- Q2 Revenue of $25.5 million, up 29% year-over-year

- Q2 Ending ARR1 of $88.9 million, up 64%

year-over-year

- Q2 Ending RPO2 of $262.9 million, up 33%

year-over-year

- Q2 Ending Evolv Express® subscriptions of 5,323, up 57%

year-over-year

Evolv Technology (NASDAQ: EVLV), a leading security technology

company pioneering AI-based screening designed to help create safer

experiences, today announced financial results for the quarter

ended June 30, 2024.

Results for the Second Quarter of 2024

Total revenue for the second quarter of 2024 was $25.5 million,

an increase of 29% compared to $19.8 million for the second quarter

of 2023. Annual Recurring Revenue (“ARR”)1 was $88.9 million at the

end of second quarter of 2024, an increase of 64% compared to $54.3

million at the end of the second quarter of 2023. Net income for

the second quarter of 2024 was $3.5 million, or $0.02 per basic and

diluted share, compared to net loss of $(66.8) million, or $(0.45)

per basic and diluted share, in the second quarter of 2023.

Adjusted earnings (loss)3 for the second quarter of 2024 was

$(11.1) million, or $(0.06) per diluted share, compared to adjusted

earnings (loss)3 of $(14.3) million, or $(0.10) per diluted share,

for the second quarter of 2023. Adjusted EBITDA3 for the second

quarter of 2024 was $(7.9) million compared to $(13.8) million in

the second quarter of 2023. As of June 30, 2024, the Company had

cash, cash equivalents, marketable securities, and restricted cash

of $56.7 million and no debt.

Results for the First Six Months of 2024

Total revenue for the six months ended June 30, 2024 was $47.2

million, an increase of 23% compared to $38.4 million for the six

months ended June 30, 2023. Net loss for the six months ended June

30, 2024 was $(8.2) million, or $(0.05) per basic and diluted

share, compared to $(95.4) million, or $(0.65) per basic and

diluted share, in the six months ended June 30, 2023. Adjusted

earnings (loss)3 for the six months ended June 30, 2024 was $(24.2)

million, or $(0.16) per diluted share, compared to adjusted

earnings (loss)3 of $(31.2) million, or $(0.21) per diluted share,

for the six months ended June 30, 2023. Adjusted EBITDA3 for the

six months ended June 30, 2024 was $(18.6) million compared to

$(29.3) million in the six months ended June 30, 2023.

The following table summarizes the breakdown of recurring and

non-recurring revenue4 for each period presented:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

% Change

2024

2023

% Change

Recurring revenue

$

21,249

$

11,689

82

%

$

40,630

$

20,764

96

%

Non-recurring revenue

4,291

8,136

(47

)%

6,578

17,642

(63

)%

Total revenue

$

25,540

$

19,825

29

%

$

47,208

$

38,406

23

%

The following table summarizes operating cash flows for each

period presented:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

3,462

$

(66,754

)

$

(8,182

)

$

(95,363

)

Non-cash expense

(12,264

)

54,225

(10,611

)

68,230

Changes in operating assets and

liabilities

(13,077

)

7,208

(19,169

)

18,378

Net cash used in operating activities

$

(21,879

)

$

(5,321

)

$

(37,962

)

$

(8,755

)

Company Comments on Outlook for 2024

The Company today commented on its business outlook for 2024.

The Company's outlook is based on the current indications for its

business, which may change at any time.

Estimate ($ in millions)

Issued May 9, 2024

Issued August 8, 2024

Total Revenue

~$100

Reaffirmed

ARR1 (ARR) at 12/31/24

~$100

Reaffirmed

Adjusted Gross Margin3

~60%

Reaffirmed

Adjusted EBITDA3

Improve by 40%+

Reaffirmed

Company to Host Live Conference Call and Webcast

The Company’s management team plans to host a live conference

call and webcast at 4:30 p.m. Eastern Time today to discuss the

financial results as well as management’s outlook for the business

and other matters. The conference call may be accessed in the

United States by dialing +1.877.692.8955 and using access code

825879. The conference call may be accessed outside of the United

States by dialing +1.234.720.6979 and using the same access code.

