Infrastructure results support consolidated

margin performance, partially offsetting global irrigation market

softness

Lindsay Corporation (NYSE: LNN), a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology, today announced results for its third quarter ended on

May 31, 2024.

Key Highlights

- Diluted earnings per share of $1.85 compared to $1.53 in the

prior year quarter

- Recognition of an income tax credit in Brazil adds $4.8 million

to net earnings

- Secured large multi-year international irrigation supply

agreement valued at more than $100 million

- Completed $17.9 million in share repurchases during the

quarter

“Market conditions in our irrigation segment continue to weigh

on farmer sentiment, resulting in demand softness. In North

America, high precipitation levels and wet field conditions across

the Midwest contributed to lower sales of irrigation equipment and

replacement parts during our third quarter," said Randy Wood,

President and Chief Executive Officer. "In Brazil, the market

continues to be tempered by lower commodity prices and tight credit

availability. We remain encouraged by the growing strength and

momentum in our infrastructure business, supported by new project

sales and momentum in leasing revenues of our Road Zipper System™.

The growth and margin expansion we achieved in our infrastructure

business for the quarter helped to offset some of the softness in

the irrigation business."

"Earlier this month we announced that we had entered into a

multi-year supply agreement to provide Zimmatic™ irrigation systems

and FieldNET™ remote management and scheduling technology to a

significant customer in the Middle East and North Africa (MENA)

region. The project, valued at more than $100 million, is the

largest in Lindsay's history and further demonstrates our ability

to execute large-scale and complex projects that address the

critical needs of our customers. The execution of this project will

help to enhance the customer's ability to increase food production,

conserve scarce water resources and improve quality of life.

Notably, the attributes of this key project are reflective of the

growth opportunities presented in international markets, where

secular global trends align with Lindsay's ability to help

customers optimize resources while creating sustained value through

our leading combination of irrigation hardware and precision

technology platforms."

"During the third quarter we also completed share repurchases

totaling $17.9 million, which aligns with our capital allocation

priorities to utilize our strong balance sheet to enhance

shareholder value. Additionally, this further demonstrates our

ability to both invest in value creation opportunities, including

the $50 million investment in Lindsay, Nebraska announced earlier

this year, while also returning cash to shareholders at opportune

times."

Third Quarter Summary

Consolidated Financial Summary

Third Quarter

(dollars in millions, except per share

amounts)

FY2024

FY2023

$ Change

% Change

Total revenues

$139.2

$164.6

($25.4)

(15%)

Operating income

$19.9

$27.0

($7.0)

(26%)

Operating margin

14.3%

16.4%

Net earnings

$20.4

$16.9

$3.5

21%

Diluted earnings per share

$1.85

$1.53

$0.32

21%

Revenues for the quarter were $139.2 million, a decrease of

$25.4 million, or 15 percent, compared to revenues of $164.6

million in the prior year third quarter. An increase in

infrastructure segment revenues was more than offset by lower

irrigation segment revenues compared to the prior year third

quarter.

Operating income for the quarter was $19.9 million, a decrease

of $7.0 million, or 26 percent, compared to operating income of

$27.0 million in the prior year third quarter. Operating margin was

14.3 percent of sales, compared to 16.4 percent of sales in the

prior year quarter. The decrease in operating income and margin

resulted mainly from lower irrigation segment revenues and the

impact from deleverage of fixed operating expenses. This decrease

was partially offset by improved operating income and operating

margin in the infrastructure segment.

Net earnings for the quarter were $20.4 million, or $1.85 per

diluted share, compared with net earnings of $16.9 million, or

$1.53 per diluted share, for the prior year third quarter. The

impact of lower operating income was favorably offset by higher

other income, driven by increased interest income and favorable

foreign currency translation results compared to the prior year

third quarter, along with the recognition of an income tax credit

in Brazil of $4.8 million, or $0.44 per diluted share.

