Alcoa Corporation (NYSE: AA; ASX: AAI) today reported results

for the third quarter 2024 that reflect the acquisition of Alumina

Limited in addition to sequential increases in net income, adjusted

net income and Adjusted EBITDA excluding special items.

Financial Results and Highlights

M, except per share amounts

3Q24

2Q24

3Q23

Revenue

$

2,904

$

2,906

$

2,602

Net income (loss) attributable to Alcoa

Corporation

$

90

$

20

$

(168

)

Income (loss) per share attributable to

Alcoa Corporation common shareholders1

$

0.38

$

0.11

$

(0.94

)

Adjusted net income (loss)

$

135

$

30

$

(202

)

Adjusted income (loss) per common

share1

$

0.57

$

0.16

$

(1.14

)

Adjusted EBITDA excluding special

items

$

455

$

325

$

70

1 For 3Q24, undistributed earnings of $1

and undistributed adjusted earnings of $2 were allocated to

preferred stock under the two-class method.

- Net income increased sequentially to $90 million, or $0.38 per

common share

- Adjusted net income increased sequentially to $135 million, or

$0.57 per common share

- Adjusted EBITDA excluding special items increased sequentially

to $455 million

- Completed the acquisition of Alumina Limited on August 1,

2024

- Announced an agreement for the sale of 25.1% interest in the

Ma’aden joint ventures

- Announced progress toward a strategic cooperation agreement

with a partner to support continued San Ciprián operations

- Paid quarterly cash dividend of $0.10 per share of stock,

totaling $26 million (including newly issued shares for the

acquisition of Alumina Limited)

- Finished the third quarter 2024 with cash balance of $1.3

billion

“During the third quarter, we maintained our pace of delivering

on strategic actions. We gained flexibility after closing the

Alumina Limited acquisition and announced the sale of our interest

in the Ma’aden joint ventures,” said Alcoa President and CEO

William F. Oplinger. “Positive markets and our focus on continuous

improvement led to stronger results for the third quarter, while we

continue to execute initiatives to further enhance our

operations.”

Third Quarter 2024 Results

- Production: Alumina production decreased 4 percent

sequentially to 2.44 million metric tons primarily due to the full

curtailment of the Kwinana refinery completed in June 2024. In the

Aluminum segment, production increased 3 percent sequentially to

559,000 metric tons primarily due to continued progress on the

Alumar smelter restart.

- Shipments: In the Alumina segment, third-party shipments

of alumina decreased 9 percent sequentially primarily due to

decreased trading. In Aluminum, total shipments decreased 6 percent

sequentially primarily due to decreased trading and the timing of

shipments.

- Revenue: The Company’s total third-party revenue was

flat sequentially at $2.9 billion. In the Alumina segment,

third-party revenue increased 9 percent on a 22 percent increase in

average realized third-party price, partially offset by lower

shipments. In the Aluminum segment, third-party revenue decreased 5

percent primarily due to lower shipments.

- Net income attributable to Alcoa Corporation was $90

million, or $0.38 per common share. Sequentially, the results

reflect increased alumina prices and lower raw material costs.

Additionally, the results reflect the benefit of the absence of Net

income attributable to noncontrolling interest for the full

quarter.

- Adjusted net income was $135 million, or $0.57 per

common share, excluding the impact from net special items of $45

million. Notable special items include a mark-to-market loss of $31

million related to energy contracts, restructuring charges of $14

million related to remediation and demolition costs at closed

locations, and a restructuring charge of $12 million for contract

termination costs at a closed location, partially offset by the tax

and noncontrolling interest impact of these items.

- Adjusted EBITDA excluding special items was $455

million, a sequential increase of $130 million primarily due to

higher alumina prices and lower raw material costs.

- Cash: Alcoa ended the quarter with a cash balance of

$1.3 billion. Cash provided from operations was $143 million. Cash

used for financing activities was $84 million primarily related to

$26 million in cash dividends on stock, $19 million of net payments

on short-term borrowings and $17 million in distributions to

noncontrolling interest. Cash used for investing activities was

$153 million due to capital expenditures of $146 million.

- Working capital: For the third quarter, Receivables from

customers of $0.9 billion, Inventories of $2.1 billion and Accounts

payable, trade of $1.5 billion comprised DWC working capital. Alcoa

reported 45 days working capital, a sequential increase of four

days primarily due to an increase in inventory days on timing of

shipments.

Key Actions

Strategic

- Ma’aden joint ventures: On September 15, 2024, Alcoa

announced that it entered into a binding share purchase and

subscription agreement with Saudi Arabian Mining Company (Ma’aden),

under which Alcoa will sell its full ownership interest of 25.1% in

the Ma’aden joint ventures to Ma’aden for approximately $1.1

billion. The transaction is subject to regulatory approvals,

approval by Ma’aden’s shareholders and other customary closing

conditions and is expected to close in the first half of 2025.

