Total Client Assets Increased 27%

Year-Over-Year to a Record $9.92 Trillion Core Net New Assets

Equaled $95.3 Billion, Year-To-Date Exceeds $250 Billion Quarterly

Net Revenues Grew 5% Year-Over-Year to $4.8 Billion

The Charles Schwab Corporation reported net income for the third

quarter totaling $1.4 billion, or $.71 diluted earnings per common

share. Excluding $153 million of pre-tax transaction-related costs,

adjusted (1) net income and diluted common earnings per share

equaled $1.5 billion and $.77, respectively.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241015717862/en/

Client Driven

Growth

$95.3B

3Q24 Core

Net New Assets

“Our momentum with clients

continues to build following the successful completion of the

Ameritrade conversion earlier this year. Third quarter net asset

gathering of over $95 billion pushed year-to-date core net new

assets to $252 billion – up 10% versus 2023 year-to-date.”

Co-Chairman and CEO Walt

Bettinger

Modern Wealth

Solutions

$40B

YTD Net Inflows to

Schwab’s Managed Investing

Solutions

“Record YTD flows into Schwab

Wealth AdvisoryTM helped Managed Investing net flows reach $40

billion – an increase of 65% versus 2023 year-to-date. Converted

Retail Ameritrade client interest in wealth solutions remains

robust, accounting for approximately 35% of these flows.”

Co-Chairman and CEO Walt

Bettinger

Diversified Operating

Model

41.2%

3Q24 Adjusted

Pre-Tax Profit Margin (1)

“Third quarter revenue increased

5% versus 3Q23, driven by sustained investor engagement and market

performance. The combination of growing revenue and expense

discipline yielded a 38.0% pre-tax profit margin – 41.2% adjusted

(1).”

CFO Mike Verdeschi

Balance Sheet

Management

$8.9B

3Q24 Reduction in Bank

Supplemental Funding (2)

“Client transactional sweep cash

grew by $9 billion sequentially, including net inflows of $17

billion in September. This build in client cash on the balance

sheet helped us reduce Bank Supplemental Funding by $8.9 billion

sequentially.”

CFO Mike Verdeschi

3Q24 Client and Business Highlights

- Healthy net asset gathering and equity market resilience

resulted in record total client assets of $9.92 trillion

- Active brokerage accounts reached 36.0 million, up 4% versus

September 2023

- Core net new assets equaled $95.3 billion, bringing the

year-to-date total to $252.1 billion – a 10% increase versus 2023

year-to-date

- Assets receiving ongoing advisory services are up 6%

sequentially and up 26% versus September 2023, including record net

flows into Schwab Wealth AdvisoryTM

- Margin balances grew sequentially by 2% to $73.0 billion, up

17% from year-end 2023

- Trading activity increased relative to the prior quarter as

client engagement remained strong

- Schwab ranked #1 by J.D. Power in Participant Satisfaction with

Retirement Plan Digital Experiences (3)

- Charles Schwab Bank rated #1 in Investor’s Business Daily Most

Trusted Financial Companies survey (4)

Three Months Ended

September 30,

%

Nine Months Ended

September 30,

%

Financial Highlights

2024

2023

Change

2024

2023

Change

Net revenues (in millions)

$

4,847

$

4,606

5

%

$

14,277

$

14,378

(1

)%

Net income (in millions)

GAAP

$

1,408

$

1,125

25

%

$

4,102

$

4,022

2

%

Adjusted

$

1,525

$

1,518

—

$

4,459

$

4,792

(7

)%

Diluted earnings per common share

GAAP

$

.71

$

.56

27

%

$

2.05

$

2.03

1

%

Adjusted

$

.77

$

.77

—

$

2.25

$

2.45

(8

)%

Pre-tax profit margin

GAAP

38.0

%

30.0

%

37.7

%

36.1

%

Adjusted

41.2

%

41.3

%

41.0

%

43.1

%

Return on average common stockholders’

equity (annualized)

14

%

14

%

14

%

18

%

Return on tangible common equity

(annualized) (1)

31

%

58

%

33

%

66

%

Note: Items labeled “adjusted” are

non-GAAP financial measures; further details on non-GAAP financial

measures and a reconciliation of such measures to GAAP reported

results are included on pages 10-12 of this release. All per-share

results are rounded to the nearest cent, based on weighted-average

diluted common shares outstanding.

3Q24 Financial Commentary

- Net revenues grew on both a year-over-year and sequential

basis, up 5% and 3%, respectively

- Sequential net interest margin expanded modestly to 2.08%

- Client transactional sweep cash balances finished September at

$384.0 billion, a sequential increase of $9.2 billion

- Bank Supplemental Funding (2) declined sequentially by $8.9

billion to $64.8 billion at September month-end

- Asset management and administration fees achieved a new

quarterly record of $1.5 billion

- Trading revenue increased 4% versus 3Q23 as a result of higher

volumes and changes in trading mix

- GAAP expenses for the quarter declined 7% versus 3Q23

- Third quarter acquisition and integration-related costs,

amortization of acquired intangibles, and restructuring costs

equaled $153 million, or a decline of $367 million versus 3Q23;

exclusive of these items, adjusted total expenses (1) increased by

6%

- Capital ratios across the firm continue to build – including

preliminary consolidated Tier 1 Leverage and adjusted Tier 1

Leverage (1) reaching 9.7% and 6.7%, respectively

(1)

Further details on non-GAAP financial

measures and a reconciliation of such measures to GAAP reported

results are included on pages 10-12 of this release.

(2)

Bank Supplemental Funding includes

repurchase agreements at the banks, Schwab Bank Certificates of

Deposit (CDs), and Federal Home Loan Bank balances.

