MarketAxess Announces Expanded Partnership with BlackRock to Deliver Enhanced Connectivity and Efficiency to Global Credit Markets

09 Setembro 2024 - 9:00AM

Business Wire

MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a

leading electronic trading platform for fixed-income securities,

today announced an expansion of its decade-long partnership with

BlackRock to seamlessly integrate MarketAxess credit trading

protocols, pricing and data into BlackRock’s Aladdin® order

execution management system (OEMS).

This announcement builds on the MarketAxess and BlackRock

partnership in Open Trading and MarketAxess analytics that began in

2013. The new connectivity will provide common clients of Aladdin

and MarketAxess with an enhanced trading experience through

integration of select MarketAxess credit protocols natively within

the Aladdin platform.

“Our two firms have a long-standing relationship and history of

successful collaboration to cater to our clients’ liquidity,

workflow and data needs. As the market evolves, we’re seeing

increased adoption of our automation protocols, with many of our

clients turning to our strategies for over 90% of their trading

volumes,” said Rich Schiffman, Global Head of Trading Solutions at

MarketAxess. “We look forward to bringing the latest of our

automation protocols, Adaptive Auto-X, as well as our market

leading RFQ solutions, Open Trading, and Live Markets central limit

order book directly to Aladdin clients through this

partnership.”

Kamya Somasundaram, Global Head of Aladdin Partnerships said:

“As the electronification of credit markets continues to

accelerate, the demand for robust liquidity, sophisticated

workflows, and analytics grows. We are excited to partner with

MarketAxess to deliver an improved trading experience for our

users.”

BlackRock’s Aladdin technology platform unifies the investment

management process by providing a common data language within an

organization to enable scale, provide insights, and support

business transformation. It combines sophisticated risk analytics

with comprehensive portfolio management, trading, operations, and

accounting tools on a single, unified platform. BlackRock’s Aladdin

platform is a financial technology platform designed for

institutional use only and is not intended for end investor

use.

About MarketAxess

MarketAxess (Nasdaq: MKTX) operates a leading electronic trading

platform that delivers greater trading efficiency, a diversified

pool of liquidity and significant cost savings to institutional

investors and broker-dealers across the global fixed-income

markets. Over 2,000 firms leverage MarketAxess’ patented technology

to efficiently trade fixed-income securities. MarketAxess’

award-winning Open Trading® marketplace is widely regarded as the

preferred all-to-all trading solution in the global credit markets.

Founded in 2000, MarketAxess connects a robust network of market

participants through an advanced full trading lifecycle solution

that includes automated trading solutions, intelligent data and

index products and a range of post-trade services. Learn more at

www.marketaxess.com and on X @MarketAxess.

Cautionary Note Regarding Forward-Looking Statements

This press release may contain forward-looking statements,

including statements about the outlook and prospects for Company,

market conditions and industry growth, as well as statements about

the Company’s future financial and operating performance. These and

other statements that relate to future results and events are based

on MarketAxess’ current expectations. The Company’s actual results

in future periods may differ materially from those currently

expected or desired because of a number of risks and uncertainties,

including: global economic, political and market factors; the level

of trading volume transacted on the MarketAxess platform; the

rapidly evolving nature of the electronic financial services

industry; the level and intensity of competition in the

fixed-income electronic trading industry and the pricing pressures

that may result; the variability of our growth rate; our ability to

introduce new fee plans and our clients’ response; our ability to

attract clients or adapt our technology and marketing strategy to

new markets; risks related to our growing international operations;

our dependence on our broker-dealer clients; the loss of any of our

significant institutional investor clients; our exposure to risks

resulting from non-performance by counterparties to transactions

executed between our clients in which we act as an intermediary in

matched principal trades; risks related to self-clearing; risks

related to sanctions levied against states or individuals that

could expose us to operational or regulatory risks; the effect of

rapid market or technological changes on us and the users of our

technology; our dependence on third-party suppliers for key

products and services; our ability to successfully maintain the

integrity of our trading platform and our response to system

failures, capacity constraints and business interruptions; the

occurrence of design defects, errors, failures or delays with our

platforms, products or services; our vulnerability to malicious

cyber-attacks and attempted cybersecurity breaches; our actual or

perceived failure to comply with privacy and data protection laws;

our ability to protect our intellectual property rights or

technology and defend against intellectual property infringement or

other claims; our ability to enter into strategic alliances and to

acquire other businesses and successfully integrate them with our

business; our dependence on our management team and our ability to

attract and retain talent; limitations on our flexibility because

we operate in a highly regulated industry; the increasing

government regulation of us and our clients; risks related to the

divergence of U.K. and European Union legal and regulatory

requirements following the U.K.’s exit from the European Union; our

exposure to costs and penalties related to our extensive

regulation; our risks of litigation and securities laws liability;

adverse effects as a result of climate change or other ESG risks

that could affect our reputation; our future capital needs and our

ability to obtain Page 5 capital when needed; limitations on our

operating flexibility contained in our credit agreement; our

exposure to financial institutions by holding cash in excess of

federally insured limits; and other factors. The Company undertakes

no obligation to update any forward-looking statements, whether as

a result of new information, future events or otherwise. More

information about these and other factors affecting MarketAxess’

business and prospects is contained in MarketAxess’ periodic

filings with the Securities and Exchange Commission and can be

accessed at www.marketaxess.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909670657/en/

INVESTOR RELATIONS Stephen Davidson MarketAxess

Holdings Inc. +1 212 813 6313 sdavidson2@marketaxess.com

MEDIA RELATIONS Marisha Mistry MarketAxess

Holdings Inc. +1 917 267 1232 mmistry@marketaxess.com

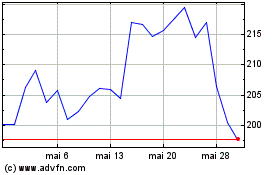

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

MarketAxess (NASDAQ:MKTX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024