10% increase in silver production over

year-to-date 2023

Hecla Mining Company (NYSE:HL) today announced its preliminary

production results for the second quarter of 2024.

HIGHLIGHTS

Year to Date ("YTD") 2024 compared to YTD

2023

- 10% increase in silver production

- Keno Hill produced 1.5 million ounces of silver, with milled

throughput of 341 tons per day ("tpd") YTD and 406 tpd in the

second quarter

- Record quarterly throughput at Lucky Friday of 1,181 tpd

- 4% increase in Casa Berardi's gold production

“Hecla produced 4.5 million silver ounces during the quarter, an

increase of 6% over the prior quarter, reflecting a full quarter of

production at Lucky Friday with record throughput, improved

throughput at Keno Hill and another solid performance by Greens

Creek," said Cassie Boggs, Interim President and CEO. "At Keno Hill

we continue to focus on improving the safety culture and

environmental performance, positioning the mine for long term

success and while our actions are starting to show positive

results, more work is required at this operation. We are also in

contact with and continue to monitor the positions of First Nation

of Na-Cho Nyäk Dun, on whose Traditional Territory Keno Hill is

partly located."

Boggs continued, “With Keno Hill's expected silver production to

exceed 2.7 million ounces this year, Hecla is on track to produce

about 17 million ounces in 2024, a nearly 20% growth rate from

2023, making Hecla the fastest growing established silver producer

with production growth in the best geographical regions."

OPERATIONS

Greens Creek

Greens Creek produced 2.2 million ounces of silver and 14,137

ounces of gold in the second quarter, a decrease of 9% and 3%,

respectively, compared to the first quarter, while processing 2,481

tpd. Silver production declined primarily due to grades reverting

to plan resulting in a decrease of 6% compared to the first

quarter, as well as slightly lower throughput.

Lucky Friday

Lucky Friday produced 1.3 million ounces of silver in the

quarter, an increase of 23% over the first quarter, reflecting a

full quarter of production compared to the first quarter when

production resumed on January 9. Mill throughput was a quarterly

record at 1,181 tpd, as the mine continues to see the benefit of

investment in infrastructure and the UCB mining method. The Company

collected $17.8 million in insurance proceeds during the quarter

with total proceeds to date at $35.2 million of the $50 million

policy sub-limit.

Casa Berardi

Casa Berardi produced 23,187 ounces of gold in the second

quarter, an increase of 5% compared to the first quarter. Increased

production during the quarter resulted from improved grades and

recoveries, partly offset by lower throughput. The mill operated at

an average of 4,033 tpd during the quarter.

Keno Hill

Keno Hill produced 900,440 ounces of silver, an increase of 39%

compared with the 646,312 ounces produced in the first quarter. The

increased production was due to higher and more consistent mill

throughput that averaged 406 tpd, a 47% improvement over the first

quarter. Silver grade was strong for the quarter averaging 25.1

ounces per ton.

While the Company’s focus on improving safety and environmental

processes has delivered increased operational consistency,

additional investment in infrastructure and continued focus on

safety, environmental, permitting and mining practices, as well as

relations with First Nation of Na-Cho Nyäk Dun remain key to

delivering long term value at this operation.

PRODUCTION SUMMARY

Three Months Ended

Six Months Ended

June 30,

March 31,

June 30,

June 30,

2024

2024

2024

2023

Production

Increase/ (Decrease)

Increase/ (Decrease)

Silver (oz)

4,458,484

4,192,098

6 %

8,650,582

7,873,529

10 %

Gold (oz)

37,324

36,592

2 %

73,916

74,822

(1)%

Lead (tons)

13,586

12,100

12 %

25,686

26,307

(2)%

Zinc (tons)

16,191

16,211

(0)%

32,402

32,734

(1)%

Greens Creek - Silver (oz)

2,243,551

2,478,594

(9)%

4,722,145

5,128,533

(8)%

Greens Creek - Gold (oz)

14,137

14,588

(3)%

28,725

31,235

(8)%

Lucky Friday - Silver (oz)

1,308,155

1,061,065

23 %

2,369,220

2,549,130

(7)%

Keno Hill - Silver (oz)

900,440

646,312

39 %

1,546,752

184,264

739 %

Casa Berardi - Gold (oz)

23,187

22,004

5 %

45,191

43,587

4 %

(1) See cautionary statement regarding preliminary statements at

the end of this release.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States. In addition to operating

mines in Alaska, Idaho, and Quebec, Canada, the Company is

developing a mine in the Yukon, Canada, and owns a number of

exploration and pre-development projects in world-class silver and

gold mining districts throughout North America.

