Atlas Energy Solutions Inc. (NYSE: AESI) (“Atlas” or the

“Company”) today reported financial and operating results for the

third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

- Total sales of $304.4 million

- Net income of $3.9 million (1% Net Income Margin)

- Adjusted EBITDA of $71.1 million (23% Adjusted EBITDA Margin)

(1)

- Net cash provided by operating activities of $85.2 million

- Adjusted Free Cash Flow of $58.7 million (19% Adjusted Free

Cash Flow Margin) (1)

- Commissioning activities for the Dune Express underway

- Declares increased quarterly dividend of $0.24 per share,

payable November 14, 2024

Financial Summary

.

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

(unaudited, in thousands,

except percentages)

Sales

$

304,434

$

287,518

$

192,667

$

157,616

Net income

$

3,918

$

14,837

$

26,787

$

56,327

Net Income Margin

1

%

5

%

14

%

36

%

Adjusted EBITDA

$

71,051

$

79,072

$

75,543

$

84,078

Adjusted EBITDA Margin

23

%

28

%

39

%

53

%

Net cash provided by operating

activities

$

85,189

$

60,856

$

39,562

$

55,406

Adjusted Free Cash Flow

$

58,669

$

73,654

$

71,083

$

68,521

Adjusted Free Cash Flow Margin

19

%

26

%

37

%

43

%

(1)

Adjusted EBITDA, Adjusted EBITDA Margin,

Adjusted Free Cash Flow and Adjusted Free Cash Flow Margin are

non-GAAP financials measures. See Non-GAAP Financial Measures for a

discussion of these measures and a reconciliation of these measures

to our most directly comparable financial measures calculated and

presented in accordance with GAAP.

John Turner, President & CEO, commented, “Our third quarter

results were impacted by higher operating expenses related to

lingering expenses related to the Kermit feed system rebuild and

our follow-on initiatives to improve our operational processes and

systems to ensure that the productive capabilities of our key

plants are optimized. Importantly, the commissioning of the Dune

Express commenced earlier this month. Our focus is on ensuring that

Atlas’ diversified network of mines and logistics solutions is

optimized for the transformational Dune Express delivery system and

our expected expansion of sales in 2025.”

Third Quarter 2024 Financial Results

Third quarter 2024 total sales increased $16.9 million, or 6%

when compared to the second quarter of 2024, to $304.4 million.

Product sales increased $17.1 million, or 13% when compared to the

second quarter of 2024, to $145.3 million. Third quarter 2024 sales

volumes increased to 6.0 million tons, or 22% when compared to the

second quarter of 2024, which was offset by lower average pricing

experienced during the period. Service sales were relatively flat

when compared to the second quarter of 2024, at $159.1 million.

Third quarter 2024 cost of sales (excluding depreciation,

depletion and accretion expense) (“cost of sales”) increased by

$23.2 million, or 11% when compared to the second quarter of 2024,

to $225.3 million. The increase in our cost of sales was primarily

driven by temporarily higher costs at our Kermit facility

associated with process improvements, the re-start of full mining

operations, and delays in dredge commissioning. In addition, our

costs of sales include incremental operating costs associated with

OnCore deployments.

Selling, general and administrative expenses (“SG&A”) for

the third quarter of 2024 decreased $1.8 million, or 7% when

compared to the second quarter of 2024, to $25.5 million. Included

within our SG&A is $6.3 million in stock based compensation and

$2.4 million in other acquisition related costs.

Net income for the third quarter of 2024 was $3.9 million, and

Adjusted EBITDA for the third quarter of 2024 was $71.1

million.

Liquidity, Capital Expenditures and Other

As of September 30, 2024, the Company’s total liquidity was

$253.4 million, which was comprised of $78.6 million in cash and

cash equivalents, $74.8 million of availability under the Company’s

ABL Facility, and $100 million of availability under the Company's

Delayed Draw Term Loan Facility. The Company had $50.0 million of

borrowings outstanding under the ABL Facility and $0.2 million of

outstanding undrawn letters of credit.

