Mastercard Transforms Cross-Border Payments for Banks With Industry-First Innovation

20 Outubro 2024 - 9:00PM

Business Wire

Introducing Mastercard Move Commercial Payments

to power near real-time commercial cross-border payments 24 hours a

day, 365 days a year

Mastercard introduced a new product innovation, Mastercard Move

Commercial Payments, that will enable banks to facilitate near

real-time, predictable and transparent commercial cross-border

payments. The new solution, revealed in Beijing at the annual Sibos

conference, aims to simplify operations, optimize liquidity, reduce

counterparty risk and provide end-to-end visibility for banks and

their customers.

Cross-border payments have been growing at double-digit rates,

according to data from McKinsey, as businesses expand their supply

chains and operations internationally. Despite this, banks still

grapple with several pain points which are passed on to their

business customers in the shape of slow and unpredictable

cross-border payments that lack pricing transparency. Mastercard

Move Commercial Payments aims to address existing challenges and

capitalize on opportunities in commercial cross-border payments in

an innovative way.

Key features include:

- Near real-time payments, 24 hours a day, 365 days a year

to help banks transform corporate trade payments and intra- and

inter-company treasury flows where working capital efficiency is

crucial.

- Settlement options to give banks more flexibility to

optimize liquidity efficiencies, with no impact on FX and

deposit-related bank revenue.

- Multilateral arrangement embedded to reduce counterparty

risk and provide outcome certainty on end-to-end transaction

clearing in near real-time.

- Leverages banks’ existing investments in Swift messaging

infrastructure, with a single technical connection that allows

corridors and currencies to be added with minimal cost and

resources.

- Fully compatible with existing correspondent banking

arrangements between respondents and correspondents. Large clearing

banks can extend the service to their institutional customers with

minimal changes to their current processes.

- Value-added services tailored for a bank’s unique needs,

including innovative risk control services and fraud

analytics.

Alan Marquard, Head of Transfer Solutions at Mastercard,

shares: “By powering fast, predictable and transparent

payments, Mastercard Move Commercial Payments will bring what is

already the norm in domestic payments to the commercial

cross-border payment space.

“Our latest product innovation aims to directly address the pain

points that are currently affecting the commercial cross-border

payments market. By shifting to this new model, they will be

empowered to generate new revenue streams while reducing risk and

enhancing the offering for their corporate customers.”

In a pilot in the UK with Lloyds Banking Group and UBS, using

Fnality as the settlement venue, Mastercard Move Commercial

Payments is being used to deliver near real-time, around-the-clock

cross-border transfers.

Mastercard Move Commercial Payments is part of the Mastercard

Move portfolio of money transfer capabilities that enables people

and businesses to move funds quickly and securely, both

domestically and internationally.

About Mastercard (NYSE: MA) www.mastercard.com

Mastercard is a global technology company in the payments

industry. Our mission is to connect and power an inclusive, digital

economy that benefits everyone, everywhere by making transactions

safe, simple, smart and accessible. Using secure data and networks,

partnerships and passion, our innovations and solutions help

individuals, financial institutions, governments and businesses

realize their greatest potential. With connections across more than

210 countries and territories, we are building a sustainable world

that unlocks priceless possibilities for all.

About Mastercard Move

Mastercard Move is Mastercard’s portfolio of money movement

capabilities powering a variety of payment experiences — from

personal payments to disbursements to business payments. Mastercard

Move reaches nearly 10 billion endpoints and gives access to an

estimated 4.8 billion people, and more than 95% of the world’s

banked population. It solves for a comprehensive range of money

transfer experiences across payments and disbursements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241020515579/en/

Giang Nguyen, Global Communications

Giang.Nguyen@mastercard.com

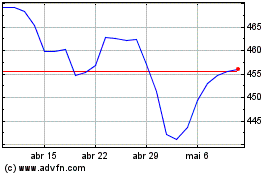

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

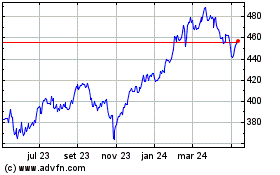

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024