$509.9 million total revenues including gross

crypto revenues and net loyalty revenues

$36.8 million operating expenses excluding

crypto costs, execution, clearing and brokerage fees, down 43.1%

year-over-year, 24.6% sequentially

Bakkt Holdings, Inc. (“Bakkt” or the “Company”) (NYSE: BKKT)

announced its financial and operational results for the quarter

ended June 30, 2024.

CEO Comments:

“We continue to make solid progress against our three key

strategic priorities,” commented Andy Main, President and CEO of

Bakkt. “Since last quarter, we have made significant strides in

partnerships across traditional and digital assets to enable

Bakkt’s solutions, which offer deep liquidity and strong analytics,

risk management, pricing, and trade matching engines. Recently, we

signed a letter of intent to work with Hidden Road to provide risk

management and back-office functionality, which we believe will

enhance our ability to manage and minimize counterparty and credit

risk for institutional clients using BakktX. We expect this

strategic partnership to strengthen our competitive advantage,

positioning us to better serve our client base and drive future

growth.”

Key Performance Indicators:

- Crypto enabled accounts grew to 6.4 million, up 6.7% YoY.

- Transacting accounts decreased 39.1% year-over-year to

approximately 719,281, primarily due to a large customer’s reduced

activity in international markets.

- Notional traded volume increased 26.6% year-over-year to $672

million, primarily due to higher trading prices for crypto

assets.

- Assets under custody increased 47.7% year-over-year to $975

million, primarily due to higher trading prices for crypto

assets.

Second Quarter 2024 Financial Highlights (unaudited):

- Total revenues of $509.9 million reflect an increase in gross

crypto services revenues driven by Bakkt Crypto. Net loyalty

revenues of $12.8 million increased 4% year-over-year driven by

higher subscription and services revenue.

- Total operating expenses of $531.9 million reflect a

significant increase in crypto costs and execution, clearing and

brokerage fees driven by Bakkt Crypto.

- Total operating expenses excluding crypto costs and execution,

clearing and brokerage fees decreased 43.1% YoY to $36.8 million

driven by cost restructuring and reduction in headcount in the

first quarter of 2024.

- Operating loss of $22.0 million improved 56.9% year-over-year

primarily due to higher crypto services revenue, and lower

compensation, SG&A and acquisition related costs.

- Net loss improved 29.7% year-over-year to $35.5 million.

- Adjusted EBITDA loss (non-GAAP) improved 26.9% year-over-year

to $17.9 million, primarily due to a reduction in compensation and

benefits and selling, general and administrative costs.

$ in millions

2Q24

2Q23

Increase/

(decrease)

Total revenues1

$509.9

$347.6

46.7%

Crypto costs and execution, clearing and

brokerage fees

495.1

334.0

48.2%

Operating expenses, excluding crypto costs

and execution, clearing and brokerage fees

36.8

64.7

(43.1%)

Total operating expenses

531.9

398.7

33.4%

Operating loss

(22.0)

(51.1)

(56.9%)

Net loss

(35.5)

(50.5)

(29.7%)

Adjusted EBITDA loss (non-GAAP)

($17.9)

($24.5)

(26.9%)

Note: “N.M” denotes Not Meaningful

Recent Operational Highlights:

- Key executive hire –

Appointed Ray Kamrath as COO to lead the company’s sales across

Bakkt’s crypto business including trade, custody and institutional

offerings.

- Partnerships Update

- Crossover Market: Announced

licensing agreement with Crossover Markets, which is expected to

significantly enhance BakktX ECN’s institutional capabilities with

faster execution and lower trading costs.

- Hidden Road: Signed a

letter of intent to work with Hidden Road to provide platform

services including real-time risk management and back-office

functionality. Once finalized, this partnership is expected to

enhance our ability to manage risk and minimize counterparty and

credit risk for institutional clients using BakktX through Hidden

Road’s real-time risk management.

Updated 2024 Guidance:2

- Full year 2024 revenues expected to be $2,568 million – $2,827

million; includes gross crypto revenues of $2,515 million - $2,770

million and net loyalty revenues of $53 million – $57 million.

- Full year 2024 crypto costs expected to be $2,505 million –

$2,755 million, in line with gross crypto revenues.

- Full year 2024 total operating expenses excluding crypto costs,

execution, clearing and brokerage fees and goodwill, intangible and

long-lived assets impairments expected to be $157 million – $162

million.

- Full year 2024 net cash used in operating activities expected

to be ($72 million) – ($79 million).

- Full year 2024 free cash flow usage (non-GAAP) expected to be

($79 million) – ($86 million).

- End of year available cash, cash equivalents and

available-for-sale securities of $35 million – $42 million.