(3)

Charles Schwab received the highest score

in the J.D. Power 2021-2022, and 2024 U.S. Retirement Plan Digital

Satisfaction Studies, which measures group retirement plan

participant satisfaction with plan provider digital experiences.

Visit https://www.jdpower.com/business/awards for more details. Use

of study results in promotional materials is subject to a license

fee.

(4)

The Investor’s Business Daily Most Trusted

Bank accolade/recognition was published by Investor’s Business

Daily on September 20, 2024, and is licensed for a 15-month

timeframe. The criteria, evaluation, and ranking were determined by

Investor’s Business Daily in conjunction with its research partner,

TechnoMetrica Market Intelligence, and were based on consumer

surveys conducted May-July 2024.

(https://www.investors.com/news/most-trusted-financial-companies-top-30-list-2024/)

Schwab paid a licensing fee to York Graphic Services, LLC. for uses

of the award and logos through January 4, 2026.

Fall Business Update

The company will host its Fall Business Update for institutional

investors this morning from 7:30 a.m. - 8:30 a.m. CT, 8:30 a.m. -

9:30 a.m. ET.

Registration for this Update webcast is accessible at

https://www.aboutschwab.com/schwabevents.

Forward-Looking Statements

This press release contains forward-looking statements relating

to asset gathering and the company’s momentum with clients; client

interest in wealth solutions; the company’s diversified operating

model; and capital ratios. These forward-looking statements reflect

management’s expectations as of the date hereof. Achievement of

these expectations and objectives is subject to risks and

uncertainties that could cause actual results to differ materially

from the expressed expectations. Important factors that may cause

such differences are described in the company’s most recent reports

on Form 10-K and Form 10-Q, which have been filed with the

Securities and Exchange Commission and are available on the

company’s website (https://www.aboutschwab.com/financial-reports)

and on the Securities and Exchange Commission’s website

(https://www.sec.gov). The company makes no commitment to update

any forward-looking statements.

About Charles Schwab

The Charles Schwab Corporation (NYSE: SCHW) is a leading

provider of financial services, with 36.0 million active brokerage

accounts, 5.4 million workplace plan participant accounts, 2.0

million banking accounts, and $9.92 trillion in client assets.

Through its operating subsidiaries, the company provides a full

range of wealth management, securities brokerage, banking, asset

management, custody, and financial advisory services to individual

investors and independent investment advisors. Its broker-dealer

subsidiary, Charles Schwab & Co., Inc. (member SIPC,

https://www.sipc.org), and its affiliates offer a complete range of

investment services and products including an extensive selection

of mutual funds; financial planning and investment advice;

retirement plan and equity compensation plan services; referrals to

independent, fee-based investment advisors; and custodial,

operational and trading support for independent, fee-based

investment advisors through Schwab Advisor Services. Its primary

banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an

Equal Housing Lender), provides banking and lending services and

products. More information is available at

https://www.aboutschwab.com.

THE CHARLES SCHWAB

CORPORATION

Consolidated Statements of

Income

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net Revenues

Interest revenue

$

3,928

$

4,028

$

11,686

$

12,148

Interest expense

(1,706

)

(1,791

)

(5,073

)

(4,851

)

Net interest revenue

2,222

2,237

6,613

7,297

Asset management and administration

fees

1,476

1,224

4,207

3,515

Trading revenue

797

768

2,391

2,463

Bank deposit account fees

152

205

488

531

Other

200

172

578

572

Total net revenues

4,847

4,606

14,277

14,378

Expenses Excluding Interest

Compensation and benefits

1,522

1,770

4,510

4,906

Professional services

256

275

756

805

Occupancy and equipment

271

305

784

923

Advertising and market development

101

102

296

293

Communications

147

151

460

485

Depreciation and amortization

231

198

692

566

Amortization of acquired intangible

assets

130

135

389

404

Regulatory fees and assessments

88

114

309

277

Other

259

173

694

535

Total expenses excluding interest

3,005

3,223

8,890

9,194

Income before taxes on income

1,842

1,383

5,387

5,184

Taxes on income

434

258

1,285

1,162

Net Income

1,408

1,125

4,102

4,022

Preferred stock dividends and other

109

108

341

299

Net Income Available to Common

Stockholders

$

1,299

$

1,017

$

3,761

$

3,723

Weighted-Average Common Shares

Outstanding:

Basic

1,829

1,821

1,827

1,825

Diluted

1,834

1,827

1,833

1,832

Earnings Per Common Shares

Outstanding (1):

Basic

$

.71

$

.56

$

2.06

$

2.04

Diluted

$

.71

$

.56

$

2.05

$

2.03

(1)

The Company has voting and nonvoting

common stock outstanding. As the participation rights, including

dividend and liquidation rights, are identical between the voting

and nonvoting stock classes, basic and diluted earnings per share

are the same for each class.

THE CHARLES SCHWAB

CORPORATION

Financial and Operating

Highlights

(Unaudited)

Q3-24 %

change

2024

2023

vs.

vs.