Third Quarter Segment Results

Irrigation Segment

Third Quarter

(dollars in millions)

FY2024

FY2023

$ Change

% Change

Revenues:

North America

$68.2

$75.0

($6.8)

(9%)

International

$46.6

$67.5

($20.9)

(31%)

Total revenues

$114.8

$142.6

($27.7)

(19%)

Operating income

$19.5

$30.7

($11.2)

(36%)

Operating margin

17.0%

21.6%

Irrigation segment revenues for the quarter were $114.8 million,

a decrease of $27.7 million, or 19 percent, compared to $142.6

million in the prior year third quarter. North America irrigation

revenues of $68.2 million decreased $6.8 million, or 9 percent,

compared to the prior year third quarter. The decrease resulted

from a combination of lower unit sales volume of irrigation

equipment, lower sales of replacement parts and slightly lower

average selling prices compared to the prior year third

quarter.

International irrigation revenues of $46.6 million decreased

$20.9 million, or 31 percent, compared to the prior year third

quarter. The decrease resulted primarily from lower sales volumes

in Brazil and other Latin America markets compared to the prior

year third quarter while demand in other markets remained stable.

In Brazil, order activity remains constrained due to the impact

lower commodity prices have on grower profitability and available

liquidity, which is reducing growers' ability to invest in

irrigation equipment in the near term. The decrease in revenues was

partially offset by the favorable effects of foreign currency

translation of approximately $0.7 million compared to the prior

year third quarter.

Irrigation segment operating income for the quarter was $19.5

million, a decrease of $11.2 million, or 36 percent, compared to

the prior year third quarter. Operating margin was 17.0 percent of

sales, compared to 21.6 percent of sales in the prior year third

quarter. Lower operating income and margin resulted mainly from

lower revenues and the impact from deleverage of fixed operating

expenses.

Infrastructure Segment

Third Quarter

(dollars in millions)

FY2024

FY2023

$ Change

% Change

Total revenues

$24.4

$22.0

$2.4

11%

Operating income

$6.3

$3.6

$2.7

76%

Operating margin

25.8%

16.2%

Infrastructure segment revenues for the quarter were $24.4

million, an increase of $2.4 million, or 11 percent, compared to

$22.0 million in the prior year third quarter. The increase

resulted from higher Road Zipper System sales and higher lease

revenues compared to the prior year third quarter. The impact of

higher sales of road safety products in the U.S. was offset by

lower sales in international markets compared to the prior year

third quarter.

Infrastructure segment operating income for the quarter was $6.3

million, an increase of $2.7 million, or 76 percent, compared to

the prior year third quarter. Operating margin was 25.8 percent of

sales, compared to 16.2 percent of sales in the prior year third

quarter. Increased operating income and operating margin resulted

from higher revenues and a more favorable margin mix of revenues

with higher Road Zipper System sales and lease revenues compared to

the prior year third quarter.

The backlog of unfilled orders as of May 31, 2024, was $246.9

million compared with $94.5 million as of May 31, 2023. Included in

these backlogs are amounts of $62.0 million and $5.2 million,

respectively, for orders that are not expected to be fulfilled

within the subsequent twelve months. The backlog in both segments

was higher compared to the prior year, with the increase in

irrigation backlog resulting from the addition of the large project

in the MENA region. Revenues for this project are expected to be

recognized beginning in the fourth quarter of fiscal 2024 and

continuing through the first quarter of fiscal 2026.

Outlook

Mr. Wood concluded, “We are now in the growing season in North

America, when weather conditions will influence crop yields,

production estimates and ultimately the direction of crop prices

and net farm income for the year. We expect demand in North America

to remain tempered until the outlook for net farm income improves.

Similarly, we expect current market conditions in Brazil to temper

demand for irrigation equipment in the near term, while we remain

confident in the longer-term growth opportunity in that market. We

expect continued growth in developing international markets driven

by the ever-present need to address food security, as evidenced by

the large project we secured in the MENA region."

“Supported by increased U.S. infrastructure spending, we expect

continued growth in Road Zipper System lease revenues and sales of

road safety products. We also remain optimistic regarding our Road

Zipper System project sales pipeline; however the timing of

individual project recognition remains challenging to predict.”

Third Quarter Conference Call

Lindsay’s fiscal 2024 third quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (833) 535-2202 in the U.S.,

or (412) 902-6745 internationally, and requesting the Lindsay

Corporation call. Additionally, the conference call will be

simulcast live on the internet and can be accessed via the investor

relations section of the Company's website, www.lindsay.com.