The conference call will be simultaneously webcast on the Company’s

investor relations website, which can be accessed at

http://ir.evolvtechnology.com. The press release with the financial

results will be available on the Company’s website prior to the

conference call. A replay of the conference call will be available

for a period of 30 days by dialing +1.866.207.1041 or

+1.402.970.0847 and using access code 8674340 or by accessing the

webcast replay on the Company’s investor relations website at

http://ir.evolvtechnology.com.

About Evolv Technology

Evolv Technology (NASDAQ: EVLV) uses advanced sensors,

artificial intelligence powered software, and cloud services to

reliably detect firearms, improvised explosives, and certain types

of knives while ignoring many harmless items such as cell phones

and keys. Its solutions and services are designed to capture

valuable visitor data customers can leverage to inform their

security operations, while providing end-users with an approachable

and non-intrusive security experience. Evolv has digitally

transformed the gateways in many places where people gather by

enabling seamless integration combined with powerful analytics and

insights. Evolv’s advanced systems have scanned more than a billion

people since 2019. Evolv has been awarded the U.S. Department of

Homeland Security (DHS) SAFETY Act Designation as a Qualified

Anti-Terrorism Technology (QATT) as well as the Security Industry

Association (SIA) New Products and Solutions (NPS) Award in the Law

Enforcement/Public Safety/Guarding Systems category, as well as

Sport Business Journal’s (SBJ) awards for “Best In Fan Experience

Technology” and “Best In Sports Technology”. Evolv®, Evolv

Express®, Evolv Insights®, Evolv Cortex AI®, and Evolv Visual Gun

Detection™ are registered trademarks or trademarks of Evolv

Technologies, Inc. in the United States and other jurisdictions.

For more information, visit https://evolvtechnology.com.

1 We define Annual Recurring

Revenue, or ARR, as subscription revenue and the recurring

service revenue related to purchase subscriptions for the final

month of the quarter normalized to a one-year period. Our

calculation of ARR is not adjusted for the impact of any known or

projected future events (such as customer cancellations, upgrades

or downgrades, or price increases or decreases) that may cause any

such contract not to be renewed on its existing terms. In addition,

the amount of actual revenue that we recognize over any 12-month

period is likely to differ from ARR at the beginning of that

period, sometimes significantly. This may occur due to new

bookings, cancellations, upgrades, downgrades or other changes in

pending renewals, as well as the effects of professional services

revenue and acquisitions or divestitures. As a result, ARR should

be viewed independently of, and not as a substitute for or forecast

of, revenue and deferred revenue. Our calculation of ARR may differ

from similarly titled metrics presented by other companies.

2 We define Remaining Performance

Obligation, or RPO, as estimated revenues expected to be

recognized in the future related to performance obligations that

are unsatisfied or partially satisfied as of the end of the

quarter.

3 Non-GAAP Financial Measures In

this press release, the Company’s adjusted gross profit (loss),

adjusted gross margin, adjusted operating expenses, adjusted

operating income (loss), adjusted EBITDA, adjusted earnings (loss),

and adjusted earnings per diluted share are not presented in

accordance with generally accepted accounting principles (GAAP) and

are not intended to be used in lieu of GAAP presentations of

results of operations. Adjusted gross profit and adjusted gross

margin exclude one-time expenses, stock-based compensation expense,

and amortization of capitalized stock-based compensation which

management believes provides a more meaningful representation of

contribution margin. Adjusted operating expenses is defined as

operating expenses less one-time expenses, stock-based compensation

expense, amortization of capitalized stock-based compensation, and

loss on impairment of lease equipment which management believes

provides a more meaningful representation of on-going operating

expense levels. Adjusted EBITDA is defined as net income (loss)

