Mastercard reinvents checkout with password and number free payments

14 Novembro 2024 - 12:29PM

Business Wire

By the end of the decade, Mastercard plans to

phase out manual card and password entry in favor of smiles and

fingerprints globally, paving the way for a future where numberless

cards are the default

Mastercard today announced its vision to transform online

shopping by 2030. Imagine a future where no physical card numbers

are needed for purchases. Where passwords or one-time codes are

obsolete, and secure on-device biometrics allow seamless

authentication across devices and websites, ensuring personal data

stays on the device. This vision is already becoming a reality

today in major markets and is poised to become ubiquitous within a

few short years.

By 2030, Mastercard aims to eliminate the need for manual card

entry and one-time or static passwords by combining tokenization,

introduced ten years ago to protect sensitive personal and payment

data, with biometric authentication for secure, seamless checkout.

In doing so, Mastercard seeks to ensure that every online

transaction across its network can be tokenized and authenticated,

making online checkout smoother and safer.

Even with the rise of cutting-edge digital payment solutions,

online shopping still faces challenges and points of friction.

Fraud rates are seven times higher online than in stores1, as

criminals exploit exposed card numbers, creating headaches for

cardholders and huge losses for merchants and card issuers. Plus,

according to Mastercard research2, nearly two-thirds of shoppers

still struggle through manually entering their card details, with

25% of carts abandoned because checkout is too complex or slow.

Paving the way for safer and quicker payments for everyone, this

vision also unlocks a new era for physical cards by making the

possibility of numberless physical cards the default, further

reducing the risk of fraud should a card be lost or stolen.

Mastercard’s technology is already making online checkout

quicker for businesses. Today, tokenization is reducing cart

abandonment and growing transaction approvals by 3-6 percentage

points across regions and generating up to $2 billion in additional

global sales each month3. Additionally, the risk of fraud is

minimized. These advancements provide significant benefits to the

wider ecosystem, including banks, consumers, and businesses.

“Just like the transition from signing and swiping to tapping

cards, we’re now moving from manual entry and passwords to seamless

and secure payments in just a few clicks. With this shift we are

protecting sensitive data through advanced encryption and

tokenization technologies,” said Jorn Lambert, chief product

officer at Mastercard. “As payments continue to be embedded across

a range of commerce experiences, we’re leading the way to a global

economy that empowers everyone – providing consumers with greater

control, convenience and peace-of-mind while unlocking new sales

for merchants, and lowering fraud for issuers.”

“Consumers in Latin America and the Caribbean are turning to

digital solutions for financial services to make their lives

better, and we are happy to see so many partners embracing the

technologies that are increasing trust in digital payments and

bringing the online shopping experience to a new level”, said

Silvana Hernandez, Executive Vice President, Core Payments,

Mastercard Latin America and the Caribbean region.

Core to this commitment to bring these new technologies together

by 2030 is continued partnership and momentum across the payments

ecosystem. Today, Mastercard is working with a range of players in

Latin America and the Caribbean region to deploy and scale these

technologies:

- Today, more than 30% of Mastercard transactions worldwide are

tokenized4 through Mastercard Digital Enablement Service

(MDES), with key markets like India already nearing 100% for

e-commerce. Latin American players have embraced the technology,

with close to 100% of issuers enabled to implement it at the

checkout.

- The Mastercard Payment Passkey Service, which was first

rolled out to millions of consumers in India, Singapore and the

United Arab Emirates, continues to scale globally. In Latin

America, Sympla, in Brazil, and Yuno, a global payments

orchestrator, are ready to start deploying it.

- Click to Pay is rapidly expanding as issuers like

Santander and Inbursa in Mexico, and Banco Inter and Carrefour Bank

in Brazil, and more enroll their card portfolios. Acquirers,

payment service providers and other channel partners including

Adyen, Prestashop, and Yuno are also enabling this technology. And

consumers are using Click to Pay to make everyday purchases at

merchants including Arcos Dorados in Brazil, Chile and Mexico, Clic

in Colombia, Viva in Mexico and coming soon Ingresso.com in

Brazil.

Mastercard continues to innovate for the speed of life –

delivering solutions and collaboration to fuel breakthroughs that

actually break through. This move builds upon several efforts from

Mastercard to reimagine the card – in 2021, the company was the

first payments network to formally phase out the magnetic stripe in

favor of newer and more secure technologies.

https://www.youtube.com/watch?v=OG_Q_TeTvJY

About Mastercard (NYSE: MA)

Mastercard powers economies and empowers people in 200+

countries and territories worldwide. Together with our customers,

we’re building a sustainable economy where everyone can prosper. We

support a wide range of digital payments choices, making

transactions secure, simple, smart and accessible. Our technology

and innovation, partnerships and networks combine to deliver a

unique set of products and services that help people, businesses

and governments realize their greatest potential.

www.mastercard.com

1 Mastercard Data Warehouse 2 Mastercard Global Foresights,

Insights & Analytics: Click to Pay Attitudes & Usage

Research, 2023 3 Mastercard Data Warehouse 4 Mastercard Data

Warehouse

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114231156/en/

Andrea Denadai Andrea.Denadai@mastercard.com

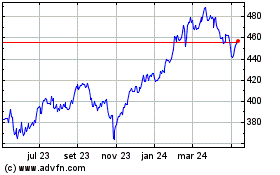

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

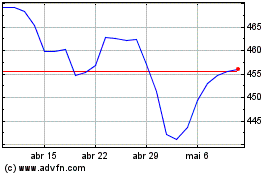

MasterCard (NYSE:MA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024