- Acquisition of Alumina Limited: On August 1, 2024, the

Company announced the completion of its acquisition of Alumina

Limited. This strategic move positions Alcoa to further strengthen

its market leadership as a pure play, upstream aluminum

company.

Operational

- Western Australia mine approvals: The Company continued

to advance mine approvals for the next two Western Australian mine

regions (Myara North and Holyoake) which were referred for

accredited assessment by the Western Australian Environmental

Protection Authority (WA EPA) under the bilateral assessment

process (Accredited Assessment). The process began in 2020 and

Alcoa is focused on receiving approval by the first quarter of

2026. The Company anticipates mining in the new regions will

commence no earlier than 2027. Until then, the Company expects

bauxite quality will remain similar to recent grades.

- San Ciprián complex: On October 16, 2024, Alcoa

announced that it is progressing toward entering into a strategic

cooperation agreement with IGNIS Equity Holdings, SL (IGNIS EQT),

to support the continued operation of the San Ciprián complex.

Under the proposed agreement, Alcoa would maintain a majority

ownership share of San Ciprián complex, including continuing as the

managing operator, with IGNIS EQT holding 25 percent. The proposed

agreement is conditional upon delivery of key areas of cooperation

with San Ciprián’s stakeholders.

- Profitability improvement programs: In January 2024, the

Company shared a series of actions to improve its profitability by

$645 million by year end 2025 in comparison to the base year 2023.

Through the third quarter 2024, the Company had implemented

numerous improvements to achieve approximately 80 percent of the

target. The Company is on track to deliver the full target by year

end 2025.

- Energy contract: In September 2024, Alcoa secured a new

power agreement with AGL Energy Limited (AGL) to support future

operations at Portland Aluminium Smelter in the State of Victoria

in Australia. The nine-year agreement for 287 megawatts of power

supply is effective July 1, 2026, when current contracts end.

Together with a contract reached with AGL in 2023, the combined

contracts represent approximately 95 percent of the energy required

to meet the facility’s total capacity of 358,000 mtpy.

Commercial

- Alumina supply agreement: On October 15, 2024, the

Company announced a long-term agreement for Alcoa to supply up to

16.5 million tonnes of smelter grade alumina to Aluminium Bahrain

B.S.C. (Alba) over 10 years.

2024 Outlook

The following outlook does not include reconciliations of the

forward-looking non-GAAP financial measures Adjusted EBITDA and

Adjusted Net Income, including transformation, intersegment

eliminations and other corporate Adjusted EBITDA; operational tax

expense; and other expense; each excluding special items, to the

most directly comparable forward-looking GAAP financial measures

because it is impractical to forecast certain special items, such

as restructuring charges and mark-to-market contracts, without

unreasonable efforts due to the variability and complexity

associated with predicting the occurrence and financial impact of

such special items. For the same reasons, the Company is unable to

address the probable significance of the unavailable information,

which could be material to future results.

Alcoa expects total 2024 Alumina segment production to remain

unchanged from the prior projection, ranging between 9.8 and 10.0

million metric tons. The Company is increasing its projection for

shipments to range between 12.9 and 13.1 million metric tons, an

increase of 0.2 million metric tons from the prior projection

primarily due to increased trading volumes. The difference between

production and shipments reflects trading volumes and externally

sourced alumina to fulfill customer contracts due to the

curtailment of the Kwinana refinery.

Alcoa expects 2024 total Aluminum segment production and

shipments to remain unchanged from the prior projection, ranging

between 2.2 and 2.3 million metric tons, and between 2.5 and 2.6

million metric tons, respectively.

Within fourth quarter 2024 Alumina Segment Adjusted EBITDA, the

Company expects sequential favorable impacts of $30 million due to

higher shipments and lower production costs.

For the fourth quarter 2024, the Company expects Aluminum

Segment performance to be flat, maintaining the strong performance

from the third quarter 2024.

The Company expects Other expenses for the fourth quarter 2024

to increase approximately $20 million sequentially on Ma’aden

equity losses and equity contributions to ELYSIS™.

Based on current alumina and aluminum market conditions, Alcoa

expects fourth quarter operational tax expense to approximate $120

million to $130 million, which may vary with market conditions and

jurisdictional profitability.

Conference Call

Alcoa will hold its quarterly conference call at 5:00 p.m.

Eastern Daylight Time (EDT) / 8:00 a.m. Australian Eastern Daylight

Time (AEDT) on Wednesday, October 16, 2024 / Thursday, October 17,

2024, to present third quarter 2024 financial results and discuss

the business, developments, and market conditions.

The call will be webcast via the Company’s homepage on

www.alcoa.com. Presentation materials for the call will be

available for viewing on the same website at approximately 4:15

p.m. EDT on October 16, 2024 / 7:15 a.m. AEDT on October 17, 2024.

Call information and related details are available under the

“Investors” section of www.alcoa.com.

Dissemination of Company Information

Alcoa intends to make future announcements regarding company

developments and financial performance through its website,

www.alcoa.com, as well as through press releases, filings with the

Securities and Exchange Commission, conference calls and webcasts.