Net cash used in investing activities was $76.3 million during

the third quarter of 2024, driven largely by the construction of

the Dune Express and other process and operational

improvements.

Quarterly Cash Dividend

On October 24, 2024, the Board of Directors of Atlas declared an

increased dividend to common stockholders of $0.24 per share, or

approximately $26.5 million in aggregate to shareholders. The

dividend will be payable on November 14, 2024 to shareholders of

record at the close of business on November 7, 2024.

Subsequent Events

Share Buyback Program

Subsequent to quarter end, the Board of Directors of Atlas

authorized a share repurchase program under which the Company may

repurchase up to $200 million of outstanding stock through December

31, 2026.

The shares may be repurchased from time to time in open market

transactions at prevailing market prices, through block trades, in

privately negotiated transactions, through derivative transactions

or by other means and in accordance with federal securities laws.

The timing, as well as the number and value of shares repurchased

under the program, will be determined by the Company at its

discretion and will depend on a variety of factors including

management's assessment of the intrinsic value of the Company's

common stock, the market price of the Company's common stock,

general market and economic conditions, available liquidity,

compliance with the Company’s debt and other agreements, applicable

legal requirements, and other considerations. The exact number of

shares to be repurchased by the Company is not guaranteed, and the

program may be suspended, modified, or discontinued at any time

without prior notice. The Company expects to fund the repurchases

by using cash on hand and expected free cash flow to be generated

over the next two years.

Conference Call Information

The Company will host a conference call to discuss financial and

operational results on Tuesday, October 29, 2024 at 9:00am Central

Time (10:00am Eastern Time). Individuals wishing to participate in

the conference call should dial (877) 407-4133. A live webcast will

be available at https://ir.atlas.energy/. Please access the webcast

or dial in for the call at least 10 minutes ahead of the start time

to ensure a proper connection. An archived version of the

conference call will be available on the Company’s website shortly

after the conclusion of the call.

The Company will also post an updated investor presentation

titled “Investor Presentation October 2024”, in addition to a

"October 2024 Growth Projects Update" video, at

https://ir.atlas.energy/ in the "Presentations” section under “News

& Events” tab on the Company’s Investor Relations webpage prior

to the conference call.

About Atlas Energy Solutions

Atlas Energy Solutions Inc. is a leading proppant producer and

proppant logistics provider, serving primarily the Permian Basin of

West Texas and New Mexico. We operate 14 proppant production

facilities across the Permian Basin with a combined annual

production capacity of 29 million tons, including both large-scale

in-basin facilities and smaller distributed mining units. We manage

a portfolio of leading-edge logistics assets, which includes our

42-mile Dune Express conveyor system, which is currently under

construction and is scheduled to come online in the fourth quarter

of 2024. In addition to our conveyor infrastructure, we manage a

fleet of 120 trucks, which are capable of delivering expanded

payloads due to our custom-manufactured trailers and patented

drop-depot process. Our approach to managing both our proppant

production and proppant logistics operations is intently focused on

leveraging technology, automation and remote operations to drive

efficiencies.

We are a low-cost producer of various high-quality, locally

sourced proppants used during the well completion process. We offer

both dry and damp sand, and carry various mesh sizes including 100

mesh and 40/70 mesh. Proppant is a key component necessary to

facilitate the recovery of hydrocarbons from oil and natural gas

wells.

Our logistics platform is designed to increase the efficiency,

safety and sustainability of the oil and natural gas industry

within the Permian Basin. Proppant logistics is increasingly a

differentiating factor affecting customer choice among proppant

producers. The cost of delivering sand, even short distances, can

be a significant component of customer spending on their well

completions given the substantial volumes that are utilized in

modern well designs.

We continue to invest in and pursue leading-edge technologies,

including autonomous trucking, digital infrastructure, and

artificial intelligence, to support opportunities to gain

efficiencies in our operations. To this end, we have recently taken

delivery of next-generation dredge mining assets to drive

efficiencies in our proppant production operations. These

technology-focused investments aim to improve our cost structure

and also combine to produce beneficial environmental and community

impacts.

