2

Total revenue

99.0

101.4

298.4

302.5

Expenses

Cost of real estate revenue

15.7

21.3

48.4

73.1

Cost of hospitality revenue

36.5

36.1

104.7

92.4

Cost of leasing revenue

7.8

6.8

22.2

18.7

Corporate and other operating expenses

6.0

6.2

18.9

17.4

Depreciation, depletion and

amortization

11.8

10.7

34.3

27.5

Total expenses

77.8

81.1

228.5

229.1

Operating income

21.2

20.3

69.9

73.4

Investment income, net

3.5

3.6

10.3

9.8

Interest expense

(8.4)

(8.4)

(25.5)

(21.8)

Equity in income from unconsolidated joint

ventures

6.8

8.7

19.5

18.4

Other (expense) income, net

(0.1)

1.3

(0.6)

3.9

Income before income taxes

23.0

25.5

73.6

83.7

Income tax expense

(6.4)

(6.8)

(19.3)

(21.7)

Net income

16.6

18.7

54.3

62.0

Net loss attributable to non-controlling

interest

0.2

0.7

1.0

2.5

Net income attributable to the Company

$16.8

$19.4

$55.3

$64.5

Basic net income per share attributable to

the Company

$0.29

$0.33

$0.95

$1.11

Basic weighted average shares

outstanding

58,331,818

58,314,117

58,328,055

58,312,461

Summary Balance Sheet

(Unaudited)

($ in millions)

September 30, 2024

December

31, 2023

Assets

Investment in real estate, net

$1,039.4

$1,018.6

Investment in unconsolidated joint

ventures

73.3

66.4

Cash and cash equivalents

82.7

86.1

Other assets

84.5

82.2

Property and equipment, net

62.2

66.0

Investments held by special purpose

entities

203.5

204.2

Total assets

$1,545.6

$1,523.5

Liabilities and Equity

Debt, net

$443.4

$453.6

Accounts payable and other liabilities

61.7

58.6

Deferred revenue

62.1

62.8

Deferred tax liabilities, net

70.4

71.8

Senior Notes held by special purpose

entity

178.4

178.2

Total liabilities

816.0

825.0

Total equity

729.6

698.5

Total liabilities and equity

$1,545.6

$1,523.5

Corporate and Other Operating

Expenses (Unaudited)

($ in millions)

Quarter

Ended September

30,

Nine

Months Ended September

30,

2024

2023

2024

2023

Employee costs

$3.0

$2.5

$9.8

$7.8

Property taxes and insurance

1.4

1.8

4.1

4.6

Professional fees

0.8

1.1

2.4

2.8

Marketing and owner association costs

0.2

0.3

0.7

0.7

Occupancy, repairs and maintenance

0.2

0.1

0.5

0.3

Other miscellaneous

0.4

0.4

1.4

1.2

Total corporate and other operating

expenses

$6.0

$6.2

$18.9

$17.4

Reconciliation of Non-GAAP Financial

Measures (Unaudited) ($ in millions)

Earnings before interest, taxes, depreciation and amortization

(“EBITDA”) is a non-GAAP financial measure, which management

believes assists investors by providing insight into operating

performance of the Company across periods on a consistent basis

and, when viewed in combination with the Company results prepared

in accordance with GAAP, provides a more complete understanding of

factors and trends affecting the Company. However, EBITDA has

limitations as an analytical tool and should not be considered in

isolation or as a substitute for analysis of results reported under

GAAP. EBITDA is calculated by adjusting “Interest expense”,

“Investment income, net”, “Income tax expense”, “Depreciation,

depletion and amortization” to “Net income attributable to the

Company”.

Quarter

Ended

Nine

Months Ended

September 30,

September 30,

2024

2023

2024

2023

Net income attributable to the Company

$16.8

$19.4

$55.3

$64.5

Plus: Interest expense

8.4

8.4

25.5

21.8

Less: Investment income, net

(3.5)

(3.6)

(10.3)

(9.8)

Plus: Income tax expense

6.4

6.8

19.3

21.7

Plus: Depreciation, depletion and

amortization

11.8

10.7

34.3

27.5

EBITDA

$39.9

$41.7

$124.1

$125.7

Important Notice Regarding

Forward-Looking Statements

Certain statements contained in this press release, as well as

other information provided from time to time by the Company or its

employees, may contain forward-looking statements that involve

risks and uncertainties that could cause actual results to differ

materially from those in the forward-looking statements. You can

identify forward-looking statements by the fact that they do not

relate strictly to historical or current facts. These statements

may include words such as “guidance,” “anticipate,” “estimate,”

“expect,” “forecast,” “project,” “plan,” “intend,” “believe,”

“confident,” “may,” “should,” “can have,” “likely,” “future” and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events. Examples of forward-looking statements

in this press release include statements regarding our growth

prospects; expansion of operational assets such as increases in

hotel rooms; plans to maintain an efficient cost structure; our

capital allocation initiatives, including the payment of our

quarterly dividend; plans regarding our joint venture developments;

and the timing of current developments and new projects in 2024 and

beyond. These statements involve risks and uncertainties, and

actual results may differ materially from any future results

expressed or implied by the forward-looking statements.

