White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA:

29W) (the "Company") is pleased to announce an updated

Mineral Resource Estimate (“MRE”) for its flagship White Gold

project located approximately 95 km south of Dawson City in

west-central Yukon, Canada. The updated mineral resource includes a

significant increase in total gold ounces, including a 18.5%

increase in inferred resources and an 4.3% increase in indicated

resources. The White Gold project now comprises 1,203,000 ounces of

gold in the Indicated Resource category (17.7 million tonnes

averaging 2.12 g/t Au) and 1,116,600 ounces of gold in the Inferred

Resource category (24.5 million tonnes averaging 1.42 g/t Au) at

US$2,000/oz gold. The gold resources at the White Gold Project are

near surface, almost entirely captured within an open pit, and

remain open for expansion in multiple directions with additional

opportunities to increase total resources via targets within close

proximity. Additional increases to the size of the resource may

also be possible through an ongoing analysis of the resource block

model and by capturing additional ounces hosted within the Target

for Further Exploration area which hosts an additional estimated 10

– 12 million tonnes grading between 1 – 2 g/t Au. These results

form part of the Company’s work program supported by strategic

partners including Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM)

and Kinross Gold Corporation (TSX: K, NYSE: KGC).

“We are very pleased to have further increased

the size of our robust flagship deposit which is one of the

highest-grade open pit gold resources in Canada of this size or

greater owned by an exploration company. Furthermore, significant

additional resource growth potential exists on the deposits

themselves, as well as in the surrounding areas which has seen only

limited exploration and has strong prospectivity for new

discoveries. We are also very encouraged by the overall

prospectivity of our district scale land package for additional

gold and other mineral resource discoveries as this area of Yukon

continues to evolve as an emerging Canadian mining camp supported

by ongoing mine development efforts, infrastructure initiatives and

other investment,” stated David D’Onofrio, Chief Executive

Officer.

Maps and images accompanying this news release

can be found at

http://whitegoldcorp.ca/investors/exploration-highlights/.

Highlights:

Updated MRE includes four gold deposits – Golden

Saddle, Arc, Ryan’s Surprise and VG located within close proximity

and includes:

- 17.660 million tonnes of Indicated

Resources averaging 2.12 grams per tonne gold for 1.203 million

ounces of gold, representing 52% of total resources.

- 24.472 million tonnes of Inferred

Resources averaging 1.42 grams per tonne gold for 1.117 million

ounces of gold, representing 48% of total resources.

- Inferred and Indicated Mineral

Resources have increased by 18.5% and 4.3% respectively, compared

to the previous 2023 MRE(1).

- 97.5% of the resources are near

surface and within an open-pit. Indicated Resources of 1.201

million ounces of gold averaging 2.12 grams per tonne gold (an

increase of 6.7%) and open-pit Inferred Resources of 1.061 million

ounces of gold averaging 1.38 grams per tonne gold (an increase of

24.4%).

- Mineralization at the Golden

Saddle, Arc, Ryan’s Surprise and VG deposits all remain open along

strike and down dip to further expand the deposits and in addition

to multiple underexplored targets in close proximity.

- The project also hosts an

additional estimated 10 – 12 million tonnes grading between 1 – 2

g/t Au of material classified as a Target for Further Exploration

which has not been included in the current resource which may

further increase the size of the resource and is currently being

evaluated in this regard.

- The Company is also currently

evaluating additional opportunities to further increase the size of

the resources by optimizing the block model and wireframes of the

Golden Saddle and Arc deposits to add additional tonnage.

- Additional results from the

Company’s 2024 work program to be released in due course

Mineral Resource Estimate

Details

Table 1. White Gold Project, Yukon

Territory, Mineral Resource Statement, ACS October 28,

2024.