plus depreciation and amortization, share-based compensation,

interest expense (income), loss on extinguishment of debt, change

in fair value of contingent earn-out liability, change in fair

value of contingently issuable common stock liability, change in

fair value of public warrant liability, loss on impairment of lease

equipment, and certain other one-time expenses. Adjusted earnings

(loss) is defined as net income (loss) plus stock-based

compensation, amortization of capitalized stock-based compensation,

loss on extinguishment of debt, change in fair value of contingent

earn-out liability, change in fair value of contingently issuable

common stock liability, change in fair value of public warrant

liability, loss on impairment of lease equipment, and certain other

one-time expenses. Management presents non-GAAP financial measures

because it considers them to be important supplemental measures of

performance. Management uses non-GAAP financial measures for

planning purposes, including analysis of the Company's performance

against prior periods, the preparation of operating budgets and to

determine appropriate levels of operating and capital investments.

Management also believes non-GAAP financial measures provide

additional insight for analysts and investors in evaluating the

Company's financial and operating performance. However, non-GAAP

financial measures have limitations as an analytical tool and are

not intended to be an alternative to financial measures prepared in

accordance with GAAP. We intend to provide non-GAAP financial

measures as part of our future earnings discussions and, therefore,

the inclusion of non-GAAP financial measures will provide

consistency in our financial reporting. Investors are encouraged to

review the reconciliation of these non-GAAP measures to their most

directly comparable GAAP financial measures included in this press

release. The Company is unable to provide a reconciliation of

Adjusted Gross Margin to GAAP Gross Margin and Adjusted EBITDA to

Net Income (Loss), each measure's most directly comparable GAAP

financial measure, on a forward-looking basis without unreasonable

effort, because items that impact these GAAP financial measures are

not within the Company’s control and/or cannot be reasonably

predicted. These items may include, but are not limited to,

predicting forward-looking share-based compensation, changes in the

fair value of derivative liabilities, changes in the fair value of

contingent earn out liabilities, changes in the fair value of

contingently issuable common stock liabilities and changes in fair

value of public warrant liabilities. Such information may have a

significant, and potentially unpredictable, impact on the Company’s

future financial results.

4 Recurring revenue includes the

recurring portion of revenue associated with pure subscription

contracts and hardware purchase subscription contracts.

Non-recurring revenue includes revenue that is one-time in

nature, such as product revenue, shipping revenue, and revenue from

installation, training, and professional services.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. We intend such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements contained in this press release and related presentation

materials other than statements of historical facts, including

without limitation statements regarding our ability to meet our

2024 guidance for revenue, ARR, adjusted gross margin, and adjusted

EBITDA, our estimates for cash and cash equivalents for fiscal year

2024, our results of operations and financial position, business

strategy, plans and prospects, our relationship with significant

manufacturers and suppliers, our ability to obtain new customers

and retain existing customers, existing and prospective products,

the potential benefits of our ongoing transition to a pure

subscription model, timing and likelihood of success, macroeconomic

and market trends, our expectations regarding any outcomes and

impact of any legal proceedings, government investigation or

enforcement action (such as the current investigations by the FTC

and the SEC), and plans and objectives of management for future

operations and results are forward-looking statements. Words such

as “believe” “may,” “will,” “expect,” “should,” “could,”

“anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,”

“potential,” “continue,” “project,” “plan,” “target,” “forecast”,

“is/are likely to” or the negative of these terms or other similar

expressions are intended to identify forward-looking statements,

though not all forward-looking statements use these words or

expressions. The forward-looking statements in this press release

and related presentation materials are only predictions. We have

based these forward-looking statements largely on our current

expectations and projections about future events and financial

trends that we believe may affect our business, financial condition

and results of operations. Forward-looking statements involve known

and unknown risks, uncertainties and other important factors that

may cause our actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to, the following: relating

