Metals Acquisition Limited (NYSE: MTAL; ASX:MAC)

Highlights

- MAC has received firm commitments to raise approximately A$150

million (approximately US$103 million)1 (before costs) at an issue

price of A$18.00 per New CDI

- Placement was well supported with support from new and existing

institutional and sophisticated investors both in Australia and

offshore, which is testament to the high-quality nature of the CSA

Copper Mine and the significant work that has been undertaken by

management to deliver on a range of operational improvements over

the past year

- Placement proceeds will be used to optimise MAC’s balance sheet

and de-lever (by retiring its existing Mezzanine Debt Facility at

the earliest practicable date) while also providing additional

flexibility to pursue strategic inorganic growth opportunities

Commentary

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) (MAC or

the Company) is pleased to advise that the Company has

received firm commitments via an oversubscribed placement of

8,333,334 new CHESS Depositary Interests (New CDIs) at an

issue price of A$18.00 per New CDI to raise A$150,000,012

(approximately US$103 million)1 (before costs) (the

Placement). The final Placement size was set at

approximately A$150 million (US$103 million).1

The Placement was strongly supported with high levels of

institutional participation that included leading global investor

groups both in Australia and offshore.

Proceeds of the Placement, together with existing cash, will

enable MAC to optimise its balance sheet and de-lever following the

acquisition of the CSA Copper Mine from Glencore plc in mid-2023,

while also providing additional flexibility to pursue strategic

inorganic growth opportunities.

Provided that necessary consents are obtained, the proceeds of

the Placement and MAC’s existing cash will allow MAC to retire the

Mezzanine Debt Facility at the earliest possible date.

The Placement issue price represents a 13.0% discount to both

the closing price of CDIs on ASX of A$20.70 on Tuesday, 8 October

2024 and the 5-day VWAP of A$20.70 on Tuesday, 8 October 2024.

Placement Details

The Placement comprises the issue of 8,333,334 New CDIs at an

issue price of A$18.00 per CDI to raise total proceeds of

A$150,000,012 (approximately US$103 million)1 (before costs).

MAC will resume trading on the ASX from market open on Thursday,

10 October 2024. The New CDIs under the Placement are expected to

settle on Monday, 14 October 2024 and be issued and commence

trading on the ASX on a normal basis on Tuesday, 15 October 2024.

New CDIs issued under the Placement will rank equally with the

Company’s existing CDIs on issue.

Barrenjoey Markets Pty Limited is acting as the sole Lead

Manager and Bookrunner to the Placement to the Placement and

Sternship Advisers Pty Ltd is acting as Co-Manager to the

Placement. Gilbert + Tobin is acting as Legal Adviser to MAC.

Indicative Timetable*

Event

Date

Announcement of completion of

Placement

Wednesday, 9 October 2024

Trading halt lifted

Thursday, 10 October 2024

Settlement of New CDIs under the

Placement

Monday, 14 October 2024

Allotment, quotation and trading of New

CDIs under the Placement

Tuesday, 15 October 2024

*The above timetable is indicative only

and subject to change. MAC reserves the right to amend these dates

at its absolute discretion, subject to the Corporations Act (2001)

(Cth), the ASX Listing Rules and other applicable laws. The

quotation of New CDIs is subject to confirmation from the ASX.

Additional Information

Additional information in relation to the Placement and the

Company can be found in the ASX announcements and Investor

Presentation released to the ASX on Wednesday, 9 October 2024,

which contain important information, including a breakdown of the

sources and uses of funds, the key risks and foreign selling

restrictions with respect to the Placement.

An updated Appendix 3B for the proposed issue of New CDIs will

follow this announcement.

Nothing contained in this announcement constitutes investment,

legal, tax or other advice. Investors should seek appropriate

professional advice before making any investment decision.

-ENDS-

This announcement has been authorised for release by Mick

McMullen, CEO and Director.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX: MAC) is a company

focused on operating and acquiring metals and mining businesses in

high quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Not an offer in the United States

This announcement does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities in the United

States or any other jurisdiction in which such an offer would be

unlawful. Any securities described in this announcement have not

been, and will not be, registered under the US Securities Act of

1933, as amended (“U.S. Securities Act”), or the securities laws of

any state or other jurisdiction of the United States. No securities

described in this announcement may be offered or sold in the United

States or to, or for the account or benefit of, any U.S. Person (as

defined in Regulation S under the U.S. Securities Act) unless they

have been registered under the U.S. Securities Act or are offered

and sold in a transaction exempt from, or not subject to, the

registration requirements of the U.S. Securities Act and any other

applicable U.S. state securities laws.

Forward Looking Statements

This release includes “forward-looking statements.” The

forward-looking information is based on the Company’s expectations,

estimates, projections and opinions of management made in light of

its experience and its perception of trends, current conditions and

expected developments, as well as other factors that management of

the Company believes to be relevant and reasonable in the

circumstances at the date that such statements are made, but which

may prove to be incorrect. Assumptions have been made by the

Company regarding, among other things: the price of copper,

continuing commercial production at the CSA Copper Mine without any

major disruption, the receipt of required governmental approvals,

the accuracy of capital and operating cost estimates, the ability

of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management

believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate.

MAC’s actual results may differ from expectations, estimates,

and projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward- looking statements. These

forward-looking statements include, without limitation, MAC’s

expectations with respect to future performance of the CSA Copper

Mine. These forward-looking statements involve significant risks

and uncertainties that could cause the actual results to differ

materially from those discussed in the forward-looking statements.

Most of these factors are outside MAC’s control and are difficult

to predict. Factors that may cause such differences include, but

are not limited to: the supply and demand for copper; the future

price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and

requirements for additional capital; cash flow provided by

operating activities; unanticipated reclamation expenses; claims

and limitations on insurance coverage; the uncertainty in Mineral

Resource estimates; the uncertainty in geological, metallurgical

and geotechnical studies and opinions; infrastructure risks; and

other risks and uncertainties indicated from time to time in MAC’s

other filings with the SEC and the ASX. MAC cautions that the

foregoing list of factors is not exclusive. MAC cautions readers

not to place undue reliance upon any forward-looking statements,

which speak only as of the date made. MAC does not undertake or

accept any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements to reflect

any change in its expectations or any change in events, conditions,

or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Copper Mine’s financial results is included from time to time

in MAC’s public reports filed with the SEC and the ASX. If any of

these risks materialize or MAC’s assumptions prove incorrect,

actual results could differ materially from the results implied by

these forward-looking statements. There may be additional risks

that MAC does not presently know, or that MAC currently believes

are immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward-looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

1 Placement proceeds converted into US$ based on an A$:US$

exchange rate of 0.6869, which represents the average exchange rate

for the week from 30 September 2024 to 4 October 2024

(inclusive).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009187729/en/

Mick McMullen Chief Executive Officer Metals Acquisition Limited

investors@metalsacqcorp.com Morne Engelbrecht Chief Financial

Officer Metals Acquisition Limited

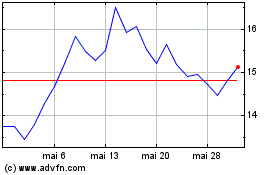

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024