New innovations connect products across

Intuit’s platform to deliver seamless, done-for-you experiences for

consumers and businesses

Intuit Inc. (Nasdaq: INTU), the global financial technology

platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and

Mailchimp, today shared the company’s strategy at Investor Day and

unveiled new AI-powered innovations that help consumers make smart

money decisions year-round and fuel business growth on Intuit’s

platform, supercharged with an AI-powered financial assistant in

customers’ pockets.

“Intuit’s AI-driven expert platform delivers seamless,

connected, done-for-you experiences that help customers make more

money with less work and have complete confidence in every

financial decision,” said Sasan Goodarzi, Intuit's chief executive

officer. “Built on years of investments in our data and AI

capabilities, Intuit’s platform is perfectly positioned to fuel the

financial success of consumers and businesses around the

world.”

Make smart money decisions year-round with seamless

integration of TurboTax and Credit Karma on one consumer financial

platform

Consumers are trying to make ends meet, get out of debt, and

save money. Upcoming innovations across TurboTax and Credit Karma

will deliver a single, connected consumer financial platform that

delivers insights and recommendations year-round and done-for-you

experiences at tax time.

Credit Karma members will soon have access to their own

personalized and interactive Financial Summary with tax, spending,

credit, and debt insights all in one place. Members who link their

accounts will be able to see when their spending could exceed

monthly income with explanations of essential and non-essential

spending and how it is impacting their ability to save money. When

they receive a pay increase, Credit Karma will proactively update

their estimated tax refund and members will be able to see

recommendations about how 401K contributions and adjusting

withholdings can help them increase their refund and save more

toward retirement.

When Credit Karma members receive their W-2 or other tax forms,

they will be able to take a photo through the Credit Karma app and

upload the document right from their mobile device. Intuit Assist,

the generative AI-powered financial assistant, will provide members

a summary of the uploaded tax document and key information like

employer, tips and social security wages. Come tax time, member

information can be pre-filled in their TurboTax return along with

linked accounts and the documents they’ve uploaded throughout the

year, saving them time and giving them confidence they are getting

their best tax outcome.

As one connected consumer financial platform, Credit Karma

members will be able to file their taxes right from the Credit

Karma app through a seamless filing experience powered by TurboTax

- no need to track down another login and password. Because faster

access to cash matters, members can choose to access their refund

up to five days early by filing with TurboTax and having their

refund deposited directly into their Credit Karma Money

account.

Fuel business growth with a single, connected business

platform

Today, businesses use 10 different apps and because they are not

connected, they do not have a holistic view of how their business

is performing. To solve this challenge, Intuit is more deeply

connecting QuickBooks and Mailchimp with new AI-powered automations

and done-for-you experiences that will help customers grow their

business while dramatically reducing manual work.

When business owners log into QuickBooks, they will see a

business feed with powerful new insights on projected cash flow,

identified invoices that are overdue, or will be soon, and

marketing and revenue opportunities with recommendations for how AI

can take the work off their plate. Business owners will be able to

generate invoices, business proposals, estimates, and email

marketing campaigns at the click of a button, without the need to

manually enter data. Business owners can quickly review content,

make changes, and hit send in minutes, reducing the amount of work

needed to get paid, convert prospects, manage customers, and drive

repeat business, all from within QuickBooks.

It’s not just about getting the estimate, or sending an invoice;

it’s actually about getting paid. New innovations will

automatically notify business owners if an upcoming cashflow dip is

predicted based on connected bank account balances, unpaid

invoices, and the data on when those invoices have historically

been paid. New AI-generated invoice reminders will make it easier

than ever for businesses to remind customers to pay them. Business

owners will also be able to see if their business has been

pre-qualified for a QuickBooks Line of Credit1, review a

pre-populated application, provide any additional information

needed to complete it, and apply without ever leaving QuickBooks.

These new innovations will be powered by Intuit Assist and

Mailchimp’s CRM capabilities, coming soon to QuickBooks US and

Canada customers.

Intuit is unveiling these upcoming innovations just over a week

after the launch of Intuit Enterprise Suite, which is designed for

larger and more complex multi-entity businesses that are focused on

growth. Intuit Enterprise Suite is an all-in-one configurable

solution with payments and bill pay, project profitability,

multi-entity financial management, payroll, human resources, and

marketing, all catered towards complex business needs and sold

together.

Supercharged financial assistant in your pocket with more

AI-powered expertise

Today, assisted tax prep is fragmented, manual, and expensive

with little price transparency. It can take over a month to have

taxes done by a CPA and get a refund. New TurboTax Live innovations

enable our experts to complete a customers’ taxes virtually in as

little as 30 minutes at a competitive price.

Customers will have the option to connect with a personal tax

expert who is local to their area and has experience with their

specific tax situation, whether it’s a question about investments,

self-employed tax deductions, or payroll taxes. Customers will be

able to share personal and financial information they’ve provided

between TurboTax, Credit Karma, and QuickBooks so data entry truly

is done-for-you. Customers will also be able to follow along with

their expert’s progress in the Full Service hub within the TurboTax

mobile app.