The Company does not incorporate the information contained on, or

accessible through, its corporate website or such other websites or

platforms referenced herein into this press release.

About Alcoa Corporation

Alcoa (NYSE: AA; ASX: AAI) is a global industry leader in

bauxite, alumina and aluminum products with a vision to reinvent

the aluminum industry for a sustainable future. Our purpose is to

turn raw potential into real progress, underpinned by Alcoa Values

that encompass integrity, operating excellence, care for people and

courageous leadership. Since developing the process that made

aluminum an affordable and vital part of modern life, our talented

Alcoans have developed breakthrough innovations and best practices

that have led to improved safety, sustainability, efficiency, and

stronger communities wherever we operate.

Discover more by visiting www.alcoa.com. Follow us on our social

media channels: Facebook, Instagram, X, YouTube and LinkedIn.

Cautionary Statement on Forward-Looking Statements

This news release contains statements that relate to future

events and expectations and as such constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as “aims,” “ambition,” “anticipates,”

“believes,” “could,” “develop,” “endeavors,” “estimates,”

“expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,”

“potential,” “plans,” “projects,” “reach,” “seeks,” “sees,”

“should,” “strive,” “targets,” “will,” “working,” “would,” or other

words of similar meaning. All statements by Alcoa Corporation that

reflect expectations, assumptions or projections about the future,

other than statements of historical fact, are forward-looking

statements, including, without limitation, statements regarding

forecasts concerning global demand growth for bauxite, alumina, and

aluminum, and supply/demand balances; statements, projections or

forecasts of future or targeted financial results, or operating

performance (including our ability to execute on strategies related

to environmental, social and governance matters, such as our Green

Finance Framework); statements about strategies, outlook, and

business and financial prospects; and statements about capital

allocation and return of capital. These statements reflect beliefs

and assumptions that are based on Alcoa Corporation’s perception of

historical trends, current conditions, and expected future

developments, as well as other factors that management believes are

appropriate in the circumstances. Forward-looking statements are

not guarantees of future performance and are subject to known and

unknown risks, uncertainties, and changes in circumstances that are

difficult to predict. Although Alcoa Corporation believes that the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, it can give no assurance that these

expectations will be attained and it is possible that actual

results may differ materially from those indicated by these

forward-looking statements due to a variety of risks and

uncertainties. Such risks and uncertainties include, but are not

limited to: (1) the impact of global economic conditions on the

aluminum industry and aluminum end-use markets; (2) volatility and

declines in aluminum and alumina demand and pricing, including

global, regional, and product-specific prices, or significant

changes in production costs which are linked to London Metal

Exchange (LME) or other commodities; (3) the disruption of

market-driven balancing of global aluminum supply and demand by

non-market forces; (4) competitive and complex conditions in global

markets; (5) our ability to obtain, maintain, or renew permits or

approvals necessary for our mining operations; (6) rising energy

costs and interruptions or uncertainty in energy supplies; (7)

unfavorable changes in the cost, quality, or availability of raw

materials or other key inputs, or by disruptions in the supply

chain; (8) our ability to execute on our strategy to be a lower

cost, competitive, and integrated aluminum production business and

to realize the anticipated benefits from announced plans, programs,

initiatives relating to our portfolio, capital investments, and

developing technologies; (9) our ability to integrate and achieve

intended results from joint ventures, other strategic alliances,

and strategic business transactions; (10) economic, political, and

social conditions, including the impact of trade policies and

adverse industry publicity; (11) fluctuations in foreign currency

exchange rates and interest rates, inflation and other economic

factors in the countries in which we operate; (12) changes in tax

laws or exposure to additional tax liabilities; (13) global

competition within and beyond the aluminum industry; (14) our

ability to obtain or maintain adequate insurance coverage; (15)

disruptions in the global economy caused by ongoing regional

conflicts; (16) legal proceedings, investigations, or changes in

foreign and/or U.S. federal, state, or local laws, regulations, or

policies; (17) climate change, climate change legislation or

regulations, and efforts to reduce emissions and build operational

resilience to extreme weather conditions; (18) our ability to

achieve our strategies or expectations relating to environmental,

social, and governance considerations; (19) claims, costs, and

liabilities related to health, safety and environmental laws,

regulations, and other requirements in the jurisdictions in which

we operate; (20) liabilities resulting from impoundment structures,

which could impact the environment or cause exposure to hazardous

substances or other damage; (21) our ability to fund capital

expenditures; (22) deterioration in our credit profile or increases

in interest rates; (23) restrictions on our current and future

operations due to our indebtedness; (24) our ability to continue to

return capital to our stockholders through the payment of cash

dividends and/or the repurchase of our common stock; (25) cyber

attacks, security breaches, system failures, software or

application vulnerabilities, or other cyber incidents; (26) labor

market conditions, union disputes and other employee relations

issues; (27) a decline in the liability discount rate or

lower-than-expected investment returns on pension assets; and (28)

the other risk factors discussed in Alcoa’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and other reports

filed by Alcoa with the SEC. Alcoa cautions readers not to place

undue reliance upon any such forward-looking statements, which

speak only as of the date they are made. Alcoa disclaims any

obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise,

except as required by applicable law. Market projections are

subject to the risks described above and other risks in the market.