1. In accordance with GAAP, crypto

services revenue and crypto costs and execution, clearing and

brokerage fees are presented on a gross basis as the Company is a

principal in those transactions.

2. Given under the following updated key

assumptions: Gross Crypto Revenue, Crypto Costs and ECB - revenue

contribution from existing clients/accounts based on Q2’24 retail

trading engagement metrics, decrease in new crypto trading accounts

driven by re-alignment of international strategy, addition of

institutional clients with steady ramp-up in assets under custody

in 2H’24 and Crypto Costs and ECB in line with gross crypto

revenue. End of year cash, cash equivalents and AFS securities –

Reduction in upper end of expected end of year balance driven by

$10mm reduction in net contribution from crypto trading, range

further adjusted for cash expense utilization in 2Q.

Webcast and Conference Call Information

Bakkt will host a conference call at 8:30 AM ET, August 14,

2024. The earnings conference call will be webcast live here and

archived on the investor relations section of Bakkt’s corporate

website under the ‘Events & Presentations’ section, along with

any related earnings materials.

Investors and analysts interested in participating in the call

are invited to dial (833) 470-1428 or (404) 975-4839, and reference

participant access code 865830 approximately ten minutes prior to

the start of the call.

About Bakkt

Founded in 2018, Bakkt builds solutions that enable our clients

to grow with the crypto economy. Through institutional-grade

custody, trading, and onramp capabilities, our clients leverage

technology that’s built for sustainable, long-term involvement in

crypto.

Bakkt is headquartered in Alpharetta, GA. For more information,

visit: https://www.bakkt.com/ | X (Formerly Twitter) @Bakkt |

LinkedIn https://www.linkedin.com/company/bakkt/.

Bakkt-E

Note on Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements include, but are not limited to, Bakkt’s

guidance and outlook, including for the full fiscal year 2024, and

the trends and assumptions underlying such guidance and outlook,

Bakkt’s cost reduction strategy and expectations regarding cost

savings, Bakkt’s plans and expectations, including statements about

new products and features, partnerships, joint ventures and growth,

Bakkt’s expectations regarding crypto market growth, and Bakkt’s

beliefs regarding its future goals, among others. Forward-looking

statements can be identified by words such as “will,” “likely,”

“expect,” “continue,” “anticipate,” “estimate,” “believe,”

“intend,” “plan,” “projection,” “outlook,” “grow,” “progress,”

“potential” or words of similar meaning. Such forward-looking

statements are based upon the current beliefs and expectations of

Bakkt’s management and are inherently subject to significant

business, economic and competitive uncertainties and contingencies,

many of which are difficult to predict and beyond Bakkt’s control.

Actual results and the timing of events may differ materially from

the results anticipated in such forward-looking statements as a

result of the following factors, among others: the Company’s

ability to continue as a going concern; the Company’s ability to

grow and manage growth profitably; changes in the Company’s

business strategy; the Company’s future capital requirements and

sources and uses of cash, including funds to satisfy its liquidity

needs; changes in the market in which the Company competes,

including with respect to its competitive landscape, technology

evolution or changes in applicable laws or regulations; changes in

the markets that the Company targets; disruptions in the crypto

market that subject the Company to additional risks, including the

risk that banks may not provide banking services to the Company;

the possibility that the Company may be adversely affected by other

economic, business, and/or competitive factors; the inability to

launch new services and products or to profitably expand into new

markets and services; the inability to execute the Company’s growth

strategies, including identifying and executing acquisitions and

the Company’s initiatives to add new clients; the Company’s failure

to comply with extensive government regulation, oversight,

licensure and appraisals; uncertain regulatory regime governing

blockchain technologies and crypto; the inability to develop and

maintain effective internal controls and procedures; the exposure

to any liability, protracted and costly litigation or reputational

damage relating to the Company’s data security; the impact of any

goodwill or other intangible assets impairments on the Company’s

operating results; and other risks and uncertainties indicated in

the Company’s filings with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on such

forward-looking statements. Such forward-looking statements relate

only to events as of the date on which such statements are made and

are based on information available to us as of the date of this

press release. Unless otherwise required by law, we undertake no

obligation to update any forward-looking statements made in this

press release to reflect events or circumstances after the date of

this press release or to reflect new information or the occurrence

of unanticipated events.

Definitions

- Crypto-enabled accounts: total

crypto accounts open.

- Transacting accounts: unique

accounts that perform at least one transaction across crypto

buy/sell and loyalty redemption each month. Monthly figures are

de-duped for the month. Quarterly figure represents sum of all

months in the quarter.

- Notional traded volume: total

notional volume of transactions across crypto buy/sell and loyalty

redemption. Figures represent gross values recorded as of order

date.

