Record 4Q24 Total Trading ADV, Up 38% With

Record Municipal Bond ADV and Record Total Rates ADV

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a

leading electronic trading platform for fixed-income securities,

today announced trading volume and preliminary variable transaction

fees per million (“FPM”) for December 2024 and the fourth quarter

ended December 31, 2024.1

Chris Concannon, CEO of MarketAxess, commented:

“In the fourth quarter, we delivered record total trading

ADV, driven by strong growth across most product areas, including

16% growth year-over-year in our international products,

record ADV in municipal bonds and record total rates

ADV. Emerging markets ADV increased 18% compared to the

prior year to the second highest level of quarterly trading

ADV ever. We delivered these strong results to finish the year as

we continue to execute our high-touch strategy, focused on

portfolio trading and block trading. A record 77% of

portfolio trades were executed on X-Pro in December and we are

continuing to gain traction with our block trading solution, which

was launched in the fourth quarter in emerging markets and

Eurobonds. Block trades in emerging markets on our platform

increased 17% in 4Q24 compared to the prior year, with the

average block trade size increasing to $13 million. We have

additional enhancements coming in the first quarter, which we

believe will enhance our market share in the coming quarters.”

Select December 2024 Highlights

- Total average daily volume (“ADV”) of $32.0 billion

increased 19% compared to the prior year, but decreased

29% compared to November 2024 levels. The decline in total

trading ADV in December compared to November 2024 includes the

impact of the normal seasonal slowdown we experience across most

product areas in the month. These results were driven by total

rates ADV of $19.8 billion, which increased 34%

compared to the prior year, but decreased 36% compared to

November 2024. Total credit ADV of $12.3 billion was in line

with the prior year, but decreased 14% compared to November

2024.

U.S. Credit2

- U.S. high-grade ADV of $5.9 billion decreased

3% compared to the prior year, and decreased 9%

compared to November 2024. Estimated market ADV increased 9%

compared to the prior year, but decreased 16% compared to

November 2024. Estimated market share was 19.5%, down from

22.1% in the prior year, but up from 18.0% in

November 2024. Including the impact of single-dealer portfolio

trades, estimated market share was 19.6%, down from

22.1% in the prior year, but up from 18.1% in

November 2024.

- U.S. high-yield ADV of $1.2 billion decreased 14%

compared to the prior year, and decreased 7% compared to

November 2024. Estimated market ADV increased 7% compared to

the prior year, but decreased 22% compared to November 2024.

Estimated market share was 14.7%, down from 18.2% in

the prior year, but up from 12.3% in November 2024.

Including the impact of single-dealer portfolio trades,

estimated market share was 14.7%, down from 18.3% in

the prior year, but up from 12.6% in November 2024.

Other Credit

- Emerging markets ADV of $2.9 billion increased 8%

compared to the prior year, but decreased 25% compared to

November 2024. The year-over-year increase was driven by a

14% increase in hard currency ADV, and a 2% increase

in local currency ADV.

- Eurobonds ADV of $1.6 billion increased 2%

compared to the prior year, but decreased 19% compared to

November 2024.

- Record municipal bond ADV of $656 million

increased 37% compared to the prior year, and increased

4% compared to November 2024. Estimated market ADV increased

26% compared to the prior year, and increased 2%

compared to November 2024. Estimated market share was 6.8%,

up from 6.3% in the prior year, and up slightly from

6.7% in November 2024.3

Strategic Priority Related Protocols & Workflow

Tools

- $1.0 billion in total portfolio trading ADV increased

48% compared to the prior year, and increased 8%

compared to November 2024. A record 77% of portfolio trading

volume was executed over X-Pro. — Estimated U.S. high-grade and

U.S. high-yield TRACE portfolio trading market ADV increased

3% compared to November 2024.

- Our estimated market share of U.S. high-grade and U.S.

high-yield TRACE portfolio trading was 16.7% in December

2024, up from 13.6% in November 2024. — Portfolio trading

represented approximately 13% of U.S. high-grade and U.S.

high-yield TRACE in December 2024, up from 10% in November

2024.

- Open Trading ADV of $3.6 billion decreased 7%

compared to the prior year, and decreased 15% compared to

November 2024. Open Trading share4 of total credit trading volume

was 36%, down from 37% in the prior year, but up from

35% in November 2024.

- Dealer RFQ ADV of $1.0 billion across all credit

products decreased 5% compared to the prior year, and

decreased 23% compared to November 2024.

- AxessIQ, the order and execution workflow solution

designed for wealth management and private banking clients,

achieved ADV of $135 million, down 9% compared to the

prior year, and down 8% compared to November 2024.

