The registration statement for BlackRock’s iShares Ethereum

Trust ETF (ETHA), has been declared effective by the U.S.

Securities and Exchange Commission (SEC). ETHA seeks to track the

price of Ethereum’s native token, ether, and is expected to begin

trading on Nasdaq on July 23, 2024. ETHA carries a 0.25% sponsor

fee with a one-year waiver reducing the fee to 0.12% on the first

$2.5B assets under management (AUM)1.

"Our clients are increasingly interested in gaining exposure to

digital assets through exchange-traded products (ETPs) which

provide convenient access, liquidity and transparency," said Jay

Jacobs, U.S. Head of Thematic and Active ETFs. “Ethereum’s appeal

lies in its decentralized nature and its potential to drive digital

transformation in finance and other industries.”

The iShares Ethereum Trust ETF (ETHA) offers exposure to the

Ethereum's native token, ether, the second largest cryptocurrency

by market capitalization.2 Ethereum, a global technology platform,

is similar to an app store that generates value for ether as usage

increases and more applications are built on top of it.

Over the last 12 months, iShares has launched 170 ETFs and ETPs

including the iShares Bitcoin Trust (IBIT), driving innovation and

providing investors with more choices to help them meet their

investment goals.

With over 20 years of experience and more than 1,400 ETFs

globally, iShares has helped millions of investors access different

corners of the market. Every iShares product is underpinned by

decades of investment expertise and institutional grade

technology.

To learn more about the iShares Ethereum Trust ETF filing visit:

https://www.sec.gov/Archives/edgar/data/2000638/000143774924023199/iset20240720_424b3.htm

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate | Twitter:

@blackrock | LinkedIn: www.linkedin.com/company/blackrock

About iShares

iShares unlocks opportunity across markets to meet the evolving

needs of investors. With more than twenty years of experience, a

global line-up of 1400+ exchange traded funds (ETFs) and $3.86

trillion in assets under management as of June 30, 2024, iShares

continues to drive progress for the financial industry. iShares

funds are powered by the expert portfolio and risk management of

BlackRock.

Important Information

A registration statement has been filed for the iShares

Ethereum Trust ETF (“the Trust”) and the registration statement has

become effective. However, shares of the Trust are not yet

available for purchase or sale. Carefully consider the Trust’s

investment objectives, risk factors, and charges and expenses

before investing. This information must be accompanied or preceded

by a current iShares Ethereum Trust ETF prospectus

and iShares Bitcoin Trust Prospectus. Please read the

prospectuses carefully before investing.

The iShares Trusts are not investment companies registered

under the Investment Company Act of 1940, and therefore are not

subject to the same regulatory requirements as mutual funds or ETFs

registered under the Investment Company Act of 1940. Investments in

these products are speculative and involve a high degree of

risk.

Investing involves a high degree of risk, including possible

loss of principal. An investment in the Trust is not suitable for

all investors, may be deemed speculative and is not intended as a

complete investment program. An investment in Shares should be

considered only by persons who can bear the risk of total loss

associated with an investment in the Trust.

Investing in digital assets involves significant risks due to

their extreme price volatility and the potential for loss, theft,

or compromise of private keys. The value of the shares is closely

tied to acceptance, industry developments, and governance changes,

making them susceptible to market sentiment. Digital assets

represent a new and rapidly evolving industry, and the value of the

Shares depends on their acceptance. Changes in the governance of a

digital asset network may not receive sufficient support from users

and miners, which may negatively affect that digital asset

network’s ability to grow and respond to challenges Investing in

the Trust comes with risks that could impact the Trust's share

value, including large-scale sales by major investors, security

threats like breaches and hacking, negative sentiment among

speculators, and competition from central bank digital currencies

and financial initiatives using blockchain technology. A disruption

of the internet or a digital asset network would affect the ability

to transfer digital assets and, consequently, would impact their

value. There can be no assurance that security procedures designed

to protect the Trust’s assets will actually work as designed or

prove to be successful in safeguarding the Trust’s assets against

all possible sources of theft, loss or damage.

The Trust may incur certain extraordinary, non-recurring

expenses that are not assumed by the Sponsor.

The iShares Ethereum Trust ETF (the “Trust”) is not sponsored,

endorsed, issued, sold or promoted by Stiftung Ethereum (the

"Ethereum Foundation"), nor does the Ethereum Foundation make any

representation regarding the advisability of investing in the

Trust. BlackRock is not affiliated with the Ethereum Foundation.

Ethereum Marks are owned by the Ethereum Foundation, used under

license.

Shares of the Trust are not deposits or other obligations of or

guaranteed by BlackRock, Inc., and its affiliates, and are not

insured by the Federal Deposit Insurance Corporation or any other

governmental agency. The sponsor of the trust is iShares Delaware

Trust Sponsor LLC (the “Sponsor”). BlackRock Investments, LLC

("BRIL"), assists in the promotion of the Trust. The Sponsor and

BRIL are affiliates of BlackRock, Inc. The bitcoin and ether

Custodian is Coinbase Custody Trust Company, LLC, which is not

affiliated with BlackRock, Inc. The Sponsor is not responsible for

losses incurred due to loss, theft, destruction, or compromise of

the trust's bitcoin or ether.

©2024 BlackRock, Inc. or its affiliates. All rights reserved.

iSHARES and BLACKROCK are trademarks of BlackRock,

Inc., or its affiliates. All other trademarks are the property of

their respective owners.

_________________ 1 BlackRock will waive a portion of the

Sponsor’s Fee for the first 12 months commencing on July 23, 2024,

so that the fee will be 0.12% of the net asset value of the Trust

for the first $2.5 billion of the Trust’s assets. If the fund

exceeds $2.5 billion of the Trust’s assets prior to the end of the

12-month period, the Sponsor’s Fee charged on assets over $2.5

billion will be 0.25%. All investors will incur the same Sponsor’s

Fee which is the weighted average of those fee rates. After the

12-month waiver period is over, the Sponsor’s Fee will be 0.25%. 2

Source: The Block, as of May 21, 2024. Ethereum’s market

capitalization of $450 billion is measured by its native token,

ether.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240722299039/en/

Press Contacts: GroupCorpCommsAMRS@blackrock.com

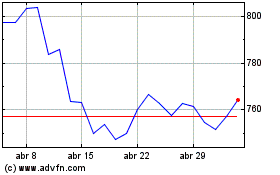

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

BlackRock (NYSE:BLK)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024