Financial community visit to North American operations

24 Setembro 2024 - 10:09AM

Business Wire

Rio Tinto is hosting a site visit for the financial community

this week to its Aluminium and Iron & Titanium operations in

Quebec, Canada.

The visit will showcase the world-class, hydro-powered aluminium

smelters in the Saguenay, including the Shipshaw Power Station and

construction progress at the low-carbon AP60 smelter, and the Iron

& Titanium facility at Sorel-Tracy, the world’s largest

critical minerals and metallurgical complex. Presentations by

management, which will also cover markets, technology,

decarbonisation and Iron Ore Company of Canada, can be found on the

website at: https://www.riotinto.com/en/invest/presentations

Rio Tinto Aluminium Chief Executive Jérôme Pécresse said: “We

are well positioned to deliver value from the strong outlook for

aluminium which is being driven by its critical role in

electrification, with global metal demand set to rise by three per

cent per year from 2023 to 2028. Recycled material is expected to

account for around half of that growth.

“We have stabilised our global footprint of low-carbon,

world-class aluminium assets and now have clear pathways to raise

both the EBITDA margin and Return on Capital Employed for our

aluminium business by five percentage points by 2030.

“We expect to achieve this through our focus on operational

excellence and technology, our increasing footprint in the recycled

market, from our privileged access to North America - the world’s

most attractive aluminium market - and by repowering our Pacific

Aluminium operations with lower cost renewables.”

Rio Tinto’s product offering has positioned the company to

exceed LME aluminium prices by ~20% over the last five years,

through product and market premiums, with the Matalco recycling

joint venture to provide further upside. Matalco is expected to

generate ~$70 million of operational, sales and marketing synergies

per year by 2028.

In the presentations, Rio Tinto also sets out a targeted

increase in Return on Capital Employed at its Iron & Titanium

business of nine percentage points by 2030 and a pathway to reach

total concentrate production capacity of 23 million tonnes of

high-grade iron ore at Iron Ore Company of Canada.

This announcement is authorised for release to the market by

Andy Hodges, Rio Tinto’s Group Company Secretary.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240924840955/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom Matthew

Klar M +44 7796 630 637 David Outhwaite M

+44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Alyesha Anderson M +61 434

868 118 Michelle Lee M +61 458 609 322 Rachel

Pupazzoni M +61 438 875 469

Media Relations, Canada Simon Letendre

M +1 514 796 4973 Malika Cherry M +1 418 592

7293 Vanessa Damha M +1 514 715 2152

Media Relations, United States Jesse

Riseborough M +1 202 394 9480

Investor Relations, United Kingdom David

Ovington M +44 7920 010 978 Laura Brooks M

+44 7826 942 797 Weiwei Hu M + 44 7825 907230

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: General

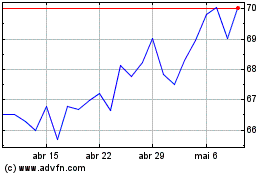

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

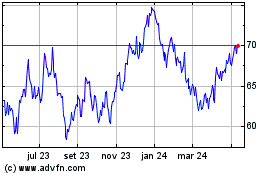

Rio Tinto (NYSE:RIO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024