Company reduces quarterly operating expenses by

51% vs. the same quarter prior year, drives $13.6 million positive

swing in quarterly income from continuing operations, demonstrating

transformation plan’s rapid effectiveness

The Arena Group Holdings, Inc. (NYSE American: AREN) (“Arena”),

a technology platform and media company home to hundreds of media

brands, including TheStreet, Parade Media (“Parade”), Men’s

Journal, Surfer, Powder and Athlon Sports, today announced

financial results for the three and nine months ending September

30, 2024 (“Q3 2024”). The Company’s business transformation plan

enabled a positive swing of more than $13.6 million in quarterly

income from continuing operations in the third quarter of 2024

compared to the net loss from continuing operations in the third

quarter of 2023 (“Q3 2023”). This resulted in quarterly net income

of $4.0 million and the first quarter of positive net income in the

Company’s history.

Financial Highlights for Q3 2024:

- Q3 2024 revenue from continuing operations was $33.6 million,

compared to $37.0 million from continuing operations in Q3

2023.

- Net income was $4.0 million, or $0.11 in diluted earnings per

share for Q3 2024, compared to a net loss of $11.2 million, or

$0.47 in diluted loss per share for Q3 2023.

- Total operating expenses from continuing operations for Q3 2024

were $8.9 million, less than half the $18.4 million spent in Q3

2023 from continuing operations.

- Adjusted EBITDA for Q3 2024 was $11.2 million compared to

Adjusted EBITDA of $3.1 million for Q3 2023.

- Arena closed a deal to license a copy of its proprietary

content management system. This deal also included Arena acquiring

multiple sites, including the top-tier automotive website,

Autoblog.

- Arena extended the maturity on its line of credit with Simplify

Inventions, LLC and converted $15 million of debt to common

equity.

“The financial results for Q3 2024 reflect the strength of the

new, leaner, more efficient Arena Group,” said The Arena Group CEO

Sara Silverstein. “We’re achieving meaningful revenue

diversification, including a significant increase in e-commerce and

other revenue, enabling a substantial improvement in profitability.

We generated higher gross margins, returned to positive operating

income, and delivered our first-ever quarter of positive net

income.”

“Our business transformation plan has focused on a restructuring

and investments in tech and editorial,” added Silverstein. “We’re

building a modern media company that not only creates great

content, but also delivers strong results for our partners and

drives diversified revenue and sustainable profits. We generated

more than $13.6 million higher income from continuing operations on

$3.4 million in lower revenue as we shed unprofitable operations.

We believe we now have a stable, profitable platform for

growth.”

After cutting an expected $40 million in costs on an annual

basis, while leaving its editorial and technology teams largely in

place, Arena’s transformation has focused on growth, audience

development, diversifying revenue and a strong balance sheet.

This includes advancements in tech that help its partners better

reach and leverage the company’s 100 million monthly users, not

only for advertising but also for e-commerce. Arena’s investment in

obtaining first-party data – via its proprietary platform –

provides industry-leading addressability and monetization.

Arena’s affiliate commerce business increased 287% during the

six months Q2-Q3 2024 versus the same period last year with

significant growth in real, organic traffic to commerce posts and

deeper relationships with retail partners who see the value of the

highly-transactional audiences. While expanding the company’s range

of commerce coverage, it has also improved revenue per post 57% Q3

2024 vs Q2 2024 as the company has become a trusted partner to

top-tier merchants.

Brand highlights:

- Athlon Sports: Audience traffic continues to grow

substantially, increasing to 231M page views in Q3 (up 65% vs Q2).

The site now garners an average of 77M page views a month, making

it one of the world's largest sports websites. Revenue was up 65%

Q3 vs. Q2.

- Parade: Digital traffic of Parade and Parade Pets

also remains strong with more than 46M average monthly users and

62M average monthly page views. It has balanced, diversified

revenue as its e-commerce business and social media audience

continue to grow.

- TheStreet: The financial brand continues to reach

a large, dedicated, high-net-worth, finance-focused audience and

excels at diversifying revenue streams through affiliate commerce

which is up +396% this quarter vs Q2.

Use of Non-GAAP Financial Measures

We report our financial results in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”); however, management believes that certain non-GAAP

financial measures provide users of our financial information with

useful supplemental information that enables a better comparison of

our performance across periods. We believe Adjusted EBITDA provides

visibility to the underlying continuing operating performance by

excluding the impact of certain items that are noncash in nature or

not related to our core business operations. We calculate Adjusted

EBITDA as net income (loss) as adjusted for net loss from

discontinued operations, with additional adjustments for (i)

interest expense (net), (ii) income taxes, (iii) depreciation and

amortization, (iv) stock-based compensation, (v) change in

valuation of contingent consideration; (vi) liquidated damages,

(vii) loss on impairment of assets, (viii) employee retention

credit, and (ix) employee restructuring payments.

