Transaction in-line with strategy to focus on

Tier 1 asset portfolio

Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM)

(“Newmont” or the “Company”) has announced today it will sell its

Akyem operation in the Republic of Ghana to Zijin Mining Group Co.,

Ltd. (“Zijin”) under a definitive agreement, for cash consideration

of up to $1 billion. The sale is part of Newmont’s ongoing program

to divest non-core assets as the Company makes a strategic shift to

focus on its Tier 1 assets.

Under the terms of the agreement, Newmont is expected to receive

cash consideration of $900 million upon closing. A further $100

million is expected to be received upon the satisfaction of certain

conditions.1

Proceeds from the transaction will support the Company’s capital

allocation priorities, including strengthening the balance sheet

and returning capital to shareholders.

“The sale of Akyem represents continued progress on the non-core

asset divestiture program announced in February, supporting our

focus on the Tier 1 assets in Newmont’s portfolio that will drive

sustainable growth and the return of capital to shareholders,” said

Tom Palmer, Newmont’s President and Chief Executive Officer.

“We believe the proposed transaction results in the greatest

overall value for Newmont shareholders and is the best strategic

fit for Akyem. We are confident that Akyem will continue to thrive

under new ownership with long-term benefits for local stakeholders

and surrounding communities. The successful completion of this

transaction will strengthen our confidence in Ghana as a favorable

mining jurisdiction and Newmont will continue to support the growth

and development of the region including our development of Ahafo

North.”

“In line with President Afuko-Addo's address in February we

ensured that our robust divestment process provided equal

opportunity for all potential buyers, Ghanaian and international,

to participate,” said Rahman Amoadu, Newmont Managing Director,

Africa. “Additionally, we have included the Minerals Income

Investment Fund (MIIF) in the process in preparation of their

potential investment in Akyem to further Ghanaian interest in the

mine.”

The transaction is expected to close in the fourth quarter of

2024, contingent on satisfaction of customary conditions precedent,

including regulatory approvals. As a result, the transaction is not

expected to have a material impact on Newmont’s 2024 outlook and

the Company has not adjusted its non-core guidance for the

year.

Newmont remains committed to Ghana including the investment of

$950 million to $1,050 million of development capital in the Ahafo

North gold mining project in the Ahafo region of Ghana.

Advisers and Counsel

In connection with the transaction, Citi acted as Newmont’s

exclusive financial adviser, Treadstone Resource Partners acted as

strategic adviser, and Davis Graham & Stubbs LLP and Reindorf

Chambers acted as legal advisers.

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, zinc, lead, and silver. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in Africa, Australia, Latin America & Caribbean,

North America, and Papua New Guinea. Newmont is the only gold

producer listed in the S&P 500 Index and is widely recognized

for its principled environmental, social, and governance practices.

Newmont is an industry leader in value creation, supported by

robust safety standards, superior execution, and technical

expertise. Founded in 1921, the Company and has been publicly

traded since 1925.

At Newmont, our purpose is to create value and improve lives

through sustainable and responsible mining. To learn more about

Newmont’s sustainability strategy and initiatives, go to

www.newmont.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements in this

news release include, without limitation, (i) expectations

regarding Q4 and 2024 outlook; (ii) statements regarding the sale

of Akyem including, without limitation, expectations regarding

timing and closing of the pending transaction, including receipt of

required approvals and satisfaction of closing conditions (see

below for additional information); (iii) expectations regarding

receipt of consideration and government ratification of mining

leases (see below for additional information); (iv) expectations

regarding use of sale proceeds, capital allocation priorities, and

return capital to shareholders; and (v) other statements regarding

future events or results. Estimates or expectations of future

events or results are based upon certain assumptions, which may

prove to be incorrect. The closing of the transaction is subject to

the satisfaction of certain customary conditions precedent,

including but not limited to, Zijin obtaining the necessary

filings, approvals, or registrations from the National Development

and Reform Commission, the Ministry of Commerce and the State

Administration of Foreign Exchange of the People’s Republic of

China, and the parties receipt of a no objections letter from the

Minister of Lands and Natural Resources of the Republic of Ghana. A

failure to satisfy these conditions precedent would delay and/or

prevent closing of the transaction. Similarly, receipt of $900

million in cash consideration is subject to closing of the

transaction, and an additional $100 million in cash consideration

is expected to be paid after the earliest to occur of the

ratification of the extended eastern mining lease by the Parliament

of Ghana, the ratification of a replacement mining lease to the

extended eastern mining lease by the Parliament of Ghana and the

five year anniversary of the closing date. The purchase price

payable at the closing is subject to adjustments for closing cash,

working capital, inventory, finished goods inventory, and other

customary purchase price adjustment items. If Zijin were to suffer

certain losses in the future in connection with the lack of

ratifications of the mining leases by the Parliament of Ghana, then

Newmont will provide indemnification upon certain agreed

conditions, up to an aggregate amount not exceeding $200 million in

aggregate based on a $1 billion purchase price. The definitive

agreement for the transaction also includes representations,

warranties, covenants, termination rights and other provisions

customary for a transaction of this nature including with respect

to transition services, tax matters, employee matters,

indemnification, and dispute resolution. For a discussion of risks

and other factors that might impact future looking statements and

future results, see the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023 filed with the U.S. Securities and

Exchange Commission (the “SEC”) on February 29, 2024, under the

heading “Risk Factors", and other factors identified in the

Company's reports filed with the SEC, available on the SEC website

or at www.newmont.com. The Company does not undertake any

obligation to release publicly revisions to any “forward-looking

statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this news release, or to

reflect the occurrence of unanticipated events, except as may be

required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that

statement.

_____________________ 1 The closing of the transaction and

receipt of consideration remains subject to the satisfaction of

certain customary conditions precedents, with contingent

consideration also remaining subject to ratification of the

underlying lease. See cautionary statement regarding

forward-looking statements and additional information on

conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008161026/en/

Investor Contact – Global Neil Backhouse

investor.relations@newmont.com

Investor Contact – Asia Pacific Natalie Worley

apac.investor.relations@newmont.com

Media Contact – Global Jennifer Pakradooni

globalcommunications@newmont.com

Media Contact – Asia Pacific Rosalie Cobai

australiacommunications@newmont.com

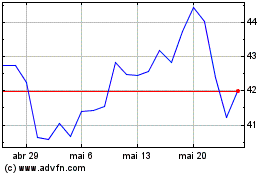

Newmont (NYSE:NEM)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Newmont (NYSE:NEM)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024