|

Area |

Type |

Classification |

Cut-off (g/t) |

Tonnes (000's) |

Grade (g/t) |

Contained Gold (oz) |

|

Golden Saddle |

Open Pit |

Indicated |

0.35 |

16,954 |

2.16 |

1,178,500 |

|

Inferred |

5,396 |

1.45 |

250,900 |

|

Underground |

Indicated |

2.3 |

23 |

2.77 |

2,100 |

|

Inferred |

382 |

3.06 |

37,500 |

|

Arc |

Open Pit |

Indicated |

0.35 |

683 |

1.02 |

22,400 |

|

Inferred |

6,781 |

1.09 |

236,700 |

|

Underground |

Inferred |

2.3 |

47 |

3.00 |

4,600 |

|

Ryan |

Open Pit |

Inferred |

0.35 |

5,499 |

1.57 |

278,300 |

|

Underground |

Inferred |

2.3 |

127 |

3.19 |

13,100 |

|

QV |

Open Pit |

Inferred |

0.35 |

6,240 |

1.47 |

295,500 |

|

|

|

|

|

|

|

|

|

All Deposits |

Open Pit |

Indicated |

0.35 |

17,637 |

2.12 |

1,200,900 |

|

All Deposits |

Open Pit |

Inferred |

23,916 |

1.38 |

1,061,400 |

|

All Deposits |

Underground |

Indicated |

2.3 |

23 |

2.84 |

2,100 |

|

All Deposits |

Underground |

Inferred |

556 |

3.09 |

55,200 |

|

All Deposits |

Total |

Indicated |

|

17,660 |

2.12 |

1,203,000 |

|

All Deposits |

Total |

Inferred |

|

24,472 |

1.42 |

1,116,600 |

-

Mineral Resources which are not Mineral Reserves do not have

demonstrated economic viability.

-

The estimate of Mineral Resources may be materially affected by

environmental, permitting, legal, title, taxation, socio-political,

marketing, or other relevant issues.

-

The Inferred Mineral Resource in this estimate has a lower level of

confidence than that applied to an Indicated Mineral Resource and

must not be converted to a Mineral Reserve. It is reasonably

expected that the majority of the Inferred Mineral Resource could

be upgraded to an Indicated Mineral Resource with continued

exploration.

-

The Mineral Resources in this report were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM

Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council.

-

Open pittable resources are constrained by GEOVIA Whittle optimized

pit shells using a 0.35 g/t Au cut-of grade and are considered to

have reasonable prospects for eventual economic extraction,

assuming a gold price of US$2,000 per ounce, a C$:US$ exchange rate

of 0.75. an open pit mining cost of CDN$3.25 per tonne, a

processing and G&A cost of CDN$27.50 per tonne milled, and gold

recoveries of 92% for Golden Saddle, and VG, along with 85% for Arc

and Ryan’s Surprise. Underground resources assume a mining cost of

CDN$120/tonne.

-

The following bulk density values for mineralized material were

used: Golden Saddle (2.62 – 2.65 t/m3), Arc (2.55 t/m3), Ryan’s

Surprise (2.63 t/m3) and VG (2.65 t/m3).

-

High-grade gold assay values have been capped as follows: Golden

Saddle and Arc (8 – 18 g/t Au), Ryan’s Surprise (9 g/t Au) and VG

(3 – 10 g/t Au).

-

The Statement of Estimates of Mineral Resources has been compiled

by Mr. Gilles Arseneau, Ph.D., P.Geo, of ARSENEAU Consulting

Services (“ACS”). Mr. Arseneau has sufficient experience that is

relevant to the style of mineralization and type of deposit under

consideration and to the activity that he has undertaken to qualify

as a Qualified Person as defined in the CIM Standards of

Disclosure.

-

All numbers are rounded. Overall numbers may not be exact due to

rounding.

The current MRE for the White Gold project was

carried out by Arseneau Consulting Services (“ACS”) of Vancouver,

B.C. and is reported in accordance with the guidelines of the

Canadian Securities Administrators National Instrument 43-101 (“NI

43-101”) and has been estimated in conformity with generally

accepted Canadian Institute of Mining, Metallurgy and Petroleum

(“CIM”) “Estimation and Mineral Resource and Mineral Reserve Best

Practices” guidelines. Mineral resources are not mineral reserves

and do not have demonstrated economic viability.

The MRE presents updated estimates for the

Golden Saddle, Arc, Ryan’s Surprise and VG deposits.