Our non-GAAP Adjusted EBITDA may not be comparable to a

similarly titled measure used by other companies, has limitations

as an analytical tool, and should not be considered in isolation,

or as a substitute for analysis of our operating results as

reported under GAAP. Additionally, we do not consider our non-GAAP

Adjusted EBITDA as superior to, or a substitute for, the equivalent

measures calculated and presented in accordance with GAAP. Some of

the limitations are that Adjusted EBITDA:

- does not reflect interest expense, or the cash required to

service our debt, which reduces cash available to us;

- does not reflect income tax provision, which is a noncash

expense;

- does not reflect depreciation and amortization expense and,

although this is a noncash expense, the assets being depreciated

may have to be replaced in the future, increasing our cash

requirements;

- does not reflect stock-based compensation and, therefore, does

not include all of our compensation costs;

- does not reflect the change in valuation of contingent

consideration, and, although this is a noncash income or expense,

the change in the valuations each reporting period are not impacted

by our actual business operations but is instead strongly tied to

the change in the market value of our common stock;

- does not reflect liquidated damages and, therefore, does not

include future cash requirements if we repay the liquidated damages

in cash instead of shares of our common stock (which the investor

would need to agree to);

- does not reflect any losses from the impairment of assets,

which is a noncash operating expense;

- does not reflect the employee retention credits recorded by us

for payroll related tax credits under the CARES Act; and

- does not reflect payments related to employee severance and

employee restructuring changes for our former executives.

The following table presents a reconciliation of Adjusted EBITDA

to net loss, which is the most directly comparable GAAP measure,

for the periods indicated:

Three Months Ended September 30,

2024

2023

Net income (loss)

$

3,956

$

(11,166

)

Net loss from discontinued operations

822

2,394

Net income (loss) from continued operations

4,778

(8,772

)

Add: Interest expense (net)

3,159

4,042

Income taxes

40

52

Depreciation and amortization

2,379

3,246

Stock-based compensation

732

3,762

Change in valuation of contingent consideration

-

60

Liquidated damages

77

151

Employee restructuring payments

(8

)

605

Adjusted EBITDA

$

11,157

$

3,146

About The Arena Group

The Arena Group (NYSE American: AREN) is an innovative

technology platform and media company with a proven cutting-edge

playbook that transforms media brands. Our unified technology

platform empowers creators and publishers with tools to publish and

monetize their content, while also leveraging quality journalism of

anchor brands like TheStreet, Parade, Men’s Journal and Athlon

Sports to build their businesses. The company aggregates content

across a diverse portfolio of brands, reaching over 100 million

users monthly. Visit us at thearenagroup.net and discover how we

are revolutionizing the world of digital media.

Forward-Looking Statements

This Press Release of The Arena Group Holdings, Inc. (the

“Company,” “we,” “our,” and “us”) contains certain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking statements relate to future events or future

performance and include, without limitation, statements concerning

our business strategy, future revenues, cost reductions, market

growth, capital requirements, product introductions, expansion

plans and the adequacy of our funding and our ability to alleviate

the conditions that raise substantial doubt about our ability to

continue as a going concern (as disclosed in our Quarterly Report

on Form 10-Q for the quarterly period ended September 30, 2024

filed with the SEC on November 14, 2024). Other statements

contained in this Press Release that are not historical facts are

also forward-looking statements. We have tried, wherever possible,

to identify forward-looking statements by terminology such as

“may,” “will,” “could,” “should,” “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” and other

stylistic variants denoting forward-looking statements.

We caution investors that any forward-looking statements

presented in this Press Release, or that we may make orally or in

writing from time to time, are based on information currently

available, as well as our beliefs and assumptions. The actual

outcome related to forward-looking statements will be affected by

known and unknown risks, trends, uncertainties, and factors that

are beyond our control or ability to predict. Although we believe

that our assumptions are reasonable, they are not guarantees of

future performance, and some will inevitably prove to be incorrect.

As a result, our actual future results can be expected to differ

from our expectations, and those differences may be material.

Accordingly, investors should use caution in relying on

forward-looking statements, which are based only on known results

and trends at the time they are made, to anticipate future results

or trends. We detail other risks in our public filings with the

Securities and Exchange Commission (the “SEC”), including in Part

I, Item 1A, Risk Factors, in our Annual Report on Form 10-K for the

year ended December 31, 2023 filed with the SEC on April 1, 2024

and in Part II, Item 1A, Risk Factors, in Quarterly Report on Form

10-Q for the quarterly period ended September 30, 2024 filed with

the SEC on November 14, 2024. The discussion in this Press Release

should be read in conjunction with the condensed consolidated

financial statements and notes thereto included in Part I, Item 1

of our Quarterly Report on Form 10-Q for the quarterly period ended

September 30, 2024 and our consolidated financial statements and

notes thereto included in Part II, Item 8 of our Annual Report on

Form 10-K for the year ended December 31, 2023.

This press release and all subsequent written and oral

forward-looking statements attributable to us or any person acting

on our behalf are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section. We

do not undertake any obligation to release publicly any revisions

to our forward-looking statements to reflect events or

circumstances after the date of this Press Release except as may be

required by law.

