Net Sales grew 30%. Gross Margin at 41.8%, the

third consecutive quarter at or above 40.0%. Cash increased $0.5

million.

Laird Superfood, Inc. (NYSE American: LSF) (“Laird Superfood,”

the “Company,” “we,” and “our”) today reported financial results

for the second quarter ended June 30, 2024.

Jason Vieth, Chief Executive Officer, commented, “I am

pleased to report that our second quarter results once again

demonstrate tremendous progress in the two most important financial

measures for our business – namely, strong sales growth and

sustained margin improvement. After reporting 22% Net Sales growth

in Q1 of this year, our Net Sales growth accelerated to 30% in Q2,

with both sales channels growing and led by 80% growth on Amazon

and 32% growth on DTC. At the same time, Net Sales in our Wholesale

business grew by 9%, and our retail scanner sales by an even more

impressive 30%, demonstrating a healthy business across all sales

channels. In addition, our Gross Margin was 41.8% during Q2 marking

the third consecutive quarter that it has been in excess of 40%,

which gives us confidence in our ability to sustain Gross Margin

above 40% going forward.”

Vieth continued: “Based on our strong performance through the

first half of the year, we are increasing our 2024 outlook. For the

full year, we are now projecting Net Sales to be $40 to $44

million, which represents 17% - 29% growth versus prior year, and

Gross Margin to be 40% - 41%, which would be a 10- to 11-point

improvement versus 2023. This increase in our full-year guidance

reflects the confidence that we have in our near-term financial

results as well as the long-term strategy and financial future of

Laird Superfood.”

Second Quarter 2024 Highlights

- Net Sales of $10.0 million compared to $9.9 million in the

prior quarter, and $7.7 million in the corresponding prior year

period.

- Wholesale sales increased by 9% year-over-year and contributed

39% of total Net Sales, driven by growth in Grocery due to velocity

improvement and distribution expansion, as well as more efficient

promotional spend.

- E-commerce sales increased by 47% year-over-year and

contributed 61% of total Net Sales, despite a significant,

continued, planned reduction in media spend in this channel. Sales

on Amazon.com increased by 80% year-over-year, building on the

strong performance over the last two quarters as compared to the

reduced prior year sales volume stemming from out-of-stock products

caused by the quality event last year. Direct-to-Consumer (DTC)

grew 32% year-over-year, driven by strong performance in both

subscription and repeat customers, higher average order value, and

improved discount rates due to strategic shifts in our promotional

strategies.

- Gross Margin was 41.8% compared to 40.0% in the first quarter

of 2024 and 24.3% in the corresponding prior year period. This

margin expansion was driven by the full realization of the cost

savings resulting from our transition to a variable cost

third-party co-manufacturing model, as well as planned reductions

in trade spend.

- Net Loss was $0.2 million, or $0.02 per diluted share, compared

to Net Loss of $3.5 million, or $0.38 per diluted share, in the

corresponding prior year period. The improvement was driven by

Gross Margin expansion, as well as lower marketing, and general and

administrative (G&A) spend.

- Adjusted Net Loss, which is a non-GAAP financial measure, was

$0.3 million, or $0.03 per diluted share, compared to $3.3 million,

or $0.36 per diluted share in the corresponding prior year period.

This improvement was driven by significantly expanded Gross Margins

and lower marketing and G&A costs. For more details on non-GAAP

financial measures, refer to the information in the non-GAAP

financial measures section of this press release.

Year-to-Date 2024

Highlights

- Net Sales of $19.9 million compared to $15.8 million in the

corresponding prior year period, representing 26% growth.

- Wholesale sales increased by 9% year-over-year and contributed

40% of total Net Sales, driven by velocity improvement and

distribution expansion in Retail, as well as more efficient

promotional spend.

- E-commerce sales increased by 40% year-over-year and

contributed 60% of total Net Sales, despite a significant, planned

reduction in media spend in this channel. Amazon.com and DTC

platform sales increased by 63% and 29%, respectively,

year-over-year, driven by growth in revenue from subscribers and

repeat customers as well as higher average order value.

- Gross Margin was 40.9% compared to 23.7% in the corresponding

prior year period. This margin expansion was driven by the full

realization of the cost savings resulting from our transition to a

variable cost third-party co-manufacturing business model, as well

as planned reductions in trade spend.