The updated MRE was prepared using a block model

approach using ordinary kriging interpolation for the Golden

Saddle, Arc and VG deposits and inverse distance squared (“ID2”)

interpolation for the Ryan’s Surprise deposit. Block model sizes

varied between deposits as follows: Golden Saddle and Arc (10 m);

Ryan’s Surprise (5 – 10 m); and VG (10 – 20 m). GEMS 6.8.4 software

was used for generating gold mineralization solids, a topography

surface, and resource estimation. Statistical analysis and resource

validations were performed using non-commercial software and with

Sage2001. Near surface resources were constrained using GEOVIA

Whittle pit optimization software. Pit slopes in rock were assumed

at 50° and the MRE assumes a long-term gold price of US$2,000 per

ounce. Gold recoveries used were 92% for the Golden Saddle and VG

deposits, and 85% for the Arc and Ryan’s Surprise deposits. Gold

recoveries are based on metallurgical testwork results for the

Golden Saddle and Arc deposits and are assumed for the Ryan’s

Surprise and VG deposits based on their close similarities to the

Arc and Golden Saddle deposits, respectively.

Mineralization on portions of both the Golden

Saddle and Arc deposits is known to extend beyond the limits of the

current resource estimate, however, the mineralization in these

areas did not meet the criteria to be classified as Mineral

Resources. Based on drilling at Golden Saddle and current geologic

models, there is an estimated 10 – 12 million additional tonnes

grading between 1 – 2 g/t Au of material classified as a Target for

Further Exploration (“TFFE”). The reader should be cautioned that

the potential quantity and grade of the TFFE is conceptual in

nature. There has been insufficient drilling to define a mineral

resource and it is uncertain if further exploration will result in

the target being advanced to a mineral resource. These zones form

more continuous mineralized units at US$ 2,000/oz gold and the

Company plans to further evaluate this mineralization through

re-modelling and optimization of the block model and wire frames to

determine if it can be incorporated in future resource

estimates.

A technical report to support the MRE for the

White Gold project, prepared in accordance with NI 43-101, will be

filed on SEDAR+ (https://www.sedarplus.ca/) and the Company’s

website (https://www.whitegoldcorp.ca/) within 45 days of the

issuance of this news release.

Resources & Opportunities in the

White Gold District

West-central Yukon is host to several highly

prospective mineral districts, including the White Gold, Dawson

Range, Klondike and Sixtymile districts. The Klondike was the

epicentre of the historic Klondike Gold Rush in 1896 with over 20

million ounces of placer gold production having occurred in the

region since that time. The Company’s property portfolio (Figure 1)

which covers large portions of the White Gold District, was

assembled by renowned prospector Shawn Ryan, and represents the

largest claim package in the region, consisting of 15,876 claims

across 26 properties and covering approximately 315,000 hectares.

Two significant advanced projects border the Company’s claims in

the south including the Coffee project owned by Newmont Corporation

(TSX: NGT, NYSE: NEM) with Indicated Resources of 2.14 Moz at 1.23

g/t Au, and Inferred Resources of 0.23 Moz at 1.01 g/t Au(2), and

Western Copper and Gold Corporation’s (TSX: WRN, NYSE: WRN) Casino

project, which has Measured and Indicated Resources of 7.6 billion

lb Cu and 14.5 Moz Au and Inferred Resources of 3.3 billion

lb Cu and 6.6 Moz Au(3). The region has seen significant investment

by various other major mining companies recently and the Yukon is

consistently ranked as a top 10 mining jurisdiction on the

Investment Attractiveness Index based on the Fraser Institute’s

Annual Survey of Mining Companies.

All four of White Gold’s near-surface deposits

are interpreted to represent structurally-controlled orogenic gold

deposits, collectively form the Company’s gold resource base in the

heart of its large land package, and remain open for expansion.

Golden Saddle DepositThe Golden

Saddle deposit is located 95 km south of Dawson City on the

Company’s White Gold property (Figure 2), which is supported by the

fully operational Thistle exploration camp with airstrip and barge

access, and up to 100-person capacity. The deposit consists of the

GS Main, GS Footwall and GS West zones and together the zones

define mineralization over a 1,500 m strike length and up to 725 m

down dip. Currently, the GS Main is the most significant zone in

terms of estimated ounces and overall grade; containing

approximately 95% of the Indicated ounces within the overall Golden

Saddle deposit. GS Main Zone contains a consistent high-grade core

of 832,000 gold ounces at a grade of 2.96 g/t gold in the Indicated

category and 107,000 gold ounces at a grade of 3.18 g/t gold

Inferred using a >1 g/t cut-off. Included in this high-grade

core is 525,600 gold ounces at a grade of 4.68 g/t gold in the

Indicated category and 81,900 gold ounces at a grade of 4.74 g/t

gold Inferred using a >3 g/t cut-off.