Replays of the conference call will remain on our website through

the next quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's website.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer

and distributor of irrigation and infrastructure equipment and

technology. Established in 1955, the company has been at the

forefront of research and development of innovative solutions to

meet the food, fuel, fiber and transportation needs of the world’s

rapidly growing population. The Lindsay family of irrigation brands

includes Zimmatic™ center pivot and lateral move agricultural

irrigation systems, FieldNET™ and FieldWise™ remote irrigation

management, FieldNET Advisor™ irrigation scheduling technology, and

industrial IoT solutions. Also a global leader in the

transportation industry, Lindsay Transportation Solutions

manufactures equipment to improve road safety and keep traffic

moving on the world’s roads, bridges and tunnels, through the

Barrier Systems™, Road Zipper™ and Snoline™ brands. For more

information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements This release contains

forward-looking statements that are subject to risks and

uncertainties, and which reflect management’s current beliefs and

estimates of future economic circumstances, industry conditions,

Company performance and financial results. You can find a

discussion of many of these risks and uncertainties in the annual,

quarterly and current reports that the Company files with the

Securities and Exchange Commission. Forward-looking statements

include information concerning possible or assumed future results

of operations and planned financing of the Company and those

statements preceded by, followed by or including the words

“anticipate,” “estimate,” “believe,” “intend,” "expect," "outlook,"

"could," "may," "should," “will,” or similar expressions. For these

statements, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. The Company undertakes no obligation

to update any forward-looking information contained in this press

release.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(Unaudited)

Three months ended

Nine months ended

(in thousands, except per share

amounts)

May 31, 2024

May 31, 2023

May 31, 2024

May 31, 2023

Operating revenues

$

139,199

$

164,553

$

452,076

$

506,953

Cost of operating revenues

92,702

111,332

306,720

346,454

Gross profit

46,497

53,221

145,356

160,499

Operating expenses:

Selling expense

9,579

8,681

28,894

27,092

General and administrative expense

12,695

13,061

40,823

41,237

Engineering and research expense

4,287

4,522

12,531

13,350

Total operating expenses

26,561

26,264

82,248

81,679

Operating income

19,936

26,957

63,108

78,820

Other income (expense):

Interest expense

(767

)

(948

)

(2,474

)

(2,895

)

Interest income

961

680

3,324

1,545

Other income (expense), net

43

(957

)

(93

)

(2,000

)

Total other income (expense)

237

(1,225

)

757

(3,350

)

Earnings before income taxes

20,173

25,732

63,865

75,470

Income tax (benefit) expense

(206

)

8,851

10,344

22,320

Net earnings

$

20,379

$

16,881

$

53,521

$

53,150

Earnings per share:

Basic

$

1.85

$

1.53

$

4.86

$

4.83

Diluted

$

1.85

$

1.53

$

4.84

$

4.80

Shares used in computing earnings per

share:

Basic

10,996

11,008

11,016

11,001

Diluted

11,030

11,052

11,055

11,063

Cash dividends declared per share

$

0.35

$

0.34

$

1.05

$

1.02

LINDSAY CORPORATION AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Unaudited)

Three months ended

Nine months ended

(in thousands)

May 31, 2024

May 31, 2023

May 31, 2024

May 31, 2023

Operating revenues:

Irrigation:

North America

$

68,235

$

75,027

$

240,457

$

249,315

International

46,605

67,544

147,569

193,115

Irrigation segment

114,840

142,571

388,026

442,430

Infrastructure segment

24,359

21,982

64,050

64,523

Total operating revenues

$

139,199

$

164,553

$

452,076

$

506,953

Operating income:

Irrigation segment

$

19,524

$

30,727

$

70,480

$

92,188

Infrastructure segment

6,276

3,556

13,401

8,947

Corporate

(5,864

)

(7,326

)

(20,773

)

(22,315

)

Total operating income

$

19,936

$

26,957

$

63,108

$

78,820

The Company manages its business activities in two reportable

segments as follows:

Irrigation – This reporting segment includes the manufacture and

marketing of center pivot, lateral move, and hose reel irrigation

systems and large diameter steel tubing, as well as various

innovative technology solutions such as GPS positioning and

guidance, variable rate irrigation, remote irrigation management

and scheduling technology, irrigation consulting and design and

industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture

and marketing of movable barriers, specialty barriers, crash

cushions and end terminals, and road marking and road safety

equipment.

