T-Mobile Announces Proposed Public Offering of Senior Notes

23 Setembro 2024 - 10:06AM

Business Wire

T-Mobile US, Inc. (NASDAQ: TMUS) (“T-Mobile”) announced today

that T-Mobile USA, Inc., its direct wholly-owned subsidiary

(“T-Mobile USA” or the “Issuer”), plans to offer, subject to market

and other conditions, senior notes (the “notes”) in a registered

public offering. T-Mobile USA intends to use the net proceeds from

the offering for general corporate purposes, which may include

among other things, share repurchases, any dividends declared by

T-Mobile’s Board of Directors and refinancing of existing

indebtedness on an ongoing basis.

J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, RBC

Capital Markets, LLC and Wells Fargo Securities, LLC are the joint

book-running managers for the offering of the notes.

The Issuer has filed a registration statement (including a

prospectus) with the Securities and Exchange Commission (“SEC”) for

the offering of notes to which this communication relates. Before

you invest, you should read the prospectus in that registration

statement and the related prospectus supplement and other documents

the Issuer has filed with the SEC for more complete information

about the Issuer and the offering of notes. You may get these

documents for free by visiting EDGAR on the SEC Web site at

http://www.sec.gov. Alternatively, the Issuer, any underwriter or

any dealer participating in the notes offering will arrange to send

you the prospectus and related prospectus supplement if you request

it by contacting J.P. Morgan Securities LLC, 383 Madison Avenue,

New York, New York 10179, Attention: Investment Grade Syndicate

Desk, 3rd Floor, by telephone (collect) at 1-212-834-4533; Morgan

Stanley & Co. LLC, 180 Varick Street, 2nd Floor, New York, NY

10014, by telephone at +1 (866) 718-1649 or by email at

Prospectus@morganstanley.com; RBC Capital Markets, LLC, 200 Vesey

Street, 8th Floor, New York, NY 10281, by telephone at +1 (866)

375-6829 or by email at rbcnyfixedincomeprospectus@rbccm.com; and

Wells Fargo Securities, LLC, 608 2nd Avenue South, Suite 1000,

Minneapolis, MN 55402, by telephone at +1 (800) 645-3751 or by

email at wfscustomerservice@wellsfargo.com.

This press release shall not constitute an offer to sell or

the solicitation of an offer to buy the notes, the related

guarantees or any other securities, nor shall it constitute an

offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements that are

based on T-Mobile management’s current expectations. Such

statements include, without limitation, statements about the

planned offering of the notes and statements regarding the intended

use of proceeds from the offering of the notes. Such

forward-looking statements are subject to certain risks,

uncertainties and assumptions, including, without limitation,

prevailing market conditions and other factors. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those expected. More information about potential risk factors

that could affect T-Mobile and its results is included in

T-Mobile’s filings with the SEC, which are available at

http://www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240921409944/en/

T-Mobile US Media Relations MediaRelations@T-Mobile.com or

Investor Relations investor.relations@t-mobile.com

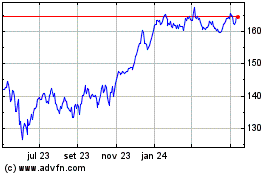

T Mobile US (NASDAQ:TMUS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

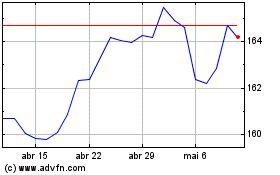

T Mobile US (NASDAQ:TMUS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024