NICE Actimize Launches AI-Powered Fraud Investigations Solution to Mitigate Losses and Maximize Efficiencies

24 Setembro 2024 - 9:00AM

Business Wire

Generative AI and advanced analytics automate

processes to help financial institutions meet regulatory timelines

and ensure customer satisfaction

NICE Actimize, a NICE business (Nasdaq:

NICE), today announced the availability of the market’s first

AI-powered Fraud Investigations solution that facilitates

end-to-end fraud management capabilities from detection to

investigations. Explicitly designed to enable fraud investigations

post detection, the new solution helps financial institutions save

both time and money with its automated workflow and robust

fraud-specific case management capabilities. Advanced Generative AI

embedded in the solution also provides automation that help

financial institutions quickly address customer concerns and

consistently meet regulatory timelines.

The NICE Actimize Fraud Investigation solution breaks down the

siloes between the fraud prevention and investigation functions

while creating an automated feedback loop that helps financial

institutions use operational findings to stop more fraud from

occurring.

Additionally, the solution streamlines the management of claims

and facilitates efficient reimbursement processes, while lowering

the cost of recovery. Among its capabilities, the fraud

investigations solution simplifies SAR (Suspicious Activity Report)

filing for fraud teams with automated fields, narrative generation,

and e-filing capabilities.

“Fighting fraud and financial crime doesn't just stop at the

moment of detection. Fraud investigation results and decisions

provide critical insights that can stop future fraudulent

transactions," said Craig Costigan, CEO, NICE Actimize. "By

redefining efficiency and reducing costs for a financial

institution, NICE Actimize's Fraud Investigation solution also

fosters customer trust and loyalty through its seamless claims

resolution process.”

“Considering regulation in the UK and competition within

banking, protecting customers from scams and ensuring swift claims

resolution is critical for financial institutions. A robust fraud

investigation solution is needed to not only better prevent scams

and authorized fraud but to minimize losses and protect against

first party fraud,” explains Trace Fooshee, Strategic Advisor in

the Fraud and AML practice, Datos Insights.

NICE Actimize’s Fraud Investigations solution works seamlessly

with its advanced IFM Fraud Management Platform. For additional

information on NICE Actimize’s Enterprise Fraud Management, please

click here.

About NICE Actimize NICE Actimize is the largest and

broadest provider of financial crime, risk and compliance solutions

for regional and global financial institutions, as well as

government regulators. Consistently ranked as number one in the

space, NICE Actimize experts apply innovative technology to protect

institutions and safeguard consumers and investors assets by

identifying financial crime, preventing fraud and providing

regulatory compliance. The company provides real-time,

cross-channel fraud prevention, anti-money laundering detection,

and trading surveillance solutions that address such concerns as

payment fraud, cybercrime, sanctions monitoring, market abuse,

customer due diligence and insider trading. Find us at

www.niceactimize.com, @NICE_Actimize or Nasdaq: NICE.

About NICE With NICE (Nasdaq: NICE), it’s never been

easier for organizations of all sizes around the globe to create

extraordinary customer experiences while meeting key business

metrics. Featuring the world’s #1 cloud native customer experience

platform, CXone, NICE is a worldwide leader in AI-powered

self-service and agent-assisted CX software for the contact center

– and beyond. Over 25,000 organizations in more than 150 countries,

including over 85 of the Fortune 100 companies, partner with NICE

to transform - and elevate - every customer interaction.

www.nice.com.

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE Ltd. All other marks are trademarks

of their respective owners. For a full list of NICE’s marks, please

see: www.nice.com/nice-trademarks.

Forward-Looking Statements This press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements, including the statements by Mr. Costigan, are based on

the current beliefs, expectations and assumptions of the management

of NICE Ltd. (the “Company”). In some cases, such forward-looking

statements can be identified by terms such as “believe,” “expect,”

“seek,” “may,” “will,” “intend,” “should,” “project,” “anticipate,”

“plan,” “estimate,” or similar words. Forward-looking statements

are subject to a number of risks and uncertainties that could cause

the actual results or performance of the Company to differ

materially from those described herein, including but not limited

to the impact of changes in economic and business conditions;

competition; successful execution of the Company’s growth strategy;

success and growth of the Company’s cloud Software-as-a-Service

business; changes in technology and market requirements; decline in

demand for the Company's products; inability to timely develop and

introduce new technologies, products and applications; difficulties

in making additional acquisitions or difficulties or delays in

absorbing and integrating acquired operations, products,

technologies and personnel; loss of market share; an inability to

maintain certain marketing and distribution arrangements; the

Company’s dependency on third-party cloud computing platform

providers, hosting facilities and service partners; cyber security

attacks or other security breaches against the Company; privacy

concerns; changes in currency exchange rates and interest rates,

the effects of additional tax liabilities resulting from our global

operations, the effect of unexpected events or geo-political

conditions, such as the impact of conflicts in the Middle East that

may disrupt our business and the global economy; the effect of

newly enacted or modified laws, regulation or standards on the

Company and our products and various other factors and

uncertainties discussed in our filings with the U.S. Securities and

Exchange Commission (the “SEC”). For a more detailed description of

the risk factors and uncertainties affecting the company, refer to

the Company's reports filed from time to time with the SEC,

including the Company’s Annual Report on Form 20-F. The

forward-looking statements contained in this press release are made

as of the date of this press release, and the Company undertakes no

obligation to update or revise them, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240924451508/en/

Corporate Media Contact: Cindy Morgan-Olson,

+1-646-408-5896, media@nice.com

Investors: Marty Cohen, +1 551 256 5354, ir@nice.com, ET

Omri Arens, +972 3 763 0127, ir@nice.com, CET

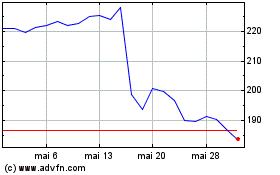

NICE (NASDAQ:NICE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

NICE (NASDAQ:NICE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024