Company Highlights Success of Recent

Restructurings, Majority Shareholder Significantly Increases

Financial Commitment for Future Growth

The Arena Group Holdings, Inc. (NYSE American: AREN), today

provided an operational update and reported financial results for

the three months ended June 30, 2024.

Management Commentary

“Nearly all of our cost reduction initiatives are complete,

leading to an expected over $40 million in eliminated costs on an

annual basis,” commented Sara Silverstein, The Arena Group’s Chief

Executive Officer. “As a result, our net losses significantly

narrowed, demonstrating that we are on the right path.”

“We achieved positive Adjusted EBITDA in the current quarter

with performance increasing significantly within the quarter from

April to June 2024,” she added. “Excluding non-recurring severance

charges and higher legal fees would have delivered profitability in

June. We anticipate being able to report to our shareholders

further improvements in the second half of this year due to the

continued phase-out of restructuring costs, increased operational

efficiencies and modest organic growth.”

Expanded Line of Credit, Increased Liquidity and Termination

of Business Combination Agreement

“I want to be clear: I am as committed to The Arena Group today

as I have ever been, particularly in light of the shift towards

profitability and the success of new leadership in such a short

period of time,” commented Manoj Bhargava, owner of Simplify

Inventions, LLC (“Simplify”).

Shortly after the opening of business on Monday, August 19,

2024, the Board of Directors of The Arena Group, and the ownership

of Simplify finalized previously disclosed negotiations around

alternative structures or options to the business combination

agreement. As a result, The Arena Group and Simplify mutually

agreed to terminate the business combination agreement in light of

changes in the structures of both organizations. To increase the

strength of the Company’s balance sheet and to address liquidity

concerns, Simplify has agreed to:

- Increase the Company’s existing $25 million line of credit with

Simplify to $50 million;

- Convert $15 million drawn on the line of credit to common

equity based on today’s 60-day volume-weighted average stock price

(VWAP); and

- Line of Credit maturity date extended to December 1, 2026.

“In the months since our pending business combination with

Bridge Media was first agreed to, The Arena Group has ended its

management of Sports Illustrated and the Bridge Media assets have

not performed to expectations,” continued Ms. Silverstein. “As a

result, combining the assets of The Arena Group and Bridge Media no

longer made sense. We have terminated the business combination and

will move forward as a significantly strengthened stand-alone

company with the continued support of our majority shareholder,

Simplify.”

Though the expansion and modification of terms on the existing

line of credit with Simplify increase liquidity and strengthen The

Arena Group, these changes do not alleviate all conditions that

raised substantial doubt about The Arena Group’s ability to

continue as a going concern as previously disclosed.

Second Quarter Business Highlights

- Sports Vertical: The new management team overhauled the

structure and business model of the Athlon Sports brand, shifting

from a fixed to a variable cost model. Following the exiting of the

Sports Illustrated brand, the new framework reached strong

operational performance in six weeks. Traffic increased nearly

four-fold from the first to the second quarter of 2024, reaching

more than 150 million pageviews. This represents an increase of

over 600% year over year.

- Finance Vertical: This vertical produced the best

quarter on record by delivering a year over year increase of over

750% in markets team page view traffic and diversifying and

solidifying revenue streams through affiliate commerce, the

relaunch of a new and improved TheStreet Pro subscription offering,

and the launch of the Come Cruise with Me site and newsletter.

- Lifestyle Vertical: The Company’s lifestyle vertical

achieved the highest April and May traffic on record and delivered

record vertical revenue. A continued focus on the health category

resulted in major pharmaceutical and healthcare sponsorships. The

Company published four newsstand issues of Parade magazine sold

exclusively in Dollar Tree stores and launched a new Best Reads

channel.

- Commerce Vertical: Revenue growth in the commerce

vertical accelerated in the current quarter and the Company

delivered year-over-year increases in both content output and

revenue as compared to second quarter of 2023.

- Adventure Vertical: Traffic in the adventure vertical

nearly doubled year over year as compared to the second quarter of

2023 while remaining stable as compared to the first quarter of

2024. The Company launched the first integrated campaign across

digital, social and video on all sites and published the first

digital cover of Men’s Journal since March 2023.

Second Quarter 2024 Financial Results

Total revenue was $27.2 million compared to $34.1 million for

the second quarter last year, a decrease of 20.2%, reflecting a

decrease in print revenue of $2.8 million due primarily to the

shutdown of Athlon Outdoor print operations, as well as lower

digital revenue. The primary driver of the decrease in digital

revenue was a 10.0% decrease in digital advertising revenue due to

the curtailing of certain less profitable brands. Gross profit was

$10.7 million, or 39.3% gross profit margin, compared to gross

profit of $13.2 million, or 38.7% gross profit margin, in the

second quarter last year. The increase in gross profit margin was

driven by a higher mix of revenue from sports partners, which

receive a higher revenue share.

