MicroStrategy® Incorporated (Nasdaq: MSTR) (“MicroStrategy”)

today announced that, on September 19, 2024, it completed its

previously announced offering of 0.625% convertible senior notes

due 2028 (the “notes”). The aggregate principal amount of the notes

sold in the offering was $1.01 billion, which includes $135 million

aggregate principal amount of notes issued pursuant to an option to

purchase, within a 13-day period beginning on, and including, the

date on which the notes were first issued, granted to the initial

purchasers under the purchase agreement, which the initial

purchasers exercised in full on September 18, 2024 and which

additional purchase was completed on September 19, 2024. The notes

were sold in a private offering to persons reasonably believed to

be qualified institutional buyers in reliance on Rule 144A under

the Securities Act of 1933, as amended (the “Securities Act”).

The notes are unsecured, senior obligations of MicroStrategy,

and bear interest at a rate of 0.625% per annum, payable

semi-annually in arrears on March 15 and September 15 of each year,

beginning on March 15, 2025. The notes will mature on September 15,

2028, unless earlier repurchased, redeemed or converted in

accordance with their terms. Subject to certain conditions, on or

after December 20, 2027, MicroStrategy may redeem for cash all or

any portion of the notes at a redemption price equal to 100% of the

principal amount of the notes to be redeemed, plus accrued and

unpaid interest, if any, to, but excluding, the redemption date, if

the last reported sale price of MicroStrategy’s class A common

stock has been at least 130% of the conversion price then in effect

for a specified period of time ending on the trading day

immediately before the date the notice of redemption is sent. If

MicroStrategy redeems fewer than all the outstanding notes, at

least $75 million aggregate principal amount of notes must be

outstanding and not subject to redemption as of the relevant

redemption notice date.

Holders of notes may require MicroStrategy to repurchase their

notes on September 15, 2027 or upon the occurrence of certain

events that constitute a fundamental change under the indenture

governing the notes at a repurchase price equal to 100% of the

principal amount of the notes to be repurchased, plus any accrued

and unpaid interest to, but excluding, the date of repurchase. In

connection with certain corporate events or if MicroStrategy calls

any note for redemption, it will, under certain circumstances, be

required to increase the conversion rate for holders who elect to

convert their notes in connection with such corporate event or

notice of redemption.

The notes are convertible into cash, shares of MicroStrategy’s

class A common stock, or a combination of cash and shares of

MicroStrategy’s class A common stock, at MicroStrategy’s election.

Prior to March 15, 2028, the notes are convertible only upon the

occurrence of certain events and during certain periods, and

thereafter, at any time until the second scheduled trading day

immediately preceding the maturity date.

The conversion rate for the notes is initially 5.4589 shares of

MicroStrategy’s class A common stock per $1,000 principal amount of

notes, which is equivalent to an initial conversion price of

approximately $183.19 per share. This represents a premium of

approximately 40% over the U.S. composite volume weighted average

price of MicroStrategy’s class A common stock from 1:00 p.m.

through 4:00 p.m. Eastern Daylight Time on September 17, 2024,

which was $130.8477. The conversion rate is subject to adjustment

upon the occurrence of certain events.

The net proceeds from the sale of the notes were approximately

$997.4 million, after deducting the initial purchasers’ discounts

and commissions and estimated offering expenses payable by

MicroStrategy.

MicroStrategy intends to use the net proceeds from the sale of

the notes to redeem in full all $500.0 million outstanding

aggregate principal amount of MicroStrategy’s 6.125% Senior Secured

Notes due 2028 (the “Senior Secured Notes”) and to use any balance

of the net proceeds to acquire additional bitcoin and for general

corporate purposes. On September 16, 2024, MicroStrategy issued a

redemption notice pursuant to which the Senior Secured Notes will

be redeemed on September 26, 2024 (the “Redemption Date”) at a

redemption price equal to 103.063% of the principal amount, plus

accrued and unpaid interest, if any, to but excluding the

Redemption Date (approximately $523.8 million in the aggregate),

with the redemption of the Senior Secured Notes contingent on the

closing and settlement of the sale of the notes. Upon redemption of

the Senior Secured Notes, all collateral securing the Senior

Secured Notes, including approximately 69,080 bitcoins, will be

released.

The notes were sold to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act. The offer and sale of the notes and the shares of

MicroStrategy’s class A common stock issuable upon conversion of

the notes, if any, have not been and will not be registered under

the Securities Act or the securities laws of any other

jurisdiction, and the notes and any such shares may not be offered

or sold in the United States absent registration or an applicable

exemption from such registration requirements. The offering of the

notes was made only by means of a private offering memorandum.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy the notes, nor shall there be any

sale of, the notes in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful under the securities

laws of any such state or jurisdiction. This press release is not a

notice of redemption with respect to the Senior Secured Notes, and

any redemption will be or has been made in accordance with the

terms of the indenture governing the Senior Secured Notes. There

can be no assurances that the redemption of the Senior Secured

Notes will be completed as described herein or at all.

About MicroStrategy Incorporated

MicroStrategy (Nasdaq: MSTR) considers itself the world’s first

Bitcoin development company. We are a publicly-traded operating

company committed to the continued development of the bitcoin

network through our activities in the financial markets, advocacy

and technology innovation. As an operating business, we are able to

use cashflows as well as proceeds from equity and debt financings

to accumulate bitcoin, which serves as our primary treasury reserve

asset. We also develop and provide industry-leading AI-powered

enterprise analytics software that promotes our vision of

Intelligence Everywhere, and are using our software development

capabilities to develop bitcoin applications. We believe that the

combination of our operating structure, bitcoin strategy and focus

on technology innovation provides a unique opportunity for value

creation.

MicroStrategy and Intelligence Everywhere are either trademarks

or registered trademarks of MicroStrategy Incorporated in the

United States and certain other countries.

Forward-Looking Statements

Statements in this press release about future expectations,

plans, and prospects, as well as any other statements regarding

matters that are not historical facts, may constitute

“forward-looking statements” within the meaning of The Private

Securities Litigation Reform Act of 1995. These statements include,

but are not limited to, statements relating to the estimated net

proceeds of the offering and the anticipated use of such net

proceeds, including the anticipated redemption of the Senior

Secured Notes. The words “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. Actual results may

differ materially from those indicated by such forward-looking

statements as a result of various important factors, including the

uncertainties related to market conditions and the other factors

discussed in the “Risk Factors” section of MicroStrategy’s

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission on August 6, 2024, and the risks described in

other filings that MicroStrategy may make with the Securities and

Exchange Commission. Any forward-looking statements contained in

this press release speak only as of the date hereof, and

MicroStrategy specifically disclaims any obligation to update any

forward-looking statement, whether as a result of new information,

future events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240920626906/en/

MicroStrategy Incorporated Shirish Jajodia Investor Relations

ir@microstrategy.com

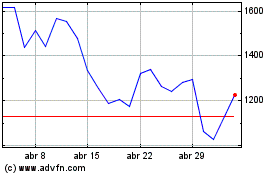

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MicroStrategy (NASDAQ:MSTR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024