Neither Alcoa nor any other person assumes responsibility for the

accuracy and completeness of any of these forward-looking

statements and none of the information contained herein should be

regarded as a representation that the forward-looking statements

contained herein will be achieved.

Non-GAAP Financial Measures

This news release contains reference to certain financial

measures that are not calculated and presented in accordance with

generally accepted accounting principles in the United States

(GAAP). Alcoa Corporation believes that the presentation of these

non-GAAP financial measures is useful to investors because such

measures provide both additional information about the operating

performance of Alcoa Corporation and insight on the ability of

Alcoa Corporation to meet its financial obligations by adjusting

the most directly comparable GAAP financial measure for the impact

of, among others, “special items” as defined by the Company,

non-cash items in nature, and/or nonoperating expense or income

items. The presentation of non-GAAP financial measures is not

intended to be a substitute for, and should not be considered in

isolation from, the financial measures reported in accordance with

GAAP. Certain definitions, reconciliations to the most directly

comparable GAAP financial measures and additional details regarding

management’s rationale for the use of the non-GAAP financial

measures can be found in the schedules to this release.

Alcoa Corporation and subsidiaries

Statement of Consolidated Operations

(unaudited)

(dollars in millions, except per-share

amounts)

Quarter Ended

September 30, 2024

June 30, 2024

September 30, 2023

Sales

$

2,904

$

2,906

$

2,602

Cost of goods sold (exclusive of expenses

below)

2,393

2,533

2,469

Selling, general administrative, and other

expenses

66

69

56

Research and development expenses

16

13

9

Provision for depreciation, depletion, and

amortization

159

163

163

Restructuring and other charges, net

30

18

22

Interest expense

44

40

26

Other expenses (income), net

12

(22

)

85

Total costs and expenses

2,720

2,814

2,830

Income (loss) before income taxes

184

92

(228

)

Provision for (benefit from) income

taxes

86

61

(35

)

Net income (loss)

98

31

(193

)

Less: Net income (loss) attributable to

noncontrolling interest

8

11

(25

)

NET INCOME (LOSS) ATTRIBUTABLE TO ALCOA

CORPORATION

$

90

$

20

$

(168

)

EARNINGS PER SHARE ATTRIBUTABLE TO ALCOA

CORPORATION COMMON SHAREHOLDERS(1):

Basic:

Net income (loss)

$

0.39

$

0.11

$

(0.94

)

Average number of common shares

231,799,090

179,560,596

178,443,311

Diluted:

Net income (loss)

$

0.38

$

0.11

$

(0.94

)

Average number of common shares

233,594,549

181,056,581

178,443,311

(1)

For the quarter ended September 30, 2024,

undistributed earnings of $1 were allocated to preferred stock

under the two-class method required by GAAP.

Alcoa Corporation and

subsidiaries

Statement of Consolidated Operations

(unaudited)

(dollars in millions, except per-share

amounts)

Nine Months Ended

September 30, 2024

September 30, 2023

Sales

$

8,409

$

7,956

Cost of goods sold (exclusive of expenses

below)

7,330

7,388

Selling, general administrative, and other

expenses

195

162

Research and development expenses

40

25

Provision for depreciation, depletion, and

amortization

483

469

Restructuring and other charges, net

250

195

Interest expense

111

79

Other expenses, net

49

145

Total costs and expenses

8,458

8,463

Loss before income taxes

(49

)

(507

)

Provision for income taxes

129

39

Net loss

(178

)

(546

)

Less: Net loss attributable to

noncontrolling interest

(36

)

(45

)

NET LOSS ATTRIBUTABLE TO ALCOA

CORPORATION

$

(142

)

$

(501

)

EARNINGS PER SHARE ATTRIBUTABLE TO ALCOA

CORPORATION COMMON SHAREHOLDERS(1):

Basic:

Net loss

$

(0.72

)

$

(2.81

)

Average number of common shares

196,997,535

178,262,741

Diluted:

Net loss

$

(0.72

)

$

(2.81

)

Average number of common shares

196,997,535

178,262,741

(1)

For the nine months ended September 30,

2024, undistributed earnings of $1 were allocated to preferred

stock under the two-class method required by GAAP.