THE ARENA GROUP HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS Three

Months Ended September 30, Nine Months Ended September

30,

2024

2023

2024

2023

Revenue

$

33,555

$

36,996

$

89,679

$

99,486

Cost of revenue (includes amortization of platform development and

developed technology for the three months ended September 30, 2024

and 2023 of $1,474 and $2,191, respectively and for the nine months

ended September 30, 2024 and 2023 of $4,530 and $6,883,

respectively)

16,562

23,046

53,035

61,991

Gross profit

16,993

13,950

36,644

37,495

Operating expenses Selling and marketing

2,011

6,422

10,326

19,173

General and administrative

6,023

10,940

24,790

35,516

Depreciation and amortization

905

1,055

2,805

3,216

Loss on impairment of assets

-

-

1,198

119

Total operating expenses

8,939

18,417

39,119

58,024

Income (loss) from operations

8,054

(4,467

)

(2,475

)

(20,529

)

Other (expense) income Change in valuation of contingent

consideration

-

(60

)

(313

)

(469

)

Interest expense, net

(3,159

)

(4,042

)

(11,747

)

(13,225

)

Liquidated damages

(77

)

(151

)

(229

)

(455

)

Total other expense

(3,236

)

(4,253

)

(12,289

)

(14,149

)

Income (loss) before income taxes

4,818

(8,720

)

(14,764

)

(34,678

)

Income tax provision

(40

)

(52

)

(116

)

(145

)

Income (loss) from continuing operations

4,778

(8,772

)

(14,880

)

(34,823

)

Loss from discontinued operations, net of tax

(822

)

(2,394

)

(92,709

)

(15,204

)

Net income (loss)

$

3,956

$

(11,166

)

$

(107,589

)

$

(50,027

)

Basic and diluted net income (loss) per common share: Continuing

operations

$

0.13

$

(0.37

)

$

(0.48

)

$

(1.61

)

Discontinued operations

(0.02

)

(0.10

)

(2.96

)

(0.70

)

Basic and diluted net income (loss) per common share

$

0.11

$

(0.47

)

$

(3.44

)

$

(2.31

)

Weighted average number of common shares outstanding – basic and

diluted

37,610,058

23,445,675

31,291,641

21,567,166

THE ARENA GROUP HOLDINGS, INC., AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS September 30, 2024

December 31, 2023 Assets Current assets: Cash and

cash equivalents

$

5,773

$

9,284

Accounts receivables, net

25,858

31,676

Prepayments and other current assets

5,675

5,791

Current assets from discontinued operations

528

43,648

Total current assets

37,834

90,399

Property and equipment, net

196

328

Operating lease right-of-use assets

2,421

176

Platform development, net

7,203

8,723

Acquired and other intangible assets, net

23,640

27,457

Other long term assets

356

1,003

Goodwill

42,575

42,575

Noncurrent assets from discontinued operations

-

18,217

Total assets

$

114,225

$

188,878

Liabilities, mezzanine equity and stockholders’ deficiency

Current liabilities: Accounts payable

$

4,192

$

7,803

Accrued expenses and other

23,386

28,903

Line of credit

-

19,609

Unearned revenue

7,574

16,938

Subscription refund liability

96

46

Operating lease liability, current portion

247

358

Contingent consideration

-

1,571

Liquidating damages payable

3,153

2,924

Bridge notes

8,000

7,887

Debt

102,404

102,309

Current liabilities from discontinued operations

98,378

47,673

Total current liabilities

247,430

236,021

Unearned revenue, net of current portion

357

542

Operating lease liability, net of current portion

1,911

-

Other long-term liabilities

46

406

Deferred tax liabilities

692

599

Simplify loan

1,100

-

Noncurrent liabilities from discontinued operations

-

10,137

Total liabilities

251,536

247,705

Mezzanine equity: Series G redeemable and convertible preferred

stock, $0.01 par value, $1,000 per share liquidation value and

1,800 shares designated; aggregate liquidation value: $168; Series

G shares issued and outstanding: 168; common shares issuable upon

conversion: 8,582 at September 30, 2024 and December 31, 2023

168

168

Series H convertible preferred stock, $0.01 par value, $1,000 per

share liquidation value and 23,000 shares designated; aggregate

liquidation value: $14,356 and $14,356; Series H shares issued and

outstanding: none and 14,356; common shares issuable upon

conversion: none and 1,981,128 at September 30, 2024 and December

31, 2023, respectively

-

-

Total mezzanine equity

168

168

Stockholders' deficiency: Common stock, $0.01 par value, authorized

1,000,000,000 shares; issued and outstanding: 47,448,047 and

23,836,706 shares at September 30, 2024 and December 31, 2023,

respectively

474

237

Additional paid-in capital

348,289

319,421

Accumulated deficit

(486,242

)

(378,653

)

Total stockholders’ deficiency

(137,479

)

(58,995

)

Total liabilities, mezzanine equity and stockholders’ deficiency

$

114,225

$

188,878

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114017258/en/

Steve Janisse c-sjanisse@thearenagroup.net 404-574-9206

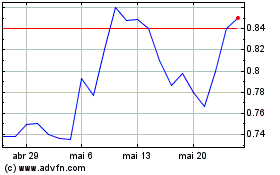

Arena (AMEX:AREN)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Arena (AMEX:AREN)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025