Third

Second

First

Fourth

Third

(In millions, except per share amounts and

as noted)

Q3-23

Q2-24

Quarter

Quarter

Quarter

Quarter

Quarter

Net Revenues

Net interest revenue

(1

)%

3

%

$

2,222

$

2,158

$

2,233

$

2,130

$

2,237

Asset management and administration

fees

21

%

7

%

1,476

1,383

1,348

1,241

1,224

Trading revenue

4

%

3

%

797

777

817

767

768

Bank deposit account fees

(26

)%

(1

)%

152

153

183

174

205

Other

16

%

(9

)%

200

219

159

147

172

Total net revenues

5

%

3

%

4,847

4,690

4,740

4,459

4,606

Expenses Excluding Interest

Compensation and benefits (1)

(14

)%

5

%

1,522

1,450

1,538

1,409

1,770

Professional services

(7

)%

(1

)%

256

259

241

253

275

Occupancy and equipment

(11

)%

9

%

271

248

265

331

305

Advertising and market development

(1

)%

(6

)%

101

107

88

104

102

Communications

(3

)%

(15

)%

147

172

141

144

151

Depreciation and amortization

17

%

(1

)%

231

233

228

238

198

Amortization of acquired intangible

assets

(4

)%

1

%

130

129

130

130

135

Regulatory fees and assessments

(23

)%

(8

)%

88

96

125

270

114

Other (2)

50

%

4

%

259

249

186

386

173

Total expenses excluding interest

(7

)%

2

%

3,005

2,943

2,942

3,265

3,223

Income before taxes on income

33

%

5

%

1,842

1,747

1,798

1,194

1,383

Taxes on income

68

%

5

%

434

415

436

149

258

Net Income

25

%

6

%

1,408

1,332

1,362

1,045

1,125

Preferred stock dividends and other

1

%

(10

)%

109

121

111

119

108

Net Income Available to Common

Stockholders

28

%

7

%

$

1,299

$

1,211

$

1,251

$

926

$

1,017

Earnings per common share (3):

Basic

27

%

8

%

$

.71

$

.66

$

.69

$

.51

$

.56

Diluted

27

%

8

%

$

.71

$

.66

$

.68

$

.51

$

.56

Dividends declared per common share

—

—

$

.25

$

.25

$

.25

$

.25

$

.25

Weighted-average common shares

outstanding:

Basic

—

—

1,829

1,828

1,825

1,823

1,821

Diluted

—

—

1,834

1,834

1,831

1,828

1,827

Performance Measures

Pre-tax profit margin

38.0

%

37.2

%

37.9

%

26.8

%

30.0

%

Return on average common stockholders’

equity (annualized) (4)

14

%

14

%

15

%

12

%

14

%

Financial Condition (at quarter

end, in billions)

Cash and cash equivalents

5

%

37

%

$

34.9

$

25.4

$

31.8

$

43.3

$

33.3

Cash and investments segregated

81

%

55

%

33.7

21.7

25.9

31.8

18.6

Receivables from brokerage clients —

net

7

%

2

%

74.0

72.8

71.2

68.7

69.1

Available for sale securities

(18

)%

(4

)%

90.0

93.6

101.1

107.6

110.3

Held to maturity securities

(8

)%

(2

)%

149.9

153.2

156.4

159.5

162.5

Bank loans — net

7

%

3

%

43.3

42.2

40.8

40.4

40.3

Total assets

(2

)%

4

%

466.1

449.7

468.8

493.2

475.2

Bank deposits

(13

)%

(2

)%

246.5

252.4

269.5

290.0

284.4

Payables to brokerage clients

23

%

12

%

89.2

80.0

84.0

84.8

72.8

Other short-term borrowings

39

%

6

%

10.6

10.0

8.4

6.6

7.6

Federal Home Loan Bank borrowings

(29

)%

(7

)%

22.6

24.4

24.0

26.4

31.8

Long-term debt

(10

)%

—

22.4

22.4

22.9

26.1

24.8

Stockholders’ equity

25

%

7

%

47.2

44.0

42.4

41.0

37.8

Other

Full-time equivalent employees (at quarter

end, in thousands)

(11

)%

(1

)%

32.1

32.3

32.6

33.0

35.9

Capital expenditures — purchases of

equipment, office facilities, and property,

net (in millions)

(46

)%

47

%

$

135

$

92

$

122

$

199

$

250

Expenses excluding interest as a

percentage of average client assets (annualized)

0.12

%

0.13

%

0.14

%

0.16

%

0.16

%

Clients’ Daily Average Trades

(DATs) (in thousands)

9

%

4

%

5,697

5,486

5,958

5,192

5,218

Number of Trading Days

2

%

1

%

63.5

63.0

61.0

62.5

62.5

Revenue Per Trade (5)

(6

)%

(2

)%

$

2.20

$

2.25

$

2.25

$

2.36

$

2.35

(1)

Fourth quarter of 2023 includes $16

million in restructuring costs. Third quarter of 2023 includes $276

million in restructuring costs.

(2)

Fourth quarter of 2023 includes $181

million in restructuring costs.

(3)

The Company has voting and nonvoting

common stock outstanding. As the participation rights, including

dividend and liquidation rights, are identical between the voting

and nonvoting stock classes, basic and diluted earnings per share

are the same for each class.

(4)

Return on average common stockholders’

equity is calculated using net income available to common

stockholders divided by average common stockholders’ equity.

(5)

Revenue per trade is calculated as trading

revenue divided by the product of DATs multiplied by the number of

trading days.

THE CHARLES SCHWAB

CORPORATION

Net Interest Revenue

Information

(In millions, except ratios or as

noted)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Average

Balance

Interest

Revenue/

Expense

Average

Yield/

Rate

Interest-earning assets

Cash and cash equivalents

$

27,623

$

369

5.24

%

$

34,391

$

459

5.22

%

$

30,128

$

1,205

5.26

%

$

38,700

$

1,419

4.83

%

Cash and investments segregated

26,220

345

5.15

%

21,987

285

5.08

%

25,744

1,014

5.18

%

29,752

1,041

4.61

%

Receivables from brokerage clients

73,102

1,431

7.66

%

63,760

1,282

7.87

%

68,557

4,042

7.75

%

61,682

3,533

7.55

%

Available for sale securities (1)