to our history of losses and ability to reach profitability; our

reliance on reseller partners to generate a growing portion of our

revenue; expectations regarding the Company’s strategies and future

financial performance, including its future business plans or

objectives, prospective performance and opportunities and

competitors, revenues, products and services, pricing, operating

expenses, market trends, liquidity, cash flows and uses of cash,

capital expenditures; the Company’s reliance on third party

contract manufacturing and distribution, and a global supply chain;

the Company recognizes a substantial portion of its revenue ratably

over the term of its agreements, and, as a result, downturns or

upturns in sales may not be immediately reflected in its operating

results; the rate of innovation required to maintain

competitiveness in the markets in which the Company competes; the

competitiveness of the market in which the Company competes; the

failure of our products to detect threats could result in injury or

loss of life, which could harm our brand, reputation, and results

of operations; the loss of designation of our Evolv Express® system

as a Qualified Anti-Terrorism Technology under the Homeland

Security SAFETY Act; risks related to our business model, which is

predicated, in part, on building a customer base that will generate

a recurring stream of revenues through the sale of our subscription

contracts; the ability for the Company to obtain, maintain, protect

and enforce the Company’s intellectual property rights and use of

“open source” software; the concentration of the Company’s revenues

on a single solution; the Company’s ability to timely design,

produce and launch its solutions, the Company’s ability to invest

in growth initiatives and pursue acquisition opportunities; the

limited liquidity and trading of the Company’s securities; risks

related to existing and changing tax laws; geopolitical risk and

changes in applicable laws or regulations; the possibility that the

Company may be adversely affected by other economic, business,

and/or competitive factors; operational risk; risks related to

material weaknesses in our internal control over financial

reporting and our remediation plans; risks related to increasing

attention to and evolving expectations for, environmental, social,

and governance initiatives; the impact of fluctuating general

economic and market conditions and reductions in spending; the need

for additional capital to support business growth, which might not

be available on acceptable terms, if at all; and litigation and

regulatory enforcement risks, including the diversion of management

time and attention and the additional costs and demands on

resources. These and other important factors discussed under the

caption “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023 filed with the Securities and Exchange

Commission ("SEC") on February 29, 2024, as any such factors may be

updated from time to time in our other filings with the SEC,

including the Quarterly Report on Form 10-Q for the quarter ended

June 30, 2024. The forward-looking statements in this press release

and related presentation materials are based upon information

available to us as of the date hereof, and while we believe such

information forms a reasonable basis for such statements, it may be

limited or incomplete, and our statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all potentially available relevant information. These

statements are inherently uncertain and investors are cautioned not

to unduly rely upon these statements.

You should review this press release and the documents that we

reference in this press release and related presentation materials

with the understanding that our actual future results, levels of

activity, performance and achievements may be materially different

from what we expect. We qualify all of our forward-looking

statements by these cautionary statements. Except as required by

applicable law, we do not plan to publicly update or revise any

forward-looking statements contained in this press release and

related presentation materials, whether as a result of any new

information, future events or otherwise.

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue:

Product revenue

$

2,044

$

7,243

$

2,647

$

15,997

Subscription revenue

15,903

7,964

30,406

14,430

Service revenue

5,553

3,905

10,937

6,691

License fee and other revenue

2,040

713

3,218

1,288

Total revenue

25,540

19,825

47,208

38,406

Cost of revenue:

Cost of product revenue

3,149

7,722

5,926

18,300

Cost of subscription revenue

6,436

3,406

12,215

5,757

Cost of service revenue

1,311

1,014

2,522

1,597

Cost of license fee and other revenue

172

270

301

574

Total cost of revenue

11,068

12,412

20,964

26,228

Gross profit

14,472

7,413

26,244

12,178

Operating expenses:

Research and development

5,722

6,395

11,927

11,784

Sales and marketing

16,892

13,613

32,897

26,417

General and administrative

14,185

10,874

26,025

19,800

Loss from impairment of property and

equipment

—

157

—

294

Total operating expenses

36,799

31,039

70,849

58,295

Loss from operations

(22,327

)