The Company wishes to caution readers that, although we believe

any forward-looking statements are based on reasonable assumptions,

certain important factors may have affected and could in the future

affect the Company’s actual financial results and could cause the

Company’s actual financial results for subsequent periods to differ

materially from those expressed in any forward-looking statement

made by or on behalf of the Company, including: our ability to

successfully implement our strategic objectives; new or increased

competition across our business units; any decline in general

economic conditions, particularly in our primary markets; interest

rate fluctuations; inflation; financial institution disruptions;

supply chain disruptions; geopolitical conflicts (such as the

conflict between Russia and Ukraine, the conflict in the Gaza Strip

and the general unrest in the Middle East) and political

uncertainty and the corresponding impact on the global economy; our

ability to successfully execute or integrate new business endeavors

and acquisitions; our ability to yield anticipated returns from our

developments and projects; our ability to effectively manage our

real estate assets, as well as the ability for us or our joint

venture partners to effectively manage the day-to-day activities of

our projects; our ability to complete construction and development

projects within expected timeframes; the interest of prospective

guests in our hotels, including the new hotels we have opened since

the beginning of 2023; reductions in travel and other risks

inherent to the hospitality industry; the illiquidity of all real

estate assets; financial risks, including risks relating to

currency fluctuations, credit risks, and fluctuations in the market

value of our investment portfolio; any potential negative impact of

our longer-term property development strategy, including losses and

negative cash flows for an extended period of time if we continue

with the self-development of granted entitlements; our dependence

on homebuilders; mix of sales from different communities and the

corresponding impact on sales period over period; the financial

condition of our commercial tenants; regulatory and insurance risks

associated with our senior living facilities; public health

emergencies; any reduction in the supply of mortgage loans or

tightening of credit markets; our dependence on strong migration

and population expansion in our regions of development,

particularly Northwest Florida; our ability to fully recover from

natural disasters and severe weather conditions; the actual or

perceived threat of climate change; the seasonality of our

business; our ability to obtain adequate insurance for our

properties or rising insurance costs; our dependence on certain

third party providers; the inability of minority shareholders to

influence corporate matters, due to concentrated ownership of

largest shareholder; the impact of unfavorable legal proceedings or

government investigations; the impact of complex and changing laws

and regulations in the areas we operate; changes in tax rates, the

adoption of new U.S. tax legislation, and exposure to additional

tax liabilities, including with respect to Qualified Opportunity

Zone program; new litigation; our ability to attract and retain

qualified employees, particularly in our hospitality business; our

ability to protect our information technology infrastructure and

defend against cyber-attacks; increased media, political, and

regulatory scrutiny negatively impacting our reputation; our

ability to maintain adequate internal controls; risks associated

with our financing arrangements, including our compliance with

certain restrictions and limitations; our ability to pay our

quarterly dividend; and the potential volatility of our common

stock. More information on these risks and other potential factors

that could affect the Company’s business and financial results is

included in the Company’s filings with the SEC, including in the

“Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” sections of the

Company’s most recently filed periodic reports on Form 10-K and

subsequent filings. The discussion of these risks is specifically

incorporated by reference into this press release.

Any forward-looking statement made by us in this press release

speaks only as of the date on which it is made, and we do not

undertake to update these statements other than as required by

law.

About The St. Joe

Company

The St. Joe Company is a real estate development, asset

management and operating company with real estate assets and

operations in Northwest Florida. The Company intends to use

existing assets for residential, hospitality and commercial

ventures. St. Joe has significant residential and commercial

land-use entitlements. The Company actively seeks higher and better

uses for its real estate assets through a range of development

activities. More information about the Company can be found on its

website at www.joe.com.

© 2024, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking

Flight” Design®, “St. Joe (and Taking Flight Design)®”, and other

development names used herein are the registered service marks of

The St. Joe Company or its affiliates or others.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022207836/en/

St. Joe Investor Relations Contact: Marek Bakun Chief Financial

Officer 1-866-417-7132 Marek.Bakun@Joe.Com

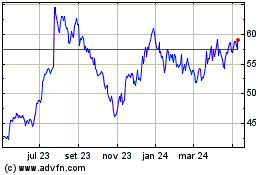

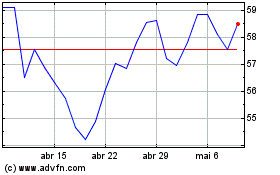

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

St Joe (NYSE:JOE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024