Alcoa Corporation and

subsidiaries

Consolidated Balance Sheet

(unaudited)

(in millions)

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,313

$

944

Receivables from customers

862

656

Other receivables

145

152

Inventories

2,096

2,158

Fair value of derivative instruments

5

29

Prepaid expenses and other current

assets(1)

445

466

Total current assets

4,866

4,405

Properties, plants, and equipment

20,535

20,381

Less: accumulated depreciation, depletion,

and amortization

13,814

13,596

Properties, plants, and equipment, net

6,721

6,785

Investments

982

979

Deferred income taxes

329

333

Fair value of derivative instruments

1

3

Other noncurrent assets(2)

1,643

1,650

Total assets

$

14,542

$

14,155

LIABILITIES

Current liabilities:

Accounts payable, trade

$

1,544

$

1,714

Accrued compensation and retirement

costs

363

357

Taxes, including income taxes

109

88

Fair value of derivative instruments

267

214

Other current liabilities

712

578

Long-term debt due within one year

464

79

Total current liabilities

3,459

3,030

Long-term debt, less amount due within one

year

2,469

1,732

Accrued pension benefits

258

278

Accrued other postretirement benefits

422

443

Asset retirement obligations

789

772

Environmental remediation

182

202

Fair value of derivative instruments

1,007

1,092

Noncurrent income taxes

74

193

Other noncurrent liabilities and deferred

credits

632

568

Total liabilities

9,292

8,310

EQUITY

Alcoa Corporation shareholders’

equity:

Preferred stock

—

—

Common stock

3

2

Additional capital

11,487

9,187

Accumulated deficit

(1,498

)

(1,293

)

Accumulated other comprehensive loss

(4,742

)

(3,645

)

Total Alcoa Corporation shareholders’

equity

5,250

4,251

Noncontrolling interest

—

1,594

Total equity

5,250

5,845

Total liabilities and equity

$

14,542

$

14,155

(1)

This line item includes $44 and $32 of

current restricted cash at September 30, 2024 and December 31,

2023, respectively.

(2)

This line item includes $53 and $71 of

noncurrent restricted cash at September 30, 2024 and December 31,

2023, respectively.

Alcoa Corporation and

subsidiaries

Statement of Consolidated Cash Flows

(unaudited)

(in millions)

Nine Months Ended September

30,

2024

2023

CASH FROM OPERATIONS

Net loss

$

(178

)

$

(546

)

Adjustments to reconcile net loss to cash

from operations:

Depreciation, depletion, and

amortization

483

469

Deferred income taxes

(8

)

(156

)

Equity loss, net of dividends

2

161

Restructuring and other charges, net

250

195

Net loss from investing activities – asset

sales

18

18

Net periodic pension benefit cost

8

4

Stock-based compensation

31

27

Loss on mark-to-market derivative

financial contracts

16

31

Other

33

67

Changes in assets and liabilities,

excluding effects of divestitures and foreign currency translation

adjustments:

(Increase) decrease in receivables

(202

)

108

Decrease in inventories

79

166

(Increase) decrease in prepaid expenses

and other current assets

(12

)

53

Decrease in accounts payable, trade

(149

)

(275

)

Decrease in accrued expenses

(88

)

(119

)

Increase (decrease) in taxes, including

income taxes

55

(52

)

Pension contributions

(14

)

(20

)

Increase in noncurrent assets

(4

)

(179

)

Decrease in noncurrent liabilities

(113

)

(59

)

CASH PROVIDED FROM (USED FOR)

OPERATIONS

207

(107

)

FINANCING ACTIVITIES

Additions to debt

989

80

Payments on debt

(285

)

(39

)

Proceeds from the exercise of employee

stock options

—

1

Dividends paid on Alcoa preferred

stock

—

—

Dividends paid on Alcoa common stock

(63

)

(54

)

Payments related to tax withholding on

stock-based compensation awards

(15

)

(34

)

Financial contributions for the

divestiture of businesses

(19

)

(44

)

Contributions from noncontrolling

interest

65

164

Distributions to noncontrolling

interest

(49

)

(24

)

Acquisition of noncontrolling interest

(23

)

—

Other

(5

)

1

CASH PROVIDED FROM FINANCING

ACTIVITIES

595

51

INVESTING ACTIVITIES

Capital expenditures

(411

)

(343

)

Proceeds from the sale of assets

2

2

Additions to investments

(30

)

(51

)

Other

5

4

CASH USED FOR INVESTING ACTIVITIES

(434

)

(388

)

EFFECT OF EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS AND RESTRICTED CASH

(5

)

—

Net change in cash and cash equivalents

and restricted cash

363

(444

)

Cash and cash equivalents and restricted

cash at beginning of year

1,047

1,474

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH AT END OF PERIOD

$

1,410

$

1,030

Alcoa Corporation and

subsidiaries

Segment Information (unaudited)

(dollars in millions, except realized

prices; dry metric tons in millions (mdmt); metric tons in

thousands (kmt))

1Q23

2Q23

3Q23

4Q23

2023

1Q24

2Q24

3Q24

Alumina:

Bauxite production (mdmt)

9.9

10.0

10.7

10.4

41.0

10.1

9.5

9.4

Third-party bauxite shipments (mdmt)

1.9

1.8

1.9

2.0

7.6

1.0

1.5

1.5

Alumina production (kmt)