(23,626

)

(44,605

)

(46,117

)

Other income (expense), net:

Interest expense

—

—

—

(654

)

Interest income

681

1,853

1,766

2,806

Other income (expense), net

(39

)

(22

)

(67

)

(3

)

Loss on extinguishment of debt

—

—

—

(626

)

Change in fair value of contingent

earn-out liability

16,514

(28,113

)

23,413

(31,431

)

Change in fair value of contingently

issuable common stock liability

3,747

(5,095

)

4,274

(5,837

)

Change in fair value of public warrant

liability

4,886

(11,751

)

7,037

(13,501

)

Total other income (expense), net

25,789

(43,128

)

36,423

(49,246

)

Net income (loss)

$

3,462

$

(66,754

)

$

(8,182

)

$

(95,363

)

Net income (loss) attributable to common

stockholders – basic and diluted

$

3,421

$

(66,754

)

$

(8,182

)

$

(95,363

)

Weighted average common shares

outstanding

Basic

156,473,080

148,882,160

154,774,899

147,664,534

Diluted

171,563,943

148,882,160

154,774,899

147,664,534

Net income (loss) per share

Basic

$

0.02

$

(0.45

)

$

(0.05

)

$

(0.65

)

Diluted

$

0.02

$

(0.45

)

$

(0.05

)

$

(0.65

)

Net income (loss)

$

3,462

$

(66,754

)

$

(8,182

)

$

(95,363

)

Other comprehensive income (loss)

Cumulative translation adjustment

8

(17

)

11

(33

)

Total other comprehensive income

(loss)

8

(17

)

11

(33

)

Total comprehensive income (loss)

$

3,470

$

(66,771

)

$

(8,171

)

$

(95,396

)

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

June 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

35,698

$

67,162

Restricted cash

—

275

Marketable securities

20,757

51,289

Accounts receivable, net

36,428

22,611

Inventory

18,604

9,507

Current portion of contract assets

1,690

3,707

Current portion of commission asset

4,810

4,339

Prepaid expenses and other current

assets

19,912

16,954

Total current assets

137,899

175,844

Restricted cash, noncurrent

275

—

Contract assets, noncurrent

144

451

Commission asset, noncurrent

7,128

7,107

Property and equipment, net

120,045

112,921

Operating lease right-of-use assets

2,161

1,195

Other assets

865

1,202

Total assets

$

268,517

$

298,720

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

5,574

$

17,400

Accrued expenses and other current

liabilities

15,913

15,578

Current portion of deferred revenue

56,168

47,677

Current portion of operating lease

liabilities

1,754

1,391

Total current liabilities

79,409

82,046

Deferred revenue, noncurrent

23,655

23,813

Operating lease liabilities,

noncurrent

566

—

Contingent earn-out liability

5,706

29,119

Contingently issuable common stock

liability

2,256

6,530

Public warrant liability

3,852

10,889

Total liabilities

115,444

152,397

Stockholders’ equity:

Preferred stock, $0.0001 par value;

100,000,000 authorized at June 30, 2024 and December 31, 2023; no

shares issued and outstanding at June 30, 2024 and December 31,

2023

—

—

Common stock, $0.0001 par value;

1,100,000,000 shares authorized at June 30, 2024 and December 31,

2023; 157,474,122 and 151,310,080 shares issued and outstanding at

June 30, 2024 and December 31, 2023, respectively

16

15

Additional paid-in capital

459,745

444,825

Accumulated other comprehensive loss

(42

)

(53

)

Accumulated deficit

(306,646

)

(298,464

)

Stockholders’ equity

153,073

146,323

Total liabilities and stockholders’

equity

$

268,517

$

298,720

EVOLV TECHNOLOGY

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(8,182

)