These upcoming innovations will disrupt the assisted tax model,

giving consumers and small and mid-market businesses complete

confidence while putting more money in their pocket, all powered by

Intuit’s Virtual Expert Platform and Intuit Assist.

Investor Day: How to Participate

These innovations and more will be shown at Intuit Investor Day

2024. The half-day event will be broadcast live via webcast on

Intuit’s website at https://investors.intuit.com/news-events. A

replay of the video broadcast will be available on Intuit’s website

approximately three hours after the meeting ends.

About Intuit

Intuit is the global financial technology platform that powers

prosperity for the people and communities we serve. With

approximately 100 million customers worldwide using products such

as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe

that everyone should have the opportunity to prosper. We never stop

working to find new, innovative ways to make that possible. Please

visit us at Intuit.com and find us on social for the latest

information about Intuit and our products and services.

Forward-looking statements

In this press release, we announce plans or intentions regarding

functionality that is not yet delivered. These statements do not

represent an obligation to deliver this functionality to customers

and should not be relied on in making a purchasing decision or an

investment decision.

This press release contains forward-looking statements,

including expectations regarding: our prospects for the business in

FY25 and beyond; demand for our products; changes to our products,

including the continuing use of data and incorporation of AI, and

their impact on our business; availability of our offerings; and

the impact of our strategic decisions on our business.

Because these forward-looking statements involve risks and

uncertainties, there are important factors that could cause our

actual results to differ materially from the expectations expressed

in the forward-looking statements. These risks and uncertainties

may be amplified by the effects of global developments and

conditions or events, including macroeconomic uncertainty and

geopolitical conditions, which have caused significant global

economic instability and uncertainty. Given these risks and

uncertainties, persons reading this communication are cautioned not

to place any undue reliance on such forward-looking statements.

These factors include, without limitation, the following: our

ability to compete successfully; potential governmental

encroachment in our tax business; our ability to develop, deploy,

and use artificial intelligence in our platform and products; our

ability to adapt to technological change and to successfully extend

our platform; our ability to predict consumer behavior; our

reliance on intellectual property; our ability to protect our

intellectual property rights; any harm to our reputation; risk

associated with our ESG and DEI practices; risks associated with

acquisition and divestiture activity; the issuance of equity or

incurrence of debt to fund acquisitions or for general business

purposes; cybersecurity incidents (including those affecting the

third parties we rely on); customer or regulator concerns about

privacy and cybersecurity incidents; fraudulent activities by third

parties using our offerings; our failure to process transactions

effectively; interruption or failure of our information technology;

our ability to maintain critical third-party business

relationships; our ability to attract and retain talent and the

success of our hybrid work model; any deficiency in the quality or

accuracy of our offerings (including the advice given by experts on

our platform); any delays in product launches; difficulties in

processing or filing customer tax submissions; risks associated

with international operations; risk associated with climate change;

changes to public policy, laws or regulations affecting our

businesses; legal proceedings in which we are involved;

fluctuations in the results of our tax business due to seasonality

and other factors beyond our control; changes in tax rates and tax

reform legislation; global economic conditions (including, without

limitation, inflation); exposure to credit, counterparty and other

risks in providing capital to businesses; amortization of acquired

intangible assets and impairment charges; our ability to repay or

otherwise comply with the terms of our outstanding debt; our

ability to repurchase shares or distribute dividends; volatility of

our stock price; our ability to successfully market our offerings;

our expectations regarding the timing and costs associated with our

plan of reorganization (“Plan”); risks related to the preliminary

nature of the estimate of the charges to be incurred in connection

with Plan, which is subject to change; and risks related to any

delays in the timing for implementing the Plan or potential

disruptions to our business or operations as we execute on the

Plan.

More details about these and other risks that may impact our

business are included in our Form 10-K for fiscal 2024 and in our

other SEC filings. You can locate these reports through our website

at http://investors.intuit.com. Forward-looking statements

represent the judgment of the management of Intuit as of the date

of this presentation. Except as required by law, we do not

undertake any duty to update any forward-looking statement or other

information in this presentation.

_________________________ 1 QuickBooks Line of Credit loans are

issued by WebBank.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926448254/en/

Investors Kim Watkins Intuit Inc. 650-944-3324

kim_watkins@intuit.com

Media Kali Fry Intuit Inc. 650-944-3036

kali_fry@intuit.com

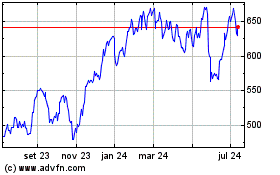

Intuit (NASDAQ:INTU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

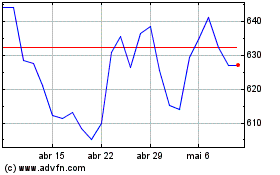

Intuit (NASDAQ:INTU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025