- Assets under custody: the sum of

coin quantities held by customers multiplied by the final quote for

each coin on the last day of the quarter.

Bakkt Q2 2024 Financial

Statements

Consolidated Balance

Sheets

$ in millions except per share

data

As of 6/30/24

(unaudited)

As of 12/31/23

Assets

Current assets

Cash and cash equivalents

$47.5

$52.9

Restricted cash

34.0

31.8

Customer funds

53.3

32.9

Available-for-sale securities

13.2

17.4

Accounts receivable, net

24.4

29.7

Prepaid insurance

5.9

13.0

Safeguarding asset for crypto

974.5

701.6

Other current assets

4.5

3.3

Total current assets

1,157.4

882.6

Property, equipment and software, net

1.9

0.1

Goodwill

68.0

68.0

Intangible assets, net

2.9

2.9

Other assets

12.7

13.3

Total assets

$1,242.9

$966.9

Liabilities and stockholders'

equity

Current liabilities

Accounts payable and accrued

liabilities

$39.3

$55.4

Customer funds payable

53.3

32.9

Deferred revenue, current

2.3

4.3

Due to related party

2.7

3.2

Safeguarding obligation for crypto

974.5

701.6

Unsettled crypto trades

1.5

1.0

Other current liabilities

3.9

3.7

Total current liabilities

1,077.4

802.1

Deferred revenue, noncurrent

2.8

3.2

Warrant liability

38.8

2.4

Other noncurrent liabilities

21.4

23.5

Total liabilities

$1,140.3

$831.2

Stockholders' equity

Class A Common Stock ($0.0001 par value,

30,000,000 shares authorized, 6,310,548 shares issued and

outstanding as of 6/30/24 and 3,793,837 shares outstanding as of

12/31/23)

0.0

0.0

Class V Common Stock ($0.0001 par value,

10,000,000 shares authorized, 7,194,941 shares issued and

outstanding as of 3/31/24 and 7,200,064 shares outstanding as of

12/31/23)

0.0

0.0

Additional paid-in capital

824.0

799.7

Accumulated other comprehensive loss

(0.3

)

(0.1

)

Accumulated deficit

(775.9

)

(751.3

)

Total stockholders' equity

47.8

48.3

Noncontrolling interest

54.8

87.4

Total equity

102.6

135.7

Total liabilities and stockholders'

equity

$1,242.9

$966.9

Consolidated Statements of

Operations (unaudited)

$ in millions except per share

data

2Q24

2Q23

Revenues:

Crypto services

$497.1

$335.3

Loyalty services, net

12.8

12.3

Total revenues

509.9

347.6

Operating expenses:

Crypto costs

491.7

331.8

Execution, clearing and brokerage fees

3.4

2.2

Compensation and benefits

22.4

27.1

Professional services

3.6

2.9

Technology and communication

3.7

4.4

Selling, general and administrative

5.5

7.6

Acquisition-related expenses

0.1

17.0

Depreciation and amortization

0.1

3.8

Related party expenses

0.2

1.5

Impairment of long-lived assets

—

—

Restructuring expenses

0.9

0.2

Other operating expenses

0.4

0.2

Total operating expenses

531.9

398.7

Operating loss

(22.0

)

(51.1

)

Interest income, net

1.2

0.7

Gain (loss) from change in fair value of

warrant liability

(15.1

)

0.4

Other income (expense), net

0.4

(0.3

)

Loss before income taxes

(35.4

)

(50.4

)

Income tax expense

(0.1

)

(0.2

)

Net loss

(35.5

)

(50.5

)

Less: Net loss attributable to

noncontrolling interest

(19.1

)

(33.7

)

Net loss attributable to Bakkt

Holdings, Inc.

($16.4

)

($16.8

)

Net loss per share attributable to Class A

Common Stockholders

Basic

($2.67

)

($4.69

)

Diluted

($2.67

)

($4.69

)

Consolidated Statements of

Cash Flows (unaudited)

$ in millions

2Q24

2Q23

Cash flows from operating

activities:

Net loss

($35.5

)

($50.5

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

0.1

3.8

Non-cash lease expense

0.4

0.7

Share-based compensation expense

2.4

4.1

Unit-based compensation expense

—

0.2

Loss on disposal of assets

0.0

—

(Gain) loss from change in fair value of

warrant liability

15.1

(0.4

)

Other

0.0

(0.2

)

Changes in operating assets and

liabilities:

Accounts receivable

12.3

4.4

Prepaid insurance

3.2

2.6

Accounts payable and accrued

liabilities

(23.5

)

4.9

Unsettled crypto trades

(3.1

)

0.0

Due to related party

0.1

0.5

Deferred revenue

(1.1

)

(0.3

)

Operating lease liabilities

(0.9

)