Rates

- Total rates ADV of $19.8 billion increased 34%

compared to the prior year, but decreased 36% compared to

November 2024.

Variable Transaction Fees Per Million (FPM)1

- The preliminary FPM for total credit for December 2024 was

approximately $148, down from $159 in the prior year,

but up from $146 in November 2024. The decline in total

credit FPM year-over-year was due to protocol and product mix,

principally by the lower Open Trading share of U.S. high-grade, an

increase in portfolio trading activity and lower levels of U.S.

high-yield activity. The increase in total credit FPM

month-over-month was due to product mix, principally U.S.

high-yield. The preliminary FPM for total rates for December 2024

was approximately $4.14, down from $4.61 in the prior

year, but up from $4.07 in November 2024.

Select 4Q24 Highlights

- Record total ADV of $41.0 billion increased

38% compared to the prior year, and increased 1%

compared to 3Q24 levels. These results were driven by record

total rates ADV of $27.1 billion, which increased 64%

compared to the prior year, and increased 3% compared to

3Q24 levels. U.S. Treasury ADV on the platform in 4Q23 was

negatively impacted by an outage at ICBC, the third-party the

Company was then using for U.S. Treasury settlement services. Total

credit ADV of $13.9 billion increased 6% compared to

the prior year, but decreased 2% compared to 3Q24.

U.S. Credit2

- U.S. high-grade ADV of $6.5 billion increased

4% compared to the prior year, but decreased 8%

compared to 3Q24. Estimated market ADV increased 18%

compared to the prior year, but decreased 3% compared to

3Q24. Estimated market share was 18.4%, down from

20.9% in the prior year, and down from 19.5% in 3Q24.

Including the impact of single-dealer portfolio trades,

estimated market share was 18.8%, down from 21.0% in

the prior year, and down from 20.0% in 3Q24.

- U.S. high-yield ADV of $1.3 billion decreased 19%

compared to the prior year, but increased 5% compared to

3Q24. Estimated market ADV increased 5% compared to the

prior year, and increased 2% compared to 3Q24. Estimated

market share was 13.4%, down from 17.2% in the prior

year, but up from 13.0% in 3Q24. Including the impact of

single-dealer portfolio trades, estimated market share was

13.7%, down from 17.3% in the prior year, but up from

13.4% in 3Q24.

Other Credit

- Emerging markets ADV of $3.5 billion increased

18% compared to the prior year, and increased 4%

compared to 3Q24. The year-over-year increase was driven by a

26% increase in hard currency ADV, and a 7% increase

in local currency ADV.

- Eurobonds ADV of $2.0 billion increased 13%

compared to the prior year, and increased 6% compared to

3Q24.

- Record municipal bond ADV of $620 million

increased 15% compared to the prior year, and increased

7% compared to 3Q24. Estimated market ADV decreased

9% compared to the prior year, but increased 32%

compared to 3Q24. Estimated market share was 7.1%, up from

5.6% in the prior year, but down from a record

8.7% in 3Q24.3

Strategic Priority Related Protocols & Workflow

Tools

- $1.1 billion in total portfolio trading ADV increased

57% compared to the prior year, but decreased 8%

compared to 3Q24. A record 71% of portfolio trading volume

was executed over X-Pro. — Estimated U.S. high-grade and U.S.

high-yield TRACE portfolio trading market ADV was flat compared to

3Q24.

- Our estimated market share of U.S. high-grade and U.S.

high-yield TRACE portfolio trading was 16.2%, down from

20.0% in 3Q24. — Portfolio trading represented approximately

11% of U.S. high-grade and U.S. high-yield TRACE in 4Q24, in

line with 3Q24.

- Open Trading ADV of $4.1 billion increased 2%

compared to the prior year, and was in line with 3Q24. Open Trading

share4 of total credit trading volume was 35%, down from

36% in the prior year, but in line with 3Q24 levels.

- Dealer RFQ ADV of $1.2 billion across all credit

products increased 8% compared to the prior year, and

increased 5% compared to 3Q24.

- AxessIQ achieved record ADV of $147

million, up 6% compared to the prior year, and up

14% compared to 3Q24.

Rates

- Record total rates ADV of $27.1 billion increased

64% compared to the prior year, and increased 3%

compared to 3Q24. U.S. Treasury ADV on the platform in November

2023 was negatively impacted by an outage at ICBC, the third-party

the Company was then using for U.S. Treasury settlement

services.