- Net Loss was $1.3 million, or $0.13 per diluted share, compared

to Net Loss of $7.7 million, or $0.83 per diluted share, in the

corresponding prior year period. The improvement was driven by

Gross Margin expansion, and lower marketing, and G&A

spend.

- Adjusted Net Loss, which is a non-GAAP financial measure, was

$1.3 million, or $0.13 per diluted share, compared to $7.2 million,

or $0.77 per diluted share in the corresponding prior year period.

This improvement was driven by significantly expanded Gross Margins

and lower marketing and G&A costs. For more details on non-GAAP

financial measures, refer to the information in the non-GAAP

financial measures section of this press release.

Revenue Disaggregation

Three Months Ended June

30,

2024

2023

$

% of Total

$

% of Total

Coffee creamers

$

4,696,979

47

%

$

4,647,553

60

%

Coffee, tea, and hot chocolate

products

2,503,529

25

%

1,957,760

25

%

Hydration and beverage enhancing

supplements

2,309,600

23

%

998,309

13

%

Harvest snacks and other food items

1,683,776

17

%

1,849,947

24

%

Other

91,909

1

%

124,953

2

%

Gross sales

11,285,793

113

%

9,578,522

124

%

Shipping income

120,402

1

%

259,843

3

%

Returns and discounts

(1,402,541

)

(14

)%

(2,114,274

)

(27

)%

Sales, net

$

10,003,654

100

%

$

7,724,091

100

%

Three Months Ended June

30,

2024

2023

$

% of Total

$

% of Total

E-commerce

$

6,098,327

61

%

$

4,139,373

54

%

Wholesale

3,905,327

39

%

3,584,718

46

%

Sales, net

$

10,003,654

100

%

$

7,724,091

100

%

Six Months Ended June

30,

2024

2023

$

% of Total

$

% of Total

Coffee creamers

$

10,267,299

52

%

$

9,779,696

62

%

Coffee, tea, and hot chocolate

products

4,678,794

23

%

3,912,901

25

%

Hydration and beverage enhancing

supplements

4,334,872

22

%

1,669,159

11

%

Harvest snacks and other food items

2,987,837

15

%

3,602,344

23

%

Other

213,921

1

%

154,683

1

%

Gross sales

22,482,723

113

%

19,118,783

122

%

Shipping income

231,830

1

%

563,069

4

%

Returns and discounts

(2,801,961

)

(14

)%

(3,844,823

)

(26

)%

Sales, net

$

19,912,592

100

%

$

15,837,029

100

%

Six Months Ended June

30,

2024

2023

$

% of Total

$

% of Total

E-commerce

$

11,966,664

60

%

$

8,567,054

54

%

Wholesale

7,945,928

40

%

7,269,975

46

%

Sales, net

$

19,912,592

100

%

$

15,837,029

100

%

Balance Sheet and Cash Flow

Highlights

The Company had $7.8 million of cash, cash equivalents, and

restricted cash as of June 30, 2024, and no outstanding debt.

Cash provided by operating activities was $0.2 million for the

first half of 2024, compared to cash used in operating activities

of $7.5 million in the first half of 2024. The improvement in cash

used relative to the corresponding prior year period was driven by

Gross Margin expansion and significant reductions in marketing and

G&A costs. Cash increased by $0.5 million in the second quarter

of 2024 as compared to cash reduction of $0.4 million in the first

quarter of 2024. The improved cash flow in the second quarter of

2024 relative to the first quarter of 2024 was due to working

capital timing, specifically the timing of accounts receivables

collections, and the distribution of 2023 employee bonuses in the

first quarter of 2024.

2024 Outlook

Based on the first half 2024 results and management's best

assessment of the environment today, the Company is raising the

guidance for the full year 2024:

- Net Sales are expected to be in the range of approximately $40

to $44 million, representing growth of 17% to 29% compared to

2023.

- Gross Margin is expected to expand to approximately 40% to 41%,

representing a 10- to 11-point improvement compared to 2023.

Conference Call and Webcast Details

The Company will host a conference call and webcast at 5:00 p.m.

