ATS Corporation (TSX: ATS) (NYSE: ATS) (“ATS” or the

“Company”) a leading automation solutions provider, today

announced it has entered into a definitive agreement to acquire

Paxiom Group (“Paxiom”), a provider of primary, secondary,

and end-of-line packaging machines in the food and beverage,

cannabis, and pharmaceutical industries.

“With a dynamic product mix and a growing global footprint,

Paxiom will be a great addition to ATS,” said Andrew Hider, Chief

Executive Officer of ATS Corporation. “As we seek to expand our

presence in regulated markets, such as food and beverage and life

sciences, the strong reputation and sophisticated offerings that

Paxiom brings to market will provide both organic and synergistic

opportunities for growth with an accretive margin profile.”

With headquarters in Montreal, Quebec, the group includes its

companies WeighPack Systems, EndFlex, Valtara and Kang-Di. With

manufacturing facilities in: Montreal, Quebec; Miami, Florida;

Schio, Italy and Shanghai, China as well as an integration center

and showroom in Las Vegas, NV, Paxiom will join ATS’ Products and

Food Technology business. Paxiom has been building leading

automated packaging solutions for over 30 years, providing a vast

product line that includes precision weigh filling, bagging,

wrapping, labelling, conveyors, case forming, robotic case packing

and end of line palletizing equipment that will complement ATS’

businesses CFT, Raytec, Marco, IWK, and NCC and allows ATS to offer

complete packaging and end-of-line solutions. In its calendar year

ended December 31, 2023, Paxiom generated revenues of approximately

$67 million and an adjusted EBITDA margin1 above 19%, with the

majority of revenues being generated in North America. Paxiom

employs approximately 200 people and has a strong customer

portfolio representing leading companies in multiple sectors.

“Paxiom’s differentiated solutions in filling, wrapping,

sealing, labelling and palletizing across a range of industries

will be a strong complement to our existing ATS portfolio,” added

Jeremy Patten, President of ATS Products & Food Technology. “As

we continue to expand our value proposition to customers across the

markets we serve, the addition of Paxiom to ATS is highly

complementary and will bring meaningful expansion to how we can

support our customers.”

The purchase price represented an EV/EBITDA1 multiple accretive

to ATS’ current trading multiple, however, specific financial terms

of the transaction were not disclosed. The transaction is expected

to close in the third calendar quarter of 2024, subject to

customary closing conditions. ATS plans to fund the acquisition

with cash and by drawing on its revolving credit facility.

1. Adjusted EBITDA is a non-IFRS measure;

adjusted EBITDA margin is a non-IFRS ratio.

About ATS Corporation

ATS Corporation is an industry-leading automation solutions

provider to many of the world's most successful companies. ATS uses

its extensive knowledge base and global capabilities in custom

automation, repeat automation, automation products and value-added

solutions including pre-automation and after-sales services, to

address the sophisticated manufacturing automation systems and

service needs of multinational customers in markets such as life

sciences, transportation, food & beverage, consumer products,

and energy. Founded in 1978, ATS employs over 7,000 people at more

than 65 manufacturing facilities and over 85 offices in North

America, Europe, Southeast Asia and Oceania. The Company's common

shares are traded on the Toronto Stock Exchange and the NYSE under

the symbol ATS. Visit the Company's website at

www.atsautomation.com.

Forward-Looking Statements

This press release contains certain statements that may

constitute forward-looking information and forward-looking

statements within the meaning of applicable Canadian and United

States securities laws ("forward-looking statements"). All such

statements are made pursuant to the “safe harbour” provisions of

Canadian provincial and territorial securities laws and the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts

regarding possible events, conditions or results of operations that

ATS believes, expects or anticipates will or may occur in the

future, including, but not limited to: the synergistic

opportunities for growth and margin expected from the acquisition;

the complement to, or expansion of, ATS’ offering; the benefit to

ATS’ customers; the completion of the acquisition of Paxiom; and

the manner of funding of the acquisition.

