ATS Announces Normal Course Issuer Bid

12 Dezembro 2024 - 8:00AM

Business Wire

ATS Corporation (TSX and NYSE: ATS) (“ATS” or the “Company”),

today announced that the Toronto Stock Exchange (“TSX”) has

accepted a notice filed by it of its intention to make a normal

course issuer bid (“NCIB”). As of December 2, 2024, ATS had a total

of 97,926,826 common shares issued and outstanding. Under the NCIB,

ATS will have the ability to purchase for cancellation up to a

maximum of 8,259,180 common shares, representing approximately 10%

of the public float of 82,591,806 common shares of the Company that

were issued and outstanding as of December 2, 2024.

Purchases under the NCIB will be made through the facilities of

the TSX and/or alternative Canadian trading systems in accordance

with applicable regulatory requirements, during the twelve-month

period commencing on December 16, 2024, and ending on or before

December 15, 2025. The average daily trading volume of the common

shares on the TSX for the six calendar months ending November 30,

2024, was 263,276 common shares. On any given trading day, ATS will

not purchase more than 25% of such average daily trading volume,

representing 65,819 common shares, except where such purchases are

made in accordance with available block purchase exemptions. The

common shares purchased under this NCIB will be cancelled.

Some purchases under the NCIB may be made pursuant to an

automatic purchase plan that has been entered into between ATS and

its broker. This plan will enable the purchase of ATS common shares

when ATS would not ordinarily be active in the market due to

internal trading blackout periods, insider trading rules, or

otherwise.

ATS believes that there are times when the market price of its

common shares may not reflect their underlying value and that the

purchase of shares by ATS will both provide liquidity to existing

shareholders and benefit remaining shareholders. The NCIB is viewed

by ATS management as one component of an overall capital structure

strategy and complementary to its acquisition growth plans.

The NCIB follows the Company’s normal course issuer bid for the

period ended December 14, 2024 (the “2023 NCIB”). Under the 2023

NCIB, the Company had obtained approval to purchase up to 8,044,818

common shares. The Company’s 2023 NCIB began on December 15, 2023

and will end on December 14, 2024. Within the past 12 months, under

the 2023 NCIB, the Company repurchased through the facilities of

the TSX and/or alternative Canadian trading systems, and cancelled,

1,021,187 common shares at a weighted average purchase price of

$44.07 per common share.

About ATS Corporation

ATS Corporation is an industry-leading automation solutions

provider to many of the world's most successful companies. ATS uses

its extensive knowledge base and global capabilities in custom

automation, repeat automation, automation products and value-added

solutions including pre-automation and after-sales services, to

address the sophisticated manufacturing automation systems and

service needs of multinational customers in markets such as life

sciences, transportation, food & beverage, consumer products,

and energy. Founded in 1978, ATS employs over 7,500 people at more

than 65 manufacturing facilities and over 85 offices in North

America, Europe, Southeast Asia and Oceania. The Company's common

shares are traded on the Toronto Stock Exchange and the New York

Stock Exchange under the symbol ATS.

Forward-looking Statements

Certain information contained in this press release may

constitute forward-looking information under applicable securities

laws, including statements related to ATS’ intentions with respect

to the NCIB and purchases thereunder and the effects of repurchases

under the bid. Forward-looking statements, by their very nature,

involve inherent risks and uncertainties and are based on several

assumptions, both general and specific. Much of this information

can be identified by looking for words such as “believe”,

“expects”, “expected”, “will”, “intends”, “projects”,

“anticipates”, “estimates”, “continues” or similar words. Purchases

made under the NCIB are not guaranteed and may be suspended at the

discretion of ATS’ Board of Directors. Forward-looking statements

are based on current information and expectations that involve a

number of risks and uncertainties, which could cause actual results

to differ materially from those anticipated. Forward-looking

statements contained in this press release are made as of the date

hereof and are subject to change. ATS assumes no obligation to

revise or update forward looking statements to reflect new

circumstances, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212696486/en/

For more information, contact: David Galison Head of

Investor Relations ATS Corporation 730 Fountain Street North

Cambridge, ON, N3H 4R7 (519) 653-6500

dgalison@atsautomation.com

For general media inquiries, contact: Matthew Robinson

Director, Corporate Communications ATS Corporation 730 Fountain

Street North Cambridge, ON, N3H 4R7 (519) 653-6500

mrobinson@atsautomation.com

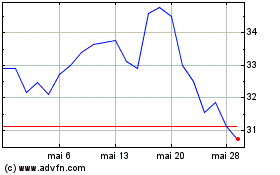

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025