Variable Transaction Fees Per Million (FPM)1

- The preliminary FPM for total credit for 4Q24 was approximately

$150, down from $156 in the prior year, but up

slightly from $149 in 3Q24. The decline in total credit FPM

year-over-year was due to product mix, principally lower levels of

U.S. high-yield activity. The increase in total credit FPM

quarter-over-quarter was due to product mix, principally U.S.

high-yield. The preliminary FPM for total rates for 4Q24 was

approximately $4.30, down from $4.62 in the prior

year, but up from $4.15 in 3Q24.

Table 1: December 2024 ADV

CREDIT RATES $ in millions(unaudited)

US/UK Trading Days5

Total ADV

Total Credit

High-Grade

High-Yield

Emerging Markets

Eurobonds

Municipal Bonds

Total Rates

US Govt. Bonds

Agcy./Other Govt.

Bonds

Dec-24

21/20

$32,037

$12,285

$5,921

$1,219

$2,869

$1,619

$656

$19,752

$18,735

$1,017

Nov-24

19/21

$44,945

$14,291

$6,533

$1,312

$3,811

$2,001

$631

$30,654

$29,325

$1,329

Dec-23

20/19

$26,994

$12,262

$6,133

$1,412

$2,649

$1,580

$480

$14,732

$14,380

$352

YoY % Change

19%

–

(3%)

(14%)

8%

2%

37%

34%

30%

189%

MoM % Change

(29%)

(14%)

(9%)

(7%)

(25%)

(19%)

4%

(36%)

(36%)

(23%)

Table 1A: December 2024 estimated market share

CREDIT RATES (unaudited)

High-Grade

High-Yield

High-Grade/High-Yield

Combined

Municipals3

US Govt. Bonds3

Dec-24

19.5%

14.7%

18.5%

6.8%

2.3%

Nov-24

18.0%

12.3%

16.7%

6.7%

2.9%

Dec-23

22.1%

18.2%

21.3%

6.3%

1.9%

YoY Bps Change

(260) bps

(350) bps

(280) bps

+50 bps

+40 bps

MoM Bps Change

+150 bps

+240 bps

+180 bps

+10 bps

(60) bps

Table 1B: 4Q24 ADV

CREDIT RATES $ in millions(unaudited)

US/UK Trading Days5

Total ADV

Total Credit

High-Grade

High-Yield

Emerging Markets

Eurobonds

Municipal Bonds

Total Rates

US Govt. Bonds

Agcy./Other Govt.

Bonds

4Q24

62/64

$41,030

$13,883

$6,454

$1,345

$3,459

$2,001

$620

$27,147

$25,952

$1,195

3Q24

64/65

$40,516

$14,116

$7,027

$1,278

$3,333

$1,891

$577

$26,400

$25,302

$1,098

4Q23

62/63

$29,641

$13,108

$6,215

$1,653

$2,927

$1,767

$539

$16,533

$16,106

$427

YoY % Change

38%

6%

4%

(19%)

18%

13%

15%

64%

61%

180%

QoQ % Change

1%

(2%)

(8%)

5%

4%

6%

7%

3%

3%

9%

Table 1C: 4Q24 estimated market share

CREDIT RATES (unaudited)

High-Grade

High-Yield High-Grade/High-YieldCombined

Municipals3 US Govt.Bonds3

4Q24

18.4%

13.4%

17.3%

7.1%

2.8%

3Q24

19.5%

13.0%

18.1%

8.7%

2.6%

4Q23

20.9%

17.2%

20.0%

5.6%

2.0%

YoY Bps Change

(250) bps

(380) bps

(270) bps

+150 bps

+80 bps

QoQ Bps Change

(110) bps

+40 bps

(80) bps

(160) bps

+20 bps

1

The FPM for total credit and total rates

for December 2024 and 4Q24 are preliminary and may be revised in

subsequent updates and public filings. The Company undertakes no

obligation to update any fee information in future press

releases.

2

The Company is highlighting the impact of

single-dealer portfolio trading volume on U.S. high-grade and U.S.

high-yield trading volume and estimated market share, where

material, but will continue to exclude single-dealer portfolio

trading activity from each product’s aggregated trading volume and

estimated market share and the total credit FPM calculation.

3

See “General Notes Regarding the Data

Presented” below.

4

Open Trading share of total credit trading

volume is derived by taking total Open Trading volume across all

credit products where Open Trading is offered and dividing by total

credit trading volume across all credit products where Open Trading

is offered.

5

The number of U.S. trading days is based

on the SIFMA holiday recommendation calendar and the number of U.K.

trading days is based primarily on the U.K. Ban holiday

schedule.