Gold mineralization at the Golden Saddle deposit

(Figure 2 & 3) is hosted in a meta-volcanic and meta-intrusive

assemblage broadly consisting of felsic orthogneiss, amphibolite,

and ultramafic units. Gold generally occurs as micron-scale blebs

along fractures or encapsulated by pyrite, and as visible gold

(less than 5 mm in size) located as free grains in quartz.

Mineralization is present in quartz veins and stockwork or breccia

with disseminated pyrite. Drill hole intersected gold

mineralization is spatially co-incident with structures, and

structures or faults which are interpreted to be the primary

conduits for hydrothermal fluids responsible for gold deposition.

The thicknesses of the mineralization and breccia zones are

variable from 5 m to over 50 m, and they pinch and swell along

strike. A consistent higher-grade core (> 3 g/t Au) occurs

within the main zone at Golden Saddle. Gold mineralization at

the Golden Saddle deposit remains open in all directions and

is known to extend beyond the limits of the current resource

estimate, however, the mineralization in these areas does not

currently meet the criteria to be classified as Mineral

Resources.

Arc DepositThe Arc deposit

(Figures 2 & 3) is located approximately 400 m south of the

Golden Saddle and consists of two zones, the Arc Main and Arc

Footwall zones, both trending E-NE and dipping to the north at

approximately 50 degrees. Mineralization at the Arc has been

defined over 1,200 m in strike length and up to 450 m down dip with

mineralization open along strike and down dip. Gold mineralization

at the Arc deposit is less well understood than the Golden Saddle,

which is partially a function of drilling at the Arc deposit being

more widely spaced. Gold mineralization is hosted within a

meta-sedimentary sequence dominated by banded (graphitic) quartzite

and interbedded pelitic biotite schist that is cross-cut by

numerous felsic to intermediate dikes and sills.

Gold mineralization appears to be focused within

breccia and shear zones that have been affected by hydrothermal

alteration and sulphide mineralization. Drilling has defined an

upper main zone as well as a lower footwall zone of anomalous gold

but of lesser tenure than the main upper zone. Mineralization

remains open to the east, west and at depth. The occurrence of gold

at Arc is not well understood but appears to be associated with

disseminated and veined pyrite, arsenopyrite and graphite.

Ryan’s Surprise DepositRyan’s

Surprise (Figures 2 & 4) is located 1.5 km west of the Golden

Saddle deposit, along a 6.5 km long x 1 km wide north-northwest

trend of anomalous gold and arsenic in soils (“Ryan’s Trend”),

which also hosts several other prospective early-stage targets in

close proximity with significant surface gold mineralization and

represent further potential for expansion of this project. Gold

mineralization at the Ryan’s Surprise deposit is primarily hosted

within a meta-sedimentary sequence dominated by banded (graphitic)

quartzite and interbedded pelitic biotite schist cross-cut by

numerous felsic – intermediate dikes and sills.

Gold mineralization appears to be focused within

breccia and shear zones that have been affected by hydrothermal

alteration and sulphide mineralization. Recent drilling has defined

multiple subparallel zones that are host to gold-bearing sulphide

mineralization including arsenopyrite and pyrite, and range in true

width from < 1 m to in some instances, > 10 m. The

mineralization footprint at the Ryan’s Surprise deposit measures

approximately 550 m north-south by 500 m east-west to a vertical

depth of 650 m remains open along strike and at depth.

Metallurgical work, and gold characterization and deportment

studies are required to further determine accurate gold recoveries.

However, host rocks, alteration and sulphide mineralization at

Ryan’s Surprise display many similarities to the Arc Deposit.