2,755

2,559

2,805

2,789

10,908

2,670

2,539

2,435

Third-party alumina shipments (kmt)

1,929

2,136

2,374

2,259

8,698

2,397

2,267

2,052

Intersegment alumina shipments (kmt)

1,039

944

966

1,176

4,125

943

1,025

1,027

Average realized third-party price per

metric ton of alumina

$

371

$

363

$

354

$

344

$

358

$

372

$

399

$

485

Third-party bauxite sales

$

136

$

113

$

111

$

124

$

484

$

64

$

96

$

93

Third-party alumina sales

$

721

$

781

$

846

$

781

$

3,129

$

897

$

914

$

1,003

Intersegment alumina sales

$

421

$

397

$

381

$

449

$

1,648

$

395

$

457

$

565

Segment Adjusted EBITDA(1)

$

103

$

33

$

53

$

84

$

273

$

139

$

186

$

367

Depreciation and amortization

$

77

$

80

$

89

$

87

$

333

$

87

$

90

$

85

Equity (loss) income

$

(17

)

$

(11

)

$

(9

)

$

(11

)

$

(48

)

$

(11

)

$

2

$

6

Aluminum:

Aluminum production (kmt)

518

523

532

541

2,114

542

543

559

Total aluminum shipments (kmt)

600

623

630

638

2,491

634

677

638

Average realized third-party price per

metric ton of aluminum

$

3,079

$

2,924

$

2,647

$

2,678

$

2,828

$

2,620

$

2,858

$

2,877

Third-party sales

$

1,810

$

1,788

$

1,644

$

1,683

$

6,925

$

1,638

$

1,895

$

1,802

Intersegment sales

$

3

$

4

$

4

$

4

$

15

$

4

$

3

$

5

Segment Adjusted EBITDA(1)

$

184

$

110

$

79

$

88

$

461

$

50

$

233

$

180

Depreciation and amortization

$

70

$

68

$

69

$

70

$

277

$

68

$

68

$

68

Equity (loss) income

$

(57

)

$

(16

)

$

(15

)

$

(18

)

$

(106

)

$

2

$

21

$

(11

)

Reconciliation of Total Segment

Adjusted EBITDA to Consolidated net (loss) income attributable to

Alcoa Corporation:

Total Segment Adjusted EBITDA(1)

$

287

$

143

$

132

$

172

$

734

$

189

$

419

$

547

Unallocated amounts:

Transformation(2)

(8

)

(17

)

(29

)

(26

)

(80

)

(14

)

(16

)

(14

)

Intersegment eliminations

(8

)

31

(4

)

(12

)

7

(8

)

(29

)

(38

)

Corporate expenses(3)

(30

)

(24

)

(33

)

(46

)

(133

)

(34

)

(41

)

(39

)

Provision for depreciation, depletion, and

amortization

(153

)

(153

)

(163

)

(163

)

(632

)

(161

)

(163

)

(159

)

Restructuring and other charges, net

(149

)

(24

)

(22

)

11

(184

)

(202

)

(18

)

(30

)

Interest expense

(26

)

(27

)

(26

)

(28

)

(107

)

(27

)

(40

)

(44

)

Other (expenses) income, net

(54

)

(6

)

(85

)

11

(134

)

(59

)

22

(12

)

Other(4)

(39

)

(22

)

2

4

(55

)

(9

)

(42

)

(27

)

Consolidated (loss) income before income

taxes

(180

)

(99

)

(228

)

(77

)

(584

)

(325

)

92

184

(Provision for) benefit from income

taxes

(52

)

(22

)

35

(150

)

(189

)

18

(61

)

(86

)

Net loss (income) attributable to

noncontrolling interest

1

19

25

77

122

55

(11

)

(8

)

Consolidated net (loss) income

attributable to Alcoa Corporation

$

(231

)

$

(102

)

$

(168

)

$

(150

)

$

(651

)

$

(252

)

$

20

$

90

The difference between segment totals and

consolidated amounts is in Corporate.

(1)

Alcoa Corporation’s definition of Adjusted

EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation,

depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general

administrative, and other expenses; Research and development

expenses; and Provision for depreciation, depletion, and

amortization. The Adjusted EBITDA presented may not be comparable

to similarly titled measures of other companies.

(2)

Transformation includes, among other

items, the Adjusted EBITDA of previously closed operations.

(3)

Corporate expenses are composed of general

administrative and other expenses of operating the corporate

headquarters and other global administrative facilities, as well as

research and development expenses of the corporate technical

center.

(4)

Other includes certain items that are not

included in the Adjusted EBITDA of the reportable segments.