(0.7

)

Customer funds payable

(34.8

)

0.0

Other assets and liabilities

(0.6

)

(0.3

)

Net cash provided by (used in) operating

activities

(65.9

)

(31.2

)

Cash flows from investing

activities:

Capitalized internal-use software

development costs and other capital expenditures

(0.4

)

(2.3

)

Purchase of available-for-sale

securities

---

0.0

Proceeds from the settlement of

available-for-sale securities

4.7

52.1

Acquisition of Bumped Financial, LLC

---

---

Acquisition of Apex Crypto LLC, net of

cash acquired

---

(44.4

)

Net cash (used in) provided by investing

activities

4.4

5.4

Cash flows from financing

activities:

Proceeds from Concurrent Offerings, net of

issuance costs

7.5

0.0

Proceeds from the exercise of warrants

0.0

---

Repurchase and retirement of Class A

Common Stock

(0.0

)

(2.5

)

Net cash provided by (used in) financing

activities

7.5

(2.5

)

Effect of exchange rate changes

(0.2

)

0.3

Net increase (decrease) in cash, cash

equivalents, restricted cash, customer funds and deposits

(54.3

)

(28.0

)

Cash, cash equivalents, restricted cash,

customer funds and deposits at the beginning of the period

$190.8

$137.9

Cash, cash equivalents, restricted cash,

customer funds and deposits at the end of the period

$136.5

$109.9

Reconciliation of Non-GAAP Financial

Measures

Non-GAAP Financial Measures – Adjusted EBITDA

Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation, amortization, acquisition-related expenses,

share-based and unit-based compensation expense, goodwill and

intangible assets impairments, restructuring charges, changes in

the fair value of our warrant liability and certain other non-cash

and/or non-recurring items that do not contribute directly to our

evaluation of operating results and are not components of our core

business operations. Adjusted EBITDA provides management with an

understanding of earnings before the impact of investing and

financing transactions and income taxes, and the effects of

aforementioned items that do not reflect the ordinary earnings of

our operations. This measure may be useful to an investor in

evaluating our performance. Adjusted EBITDA is not a measure of our

financial performance under GAAP and should not be considered as an

alternative to net income (loss) or other performance measures

derived in accordance with GAAP. Our definition of Adjusted EBITDA

may not be comparable to similarly titled measures used by other

companies.

Non-GAAP financial measures like Adjusted EBITDA have

limitations, should be considered as supplemental in nature and are

not meant as a substitute for the related financial information

prepared in accordance with GAAP. The non-GAAP financial measures

should be considered alongside other financial performance

measures, including net loss and our other financial results

presented in accordance with GAAP.

$mm's

2Q24

2Q23

Net loss

($35.5

)

($50.5

)

Depreciation and amortization

0.1

3.8

Interest income, net

(1.2

)

(0.7

)

Income tax expense

0.1

0.2

EBITDA

($36.6

)

($47.2

)

Acquisition-related expenses

0.1

17.0

Share-based and unit-based compensation

expense

2.4

4.4

Loss (gain) from change in fair value of

warrant liability

15.1

(0.4

)

Restructuring expenses

0.9

0.2

Shelf registration expenses

—

—

Transition services expense

0.2

1.5

Adjusted EBITDA loss

($17.9

)

($24.5

)

Free Cash Flow is a non-GAAP financial measure. Free Cash Flow

is cash flow from operations adjusted for “capitalized internal use

software development costs and other capital expenditures” and

“interest income.” We adjust for capitalized expenses associated

with internally developed software for our technology platforms

given they are a large component of our ongoing expense base given

our position as a technology platform company.

We provide Free Cash Flow because we believe that Free Cash

Flow, when viewed with our results under GAAP, provides useful

information for the reasons noted above. However, Free Cash Flow is

not a measure of liquidity under GAAP and, accordingly, should not

be considered as an alternative to net cash used in operating

activities as an indicator of liquidity.

$mm's

FY2024

Low

High

Net cash used in operating

activities

($72.0

)

($79.0

)

Capex

(3.1

)

(3.1

)

Interest income, net

(3.9

)

(4.0

)

Free Cash Flow

($79.0

)

($86.1

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813661648/en/

Investor Relations IR@bakkt.com

Media press@bakkt.com

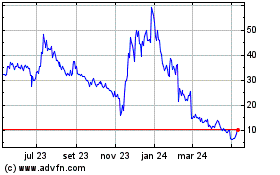

Bakkt (NYSE:BKKT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

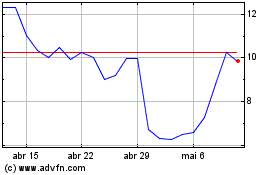

Bakkt (NYSE:BKKT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024