$

(95,363

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

7,442

4,087

Write-off of inventory and change in

inventory reserve

1,725

337

Loss from impairment of property and

equipment

—

294

Stock-based compensation

13,834

11,732

Non-cash interest expense

—

22

Amortization (accretion) of premium

(discount) on marketable securities, net of change in accrued

interest

181

(242

)

Non-cash lease expense

728

432

Change in allowance for expected credit

losses

203

173

Loss on extinguishment of debt

—

626

Change in fair value of earn-out

liability

(23,413

)

31,431

Change in fair value of contingently

issuable common stock

(4,274

)

5,837

Change in fair value of public warrant

liability

(7,037

)

13,501

Changes in operating assets and

liabilities

Accounts receivable

(14,020

)

(646

)

Inventory

(10,354

)

5,080

Commission assets

(492

)

(1,258

)

Contract assets

2,324

(1,184

)

Other assets

337

(43

)

Prepaid expenses and other current

assets

(2,958

)

580

Accounts payable

(1,653

)

(7,409

)

Deferred revenue

8,333

24,113

Accrued expenses and other current

liabilities

79

(342

)

Operating lease liability

(765

)

(513

)

Net cash used in operating activities

(37,962

)

(8,755

)

Cash flows from investing

activities:

Development of internal-use software

(3,408

)

(1,599

)

Purchases of property and equipment

(21,092

)

(33,173

)

Proceeds from sale of property and

equipment

—

60

Purchases of marketable securities

(14,567

)

(29,405

)

Proceeds from maturities of marketable

securities

44,918

—

Net cash provided by (used in) investing

activities

5,851

(64,117

)

Cash flows from financing

activities:

Proceeds from exercise of stock

options

636

344

Proceeds from long-term debt

—

1,876

Repayment of principal on long-term

debt

—

(31,876

)

Payment of debt issuance costs and

prepayment penalty

—

(332

)

Net cash provided by (used in) financing

activities

636

(29,988

)

Effect of exchange rate changes on cash

and cash equivalents

11

(33

)

Net decrease in cash, cash equivalents and

restricted cash

(31,464

)

(102,893

)

Cash, cash equivalents and restricted

cash

Cash, cash equivalents and restricted cash

at beginning of period

67,437

230,058

Cash, cash equivalents and restricted cash

at end of period

$

35,973

$

127,165

EVOLV TECHNOLOGY

SUMMARY OF KEY OPERATING

STATISTICS

(Unaudited)

Three Months Ended or as

of,

($ in thousands)

March 31, 2023

June 30, 2023

September 30,

2023

December 31,

2023

March 31, 2024

June 30, 2024

New customers

61

74

70

75

53

84

Annual recurring revenue

$

42,021

$

54,339

$

65,774

$

74,989

$

82,511

$

88,864

Recurring revenue

$

9,075

$

11,689

$

14,377

$

17,350

$

19,381

$

21,249

Remaining performance obligation

$

161,813

$

198,296

$

221,126

$

240,513

$

254,070

$

262,947

Net additions

520

599

628

491

377

441

Ending deployed units

2,787

3,386

4,014

4,505

4,882

5,323

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP

OPERATING EXPENSES TO ADJUSTED OPERATING EXPENSES

(In thousands)

(Unaudited)

Three Months Ended,

March 31, 2023

June 30, 2023

September 30,

2023

December 31,

2023

March 31, 2024

June 30, 2024

Operating expenses, GAAP

$

27,256

$

31,039

$

31,629

$

32,167

$

34,050

$

36,799

Stock-based compensation

(4,898

)

(6,505

)

(5,454

)

(6,711

)

(6,272

)

(7,251

)

Loss on impairment of lease equipment

(137

)

(157

)

(28

)

—

—

—

Other one-time expenses

(53

)

(683

)

(945

)

(535

)

(476

)

(3,011

)