General Notes Regarding the Data Presented

Reported MarketAxess volume in all product categories includes

only fully electronic trading volume. MarketAxess trading volumes

and the Financial Industry Regulatory Authority (“FINRA”) Trade

Reporting and Compliance Engine (“TRACE”) reported volumes are

available on the Company’s website at

investor.marketaxess.com/volume.

For periods beginning with January 2024, the Company has made

changes to the market volume data used to calculate estimated

market share for Municipal and U.S. Government Bonds. For Municipal

Bonds, the Company previously used estimates, derived from data

issued by the Municipal Securities Rule Making Board (“MSRB”),

including estimates for new issuance, commercial paper and

variable-rate trading activity, and excluded these volumes from the

estimated market volume data. While the Company still uses

estimates, the new methodology for identifying and excluding these

volumes from the market volume data is now based on MSRB “flags” to

identify new issuance, commercial paper, and variable-rate volumes.

For U.S. Government Bonds, the previous data source for estimated

market volumes was the Federal Reserve Bank’s Reported Primary

Dealer U.S. Treasury Bond Trading Volumes, which was reported on a

one-week lag. The new source for U.S. Government Bond trading

volumes is FINRA’s U.S. Treasury TRACE data. The Company believes

that the refined methodology used for Municipal Bonds, and the new

data source for U.S. Government Bonds, provides more accurate

measures of estimated market volumes and estimated market share.

Prior comparable periods have been recast retrospectively for both

Municipal and U.S. Government Bonds to conform to the updated

presentation of the data. The new estimated market volume data is

also available on the Company’s website at

investor.marketaxess.com/volume.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain forward-looking statements,

including statements about the outlook and prospects for the

Company, market conditions and industry growth, as well as

statements about the Company’s future financial and operating

performance. These and other statements that relate to future

results and events are based on MarketAxess’ current expectations.

The Company’s actual results in future periods may differ

materially from those currently expected or desired because of a

number of risks and uncertainties, including: global economic,

political and market factors; the level of trading volume

transacted on the MarketAxess platform; the rapidly evolving nature

of the electronic financial services industry; the level and

intensity of competition in the fixed-income electronic trading

industry and the pricing pressures that may result; the variability

of our growth rate; our ability to introduce new fee plans and our

clients’ response; our ability to attract clients or adapt our

technology and marketing strategy to new markets; risks related to

our growing international operations; our dependence on our

broker-dealer clients; the loss of any of our significant

institutional investor clients; our exposure to risks resulting

from non-performance by counterparties to transactions executed

between our clients in which we act as an intermediary in matched

principal trades; risks related to self-clearing; risks related to

sanctions levied against states or individuals that could expose us

to operational or regulatory risks; the effect of rapid market or

technological changes on us and the users of our technology; our

dependence on third-party suppliers for key products and services;

our ability to successfully maintain the integrity of our trading

platform and our response to system failures, capacity constraints

and business interruptions; the occurrence of design defects,

errors, failures or delays with our platforms, products or

services; our vulnerability to malicious cyber-attacks and

attempted cybersecurity breaches; our actual or perceived failure

to comply with privacy and data protection laws; our ability to

protect our intellectual property rights or technology and defend

against intellectual property infringement or other claims; our

ability to enter into strategic alliances and to acquire other

businesses and successfully integrate them with our business; our

dependence on our management team and our ability to attract and

retain talent; limitations on our flexibility because we operate in

a highly regulated industry; the increasing government regulation

of us and our clients; risks related to the divergence of U.K. and

European Union legal and regulatory requirements following the

U.K.’s exit from the European Union; our exposure to costs and

penalties related to our extensive regulation; our risks of

litigation and securities laws liability; adverse effects as a

result of climate change or other ESG risks that could affect our

reputation; our future capital needs and our ability to obtain

capital when needed; limitations on our operating flexibility

contained in our credit agreement; our exposure to financial

institutions by holding cash in excess of federally insured limits;

and other factors. The Company undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise. More information about

these and other factors affecting MarketAxess’ business and

prospects is contained in MarketAxess’ periodic filings with the

Securities and Exchange Commission and can be accessed at

www.marketaxess.com.

About MarketAxess

MarketAxess (Nasdaq: MKTX) operates a leading electronic trading

platform that delivers greater trading efficiency, a diversified

pool of liquidity and significant cost savings to institutional

investors and broker-dealers across the global fixed-income

markets. Over 2,000 firms leverage MarketAxess’ patented technology

to efficiently trade fixed-income securities. Our automated and

algorithmic trading solutions, combined with our integrated and

actionable data offerings, help our clients make faster,

better-informed decisions on when and how to trade on our platform.