ET today to discuss our financial results. Participants may access

the live webcast on the Laird Superfood Investor Relations website

at https://investors.lairdsuperfood.com under “Events.”

About Laird Superfood

Laird Superfood, Inc. creates award-winning, plant-based

superfood products that are clean, delicious, and functional. The

Company's products are designed to enhance a consumer's daily

ritual and keep them fueled naturally throughout the day. The

Company was co-founded in 2015 by the world's most prolific

big-wave surfer, Laird Hamilton. Laird Superfood's offerings are

environmentally conscientious, responsibly tested and made with

real ingredients. Shop all products online at

www.lairdsuperfood.com and join the Laird Superfood community on

social media for the latest news and daily doses of

inspiration.

Forward-Looking Statements

This press release and the conference call referencing this

press release contain “forward-looking” statements, as that term is

defined under the federal securities laws, including but not

limited to statements regarding Laird Superfood’s anticipated cash

runway, future financial performance, and growth. Such

forward-looking statements may be identified by words such as

"anticipates," "believes," "continues," "could," "estimates,"

"expects," "intends," "may," "outlook," "plans," "potential,"

"predicts," "projects," "seeks," "should," "will," "would," or the

antonyms of these terms or other comparable terminology. These

forward-looking statements are based on Laird Superfood’s current

assumptions, expectations and beliefs and are subject to

substantial risks, uncertainties, assumptions and changes in

circumstances that may cause Laird Superfood’s actual results,

performance or achievements to differ materially from those

expressed or implied in any forward-looking statement. We expressly

disclaim any obligation to update or alter any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

The risks and uncertainties referred to above include, but are

not limited to: (1) the effects of global outbreaks of pandemics or

contagious diseases or fear of such outbreaks, including on our

supply chain, the demand for our products, and on overall economic

conditions and consumer confidence and spending levels; (2)

volatility regarding our revenue, expenses, including shipping

expenses, and other operating results; (3) our ability to acquire

new direct and wholesale customers and successfully retain existing

customers; (4) our ability to attract and retain our suppliers,

distributors and co-manufacturers, and effectively manage their

costs and performance; (5) effects of real or perceived quality or

health issues with our products or other issues that adversely

affect our brand and reputation; (6) our ability to innovate on a

timely and cost-effective basis, predict changes in consumer

preferences and develop successful new products, or updates to

existing products, and develop innovative marketing strategies; (7)

adverse developments regarding prices and availability of raw

materials and other inputs, a substantial amount of which come from

a limited number of suppliers outside the United States, including

in areas which may be adversely affected by climate change; (8)

effects of changes in the tastes and preferences of our consumers

and consumer preferences for natural and organic food products; (9)

the financial condition of, and our relationships with, our

suppliers, co-manufacturers, distributors, retailers and food

service customers, as well as the health of the food service

industry generally; (10) the ability of ourselves, our suppliers

and co-manufacturers to comply with food safety, environmental or

other laws or regulations; (11) our plans for future investments in

our business, our anticipated capital expenditures and our

estimates regarding our capital requirements, including our ability

to continue as a going concern; (12) the costs and success of our

marketing efforts, and our ability to promote our brand; (13) our

reliance on our executive team and other key personnel and our

ability to identify, recruit and retain skilled and general working

personnel; (14) our ability to effectively manage our growth; (15)

our ability to compete effectively with existing competitors and

new market entrants; (16) the impact of adverse economic

conditions; (17) the growth rates of the markets in which we

compete, and (18) the other risks described in our Annual Report on

Form 10-K for the year ended December 31, 2023 and other filings we

make with the Securities and Exchange Commission.

