HIGHLIGHTS

- Repurchased 895,076 shares of common stock during Q2 2024

- Repurchased 1,444,432 shares in total during Q1 and Q2

2024

- Board of Directors approved new $150 million share repurchase

authorization

- Management will recommend that the Board of Directors approve a

5% mid-year increase to NOG’s quarterly common stock dividend, to

$0.42 per share, for the third quarter of 2024

Northern Oil and Gas, Inc. (NYSE: NOG) (the “Company” or “NOG”)

provided a shareholder return update.

SHAREHOLDER RETURN UPDATE

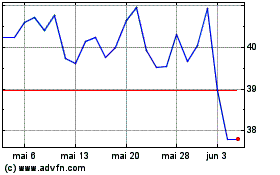

NOG repurchased 895,076 shares of common stock during the second

quarter of 2024 at an average price, inclusive of commissions, of

$38.96 per share. During the first half of 2024, the Company

repurchased 1,444,432 shares at an average price, inclusive of

commissions, of approximately $37.99 per share. In total, the

Company has allocated approximately $55 million to share

repurchases year-to-date. Additionally, the Company has declared

common stock dividends totaling approximately $80 million

year-to-date, bringing capital allocated to shareholder returns to

approximately $135 million in the first half of 2024.

In July 2024, NOG’s Board of Directors approved a new $150

million common stock repurchase authorization, replacing its prior

authorization which was substantially depleted. Under this program,

shares may be repurchased periodically, including in the open

market or privately negotiated transactions. The actual timing,

manner, number, and value of shares repurchased, if any, will

depend on a number of factors, including the availability of free

cash flow, market price, general market and economic conditions,

applicable legal and contractual requirements, and other business

considerations.

Per Company policy, interim modifications to the dividend can be

driven by material changes in realized commodity prices,

significant corporate actions or other events, prior to the

Company’s planned annual dividend review during the first quarter

of a given fiscal year. Management intends to submit a request to

the Board of Directors for a 5%, or $0.02, mid-year increase to

NOG’s quarterly common stock dividend, to $0.42 per share, for the

third quarter of 2024. The recommendation is driven by strong cash

flow experienced year-to-date and a robust business outlook,

combined with the confidence in the cash flows to be provided by

NOG’s pending acquisitions, Under Delaware law, the Board may not

approve dividends more than 60 days before the record date.

The Company continues to plan for its regularly scheduled annual

review of dividend policy with the Board of Directors in the first

quarter of 2025.

MANAGEMENT COMMENTS

“NOG continues with a multi-pronged approach to creating value,”

commented Nick O’Grady, NOG’s Chief Executive Officer. “We see

benefits to retiring our shares when attractive, increasing our

cash returns to our shareholders when appropriate, and continuing

to find organic and inorganic growth opportunities to drive the

highest possible long term total return for our investors. Our

share repurchases and recommendation for a mid-year increase to our

dividend are a testament to the confidence we have in NOG’s

future.”

“Per our policy, significant corporate actions can warrant

interim increases to the dividend prior to our annual review,”

commented Chad Allen, NOG’s Chief Financial Officer. “We believe

our strong base business outlook and the significant cash flows

associated with our pending acquisitions also provide capacity for

additional shareholder returns over time.”

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring

and investing in non-operated minority working and mineral

interests in the premier hydrocarbon producing basins within the

contiguous United States. More information about NOG can be found

at www.noginc.com.

SAFE HARBOR

This press release contains forward-looking statements regarding

future events and future results that are subject to the safe

harbors created under the Securities Act of 1933 (the “Securities

Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”).

All statements other than statements of historical facts included

in this release regarding NOG’s dividend plans and practices

(including timing and amounts), financial position, business

strategy, plans and objectives of management for future operations,

and other matters are forward-looking statements. When used in this

release, forward-looking statements are generally accompanied by

terms or phrases such as “estimate,” “guidance,” “project,”

“predict,” “believe,” “expect,” “continue,” “anticipate,” “target,”

“could,” “plan,” “intend,” “seek,” “goal,” “will,” “should,” “may”

or other words and similar expressions that convey the uncertainty

of future events or outcomes. Items contemplating or making

assumptions about actual or potential future trends or operating

results also constitute such forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

NOG’s control) that could cause actual results to differ materially

from those set forth in the forward-looking statements, including

the following: changes in crude oil and natural gas prices, the

pace of drilling and completions activity on NOG's properties and

properties pending acquisition, NOG's ability to acquire additional

development opportunities, integration and benefits of property

acquisitions, or the effects of such acquisitions on NOG’s cash

position and levels of indebtedness, changes in NOG's reserves

estimates or the value thereof, general economic or industry

conditions, nationally and/or in the communities in which NOG

conducts business, changes in the interest rate environment,

legislation or regulatory requirements, conditions of the

securities markets, NOG's ability to consummate any pending

acquisition transactions, other risks and uncertainties related to

the closing of pending acquisition transactions, NOG's ability to

raise or access capital, changes in accounting principles, policies

or guidelines, financial or political instability, acts of war or

terrorism, and other economic, competitive, governmental,

regulatory and technical factors affecting NOG's operations,

products, services and prices.

NOG has based these forward-looking statements on its current

expectations and assumptions about future events. While management

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory and other risks, contingencies and

uncertainties, most of which are difficult to predict and many of

which are beyond NOG's control. NOG does not undertake any duty to

update or revise any forward-looking statements, except as may be

required by the federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725383066/en/

Evelyn Leon Infurna Vice President of Investor Relations (952)

476-9800 ir@northernoil.com

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024