98,645

531

2.14

%

129,545

724

2.22

%

104,830

1,680

2.13

%

143,360

2,340

2.17

%

Held to maturity securities

151,004

650

1.71

%

163,904

706

1.72

%

154,231

1,998

1.72

%

167,405

2,172

1.73

%

Bank loans

42,653

484

4.52

%

40,177

426

4.23

%

41,585

1,384

4.44

%

40,183

1,227

4.08

%

Total interest-earning assets

419,247

3,810

3.58

%

453,764

3,882

3.37

%

425,075

11,323

3.52

%

481,082

11,732

3.23

%

Securities lending revenue

87

105

258

341

Other interest revenue

31

41

105

75

Total interest-earning assets

$

419,247

$

3,928

3.69

%

$

453,764

$

4,028

3.50

%

$

425,075

$

11,686

3.63

%

$

481,082

$

12,148

3.35

%

Funding sources

Bank deposits

$

248,405

$

841

1.35

%

$

290,853

$

911

1.24

%

$

260,254

$

2,602

1.34

%

$

315,309

$

2,392

1.01

%

Payables to brokerage clients

72,700

79

0.43

%

63,731

66

0.41

%

69,586

229

0.44

%

68,548

205

0.40

%

Other short-term borrowings

10,821

150

5.52

%

7,315

97

5.26

%

9,164

382

5.57

%

7,286

280

5.13

%

Federal Home Loan Bank borrowings

22,621

310

5.38

%

36,287

477

5.18

%

24,347

988

5.36

%

35,896

1,387

5.11

%

Long-term debt

22,446

208

3.71

%

23,492

193

3.30

%

23,299

640

3.66

%

21,685

489

3.01

%

Total interest-bearing liabilities

376,993

1,588

1.67

%

421,678

1,744

1.64

%

386,650

4,841

1.67

%

448,724

4,753

1.41

%

Non-interest-bearing funding sources

42,254

32,086

38,425

32,358

Securities lending expense

118

46

230

96

Other interest expense

—

1

2

2

Total funding sources

$

419,247

$

1,706

1.61

%

$

453,764

$

1,791

1.56

%

$

425,075

$

5,073

1.59

%

$

481,082

$

4,851

1.35

%

Net interest revenue

$

2,222

2.08

%

$

2,237

1.94

%

$

6,613

2.04

%

$

7,297

2.00

%

(1)

Amounts have been calculated based on

amortized cost.

THE CHARLES SCHWAB

CORPORATION

Asset Management and

Administration Fees Information

(In millions, except ratios or as

noted)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Average

Client

Assets

Revenue

Average

Fee

Average

Client

Assets

Revenue

Average

Fee

Average

Client

Assets

Revenue

Average

Fee

Average

Client

Assets

Revenue

Average

Fee

Schwab money market funds

$

551,945

$

379

0.27

%

$

414,074

$

270

0.26

%

$

525,166

$

1,072

0.27

%

$

368,788

$

735

0.27

%

Schwab equity and bond funds,

exchange-traded funds (ETFs), and collective trust funds (CTFs)

603,314

118

0.08

%

485,326

99

0.08

%

569,608

337

0.08

%

466,995

284

0.08

%

Mutual Fund OneSource® and other

no-transaction-

fee funds

354,664

224

0.25

%

255,039

170

0.26

%

335,813

647

0.26

%

235,561

469

0.27

%

Other third-party mutual funds and

ETFs

611,555

106

0.07

%

632,902

127

0.08

%

606,026

314

0.07

%

663,577

393

0.08

%

Total mutual funds, ETFs, and CTFs (1)

$

2,121,478

$

827

0.16

%

$

1,787,341

$

666

0.15

%

$

2,036,613

$

2,370

0.16

%

$

1,734,921

$

1,881

0.14

%

Advice solutions (1)

Fee-based

$

554,726

$

559

0.40

%

$

468,305

$

476

0.40

%

$

528,850

$

1,572

0.40

%

$

455,730

$

1,393

0.41

%

Non-fee-based

114,307

—

—

97,957

—

—

110,191

—

—

95,951

—

—

Total advice solutions

$

669,033

$

559

0.33

%

$

566,262

$

476

0.33

%

$

639,041

$

1,572

0.33

%

$

551,681

$

1,393

0.34

%

Other balance-based fees (2)

795,737

72

0.04

%

610,450

64

0.04

%

759,645

210

0.04

%

588,922

189

0.04

%

Other (3)

18

18

55

52

Total asset management and

administration fees

$

1,476

$

1,224

$

4,207

$

3,515

(1)

Advice solutions include managed

portfolios, specialized strategies, and customized investment

advice such as Schwab Wealth AdvisoryTM, Schwab Managed

PortfoliosTM, Managed Account Select®, Schwab Advisor Network®,

Windhaven Strategies®, ThomasPartners® Strategies, Schwab Index

Advantage advised retirement plan balances, Schwab Intelligent

Portfolios®, Institutional Intelligent Portfolios®, Schwab

Intelligent Portfolios Premium®, AdvisorDirect®, Essential

Portfolios, Selective Portfolios, and Personalized Portfolios; as

well as legacy non-fee advice solutions including Schwab Advisor

Source and certain retirement plan balances. Average client assets

for advice solutions may also include the asset balances contained

in the mutual fund and/or ETF categories listed above. For the

total end of period view, please see the Monthly Activity

Report.

(2)

Includes various asset-related fees, such

as trust fees, 401(k) recordkeeping fees, and mutual fund clearing

fees and other service fees.

(3)

Includes miscellaneous service and

transaction fees relating to mutual funds and ETFs that are not

balance-based.

THE CHARLES SCHWAB

CORPORATION

Growth in Client Assets and

Accounts

(Unaudited)

Q3-24 % Change

2024

2023

vs.

vs.