LAIRD SUPERFOOD, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Sales, net

$

10,003,654

$

7,724,091

$

19,912,592

$

15,837,029

Cost of goods sold

(5,826,373

)

(5,848,023

)

(11,771,210

)

(12,087,085

)

Gross profit

4,177,281

1,876,068

8,141,382

3,749,944

General and administrative

Salaries, wages, and benefits

975,809

1,090,266

1,898,216

2,405,715

Other general and administrative

1,172,363

1,608,235

2,407,704

3,375,096

Total general and administrative

expenses

2,148,172

2,698,501

4,305,920

5,780,811

Sales and marketing

Marketing and advertising

1,383,425

2,036,766

3,436,683

4,187,822

Selling

920,739

721,630

1,699,895

1,574,834

Related party marketing agreements

63,566

74,776

126,067

164,564

Total sales and marketing expenses

2,367,730

2,833,172

5,262,645

5,927,220

Total operating expenses

4,515,902

5,531,673

9,568,565

11,708,031

Operating loss

(338,621

)

(3,655,605

)

(1,427,183

)

(7,958,087

)

Other income

103,069

149,109

214,066

320,103

Loss before income taxes

(235,552

)

(3,506,496

)

(1,213,117

)

(7,637,984

)

Income tax expense

(3,524

)

(750

)

(42,481

)

(13,172

)

Net loss

$

(239,076

)

$

(3,507,246

)

$

(1,255,598

)

$

(7,651,156

)

Net loss per share:

Basic and diluted

$

(0.02

)

$

(0.38

)

$

(0.13

)

$

(0.83

)

Weighted-average shares of common stock

outstanding used in computing net loss per share of common stock,

basic and diluted

9,833,001

9,284,585

9,617,800

9,249,738

LAIRD SUPERFOOD, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities

Net loss

$

(1,255,598

)

$

(7,651,156

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

138,579

163,532

Stock-based compensation

533,273

453,711

Provision for inventory obsolescence

187,901

378,859

Allowance for credit losses

(28,425

)

51,363

Noncash lease costs

76,169

76,168

Other operating activities, net

—

38,984

Changes in operating assets and

liabilities:

Accounts receivable

(117,929

)

(371,355

)

Inventory

(263,719

)

(539,579

)

Prepaid expenses and other current

assets

149,152

1,328,709

Operating lease liability

(64,812

)

(62,923

)

Accounts payable

310,019

1,202,716

Accrued expenses

555,804

(2,529,105

)

Net cash from operating activities

220,414

(7,460,076

)

Cash flows from investing

activities

(13,462

)

245,706

Cash flows from financing

activities

(86,066

)

(19,137

)

Net change in cash and cash

equivalents

120,886

(7,233,507

)

Cash, cash equivalents, and restricted

cash, beginning of period

7,706,806

17,809,802

Cash, cash equivalents, and restricted

cash, end of period

$

7,827,692

$

10,576,295

Supplemental disclosures of cash flow

information

Right-of-use assets obtained in exchange

for operating lease liabilities

$

—

$

344,382

Supplemental disclosures of non-cash

investing activities

Receivable from sale of assets

held-for-sale included in other current assets at the end of the

period

$

—

$

450,351

LAIRD SUPERFOOD, INC.

CONSOLIDATED BALANCE

SHEETS

(unaudited)

As of

June 30, 2024

December 31, 2023

Assets

Current assets

Cash, cash equivalents, and restricted

cash

$

7,827,692

$

7,706,806

Accounts receivable, net

1,168,726

1,022,372

Inventory, net

6,398,377

6,322,559

Prepaid expenses and other current

assets

1,136,412

1,285,564

Total current assets

16,531,207

16,337,301

Noncurrent assets

Property and equipment, net

96,477

122,595

Intangible assets, net

986,232

1,085,231

Related party license agreements

132,100

132,100

Right-of-use assets

290,929

354,732

Total noncurrent assets

1,505,738

1,694,658

Total assets

$

18,036,945

$

18,031,959

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

1,942,263

$

1,647,673

Accrued expenses

3,131,097

2,586,343

Related party liabilities

29,167

2,688

Lease liabilities, current portion

147,720

138,800

Total current liabilities

5,250,247

4,375,504

Lease liabilities

182,470

243,836

Total liabilities

5,432,717

4,619,340

Stockholders’ equity

Common stock, $0.001 par value,

100,000,000 shares authorized at June 30, 2024 and December 31,

2023; 10,474,633 and 10,108,929 issued and outstanding at June 30,

2024, respectively; and 9,749,326 and 9,383,622 issued and

outstanding at December 31, 2023, respectively.