Forward-looking statements are inherently subject to significant

known and unknown risks, uncertainties, and other factors that may

cause the actual results, performance, or achievements of ATS, or

developments in ATS’ business or in its industry, to differ

materially from the anticipated results, performance, achievements,

or developments expressed or implied by such forward-looking

statements. Important risks, uncertainties, and factors that could

cause actual results to differ materially from expectations

expressed in the forward-looking statements include, but are not

limited to, the impact of regional or global conflicts; general

market performance including capital market conditions and

availability and cost of credit; performance of the markets that

ATS serves; industry challenges in securing the supply of labour,

materials, and, in certain jurisdictions, energy sources such as

natural gas; impact of inflation; interest rate changes; foreign

currency and exchange risk; the relative strength of the Canadian

dollar; risks related to customer concentration; risks related to a

recession, slowdown, and/or sustained downturn in the economy;

impact of factors such as increased pricing pressure, increased

cost of energy and supplies, and delays in relation thereto, and

possible margin compression; the regulatory and tax environment;

the emergence of new infectious diseases or any epidemic or

pandemic outbreak or resurgence, and collateral consequences

thereof, including the disruption of economic activity, volatility

in capital and credit markets, and legislative and regulatory

responses; the effect of events involving limited liquidity,

defaults, non-performance or other adverse developments that affect

financial institutions, transaction counterparties, or other

companies in the financial services industry generally, or concerns

or rumours about any events of these kinds or other similar risks,

that have in the past and may in the future lead to market-wide

liquidity problems; energy shortages and global prices increases;

the consequences of activist initiatives on business performance,

results, or share price; the impact of analyst reports on price and

trading volume of ATS’ shares; that closing is delayed or

prohibited as a result of the inability to complete closing

conditions; that the expected synergies are not realized; that the

acquisition does not complement or expand ATS’ offering, or benefit

customers, as expected; that the transaction is not funded as

expected; and other risks and uncertainties detailed from time to

time in ATS' filings with securities regulators, including, without

limitation, the risk factors described in ATS’ annual information

form for the fiscal year ended March 31, 2024, which are available

on the System for Electronic Data Analysis and Retrieval+

("SEDAR+") at www.sedarplus.com and on the U.S. Securities Exchange

Commission’s Electronic Data Gathering, Analysis and Retrieval

System (“EDGAR”) at www.sec.gov. ATS has attempted to identify

important factors that could cause actual results to materially

differ from current expectations, however, there may be other

factors that cause actual results to differ materially from such

expectations.

Forward-looking statements are necessarily based on a number of

estimates, factors, and assumptions regarding, among others,

management's current plans, estimates, projections, beliefs and

opinions, the future performance and results of the Company’s

business and operations; the ability of ATS to execute on its

business objectives; and general economic and political conditions,

and global events, including any epidemic or pandemic outbreak or

resurgence.

Forward-looking statements included in this press release are

only provided to understand management’s current expectations

relating to future periods and, as such, are not appropriate for

any other purpose. Although ATS believes that the expectations

reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and ATS cautions you

not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. ATS does

not undertake any obligation to update forward-looking statements

contained herein other than as required by law.

Non-IFRS and Other Financial Measures

Throughout this press release management refers to certain

non-IFRS measures, and non-IFRS ratios. The term "adjusted EBITDA"

is a non-IFRS measure, and "adjusted EBITDA margin" is a non-IFRS

ratio, both of which do not have any standardized meaning

prescribed within International Financial Reporting Standards

("IFRS") and therefore may not be comparable to similar measures

presented by other companies. Such measures should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. Adjusted EBITDA is

defined as net income excluding income tax expense, net finance

costs, depreciation and amortization before items excluded from

management's internal analysis of operating results, such as

amortization expense of acquisition-related intangible assets,

acquisition-related transaction and integration costs,

restructuring charges, the mark-to-market adjustment on stock-based

compensation and certain other adjustments which would be

non-recurring in nature ("adjustment items"). Adjusted EBITDA

margin is an expression of the Company's adjusted EBITDA as a

percentage of revenues. Adjusted EBITDA and adjusted EBITDA margin

are used by the Company to evaluate the performance of its

operations. Management believes that adjusted EBITDA is an

important indicator of the Company's ability to generate operating

cash flows to fund continued investment in its operations. The

adjustment items used by management to arrive at these metrics are

not considered to be indicative of the business' ongoing operating

performance. Management believes that ATS shareholders and

potential investors in ATS use these additional IFRS measures and

non-IFRS financial measures in making investment decisions and

measuring operational results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240515213021/en/

For more information: David Galison Head of Investor

Relations ATS Corporation 730 Fountain Street North Cambridge, ON,

N3H 4R7 (519) 653-6500 dgalison@atsautomation.com

For general media inquiries: Matthew Robinson Director,

Corporate Communications ATS Corporation 730 Fountain Street North

Cambridge, ON, N3H 4R7 (519) 653-6500

mrobinson@atsautomation.com

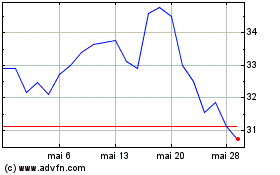

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025