Empower Achieves Record Earnings of $236M for Q2 2024 Representing 19% Year-over-Year Growth

07 Agosto 2024 - 11:19AM

Business Wire

- Company attains after tax earnings growth of 12%

quarter-over-quarter

- Empower Personal WealthTM expands assets under administration

(AUA) 23% over 12 months as sales from defined contribution plans

see strong expansion

- Empower Workplace Solutions AUA is up 14% with strong momentum

across segments, including public plan sector

Empower is announcing record second-quarter earnings achieved as

of June 30, 2024, through business growth and sales momentum in its

Workplace Solutions and Personal Wealth units.

The company achieved after-tax base earnings of US $236 million,

an increase of $38 million, or 19%, compared to the second quarter

of 2023. The growth is primarily due to strong organic sales, a

rise in fee income resulting from higher equity markets, and higher

surplus income.

The company administers more than $1.6 trillion in assets for

18.6 million individuals.1

Empower released results as part of a broader quarterly

announcement by its parent company, Winnipeg-based Great-West

Lifeco (TSX: GWO-CA). For more information on Great-West Lifeco’s

second-quarter 2024 results, please see the release on the firm’s

website.

- Great-West Lifeco reports record base earnings in the second

quarter of 2024 (greatwestlifeco.com)

“At the center of Empower’s value proposition is the delivery of

advice and service to investors of all types who are coming to us

in increasing numbers to provide retirement and wealth management

services,” said Empower President and CEO Edmund F. Murphy III. “As

the broader macroeconomic picture and the markets present

challenges, we will continue to deliver what individuals need to

help them on their path to greater financial security.”

During the quarter, Empower Personal Wealth, established in

January 2023, recognized a 23% growth in assets under

administration year-over-year driven by market performance and

positive net flows. The company is beginning to see the benefits of

greater visibility among individual investors, heightened brand

awareness and elevated customer loyalty from retirement plan

participants becoming Personal Wealth customers.

In the Workplace Solutions business, Empower continues to

achieve strong organic growth, with assets under administration up

14% on a year-over-year basis. Sales for Empower’s advisor-sold

business (plans with under $50 million in assets) are up 35%

year-over-year, following a record 2023.

Recent wins in the public plan sector have shown particular

growth in 2024. Empower serves state-level plans for 29 of 50

states and in total supports the retirement needs of more than 4.1

million public workers who have invested more than $240 billion in

assets across Empower’s government business, as of June 30.

So far this year, Empower announced new and retained client

commitments from public plan clients across the country, such as

the County of Orange (Calif.) with approximately $2.5 billion in

assets and the Kansas Public Employees Retirement System (KPERS)

with more than 27,300 plan participants who have saved

approximately $1.3 billion in assets. In addition, Empower

announced several public transportation authority commitments,

including the Santa Clara Valley Transportation Authority (VTA)

based out of San Jose, Calif., New Jersey Transit, Chicago Transit

Authority, Southeastern Pennsylvania Transportation Authority and

METRO Transit Authority of Harris County. These recommitments

encompass approximately 50,000 transit authority plan

participants.

In addition, Prudential integration was completed in the second

quarter of 2024. Retention targets exceeded and the expected U.S.

$180 million pre-tax of run rate cost synergies have been achieved,

according to the Great-West Lifeco release.

About Empower

Recognized as the second-largest retirement services provider in

the U.S.2 by total participants, Empower administers approximately

$1.6 trillion in assets for 18.6 million investors1 through the

provision of retirement plans, advice, wealth management and

investments. Connect with us on empower.com, Facebook, X, LinkedIn,

TikTok and Instagram.

- As of June 30, 2024. Information refers to all retirement

business of Empower Annuity Insurance Company of America (EAICA)

and its subsidiaries, including Empower Retirement, LLC; Empower

Life & Annuity Insurance Company of New York (ELAINY); and

Empower Annuity Insurance Company (EAIC), marketed under the

Empower brand. Assets under Administration (AUA) refers to the

assets administered by Empower. AUA does not reflect the financial

stability or strength of a company.

- Pensions & Investments DC Recordkeeper Survey (2024).

Ranking measured by total number of participants as of December 31,

2023.

Securities, when presented, are offered and/or distributed by

Empower Financial Services, Inc., Member FINRA/SIPC. EFSI is an

affiliate of Empower Retirement, LLC; Empower Funds, Inc.; and

registered investment adviser Empower Advisory Group, LLC. This

material is for informational purposes only and is not intended to

provide investment, legal, or tax recommendations or advice.

Empower refers to the products and services offered by Empower

Annuity Insurance Company of America and its subsidiaries.

“EMPOWER” and all associated logos and product names are trademarks

of Empower Annuity Insurance Company of America.

©2024 Empower Annuity Insurance Company of America. All rights

reserved. RO3772186-0824

Learn more:

To learn more about how we’re empowering plan sponsors and their

participants to be more engaged in their retirement plans than ever

before, call us on 800-719-9914.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807158470/en/

Stephen Gawlik - Stephen.Gawlik@empower.com Mandy Cassano -

Mandy.Cassano@empower.com

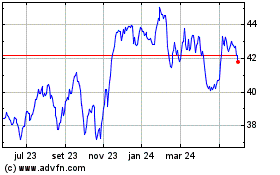

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

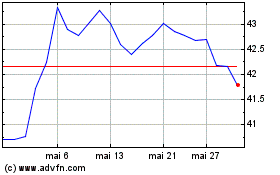

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025