Third

Second

First

Fourth

Third

(In billions, at quarter end, except as

noted)

Q3-23

Q2-24

Quarter

Quarter

Quarter

Quarter

Quarter

Assets in client accounts

Schwab One®, certain cash equivalents, and

bank deposits

(5

)%

1

%

$

334.1

$

330.7

$

348.2

$

368.3

$

353.1

Bank deposit account balances

(16

)%

(1

)%

84.0

84.5

90.2

97.4

99.5

Proprietary mutual funds (Schwab Funds®

and Laudus Funds®) and CTFs

Money market funds (1)

29

%

5

%

562.1

533.6

515.7

476.4

436.3

Equity and bond funds and CTFs (2)

36

%

7

%

228.9

214.4

206.0

186.7

167.9

Total proprietary mutual funds and

CTFs

31

%

6

%

791.0

748.0

721.7

663.1

604.2

Mutual Fund Marketplace® (3)

Mutual Fund OneSource® and other

no-transaction-fee funds

24

%

4

%

358.0

344.8

329.2

306.2

288.0

Mutual fund clearing services

29

%

6

%

280.8

264.7

248.1

233.4

216.9

Other third-party mutual funds

17

%

5

%

1,236.5

1,177.5

1,182.9

1,126.5

1,055.3

Total Mutual Fund Marketplace

20

%

5

%

1,875.3

1,787.0

1,760.2

1,666.1

1,560.2

Total mutual fund assets

23

%

5

%

2,666.3

2,535.0

2,481.9

2,329.2

2,164.4

Exchange-traded funds

Proprietary ETFs (2)

35

%

10

%

385.9

349.6

342.9

319.4

286.2

Other third-party ETFs

40

%

9

%

1,888.2

1,738.6

1,676.6

1,521.7

1,352.6

Total ETF assets

39

%

9

%

2,274.1

2,088.2

2,019.5

1,841.1

1,638.8

Equity and other securities

33

%

5

%

3,839.6

3,648.8

3,467.7

3,163.5

2,886.4

Fixed income securities

6

%

—

795.4

792.0

779.0

779.7

747.4

Margin loans outstanding

12

%

2

%

(73.0

)

(71.7

)

(68.1

)

(62.6

)

(65.1

)

Total client assets

27

%

5

%

$

9,920.5

$

9,407.5

$

9,118.4

$

8,516.6

$

7,824.5

Client assets by business

Investor Services

28

%

5

%

$

5,305.9

$

5,055.7

$

4,852.2

$

4,519.1

$

4,157.7

Advisor Services

26

%

6

%

4,614.6

4,351.8

4,266.2

3,997.5

3,666.8

Total client assets

27

%

5

%

$

9,920.5

$

9,407.5

$

9,118.4

$

8,516.6

$

7,824.5

Net growth in assets in client

accounts (for the quarter ended)

Net new assets by business

Investor Services (4)

28

%

(8

)%

$

36.7

$

39.9

$

34.9

$

25.0

$

28.6

Advisor Services (5)

176

%

58

%

54.1

34.3

53.3

41.3

19.6

Total net new assets

88

%

22

%

$

90.8

$

74.2

$

88.2

$

66.3

$

48.2

Net market gains (losses)

422.2

214.9

513.6

625.8

(239.5

)

Net growth (decline)

$

513.0

$

289.1

$

601.8

$

692.1

$

(191.3

)

New brokerage accounts (in

thousands, for the quarter ended)

9

%

(1

)%

972

985

1,094

910

894

Client accounts (in thousands)

Active brokerage accounts

4

%

1

%

35,982

35,612

35,301

34,838

34,540

Banking accounts

9

%

1

%

1,954

1,931

1,885

1,838

1,799

Workplace Plan Participant Accounts

(6)

5

%

—

5,388

5,363

5,277

5,221

5,141

(1)

Total client assets in purchased money

market funds are located at:

https://www.aboutschwab.com/investor-relations.

(2)

Includes balances held on and off the

Schwab platform. As of September 30, 2024, off-platform equity and

bond funds, CTFs, and ETFs were $34.4 billion, $4.1 billion, and

$129.3 billion, respectively.

(3)

Excludes all proprietary mutual funds and

ETFs.

(4)

Third quarter of 2024 includes net

outflows of $4.4 billion from off-platform Schwab Bank Retail CDs

and an outflow of $0.1 billion from an international relationship.

Second quarter of 2024 includes net inflows of $2.7 billion from

off-platform Schwab Bank Retail CDs and an inflow of $10.3 billion

from a mutual fund clearing services client. First quarter of 2024

includes net outflows of $7.4 billion from off-platform Schwab Bank

Retail CDs. Fourth quarter of 2023 includes net inflows of $2.4

billion from off-platform Schwab Bank Retail CDs and outflows of

$5.8 billion from an international relationship. Third quarter of

2023 includes net inflows of $3.3 billion from off-platform Schwab

Bank Retail CDs.

(5)

Fourth quarter of 2023 includes outflows

of $6.4 billion from an international relationship. Third quarter

of 2023 includes an outflow of $0.8 billion from an international

relationship.

(6)

Beginning in the fourth quarter 2023,

Retirement Plan Participants was expanded to include accounts in

Stock Plan Services, Designated Brokerage Services, and Retirement

Business Services. Participants may be enrolled in services in more

than one Workplace business. Third quarter 2023 has been recast to

reflect this change.

The Charles Schwab Corporation

Monthly Activity Report For September 2024

2023

2024

Change

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Mo.

Yr.