10,107

9,384

Additional paid-in capital

120,147,868

119,701,384

Accumulated deficit

(107,553,747

)

(106,298,149

)

Total stockholders’ equity

12,604,228

13,412,619

Total liabilities and stockholders’

equity

$

18,036,945

$

18,031,959

LAIRD SUPERFOOD, INC.

NON-GAAP FINANCIAL

MEASURES

(unaudited)

In this press release, we report adjusted

net loss, and adjusted net loss per diluted share, which are

financial measures not required by, or presented in accordance

with, accounting principles generally accepted in the United States

of America (“GAAP”). Management uses these adjusted metrics to

evaluate financial performance because they allow for

period-over-period comparisons of the Company’s ongoing operations

before the impact of certain items described below. Management

believes this information may also be useful to investors to

compare the Company’s results period-over-period. We define

adjusted net loss and adjusted net loss per diluted share to

exclude certain non-recurring items defined in detail in the tables

to follow. We define adjusted gross margin to exclude the net sales

and cost of goods sold components of non-recurring items defined in

the tables to follow. Please be aware that adjusted gross margin,

adjusted net loss, and adjusted net loss per diluted share have

limitations and should not be considered in isolation or as a

substitute for gross margin, net loss, or net loss per diluted

share. In addition, we may calculate and/or present adjusted gross

margin, adjusted net loss, and adjusted net loss per diluted share

differently than measures with the same or similar names that other

companies report, and as a result, the non-GAAP measures we report

may not be comparable to those reported by others.

These non-GAAP measures are reconciled to

the most directly comparable GAAP measures in the tables that

follow:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(239,076

)

$

(3,507,246

)

$

(1,255,598

)

$

(7,651,156

)

Adjusted for:

Product quality issue (a)

(24,051

)

—

(35,246

)

491,861

Strategic organizational shifts (b)

—

74,690

—

(60,690

)

Company-wide rebranding costs (c)

—

102,355

—

163,806

Adjusted net loss

$

(263,127

)

$

(3,330,201

)

$

(1,290,844

)

$

(7,056,179

)

Net loss per share, diluted:

$

(0.02

)

$

(0.38

)

$

(0.13

)

$

(0.83

)

Adjusted net loss per share,

diluted:

$

(0.03

)

$

(0.36

)

$

(0.13

)

$

(0.76

)

Weighted-average shares of common stock

outstanding used in computing adjusted net loss per share of common

stock, diluted

9,833,001

9,284,585

9,617,800

9,249,738

(a) In January 2023, we identified a

product quality issue with raw material from one vendor and we

voluntarily withdrew any affected finished goods. We previously

incurred costs associated with product testing, discounts for

replacement orders, and inventory obsolescence costs. We reached

settlement with a supplier in the third quarter of 2023 and have

recorded recoveries in the first and second quarters of 2024.

(b) Costs incurred as part of the

strategic downsizing of the Company's operations, including

severances, forfeitures of stock-based compensation, and other

personnel costs, IT integration costs, and freight costs to move

inventory to third-party facilities.

(c) Costs incurred as part of the

company-wide rebranding efforts that launched in Q1 2023.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Gross margin

41.8

%

24.3

%

40.9

%

23.7

%

Adjusted for:

Product quality issue (a)

-0.3

%

—

-0.2

%

2.6

%

Strategic organizational shifts (b)

—

—

—

-0.1

%

Adjusted gross margin

41.5

%

24.3

%

40.7

%

26.8

%

(a) In January 2023, we identified a

product quality issue with raw material from one vendor and we

voluntarily withdrew any affected finished goods. We previously

incurred costs associated with product testing, discounts for

replacement orders, and inventory obsolescence costs. We reached

settlement with a supplier in the third quarter of 2023 and

recorded recoveries in the first half of 2024.

(b) Costs incurred as part of the

strategic downsizing of the Company's operations, including

severances, forfeitures of stock-based compensation, and other

personnel costs, and freight costs to move inventory to third-party

facilities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807738928/en/

Investor Relations Contact Trevor Rousseau

investors@lairdsuperfood.com

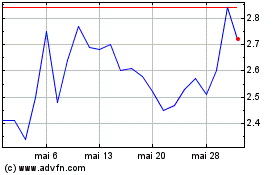

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Laird Superfood (AMEX:LSF)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024