Adjusted operating expenses

$

22,168

$

23,694

$

25,202

$

24,921

$

27,302

$

26,537

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP GROSS

PROFIT TO ADJUSTED GROSS PROFIT, GAAP GROSS MARGIN TO ADJUSTED

GROSS MARGIN AND GAAP OPERATING INCOME (LOSS) TO ADJUSTED OPERATING

INCOME (LOSS)

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

25,540

$

19,825

$

47,208

$

38,406

Cost of revenue

11,068

12,412

20,964

26,228

Gross profit, GAAP

14,472

7,413

26,244

12,178

Stock-based compensation

173

184

311

329

Amortization of capitalized stock-based

compensation

15

11

29

21

Other one-time expenses

106

—

1,310

—

Adjusted gross profit

$

14,766

$

7,608

$

27,894

$

12,528

Gross margin %

56.7

%

37.4

%

55.6

%

31.7

%

Adjusted gross margin %

57.8

%

38.4

%

59.1

%

32.6

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating loss, GAAP

$

(22,327

)

$

(23,626

)

$

(44,605

)

$

(46,117

)

Stock-based compensation

7,424

6,689

13,834

11,732

Amortization of capitalized stock-based

compensation

15

11

29

21

Loss on impairment of lease equipment

—

157

—

294

Other one-time expenses

3,117

683

4,797

736

Adjusted operating loss

$

(11,771

)

$

(16,086

)

$

(25,945

)

$

(33,334

)

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP NET

INCOME (LOSS) TO ADJUSTED EBITDA

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

3,462

$

(66,754

)

$

(8,182

)

$

(95,363

)

Depreciation & amortization

3,968

2,272

7,442

4,087

Stock-based compensation

7,424

6,689

13,834

11,732

Interest expense (income)

(681

)

(1,853

)

(1,766

)

(2,152

)

Loss on extinguishment of debt

—

—

—

626

Change in fair value of contingent

earn-out liability

(16,514

)

28,113

(23,413

)

31,431

Change in fair value of contingently

issuable common stock liability

(3,747

)

5,095

(4,274

)

5,837

Change in fair value of public warrant

liability

(4,886

)

11,751

(7,037

)

13,501

Loss on impairment of lease equipment

—

157

—

294

Other one-time expenses

3,117

683

4,797

736

Adjusted EBITDA

$

(7,857

)

$

(13,847

)

$

(18,599

)

$

(29,271

)

EVOLV TECHNOLOGY

RECONCILIATION OF GAAP NET

INCOME (LOSS) TO ADJUSTED EARNINGS (LOSS)

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

$

3,462

$

(66,754

)

$

(8,182

)

$

(95,363

)

Stock-based compensation

7,424

6,689

13,834

11,732

Amortization of capitalized stock-based

compensation

15

11

29

21

Loss on extinguishment of debt

—

—

—

626

Change in fair value of contingent

earn-out liability

(16,514

)

28,113

(23,413

)

31,431

Change in fair value of contingently

issuable common stock liability

(3,747

)

5,095

(4,274

)

5,837

Change in fair value of public warrant

liability

(4,886

)

11,751

(7,037

)

13,501

Loss on impairment of lease equipment

—

157

—

294

Other one-time expenses

3,117

683

4,797

736

Adjusted loss

$

(11,129

)

$

(14,255

)

$

(24,246

)

$

(31,185

)

Weighted average common shares outstanding

– diluted

171,563,943

148,882,160

154,774,899

147,664,534

Adjusted loss per share – diluted

$

(0.06

)

$

(0.10

)

$

(0.16

)

$

(0.21

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807488453/en/

Investor Relations: Brian Norris Senior Vice President of

Finance and Investor Relations bnorris@evolvtechnology.com

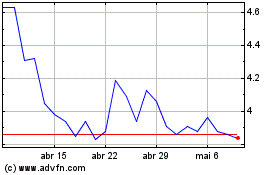

Evolv Technologies (NASDAQ:EVLV)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Evolv Technologies (NASDAQ:EVLV)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024