ATS Announces Pricing of Upsized $400 Million Senior Unsecured Notes Offering

15 Agosto 2024 - 7:30AM

Business Wire

ATS Corporation (TSX and NYSE: ATS) (“ATS” or the

“Company”) announced today that it has entered into an

underwriting agreement to sell, pursuant to a private placement

offering (the “Offering”), C$400 million aggregate principal

amount of 6.50% senior unsecured notes due 2032 (the

“Notes”), which aggregate principal amount of Notes was

upsized from the initial deal size of C$300 million. The Notes will

be issued at a price of C$1,000 per C$1,000 principal amount of

Notes. The Notes will accrue interest at the rate of 6.50% per

annum, payable in cash in equal payments semi-annually in arrears

on February 21 and August 21 of each year, commencing on February

21, 2025. The Notes will be issued pursuant to an indenture to be

entered into between the Company and Computershare Trust Company of

Canada, as trustee.

ATS intends to use the net proceeds of the Offering to pay

outstanding amounts owed under the revolving line of credit

available under its senior syndicated credit facility.

The Notes are being conditionally offered for sale in Canada on

a private placement basis pursuant to certain prospectus

exemptions. The Notes have not been registered under the United

States Securities Act of 1933, as amended (the "U.S. Securities

Act"), or any state securities laws, and are being offered and

sold in the United States only to persons reasonably believed to be

qualified institutional buyers in reliance on Rule 144A under the

U.S. Securities Act and applicable state securities laws and

outside the United States in offshore transactions in reliance on

Regulation S under the U.S. Securities Act.

Subject to customary closing conditions, the closing of the

Offering is expected to occur on or about August 21, 2024.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes, nor shall there be any

offer or sale of the Notes in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About ATS Corporation

ATS Corporation is an industry-leading automation solutions

provider to many of the world's most successful companies. ATS uses

its extensive knowledge base and global capabilities in custom

automation, repeat automation, automation products and value-added

solutions including pre-automation and after-sales services, to

address the sophisticated manufacturing automation systems and

service needs of multinational customers in markets such as life

sciences, transportation, food & beverage, consumer products,

and energy. Founded in 1978, ATS employs over 7,000 people at more

than 65 manufacturing facilities and over 85 offices in North

America, Europe, Southeast Asia and Oceania. The Company's common

shares are traded on the Toronto Stock Exchange and the NYSE under

the symbol ATS.

Forward-looking Statements

This press release contains certain statements that may

constitute forward-looking information and forward-looking

statements within the meaning of applicable Canadian and United

States securities laws (“forward-looking statements”). All such

statements are made pursuant to the “safe harbour” provisions of

Canadian provincial and territorial securities laws and the U.S.

Private Securities Litigation Reform Act of 1995.

Forward-looking statements include all statements that are not

historical facts regarding possible events, conditions or results

of operations that ATS believes, expects or anticipates will or may

occur in the future, including, but not limited to: the anticipated

timing for closing of the Offering of the Notes, and the use of

proceeds from the Offering of the Notes. Forward-looking statements

are inherently subject to significant known and unknown risks,

uncertainties, and other factors that may cause the actual results,

performance, or achievements of ATS, or developments in ATS’

business or in its industry, to differ materially from the

anticipated results, performance, achievements, or developments

expressed or implied by such forward-looking statements. Important

risks, uncertainties, and factors that could cause actual results

to differ materially from expectations expressed in the

forward-looking statements include, but are not limited to, the

failure to close the Offering within the timeline expected, or at

all, for any reason; general market performance including market

conditions and availability and cost of credit; and other risks and

uncertainties detailed from time to time in ATS' filings with

securities regulators, including, without limitation, the risk

factors described in ATS’ annual information form for the fiscal

year ended March 31, 2024, which are available on the System for

Electronic Data Analysis and Retrieval+ (SEDAR+) at

www.sedarplus.com and on the U.S. Securities Exchange Commission’s

Electronic Data Gathering, Analysis and Retrieval System (EDGAR) at

www.sec.gov. ATS has attempted to identify important factors that

could cause actual results to materially differ from current

expectations, however, there may be other factors that cause actual

results to differ materially from such expectations.

Forward-looking statements are necessarily based on a number of

estimates, factors, and assumptions regarding, among others,

management's current plans, estimates, projections, beliefs and

opinions; the future performance and results of the Company’s

business and operations; the ability of ATS to execute on its

business objectives, and the closing of the Offering substantially

in accordance with the expected timing.

Forward-looking statements included herein are only provided to

understand management’s current expectations relating to future

periods and, as such, are not appropriate for any other purpose.

Although ATS believes that the expectations reflected in such

forward-looking statements are reasonable, such statements involve

risks and uncertainties, and ATS cautions you not to place undue

reliance upon any such forward-looking statements, which speak only

as of the date they are made. ATS does not undertake any obligation

to update forward-looking statements contained herein other than as

required by law.

SOURCE: ATS Corporation

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815214036/en/

For more information, contact: David Galison Head of

Investor Relations ATS Corporation 730 Fountain Street North

Cambridge, ON, N3H 4R7 (519) 653-6500 dgalison@atsautomation.com

For general media inquiries, contact: Matthew Robinson

Director, Corporate Communications ATS Corporation 730 Fountain

Street North Cambridge, ON, N3H 4R7 (519) 653-6500

mrobinson@atsautomation.com

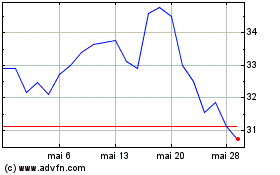

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024