While our core business is fundamentally aligned with a lower

emissions economy, our core obligation has been, and will always

be, to our stockholders. We recognize that maximizing value for our

stockholders requires that we optimize the outcomes for our broader

stakeholders, including our employees and the communities in which

we operate. We are proud of the fact that our approach to

innovation in the hydrocarbon industry while operating in an

environmentally responsible manner creates immense value. Since our

founding in 2017, our core mission has been to improve human

beings’ access to the hydrocarbons that power our lives while also

delivering differentiated social and environmental progress. Our

Atlas team has driven innovation and has produced industry-leading

environmental benefits by reducing energy consumption, emissions,

and our aerial footprint. We call this Sustainable Environmental

and Social Progress.

We were founded in 2017 by Ben M. “Bud” Brigham, our Executive

Chairman, and are led by an entrepreneurial team with a history of

constructive disruption bringing significant and complementary

experience to this enterprise, including the perspective of

longtime E&P operators, which provides for an elevated

understanding of the end users of our products and services. Our

executive management team has a proven track record with a history

of generating positive returns and value creation. Our experience

as E&P operators was instrumental to our understanding of the

opportunity created by in-basin sand production and supply in the

Permian Basin, which we view as North America’s premier shale

resource and which we believe will remain its most active through

economic cycles.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Statements

that are predictive or prospective in nature, that depend upon or

refer to future events or conditions or that include the words

“may,” “assume,” “forecast,” “position,” “strategy,” “potential,”

“continue,” “could,” “will,” “plan,” “project,” “budget,”

“predict,” “pursue,” “target,” “seek,” “objective,” “believe,”

“expect,” “anticipate,” “intend,” “estimate” and other expressions

that are predictions of or indicate future events and trends and

that do not relate to historical matters identify forward-looking

statements. Examples of forward-looking statements include, but are

not limited to, timing expectations and costs associated with the

execution of process improvements at the Kermit facility; expected

production volumes; the ultimate impact of the incident on Atlas’s

future performance, operations and operating expenses; our plans

and expectations regarding our newly authorized stock repurchase

program; expectations regarding the leverage and dividend profile

and expectations of Atlas; our business strategy, industry, future

operations and profitability, expected capital expenditures and the

impact of such expenditures on our performance, statements about

our financial position, production, revenues and losses, our

capital programs, management changes, current and potential future

long-term contracts and our future business and financial

performance.

Although forward-looking statements reflect our good faith

beliefs at the time they are made, we caution you that these

forward-looking statements are subject to a number of risks and

uncertainties, most of which are difficult to predict and many of

which are beyond our control. These risks include but are not

limited to: uncertainty regarding the ultimate cost and time needed

to execute the desired process improvements at our production

facilities; unexpected future capital expenditures; uncertainties

as to whether the Hi-Crush Acquisition will achieve its anticipated

benefits and projected synergies within the expected time period or

at all; Atlas’s ability to integrate Hi-Crush Inc.’s operations in

a successful manner and in the expected time period; unforeseen or

unknown liabilities; unexpected future capital expenditures; our

ability to successfully execute our stock repurchase program or

implement future stock repurchase programs; commodity price

volatility, including volatility stemming from the ongoing armed

conflicts between Russia and Ukraine and Israel and Hamas;

increasing hostilities and instability in the Middle East; adverse

developments affecting the financial services industry; our ability

to complete growth projects, including the Dune Express, on time

and on budget; the risk that stockholder litigation in connection

with our recent corporate reorganization may result in significant

costs of defense, indemnification and liability; changes in general

economic, business and political conditions, including changes in

the financial markets; transaction costs; actions of OPEC+ to set

and maintain oil production levels; the level of production of

crude oil, natural gas and other hydrocarbons and the resultant

market prices of crude oil; inflation; environmental risks;