VG DepositThe VG deposit

(Figure 5) is located approximately 85km south of Dawson City and

11km north of the Golden Saddle deposit. Gold mineralization at the

VG deposit is hosted in quartz ± carbonate veins, stockwork and

breccia zones, and pyrite veinlets, including cubic pyrite and

visible gold, associated with intense-quartz-carbonate-sericite

alteration, pervasive K-spar and hematite emplaced along en-echelon

faults or shear zones. Visually, the style of gold mineralization

and alteration appears identical to the Golden Saddle deposit,

along with similar dominant host rocks of biotite-feldspar (±

augen)-quartz gneisses. To date, no metallurgical testwork has been

performed on the VG mineralization, however given its close

similarities to Golden Saddle, gold recoveries are assumed to be

similar. Opportunities exist at the VG deposit to quickly

upgrade a significant portion of Inferred Resources to Indicated,

as well as for expansion of gold mineralization at depth and along

strike. There are also several other prospective targets on the

property which have received limited exploration work and offer

potential for additional discoveries.

Qualified Persons, Technical Information and Quality

Control

The MRE for the White Gold Project was prepared

by Dr. Gilles Arseneau of Arseneau Consulting Services (ACS), an

Independent Qualified Person (“QP”) as defined under NI 43-101, who

has reviewed and approved the contents of this news release. The

technical content of this news release has also been reviewed and

approved by Terry Brace, P.Geo. and Vice President of Exploration

for the Company who is also a QP as defined under NI 43-101 –

Standards of Disclosure of Mineral Projects.

QA/QC

White Gold’s drill core sampling consisted of

collecting samples over 0.50 m to 2.50 m intervals (depending on

lithology and style of mineralization) over the entire hole length.

RC samples were collected at continuous 1.5 m intervals. All drill

core was cut in half using a diamond saw, with half of the core

placed in sample bags and the other half returned to the core box.

Standard, blank, and duplicate samples were inserted into both the

drill core and RC sample streams at regular intervals to meet a

designated QA/QC sample insertion rate. All samples were organized

into batches, flown via fixed-wing aircraft from camp, and

transported via courier to an ISO-certified laboratory for

analysis.

About White Gold Corp.The

Company owns a portfolio of 15,876 quartz claims across 26

properties covering approximately 315,000 hectares (3,150 km2)

representing approximately 40% of the Yukon’s emerging White Gold

District. The Company’s flagship White Gold project hosts four

near-surface gold deposits which collectively contain an estimated

1,203,000ounces of gold in Indicated Resources and 1,116,600 ounces

of gold in Inferred Resources (this news release). Regional

exploration work has also produced several other new discoveries

and prospective targets on the Company’s claim packages which

border sizable gold discoveries including the Coffee project owned

by Newmont Corporation with Measured and Indicated Resources of 2.1

Moz at 1.28 g/t gold and Inferred Resources of 0.2 Moz at 1.04 g/t

gold(2), and Western Copper and Gold Corporation’s Casino project

which has Measured and Indicated Resources of 7.6 Blb copper and

14.5 Moz gold and Inferred Resources of 3.3 Blb copper and 6.6 Moz

gold(3). For more information visit www.whitegoldcorp.ca.

(1) See White Gold Corp. technical report titled

“2023 Technical Report for the White Gold Project, Dawson Range,

Yukon, Canada ”, Effective Date April 15, 2023, Report Date May 30,

2023, NI 43-101 Compliant Technical Report prepared by Dr. Gilles

Arseneau, P.Geo., available on SEDAR+.(2) See Newmont Corporation

Form 10-K: Annual report for the year ending December 31, 2023, in

the Measured, Indicated, and Inferred Resources section, dated

February 29, 2024, available on EDGAR. Reserves and resources

disclosed in this Form 10-K have been prepared in accordance with

the Regulation S-K 1300, and do not indicate NI43-101

compliance.(3) See Western Copper and Gold Corporation technical

report titled “Casino project, Form 43-101F1 Technical Report

Feasibility Study, Yukon Canada”, Effective Date June 13, 2022,

Issue Date August 8, 2022, NI 43-101 Compliant Technical Report

prepared by Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John

M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo.,

Daniel Friedman, P.Eng., Scott Weston, P.Geo., available on

SEDAR+.