Market Indices (at month end)

Dow Jones Industrial Average®

33,508

33,053

35,951

37,690

38,150

38,996

39,807

37,816

38,686

39,119

40,843

41,563

42,330

2

%

26

%

Nasdaq Composite®

13,219

12,851

14,226

15,011

15,164

16,092

16,379

15,658

16,735

17,733

17,599

17,714

18,189

3

%

38

%

Standard & Poor’s® 500

4,288

4,194

4,568

4,770

4,846

5,096

5,254

5,036

5,278

5,460

5,522

5,648

5,762

2

%

34

%

Client Assets (in billions of

dollars)

Beginning Client Assets

8,094.7

7,824.5

7,653.4

8,180.6

8,516.6

8,558.1

8,879.5

9,118.4

8,847.5

9,206.3

9,407.5

9,572.1

9,737.7

Net New Assets (1)

27.2

5.0

19.2

42.1

14.8

31.7

41.7

10.0

31.0

33.2

29.0

31.5

30.3

(4

)%

11

%

Net Market Gains (Losses)

(297.4

)

(176.1

)

508.0

293.9

26.7

289.7

197.2

(280.9

)

327.8

168.0

135.6

134.1

152.5

Total Client Assets (at month end)

7,824.5

7,653.4

8,180.6

8,516.6

8,558.1

8,879.5

9,118.4

8,847.5

9,206.3

9,407.5

9,572.1

9,737.7

9,920.5

2

%

27

%

Core Net New Assets (1,2)

27.1

11.3

21.7

43.1

17.2

33.4

45.0

1.0

31.1

29.1

29.0

32.8

33.5

2

%

24

%

Receiving Ongoing Advisory Services (at

month end)

Investor Services

533.0

522.2

557.0

581.4

584.1

601.8

618.5

602.2

624.0

632.9

649.1

663.7

675.1

2

%

27

%

Advisor Services (3)

3,448.0

3,380.3

3,604.4

3,757.4

3,780.4

3,902.5

4,009.5

3,893.9

4,027.3

4,090.0

4,185.4

4,268.1

4,343.8

2

%

26

%

Client Accounts (at month end, in

thousands)

Active Brokerage Accounts

34,540

34,571

34,672

34,838

35,017

35,127

35,301

35,426

35,524

35,612

35,743

35,859

35,982

—

4

%

Banking Accounts

1,799

1,812

1,825

1,838

1,856

1,871

1,885

1,901

1,916

1,931

1,937

1,940

1,954

1

%

9

%

Workplace Plan Participant Accounts

(4)

5,141

5,212

5,212

5,221

5,226

5,268

5,277

5,282

5,345

5,363

5,382

5,373

5,388

—

5

%

Client Activity

New Brokerage Accounts (in thousands)

280

284

286

340

366

345

383

361

314

310

327

324

321

(1

)%

15

%

Client Cash as a Percentage of Client

Assets (5)

10.8

%

11.2

%

10.7

%

10.5

%

10.5

%

10.2

%

10.0

%

10.2

%

9.9

%

9.7

%

9.6

%

9.5

%

9.5

%

—

(130) bp

Derivative Trades as a Percentage of Total

Trades

24.2

%

23.2

%

23.1

%

21.8

%

21.8

%

22.2

%

21.9

%

22.1

%

21.9

%

21.3

%

21.2

%

20.8

%

21.5

%

70 bp

(270) bp

Selected Average Balances (in millions

of dollars)

Average Interest-Earning Assets (6)

444,864

438,522

439,118

446,305

443,694

434,822

431,456

423,532

415,950

417,150

417,379

420,191

420,203

—

(6

)%

Average Margin Balances

64,014

63,946

61,502

62,309

61,368

63,600

66,425

68,827

67,614

69,730

73,206

73,326

72,755

(1

)%

14

%

Average Bank Deposit Account Balances

(7)

100,404

97,893

94,991

95,518

95,553

92,075

90,774

88,819

86,844

85,195

83,979

82,806

82,336

(1

)%

(18

)%

Mutual Fund and Exchange-Traded

Fund

Net Buys (Sells) (8,9) (in millions of

dollars)

Equities

675

(3,039

)

6,099

7,903

8,182

7,624

10,379

3,472

5,734

3,379

10,908

5,609

5,217

Hybrid

(828

)

(1,457

)

(1,466

)

(1,596

)

(501

)

(1,330

)

(439

)

(703

)

(558

)

(843

)

(1,155

)

(1,377

)

(432

)

Bonds

2,723

1,094

255

6,104

7,510

9,883

7,561

5,949

5,854

6,346

8,651

10,919

11,015

Net Buy (Sell) Activity (in millions of

dollars)

Mutual Funds (8)

(5,853

)

(12,245

)

(9,267

)

(7,406

)

(966

)

(1,348

)

(1,607

)

(4,818

)

(5,544

)

(4,254

)

(4,679

)

(4,003

)

(1,261

)

Exchange-Traded Funds (9)

8,423

8,843

14,155

19,817

16,157

17,525

19,108

13,536

16,574

13,136

23,083

19,154

17,061

Money Market Funds

13,388

16,976

11,670

7,745

11,717

10,129

9,085

(2,357

)

9,790

3,858

9,110

8,048

9,672

Note: Certain supplemental details related

to the information above can be found at:

https://www.aboutschwab.com/financial-reports.

(1)

Unless otherwise noted, differences

between net new assets and core net new assets are net flows from

off-platform Schwab Bank Retail CDs. Additionally, 2024 includes an

outflow from a large international relationship of $0.1 billion in

August and an inflow of $10.3 billion from a mutual fund clearing

services client in April. 2023 also includes outflows from a large

international relationship of $0.8 billion in September, $6.2

billion in October, $5.4 billion in November, and $0.6 billion in

December.

