NICE Actimize 2024 Fraud Insights Report Shows Investment and Romance Scams Pose Increased Consumer Risk

11 Setembro 2024 - 9:00AM

Business Wire

Leveraging AI and collective intelligence, NICE

Actimize fights evolving fraud threats to protect consumers and

financial institutions

NICE Actimize, a NICE (NASDAQ: NICE)

business, has released "The 2024 NICE Actimize Fraud Insights

Report, First Edition,” which explores the latest data behind the

evolution of fraud attacks. The new report indicates that

fraudsters continue to move away from Account Takeover (ATO) to

Authorized Fraud and that there is also a shift in fraud typologies

over the previous year, leaning toward an increased number of

investment and romance scams.

Authorized fraud continued to rise across the globe in 2023. The

fraud typology and payment type mix saw notable changes,

particularly a continued shift away from account takeover (ATO) and

P2P fraud towards authorized fraud, and domestic wire fraud, as

well as continued growth of check & deposit fraud in North

America. Attempted fraud increased in volume (+6%) but decreased by

value (-26%). This change reflects the shift towards payment types

and fraud typologies traditionally higher in volume and lower in

value, as well as improvements in detection and prevention—

especially in P2P.

“Financial institutions face a surge of fraud threats that

require sophisticated, agile prevention. NICE Actimize embeds AI

and other cutting-edge technologies into our enterprise fraud

solutions to reduce these challenges,” said Craig

Costigan, CEO, NICE Actimize. “By leveraging advanced AI for

real-time detection, decisioning, and continuous adaptation, you

can ensure fraud is identified quickly and is mitigated. With

industry-wide collective intelligence, NICE Actimize provides a

robust defense against evolving fraud tactics, safeguarding both

institutions and banking customers.”

The NICE Actimize 2024 Fraud Insights Report’s data also

indicated:

- Genuine transactions on P2P have surged 36% by volume and 38%

by value. This shows that consumers value the benefits of faster

payments and feel that they are safe to use, despite the constant

talk of fraud.

- Web based P2P transactions constitute only 6% of the total P2P

transaction volume yet have a fraud rate over 5X that of mobile

based P2P transactions.

Leveraging NICE Actimize’s collective intelligence and Federated

Learning, the report was created by analyzing billions of banking

and payments transactions.

To download a copy of NICE Actimize’s 2024 Fraud Insights

report, please click here.

About NICE Actimize NICE Actimize is the largest and

broadest provider of financial crime, risk, and compliance

solutions for regional and global financial institutions and

government regulators. Consistently ranked as number one in the

space, NICE Actimize experts apply innovative technology to protect

institutions and safeguard consumers’ and investors’ assets by

identifying financial crime, preventing fraud, and providing

regulatory compliance. In addition, the Company provides real-time,

cross-channel fraud prevention, anti-money laundering detection,

and trading surveillance solutions that address such concerns as

payment fraud, cybercrime, sanctions monitoring, market abuse,

customer due diligence, and insider trading. Find us at

www.niceactimize.com, @NICE_Actimize or Nasdaq: NICE.

About NICE With NICE (Nasdaq: NICE), it's never been

easier for organizations of all sizes around the globe to create

extraordinary customer experiences while meeting key business

metrics. Featuring the world's #1 cloud-native customer experience

platform, CXone, NICE is a worldwide leader in AI-powered

self-service and agent-assisted CX software for the contact center

– and beyond. Over 25,000 organizations in more than 150 countries,

including over 85 of the Fortune 100 companies, partner with NICE

to transform - and elevate - every customer interaction.

www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE Ltd. All other marks are trademarks

of their respective owners. For a full list of NICE’s marks, please

see: www.nice.com/nice-trademarks.

Forward-Looking Statements This press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements, including the statements by Mr. Costigan, are based on

the current beliefs, expectations and assumptions of the management

of NICE Ltd. (the “Company”). In some cases, such forward-looking

statements can be identified by terms such as “believe,” “expect,”

“seek,” “may,” “will,” “intend,” “should,” “project,” “anticipate,”

“plan,” “estimate,” or similar words. Forward-looking statements

are subject to a number of risks and uncertainties that could cause

the actual results or performance of the Company to differ

materially from those described herein, including but not limited

to the impact of changes in economic and business conditions;

competition; successful execution of the Company’s growth strategy;

success and growth of the Company’s cloud Software-as-a-Service

business; changes in technology and market requirements; decline in

demand for the Company's products; inability to timely develop and

introduce new technologies, products and applications; difficulties

in making additional acquisitions or difficulties or delays in

absorbing and integrating acquired operations, products,

technologies and personnel; loss of market share; an inability to

maintain certain marketing and distribution arrangements; the

Company’s dependency on third-party cloud computing platform

providers, hosting facilities and service partners; cyber security

attacks or other security breaches against the Company; privacy

concerns; changes in currency exchange rates and interest rates,

the effects of additional tax liabilities resulting from our global

operations, the effect of unexpected events or geo-political

conditions, such as the impact of conflicts in the Middle East that

may disrupt our business and the global economy; the effect of

newly enacted or modified laws, regulation or standards on the

Company and our products and various other factors and

uncertainties discussed in our filings with the U.S. Securities and

Exchange Commission (the “SEC”). For a more detailed description of

the risk factors and uncertainties affecting the company, refer to

the Company's reports filed from time to time with the SEC,

including the Company’s Annual Report on Form 20-F. The

forward-looking statements contained in this press release are made

as of the date of this press release, and the Company undertakes no

obligation to update or revise them, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911654861/en/

Corporate Media Contact: Cindy Morgan-Olson, +1 646 408

5896, NICE Actimize, media@nice.com, ET

Investors Marty Cohen, +1 551 256 5354, ir@nice.com, ET

Omri Arens, +972 3 763 0127, ir@nice.com, CET

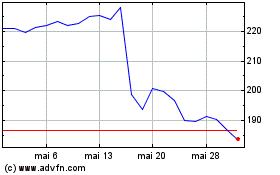

NICE (NASDAQ:NICE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

NICE (NASDAQ:NICE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024