Cautionary Note Regarding Forward

Looking InformationThis news release contains

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”) within the meaning of

the applicable Canadian securities legislation. All statements,

other than statements of historical fact, are forward-looking

statements and are based on expectations, estimates and projections

as at the date of this news release. Any statement that involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as “expects”,

or “does not expect”, “is expected”, “anticipates” or “does not

anticipate”, “plans”, “proposed”, “budget”, “scheduled”,

“forecasts”, “estimates”, “believes” or “intends” or variations of

such words and phrases or stating that certain actions, events or

results “may” or “could”, “would”, “might” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. In this news release,

forward-looking statements relate, among other things, the

Company’s objectives, goals and exploration activities conducted

and proposed to be conducted at the Company’s properties; future

growth potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: The

expected benefits to the Company relating to the exploration

conducted and proposed to be conducted at the White Gold

properties; the receipt of all applicable regulatory approvals for

the Offering; failure to identify any additional mineral resources

or significant mineralization; the preliminary nature of

metallurgical test results; uncertainties relating to the

availability and costs of financing needed in the future, including

to fund any exploration programs on the Company’s properties;

business integration risks; fluctuations in general macroeconomic

conditions; fluctuations in securities markets; fluctuations in

spot and forward prices of gold, silver, base metals or certain

other commodities; fluctuations in currency markets (such as the

Canadian dollar to United States dollar exchange rate); change in

national and local government, legislation, taxation, controls,

regulations and political or economic developments; risks and

hazards associated with the business of mineral exploration,

development and mining (including environmental hazards, industrial

accidents, unusual or unexpected formations pressures, cave-ins and

flooding); inability to obtain adequate insurance to cover risks

and hazards; the presence of laws and regulations that may impose

restrictions on mining and mineral exploration; employee relations;

relationships with and claims by local communities and indigenous

populations; availability of increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development (including the risks of obtaining

necessary licenses, permits and approvals from government

authorities); the unlikelihood that properties that are explored

are ultimately developed into producing mines; geological factors;

actual results of current and future exploration; changes in

project parameters as plans continue to be evaluated; soil sampling

results being preliminary in nature and are not conclusive evidence

of the likelihood of a mineral deposit; title to properties;

ongoing uncertainties relating to the COVID-19 pandemic; and those

factors described under the heading “Risks Factors” in the

Company’s annual information form dated July 29, 2020 available on

SEDAR+. Although the forward-looking statements contained in this

news release are based upon what management of the Company

believes, or believed at the time, to be reasonable assumptions,

the Company cannot assure shareholders that actual results will be

consistent with such forward-looking statements, as there may be

other factors that cause results not to be as anticipated,

estimated or intended. Accordingly, readers should not place undue

reliance on forward-looking statements and information. There can

be no assurance that forward-looking information, or the material

factors or assumptions used to develop such forward-looking

information, will prove to be accurate. The Company does not

undertake to release publicly any revisions for updating any

voluntary forward-looking statements, except as required by

applicable securities law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

For Further Information, Please

Contact:

Contact Information:David

D’OnofrioChief Executive OfficerWhite Gold Corp.(647) 930-1880

ir@whitegoldcorp.ca

Request Meeting:

https://calendly.com/meet-with-wgo/15min

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f62dcf61-58c3-46b8-9eec-4b7394a4c05ehttps://www.globenewswire.com/NewsRoom/AttachmentNg/4a126849-5da4-4fe1-a416-b66713fbcf12https://www.globenewswire.com/NewsRoom/AttachmentNg/7dd8fe7a-22cb-4fb3-ba4f-f316ee8885fchttps://www.globenewswire.com/NewsRoom/AttachmentNg/66d9f5a7-b96b-458c-ab10-a2ad860c838fhttps://www.globenewswire.com/NewsRoom/AttachmentNg/1835d18c-5ca4-41b7-b874-c37e4012f0ce

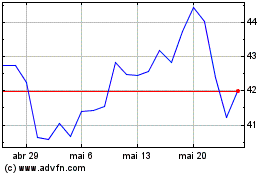

Newmont (NYSE:NEM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Newmont (NYSE:NEM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025