MarketAxess’ award-winning Open Trading® marketplace is widely

regarded as the preferred all-to-all trading solution in the global

credit markets. Founded in 2000, MarketAxess connects a robust

network of market participants through an advanced full trading

lifecycle solution that includes automated trading solutions,

intelligent data and index products and a range of post-trade

services. Learn more at www.marketaxess.com and on X

@MarketAxess.

Table 2: Trading Volume Detail

Month Ended December

31,

In millions (unaudited)

2024

2023

% Change

Volume

ADV

Volume

ADV

Volume

ADV

Credit

High-grade

$

124,334

$

5,921

$

122,656

$

6,133

1

%

(3

)

%

High-yield

25,598

1,219

28,248

1,412

(9

)

(14

)

Emerging markets

60,240

2,869

52,988

2,649

14

8

Eurobonds

32,380

1,619

30,025

1,580

8

2

Other credit

13,800

657

9,762

488

41

35

Total credit trading1

256,352

12,285

243,679

12,262

5

-

Rates

U.S. government bonds2

393,430

18,735

287,590

14,380

37

30

Agency and other government bonds1

20,414

1,017

6,830

352

199

189

Total rates trading

413,844

19,752

294,420

14,732

41

34

Total trading

$

670,196

$

32,037

$

538,099

$

26,994

25

19

Number of U.S. Trading Days3

21

20

Number of U.K. Trading Days4

20

19

Quarter Ended December

31,

In millions (unaudited)

2024

2023

% Change

Volume

ADV

Volume

ADV

Volume

ADV

Credit

High-grade

$

400,129

$

6,454

$

385,301

$

6,215

4

%

4

%

High-yield

83,373

1,345

102,501

1,653

(19

)

(19

)

Emerging markets

214,439

3,459

181,445

2,927

18

18

Eurobonds

128,064

2,001

111,330

1,767

15

13

Other credit

38,698

624

33,854

546

14

14

Total credit trading1

864,703

13,883

814,431

13,108

6

6

Rates

U.S. government bonds2

1,608,995

25,952

998,542

16,106

61

61

Agency and other government bonds1

76,221

1,195

26,684

427

186

180

Total rates trading

1,685,216

27,147

1,025,226

16,533

64

64

Total trading

$

2,549,919

$

41,030

$

1,839,657

$

29,641

39

38

Number of U.S. Trading Days3

62

62

Number of U.K. Trading Days4

64

63

Table 2: Trading Volume Detail

(continued)

Year-to-Date Ended December

31,

In millions (unaudited)

2024

2023

% Change

Volume

ADV

Volume

ADV

Volume

ADV

Credit

High-grade

$

1,711,275

$

6,845

$

1,457,559

$

5,854

17

%

17

%

High-yield

334,761

1,339

398,275

1,599

(16

)

(16

)

Emerging markets

859,412

3,438

717,877

2,883

20

19

Eurobonds

508,093

2,008

441,171

1,758

15

14

Other credit

135,975

543

112,451

451

21

20

Total credit trading1

3,549,516

14,173

3,127,333

12,545

13

13

Rates

U.S. government bonds2

5,511,045

22,044

4,545,850

18,256

21

21

Agency and other government bonds1

227,614

902

106,933

427

113

111

Total rates trading

5,738,659

22,946

4,652,783

18,683

23

23

Total trading

$

9,288,175

$

37,119

$

7,780,116

$

31,228

19

19

Number of U.S. Trading Days3

250

249

Number of U.K. Trading Days4

253

251

1 Consistent with FINRA TRACE reporting

standards, both sides of trades are included in the Company's

reported volumes when the Company executes trades on a matched

principal basis between two counterparties.

2 Consistent with industry standards, U.S.

government bond trades are single-counted.

3 The number of U.S. trading days is based

on the SIFMA holiday recommendation calendar.

4 The number of U.K. trading days is based

primarily on the U.K. Bank holiday schedule.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250105378963/en/

INVESTOR RELATIONS Stephen Davidson MarketAxess

Holdings Inc. +1 212 813 6313 sdavidson2@marketaxess.com

MEDIA RELATIONS Marisha Mistry MarketAxess

Holdings Inc. +1 917 267 1232 mmistry@marketaxess.com

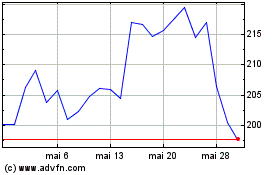

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025