Alcoa Corporation and

subsidiaries

Calculation of Financial Measures

(unaudited)

(in millions, except per-share

amounts)

Adjusted Income

Income (Loss)

Quarter ended

September 30, 2024

June 30, 2024

September 30, 2023

Net income (loss) attributable to Alcoa

Corporation

$

90

$

20

$

(168

)

Special items:

Restructuring and other charges, net

30

18

22

Other special items(1)

34

(18

)

13

Discrete and other tax items

impacts(2)

(3

)

—

(60

)

Tax impact on special items(3)

(12

)

5

(6

)

Noncontrolling interest impact(3)

(4

)

5

(3

)

Subtotal

45

10

(34

)

Net income (loss) attributable to Alcoa

Corporation – as adjusted

$

135

$

30

$

(202

)

Diluted EPS(4):

Net income (loss) attributable to Alcoa

Corporation common shareholders

$

0.38

$

0.11

$

(0.94

)

Net income (loss) attributable to Alcoa

Corporation common shareholders – as adjusted

$

0.57

$

0.16

$

(1.14

)

Net income (loss) attributable to Alcoa

Corporation – as adjusted and Diluted EPS – as adjusted are

non-GAAP financial measures. Management believes these measures are

meaningful to investors because management reviews the operating

results of Alcoa Corporation excluding the impacts of restructuring

and other charges, various tax items, and other special items

(collectively, “special items”). There can be no assurances that

additional special items will not occur in future periods. To

compensate for this limitation, management believes it is

appropriate to consider Net income (loss) attributable to Alcoa

Corporation and Diluted EPS determined under GAAP as well as Net

income (loss) attributable to Alcoa Corporation – as adjusted and

Diluted EPS – as adjusted.

(1)

Other special items include the

following:

- for the quarter ended September 30, 2024, a net unfavorable

change in mark-to-market energy derivative instruments ($31),

external costs related to portfolio actions ($4), and a net benefit

for other special items ($1);

- for the quarter ended June 30, 2024, a net favorable change in

mark-to-market energy derivative instruments ($26), an adjustment

to the gain on sale of the Warrick Rolling Mill in Evansville,

Indiana for additional site separation costs ($4), external costs

related to portfolio actions ($2), and net charges for other

special items ($2); and,

- for the quarter ended September 30, 2023, a net unfavorable

change in mark-to-market energy derivative instruments ($21), gain

on sale of non-core rights ($9), and charges for other special

items ($1).

(2)

Discrete and other tax items are generally

unusual or infrequently occurring items, changes in law, items

associated with uncertain tax positions, or the effect of

measurement-period adjustments and include the following:

- for the quarter ended September 30, 2024, a net benefit for

discrete tax items ($3).

- for the quarter ended September 30, 2023, a benefit related to

the reversal of a valuation allowance on deferred tax assets of the

Company's subsidiaries in Iceland ($58) and a net benefit for other

discrete tax items ($2).

(3)

The tax impact on special items is based

on the applicable statutory rates in the jurisdictions where the

special items occurred. The noncontrolling interest impact on

special items represents Alcoa’s partner’s share of certain special

items.

(4)

In any period with a Net loss attributable

to Alcoa Corporation (GAAP or as adjusted), the average number of

common shares applicable to diluted earnings per share exclude

certain share equivalents as their effect is anti-dilutive. For the

quarter ended September 30, 2024, undistributed earnings of $1 and

undistributed earnings – as adjusted of $2 were allocated to

preferred stock under the two-class method.

Alcoa Corporation and

subsidiaries

Calculation of Financial Measures

(unaudited), continued

(in millions)

Adjusted EBITDA

Quarter ended

September 30, 2024

June 30, 2024

September 30, 2023

Net income (loss) attributable to Alcoa

Corporation

$

90

$

20

$

(168

)

Add:

Net income (loss) attributable to

noncontrolling interest

8

11

(25

)

Provision for (benefit from) income

taxes

86

61

(35

)

Other expenses (income), net

12

(22

)

85

Interest expense

44

40

26

Restructuring and other charges, net

30

18

22

Provision for depreciation, depletion, and

amortization

159

163

163

Adjusted EBITDA

429

291

68

Special items(1)

26

34

2

Adjusted EBITDA, excluding special

items

$

455

$

325

$

70

Alcoa Corporation’s definition of Adjusted

EBITDA (Earnings before interest, taxes, depreciation, and

amortization) is net margin plus an add-back for depreciation,

depletion, and amortization. Net margin is equivalent to Sales

minus the following items: Cost of goods sold; Selling, general

administrative, and other expenses; Research and development

expenses; and Provision for depreciation, depletion, and

amortization. Adjusted EBITDA is a non-GAAP financial measure.

Management believes this measure is meaningful to investors because

Adjusted EBITDA provides additional information with respect to

Alcoa Corporation’s operating performance and the Company’s ability

to meet its financial obligations. The Adjusted EBITDA presented

may not be comparable to similarly titled measures of other

companies.