(2)

Net new assets before significant one-time

inflows or outflows, such as acquisitions/divestitures or

extraordinary flows (generally greater than $10 billion) relating

to a specific client, and activity from off-platform Schwab Bank

Retail CDs. These flows may span multiple reporting periods.

(3)

Excludes Retirement Business Services.

(4)

Beginning October 2023, Retirement Plan

Participants was expanded to include accounts in Stock Plan

Services, Designated Brokerage Services, and Retirement Business

Services. Participants may be enrolled in services in more than one

Workplace business. September 2023 has been recast to reflect this

change.

(5)

Schwab One®, certain cash equivalents,

bank deposits, third-party bank deposit accounts, and money market

fund balances as a percentage of total client assets; client cash

excludes brokered CDs issued by Charles Schwab Bank.

(6)

Represents average total interest-earning

assets on the Company’s balance sheet.

(7)

Represents average clients’ uninvested

cash sweep account balances held in deposit accounts at third-party

financial institutions.

(8)

Represents the principal value of client

mutual fund transactions handled by Schwab, including transactions

in proprietary funds. Includes institutional funds available only

to Investment Managers. Excludes money market fund

transactions.

(9)

Represents the principal value of client

ETF transactions handled by Schwab, including transactions in

proprietary ETFs.

THE CHARLES SCHWAB CORPORATION Non-GAAP

Financial Measures (In millions, except ratios and per share

amounts) (Unaudited)

In addition to disclosing financial results in accordance with

generally accepted accounting principles in the U.S. (GAAP),

Schwab’s third quarter earnings release contains references to the

non-GAAP financial measures described below. We believe these

non-GAAP financial measures provide useful supplemental information

about the financial performance of the Company, and facilitate

meaningful comparison of Schwab’s results in the current period to

both historic and future results. These non-GAAP measures should

not be considered a substitute for, or superior to, financial

measures calculated in accordance with GAAP, and may not be

comparable to non-GAAP financial measures presented by other

companies.

Schwab’s use of non-GAAP measures is reflective of certain

adjustments made to GAAP financial measures as described below.

Beginning in the third quarter of 2023, these adjustments also

include restructuring costs, which the Company began incurring in

connection with its previously announced plans to streamline its

operations to prepare for post-integration of Ameritrade. See Part

I – Item 1 – Note 10 of our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024 for additional information.

Non-GAAP Adjustment or

Measure

Definition

Usefulness to Investors and

Uses by Management

Acquisition and integration-related costs,

amortization of acquired intangible assets, and restructuring

costs

Schwab adjusts certain GAAP financial

measures to exclude the impact of acquisition and

integration-related costs incurred as a result of the Company’s

acquisitions, amortization of acquired intangible assets,

restructuring costs, and, where applicable, the income tax effect

of these expenses.

Adjustments made to exclude amortization

of acquired intangible assets are reflective of all acquired

intangible assets, which were recorded as part of purchase

accounting. These acquired intangible assets contribute to the

Company’s revenue generation. Amortization of acquired intangible

assets will continue in future periods over their remaining useful

lives.

We exclude acquisition and

integration-related costs, amortization of acquired intangible

assets, and restructuring costs for the purpose of calculating

certain non-GAAP measures because we believe doing so provides

additional transparency of Schwab’s ongoing operations, and is

useful in both evaluating the operating performance of the business

and facilitating comparison of results with prior and future

periods.

Costs related to acquisition and

integration or restructuring fluctuate based on the timing of

acquisitions, integration and restructuring activities, thereby

limiting comparability of results among periods, and are not

representative of the costs of running the Company’s ongoing

business. Amortization of acquired intangible assets is excluded

because management does not believe it is indicative of the

Company’s underlying operating performance.

Return on tangible common equity

Return on tangible common equity

represents annualized adjusted net income available to common

stockholders as a percentage of average tangible common equity.

Tangible common equity represents common equity less goodwill,

acquired intangible assets — net, and related deferred tax

liabilities.

Acquisitions typically result in the

recognition of significant amounts of goodwill and acquired

intangible assets. We believe return on tangible common equity may

be useful to investors as a supplemental measure to facilitate

assessing capital efficiency and returns relative to the

composition of Schwab’s balance sheet.

Adjusted Tier 1 Leverage Ratio

Adjusted Tier 1 Leverage Ratio represents

the Tier 1 Leverage Ratio as prescribed by bank regulatory guidance

for the consolidated company and for Charles Schwab Bank, SSB

(CSB), adjusted to reflect the inclusion of accumulated other

comprehensive income (AOCI) in the ratio.

Inclusion of the impacts of AOCI in the

Company’s Tier 1 Leverage Ratio provides additional information

regarding the Company’s current capital position. We believe

Adjusted Tier 1 Leverage Ratio may be useful to investors as a

supplemental measure of the Company’s capital levels.

The Company also uses adjusted diluted EPS and return on

tangible common equity as components of performance criteria for

employee bonus and certain executive management incentive

compensation arrangements. The Compensation Committee of CSC’s

Board of Directors maintains discretion in evaluating performance

against these criteria. Additionally, the Company uses adjusted

Tier 1 Leverage Ratio in managing capital, including its use of the

measure as its long-term operating objective.