Total operating expenses were $13.3 million compared to $19.6

million for the second quarter last year, a decrease of 32.1%.

Included in this reduction was a 45.7% decrease in selling and

marketing costs and a 25.6% decrease in general and administrative

costs. The decreases were primarily related to decreases in payroll

and employee benefits costs, lower professional marketing services

expenses and a reduction in circulation costs.

For the three months ended June 30, 2024, the net loss from

continuing operations was $6.9 million, a narrowing of $4.6 million

compared to a net loss from continuing operations of $11.5 million

in the comparable quarter last year. Net loss, inclusive of a $1.2

million loss from discontinued operations (net of tax), was $8.2

million, or $0.28 per diluted share, compared to a net loss of

$19.5 million (inclusive of a loss from discontinued operations of

$8.0 million), or $0.88 per diluted share, in the second quarter

last year.

As of June 30, 2024, the Company had cash and cash equivalents

of $6.1 million, compared to $9.3 million as of December 31, 2023.

Total debt as of June 30, 2024 was $123.1 million compared to

$129.8 million as of December 31, 2023, a reduction of $6.7

million.

KPMG Appointed as Independent Auditor

On July 11, 2024, the Board of Directors approved the

appointment of KPMG LLP as The Arena Group’s new independent

registered public accounting firm to perform independent audit

services, effective immediately, replacing Marcum LLP.

About The Arena Group

The Arena Group (NYSE American: AREN) is an innovative

technology platform and media company with a proven cutting-edge

playbook that transforms media brands. Our unified technology

platform empowers creators and publishers with tools to publish and

monetize their content, while also leveraging quality journalism of

anchor brands like TheStreet, Parade, Men’s Journal and Athlon

Sports to build their businesses. The company aggregates content

across a diverse portfolio of over 265 brands, reaching over 100

million users monthly. Visit us at thearenagroup.net and discover

how we are revolutionizing the world of digital media.

Forward Looking Statements

This press release includes statements that constitute

forward-looking statements. Forward-looking statements may be

identified by the use of words such as “forecast,” “guidance,”

“plan,” “estimate,” “will,” “would,” “project,” “maintain,”

“intend,” “expect,” “anticipate,” “prospect,” “strategy,” “future,”

“likely,” “may,” “should,” “believe,” “continue,” “opportunity,”

“potential,” and other similar expressions that predict or indicate

future events or trends or that are not statements of historical

matters, and include, for example, statements related to the

Company’s anticipated future expenses and investments, business

strategy and plans, expectations relating to its industry, market

conditions and market trends and growth, market position and

potential market opportunities, and objectives for future

operations. These forward-looking statements are based on

information available at the time the statements are made and/or

management’s good faith belief as of that time with respect to

future events and are subject to risks and uncertainties that could

cause actual results to differ materially from those expressed in

or suggested by the forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, the ability of the Company to expand its verticals; the

Company’s ability to grow its subscribers; the Company’s ability to

grow its advertising revenue; general economic uncertainty in key

global markets and a worsening of global economic conditions or low

levels of economic growth; the effects of steps that the Company

could take to reduce operating costs; the remaining effects of the

COVID-19 pandemic and impact on the demand for the Company

products; the inability of the Company to sustain profitable sales

growth; circumstances or developments that may make the Company

unable to implement or realize the anticipated benefits, or that

may increase the costs, of its current and planned business

initiatives; and those factors detailed by the Company in its

public filings with the SEC, including its Annual Reports on Form

10-K and Quarterly Reports on Form 10-Q. Should one or more of

these risks, uncertainties, or facts materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by the

forward-looking statements contained herein. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. Except as required under the federal

securities laws and the rules and regulations of the SEC, we do not

have any intention or obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events, or otherwise.