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

May 31, 2024

May 31, 2023

August 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

140,221

$

131,577

$

160,755

Marketable securities

12,497

12,806

5,556

Receivables, net

134,461

154,167

144,774

Inventories, net

171,522

166,759

155,932

Other current assets

30,017

25,943

20,467

Total current assets

488,718

491,252

487,484

Property, plant, and equipment, net

111,629

96,992

99,681

Intangibles, net

25,644

16,860

27,719

Goodwill

84,102

67,441

83,121

Operating lease right-of-use assets

16,308

17,378

17,036

Deferred income tax assets

13,367

11,518

10,885

Other noncurrent assets

18,333

22,177

19,734

Total assets

$

758,101

$

723,618

$

745,660

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable

$

35,062

$

42,207

$

44,278

Current portion of long-term debt

229

225

226

Other current liabilities

88,446

90,616

91,604

Total current liabilities

123,737

133,048

136,108

Pension benefits liabilities

4,159

4,653

4,382

Long-term debt

115,029

115,209

115,164

Operating lease liabilities

16,134

18,119

17,689

Deferred income tax liabilities

682

689

689

Other noncurrent liabilities

18,364

15,104

15,977

Total liabilities

278,105

286,822

290,009

Shareholders' equity:

Preferred stock

—

—

—

Common stock

19,123

19,092

19,094

Capital in excess of stated value

102,752

96,627

98,508

Retained earnings

678,261

620,922

636,297

Less treasury stock - at cost

(295,138

)

(277,238

)

(277,238

)

Accumulated other comprehensive loss,

net

(25,002

)

(22,607

)

(21,010

)

Total shareholders' equity

479,996

436,796

455,651

Total liabilities and shareholders'

equity

$

758,101

$

723,618

$

745,660

LINDSAY CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Nine months ended

(in thousands)

May 31, 2024

May 31, 2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net earnings

$

53,521

$

53,150

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

15,847

14,466

Provision for uncollectible accounts

receivable

321

985

Deferred income taxes

(2,504

)

(1,548

)

Share-based compensation expense

4,887

4,775

Unrealized foreign currency transaction

loss

58

2,045

Other, net

237

574

Changes in assets and liabilities:

Receivables

8,107

(15,842

)

Inventories

(17,118

)

25,289

Other current assets

(9,768

)

4,401

Accounts payable

(8,592

)

(17,953

)

Other current liabilities

(5,539

)

(11,865

)

Other noncurrent assets and

liabilities

3,193

691

Net cash provided by operating

activities

42,650

59,168

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property, plant, and

equipment

(23,527

)

(13,283

)

Purchases of marketable securities

(15,042

)

(4,932

)

Proceeds from maturities of marketable

securities

8,320

3,675

Other investing activities, net

(2,140

)

(4,399

)

Net cash used in investing activities

(32,389

)

(18,939

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Repurchase of common stock

(17,900

)

—

Dividends paid

(11,557

)

(11,228

)

Common stock withheld for payroll tax

obligations

(1,575

)

(2,471

)

Proceeds from exercise of stock

options

479

—

Other financing activities, net

313

180

Net cash used in financing activities

(30,240

)

(13,519

)

Effect of exchange rate changes on cash

and cash equivalents

(555

)

(181

)

Net change in cash and cash

equivalents

(20,534

)

26,529

Cash and cash equivalents, beginning of

period

160,755

105,048

Cash and cash equivalents, end of

period

$

140,221

$

131,577

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240627357040/en/

LINDSAY CORPORATION: Alicia Pfeifer Vice President,

Investor Relations & Treasury 402-933-6429

Alicia.Pfeifer@lindsay.com

Alpha IR: Joe Caminiti or Stephen Poe 312-445-2870

LNN@alpha-ir.com

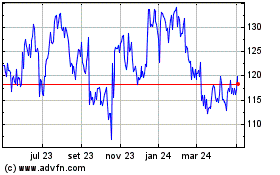

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

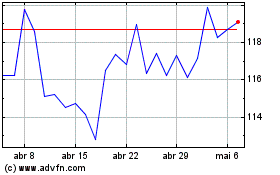

Lindsay (NYSE:LNN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024