(1)

Special items include the following (see

reconciliation of Adjusted Income above for additional

information):

- for the quarter ended September 30, 2024, the mark-to-market

contracts associated with the Portland smelter generated gains

($21) in Other expenses (income), net which economically offset a

portion of the cost of power recorded in Cost of goods sold. This

non-GAAP reclass presents the net cost of power within Cost of

goods sold. This was in addition to external costs related to

portfolio actions ($4) and charges for other specials items

($1);

- for the quarter ended June 30, 2024, net cost of power

associated with the Portland smelter ($29), external costs related

to portfolio actions ($2), and net charges for other specials items

($3); and,

- for the quarter ended September 30, 2023, costs related to the

restart process at the Alumar, Brazil smelter ($1) and costs

related to the restart process at the San Ciprián, Spain smelter

($1).

Alcoa Corporation and

subsidiaries

Calculation of Financial Measures

(unaudited), continued

(in millions)

Free Cash Flow

Quarter ended

September 30, 2024

June 30, 2024

September 30, 2023

Cash provided from operations

$

143

$

287

$

69

Capital expenditures

(146

)

(164

)

(145

)

Free cash flow

$

(3

)

$

123

$

(76

)

Free Cash Flow is a non-GAAP financial

measure. Management believes this measure is meaningful to

investors because management reviews cash flows generated from

operations after taking into consideration capital expenditures,

which are necessary to maintain and expand Alcoa Corporation’s

asset base and are expected to generate future cash flows from

operations. It is important to note that Free Cash Flow does not

represent the residual cash flow available for discretionary

expenditures since other non-discretionary expenditures, such as

mandatory debt service requirements, are not deducted from the

measure.

Net Debt

September 30, 2024

December 31, 2023

Short-term borrowings

$

12

$

56

Long-term debt due within one year

464

79

Long-term debt, less amount due within one

year

2,469

1,732

Total debt

2,945

1,867

Less: Cash and cash equivalents

1,313

944

Net debt

$

1,632

$

923

Net debt is a non-GAAP financial measure.

Management believes this measure is meaningful to investors because

management assesses Alcoa Corporation’s leverage position after

considering available cash that could be used to repay outstanding

debt. When cash exceeds total debt, the measure is expressed as net

cash.

Alcoa Corporation and

subsidiaries

Calculation of Financial Measures

(unaudited), continued

(in millions)

Adjusted Net Debt and Proportional

Adjusted Net Debt

September 30, 2024

December 31, 2023

Consolidated

NCI

Alcoa Proportional

Consolidated

NCI

Alcoa Proportional

Short-term borrowings

$

12

$

—

$

12

$

56

$

—

$

56

Long-term debt due within one year

464

—

464

79

31

48

Long-term debt, less amount due within one

year

2,469

—

2,469

1,732

—

1,732

Total debt

2,945

—

2,945

1,867

31

1,836

Less: Cash and cash equivalents

1,313

—

1,313

944

141

803

Net debt (net cash)

1,632

—

1,632

923

(110

)

1,033

Plus: Net pension / OPEB liability

581

—

581

657

17

640

Adjusted net debt (net cash)

$

2,213

$

—

$

2,213

$

1,580

$

(93

)

$

1,673

Net debt is a non-GAAP financial measure.

Management believes that this measure is meaningful to investors

because management assesses Alcoa Corporation’s leverage position

after considering available cash that could be used to repay

outstanding debt. When cash exceeds total debt, the measure is

expressed as net cash.

Adjusted net debt and proportional

adjusted net debt (prior to Alcoa’s acquisition of Alumina Limited

on August 1, 2024) are also non-GAAP financial measures. Management

believes that these additional measures are meaningful to investors

because management also assesses Alcoa Corporation’s leverage

position after considering available cash that could be used to

repay outstanding debt and net pension/OPEB liability, net of the

portion of those items attributable to noncontrolling interest

(NCI).

DWC Working Capital and Days Working

Capital

Quarter ended

September 30, 2024

June 30, 2024

September 30, 2023

Receivables from customers

$

862

$

939

$

691

Add: Inventories

2,096

1,975

2,190

Less: Accounts payable, trade

(1,544

)

(1,619

)

(1,472

)

DWC working capital

$

1,414

$

1,295

$

1,409

Sales

$

2,904

$

2,906

$

2,602

Number of days in the quarter

92

91

92

Days working capital(1)

45

41

50

DWC working capital and Days working

capital are non-GAAP financial measures. Management believes that

these measures are meaningful to investors because management uses

its working capital position to assess Alcoa Corporation’s

efficiency in liquidity management.

(1)

Days working capital is calculated as DWC

working capital divided by the quotient of Sales and number of days

in the quarter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241012435567/en/

Investor Contact: Yolande Doctor +1 412 992 5450

Yolande.B.Doctor@alcoa.com Media Contact: Courtney Boone +1

412 527 9792 Courtney.Boone@alcoa.com

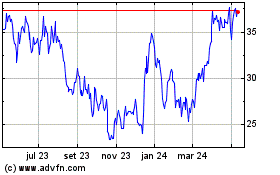

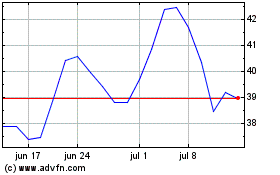

Alcoa (NYSE:AA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Alcoa (NYSE:AA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025