The tables below present reconciliations of GAAP measures to

non-GAAP measures:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Total Expenses Excluding

Interest

Net

Income

Total Expenses Excluding

Interest

Net

Income

Total Expenses Excluding

Interest

Net

Income

Total Expenses Excluding

Interest

Net

Income

Total expenses excluding interest

(GAAP),

Net income (GAAP)

$

3,005

$

1,408

$

3,223

$

1,125

$

8,890

$

4,102

$

9,194

$

4,022

Acquisition and integration-related costs

(1)

(23

)

23

(106

)

106

(97

)

97

(334

)

334

Amortization of acquired intangible

assets

(130

)

130

(135

)

135

(389

)

389

(404

)

404

Restructuring costs (2)

—

—

(279

)

279

18

(18

)

(279

)

279

Income tax effects (3)

N/A

(36

)

N/A

(127

)

N/A

(111

)

N/A

(247

)

Adjusted total expenses

(non-GAAP),

Adjusted net income (non-GAAP)

$

2,852

$

1,525

$

2,703

$

1,518

$

8,422

$

4,459

$

8,177

$

4,792

(1)

Acquisition and integration-related costs

for the three and nine months ended September 30, 2024 primarily

consist of $9 million and $44 million of compensation and benefits,

$3 million and $32 million of professional services, and $8 million

and $13 million of depreciation and amortization. Acquisition and

integration-related costs for the three and nine months ended

September 30, 2023 primarily consist of $52 million and $158

million of compensation and benefits, $37 million and $111 million

of professional services, $7 million and $21 million of occupancy

and equipment, and $4 million and $26 million of other.

(2)

Restructuring costs for the nine months

ended September 30, 2024 reflect a change in estimate of $34

million in compensation and benefits, offset by $3 million of

occupancy and equipment and $13 million of other. Restructuring

costs for the three and nine months ended September 30, 2023

primarily consist of $276 million of compensation and benefits.

(3)

The income tax effects of the non-GAAP

adjustments are determined using an effective tax rate reflecting

the exclusion of non-deductible acquisition costs and are used to

present the acquisition and integration-related costs, amortization

of acquired intangible assets, and restructuring costs on an

after-tax basis.

N/A Not applicable.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Amount

% of

Total Net Revenues

Amount

% of

Total Net Revenues

Amount

% of

Total Net Revenues

Amount

% of

Total Net Revenues

Income before taxes on income

(GAAP),

Pre-tax profit margin (GAAP)

$

1,842

38.0

%

$

1,383

30.0

%

$

5,387

37.7

%

$

5,184

36.1

%

Acquisition and integration-related

costs

23

0.5

%

106

2.3

%

97

0.7

%

334

2.3

%

Amortization of acquired intangible

assets

130

2.7

%

135

2.9

%

389

2.7

%

404

2.8

%

Restructuring costs

—

—

279

6.1

%

(18

)

(0.1

)%

279

1.9

%

Adjusted income before taxes on income

(non-GAAP),

Adjusted pre-tax profit margin

(non-GAAP)

$

1,995

41.2

%

$

1,903

41.3

%

$

5,855

41.0

%

$

6,201

43.1

%

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Amount

Diluted

EPS

Amount

Diluted

EPS

Amount

Diluted

EPS

Amount

Diluted

EPS

Net income available to common

stockholders (GAAP),

Earnings per common share — diluted

(GAAP)

$

1,299

$

.71

$

1,017

$

.56

$

3,761

$

2.05

$

3,723

$

2.03

Acquisition and integration-related

costs

23

.01

106

.06

97

.05

334

.18

Amortization of acquired intangible

assets

130

.07

135

.07

389

.21

404

.22

Restructuring costs

—

—

279

.15

(18

)

(.01

)

279

.15

Income tax effects

(36

)

(.02

)

(127

)

(.07

)

(111

)

(.05

)

(247

)

(.13

)

Adjusted net income available to common

stockholders

(non-GAAP), Adjusted diluted EPS

(non-GAAP)

$

1,416

$

.77

$

1,410

$

.77

$

4,118

$

2.25

$

4,493

$

2.45

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Return on average common stockholders’

equity (GAAP)

14

%

14

%

14

%

18

%

Average common stockholders’ equity

$

36,393

$

28,274

$

34,895

$

27,747

Less: Average goodwill

(11,951

)

(11,951

)

(11,951

)

(11,951

)

Less: Average acquired intangible assets —

net

(7,938

)

(8,457

)

(8,067

)

(8,589

)

Plus: Average deferred tax liabilities

related to goodwill and acquired intangible assets — net

1,735

1,822

1,747

1,830

Average tangible common equity

$

18,239

$

9,688

$

16,624

$

9,037

Adjusted net income available to common

stockholders (1)

$

1,416

$

1,410

$

4,118

$

4,493

Return on tangible common equity

(non-GAAP)

31

%

58

%

33

%

66

%

(1)

See table above for the reconciliation of

net income available to common stockholders to adjusted net income

available to common stockholders (non-GAAP).

(Preliminary)

September 30, 2024

CSC

CSB

Tier 1 Leverage Ratio (GAAP)

9.7

%

11.2

%

Tier 1 Capital

$

43,692

$

32,225

Plus: AOCI adjustment

(14,620

)

(12,669

)

Adjusted Tier 1 Capital

29,072

19,556

Average assets with regulatory

adjustments

450,752

287,924

Plus: AOCI adjustment

(15,353

)

(13,480

)

Adjusted average assets with regulatory

adjustments

$

435,399

$

274,444

Adjusted Tier 1 Leverage Ratio

(non-GAAP)

6.7

%

7.1

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015717862/en/

MEDIA Mayura Hooper, 415-667-1525

public.relations@schwab.com

INVESTORS/ANALYSTS Jeff Edwards, 817-854-6177

investor.relations@schwab.com

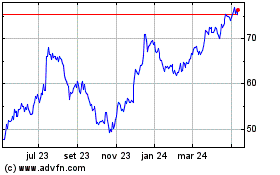

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

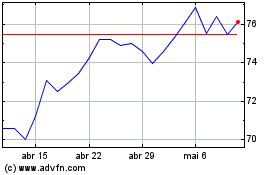

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024