THE ARENA GROUP HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS Three Months

Ended June 30, Six Months Ended June 30,

2024

2023

2024

2023

Revenue

$

27,183

$

34,072

$

56,124

$

62,490

Cost of revenue (includes amortization of developed technology and

platform development for three months ended 2024 and 2023 of $1,507

and $2,323, respectively and for the six months ended 2024 and 2023

of $3,056 and $4,692, respectively)

16,465

20,855

36,473

38,945

Gross profit

10,718

13,217

19,651

23,545

Operating expenses Selling and marketing

3,751

6,904

8,315

12,751

General and administrative

8,632

11,601

18,767

24,576

Depreciation and amortization

913

1,065

1,900

2,161

Loss on impairment of assets

-

-

1,198

119

Total operating expenses

13,296

19,570

30,180

39,607

Loss from operations

(2,578

)

(6,353

)

(10,529

)

(16,062

)

Other (expense) income Change in valuation of contingent

consideration

-

90

(313

)

(409

)

Interest expense, net

(4,249

)

(5,001

)

(8,588

)

(9,183

)

Liquidated damages

(76

)

(177

)

(152

)

(304

)

Total other expense

(4,325

)

(5,088

)

(9,053

)

(9,896

)

Loss before income taxes

(6,903

)

(11,441

)

(19,582

)

(25,958

)

Income tax provision

(35

)

(86

)

(76

)

(93

)

Loss from continuing operations

(6,938

)

(11,527

)

(19,658

)

(26,051

)

Loss from discontinued operations, net of tax

(1,249

)

(7,957

)

(91,887

)

(12,810

)

Net loss

$

(8,187

)

$

(19,484

)

$

(111,545

)

$

(38,861

)

Basic and diluted net loss per common share: Continuing operations

$

(0.24

)

$

(0.52

)

$

(0.70

)

$

(1.27

)

Discontinued operations

(0.04

)

(0.36

)

(3.27

)

(0.62

)

Basic and diluted net loss per common share

$

(0.28

)

$

(0.88

)

$

(3.97

)

$

(1.89

)

Weighted average number of common shares outstanding – basic and

diluted

29,399,365

22,074,500

28,110,331

20,509,676

THE ARENA GROUP HOLDINGS, INC., AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS June 30, 2024

December 31, 2023 Assets Current assets: Cash and

cash equivalents

$

6,085

$

9,284

Accounts receivables, net

22,698

31,676

Prepayments and other current assets

5,555

5,791

Current assets from discontinued operations

1,014

43,648

Total current assets

35,352

90,399

Property and equipment, net

225

328

Operating lease right-of-use assets

2,565

176

Platform development, net

7,380

8,723

Acquired and other intangible assets, net

24,489

27,457

Other long term assets

773

1,003

Goodwill

42,575

42,575

Noncurrent assets from discontinued operations

-

18,217

Total assets

$

113,359

$

188,878

Liabilities, mezzanine equity and stockholders’ deficiency

Current liabilities: Accounts payable

$

4,977

$

7,803

Accrued expenses and other

27,270

28,903

Line of credit

-

19,609

Unearned revenue

10,719

16,938

Subscription refund liability

131

46

Operating lease liability, current portion

122

358

Contingent consideration

-

1,571

Liquidating damages payable

3,076

2,924

Simplify loan

12,748

-

Bridge notes

8,000

7,887

Debt

102,372

102,309

Current liabilities from discontinued operations

97,516

47,673

Total current liabilities

266,931

236,021

Unearned revenue, net of current portion

530

542

Operating lease liability, net of current portion

2,101

-

Other long-term liabilities

169

406

Deferred tax liabilities

661

599

Noncurrent liabilities from discontinued operations

-

10,137

Total liabilities

270,392

247,705

Mezzanine equity: Series G redeemable and convertible preferred

stock, $0.01 par value, $1,000 per share liquidation value and

1,800 shares designated; aggregate liquidation value: $168; Series

G shares issued and outstanding: 168; common shares issuable upon

conversion: 8,582 at March 31, 2024 and December 31, 2023

168

168

Total mezzanine equity

168

168

Stockholders' deficiency: Common stock, $0.01 par value, authorized

1,000,000,000 shares; issued and outstanding: 29,573,932 and

23,836,706 shares at June 30, 2024 and December 31, 2023,

respectively

295

237

Additional paid-in capital

332,702

319,421

Accumulated deficit

(490,198

)

(378,653

)

Total stockholders’ deficiency

(157,201

)

(58,995

)

Total liabilities, mezzanine equity and stockholders’ deficiency

$

113,359

$

188,878

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240818869669/en/

Investor Relations Contact Rob Fink, FNK IR

aren@fnkir.com 646.809.4048

The Arena Group Contact Steve Janisse

c-sjanisse@thearenagroup.net 404.574.9206

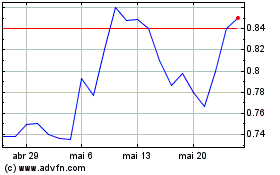

Arena (AMEX:AREN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Arena (AMEX:AREN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024