Dan Burke Joins MarketAxess as Global Head of Emerging Markets

29 Abril 2024 - 8:00AM

Business Wire

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a

leading electronic trading platform for fixed-income securities,

today announced the appointment of Dan Burke as Global Head of

Emerging Markets (EM).

As Global Head of EM, Mr. Burke will be responsible for the

development and execution of business strategy for the EM business

in both hard currency and local markets. He will lead business and

product management expansion of the company’s EM trading business

across geographies and products.

Raj Paranandi, Chief Operating Officer, EMEA & APAC at

MarketAxess, commented, “Dan brings a wealth of Emerging Markets

experience and a valuable dealer perspective to MarketAxess at a

time when adoption of and appetite for electronification of the

asset class has grown significantly. There is still much more that

MarketAxess can and will do to drive greater liquidity and

efficiency for both investors and dealers internationally. I look

forward to watching this area grow under Dan’s leadership.”

Mr. Burke most recently served as Managing Director at Standard

Chartered in Singapore and London in his role as Global Head of

Electronic and Algo Trading. During his time there, he played a

strategic role in the automation of the firm’s credit offering and

entry into algorithmic market making and portfolio trading. Prior

to joining Standard Chartered, Mr. Burke held several senior credit

trading roles at Deutsche Bank in Singapore and Bank of America

Merrill Lynch in Tokyo and Hong Kong.

“I’m delighted to be joining MarketAxess, a leading solution for

Emerging Markets trading, and a platform that I have been a client

of for over 20 years. MarketAxess is well positioned to accelerate

the delivery of innovative solutions in Emerging Markets globally,

and I look forward to partnering with all market participants to

take our offering to the next level,” said Mr. Burke.

Mr. Burke is based in London and reports to Raj Paranandi.

The MarketAxess EM trading solution serves over 1,600 market

participants in over 120 countries. Recent investments include the

expansion of Open Trading for Emerging Markets local currency

bonds, growth of Request-for-Market to support larger EM trades,

and new country-specific protocols like Casada in Brazil.

MarketAxess reported record EM average daily volume of $3.6

billion, up 17.3%, in the first quarter of 2024. Latin America and

Asia-Pacific clients generated record levels of average daily

volume in the quarter, up 11.1% and 54.8%, respectively.

MarketAxess was also recognized as “Best Secondary Market Trading

Platform” by Global Capital at their 2023 Bond Awards.

About MarketAxess

MarketAxess (Nasdaq: MKTX) operates a leading electronic trading

platform that delivers greater trading efficiency, a diversified

pool of liquidity and significant cost savings to institutional

investors and broker-dealers across the global fixed-income

markets. Over 2,000 firms leverage MarketAxess’ patented technology

to efficiently trade fixed-income securities. MarketAxess’

award-winning Open Trading® marketplace is widely regarded as the

preferred all-to-all trading solution in the global credit markets.

Founded in 2000, MarketAxess connects a robust network of market

participants through an advanced full trading lifecycle solution

that includes automated trading solutions, intelligent data and

index products and a range of post-trade services. Learn more at

www.marketaxess.com and on X @MarketAxess.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429796315/en/

INVESTOR RELATIONS Stephen Davidson MarketAxess

Holdings Inc. +1 212 813 6313 sdavidson2@marketaxess.com

MEDIA RELATIONS Marisha Mistry MarketAxess

Holdings Inc. +1 917 267 1232 mmistry@marketaxess.com

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

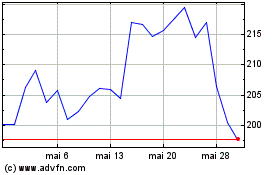

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025