Cautionary Statements Regarding Estimates and Forward-Looking

Statements

All measures of the Company's second quarter 2024 operating

results contained in this release are preliminary and reflect the

Company’s expected results as of the date of this release. Actual

reported second quarter 2024 results are subject to management's

final review as well as review by the Company's independent

registered accounting firm and may vary significantly from current

expectations because of a number of factors, including, without

limitation, additional or revised information and changes in

accounting standards or policies or in how those standards are

applied.

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, including

Canadian securities laws. Words such as “may”, “will”, “should”,

“expects”, “intends”, “projects”, “believes”, “estimates”,

“targets”, “anticipates” and similar expressions are used to

identify these forward-looking statements. Such forward-looking

statements may include, without limitation, that Keno Hill’s 2024

production is expected to exceed 2.7 million ounces. The material

factors or assumptions used to develop such forward-looking

statements or forward-looking information include that the

Company’s plans for development and production will proceed as

expected and will not require revision as a result of risks or

uncertainties, whether known, unknown or unanticipated, to which

the Company’s operations are subject.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect, which

could cause actual results to differ from forward-looking

statements. Such assumptions, include, but are not limited to: (i)

there being no significant change to current geotechnical,

metallurgical, hydrological and other physical conditions; (ii)

permitting, development, operations and expansion of the Company’s

projects being consistent with current expectations and mine plans;

(iii) political/regulatory developments in any jurisdiction in

which the Company operates being consistent with its current

expectations; (iv) the exchange rate for the USD/CAD being

approximately consistent with current levels; (v) certain price

assumptions for gold, silver, lead and zinc; (vi) prices for key

supplies being approximately consistent with current levels; (vii)

the accuracy of our current mineral reserve and mineral resource

estimates; (viii) there being no significant changes to the

availability of employees, vendors and equipment; (ix) the

Company’s plans for development and production will proceed as

expected and will not require revision as a result of risks or

uncertainties, whether known, unknown or unanticipated; (x)

counterparties performing their obligations under hedging

instruments and put option contracts; (xi) sufficient workforce is

available and trained to perform assigned tasks; (xii) weather

patterns and rain/snowfall within normal seasonal ranges so as not

to impact operations; (xiii) relations with interested parties,

including First Nations and Native Americans, remain productive;

(xiv) maintaining availability of water rights; (xv) factors do not

arise that reduce available cash balances; and (xvi) there being no

material increases in our current requirements to post or maintain

reclamation and performance bonds or collateral related

thereto.

In addition, material risks that could cause actual results to

differ from forward-looking statements include but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; and (vi)

litigation, political, regulatory, labor and environmental risks.

For a more detailed discussion of such risks and other factors, see

the Company's 2023 Form 10-K filed on February 15, 2024 for a more

detailed discussion of factors that may impact expected future

results. The Company undertakes no obligation and has no intention

of updating forward-looking statements other than as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240710768765/en/

Anvita M. Patil Vice President – Investor Relations and

Treasurer

Cheryl Turner Communications Coordinator

800-HECLA91 (800-432-5291) Investor Relations Email:

hmc-info@hecla.com Website: www.hecla.com

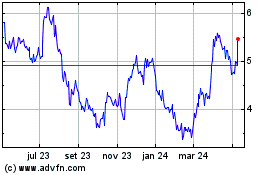

Hecla Mining (NYSE:HL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

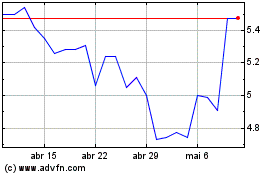

Hecla Mining (NYSE:HL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024