operating risks; regulatory changes; lack of demand; market share

growth; the uncertainty inherent in projecting future rates of

reserves; production; cash flow; access to capital; the timing of

development expenditures; the ability of our customers to meet

their obligations to us; our ability to maintain effective internal

controls; and other factors discussed or referenced in our filings

made from time to time with the U.S. Securities and Exchange

Commission (“SEC”), including those discussed under the heading

“Risk Factors” in Annual Report on Form 10-K, filed with the SEC on

February 27, 2024, and any subsequently filed Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K. Readers are cautioned

not to place undue reliance on forward-looking statements, which

speak only as of the date hereof. Factors or events that could

cause our actual results to differ may emerge from time to time,

and it is not possible for us to predict all of them. We undertake

no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

Atlas Energy Solutions

Inc.

Condensed Consolidated

Statements of Income

(unaudited, in thousands, except

per share data)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Product sales

$

145,347

$

128,210

$

113,432

$

114,773

Service sales

159,087

159,308

79,235

42,843

Total sales

304,434

287,518

192,667

157,616

Cost of sales (excluding depreciation,

depletion and accretion expense)

225,347

202,136

106,746

67,770

Depreciation, depletion and accretion

expense

26,069

25,027

17,175

10,221

Gross profit

53,018

60,355

68,746

79,625

Selling, general and administrative

expense (including stock and unit-based compensation expense of

$6,289, $5,466, $4,206 and $1,414, respectively.)

25,463

27,266

28,008

14,301

Amortization expense of acquired

intangible assets

3,744

3,768

1,061

—

Loss on disposal of assets

8,574

11,098

—

—

Insurance recovery (gain)

—

(10,000

)

—

—

Operating income

15,237

28,223

39,677

65,324

Interest (expense), net

(11,193

)

(10,458

)

(4,978

)

(1,496

)

Other income

289

138

23

136

Income before income taxes

4,333

17,903

34,722

63,964

Income tax expense

415

3,066

7,935

7,637

Net income

$

3,918

$

14,837

$

26,787

$

56,327

Less: Net income attributable to

redeemable noncontrolling interest

26,887

Net income attributable to Atlas Energy

Solutions Inc.

$

3,918

$

14,837

$

26,787

$

29,440

Net income per common share

Basic

$

0.04

$

0.13

$

0.26

$

0.51

Diluted

$

0.04

$

0.13

$

0.26

$

0.51

Weighted average common shares

outstanding

Basic

109,883

111,064

102,931

57,237

Diluted

111,078

112,023

103,822

57,928

Atlas Energy Solutions

Inc.

Condensed Consolidated

Statements of Cash Flows

(unaudited, in thousands)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Operating activities:

Net income

$

3,918

$

14,837

$

26,787

$

56,327

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation, depletion and accretion

expense

26,972

25,886

18,007

10,746

Amortization of debt discount

1,045

1,083

407

231

Amortization of deferred financing

costs

122

118

78

79

Amortization expense of acquired

intangible assets

3,744

3,768

1,061

—

Loss on disposal of assets

8,574

11,098

—

—

Stock and unit-based compensation

6,289

5,466

4,206

1,414

Deferred income tax

154

2,758

7,521

9,432

Other

(906

)

(744

)

(5

)

(42

)

Changes in operating assets and

liabilities:

35,277

(3,414

)

(18,500

)

(22,781

)

Net cash provided by operating

activities

85,189

60,856

39,562

55,406

Investing activities:

Purchases of property, plant and

equipment

(86,276

)

(115,790

)

(95,486

)

(98,858

)

Hi-Crush acquisition, net of cash

acquired

—

—

(142,233

)

—

Proceeds from insurance recovery

10,000

—

—

—

Net cash used in investing

activities

(76,276

)

(115,790

)

(237,719

)

(98,858

)

Financing Activities:

Prepayment fee on 2021 Term Loan Credit

Facility

—

—

—

(2,649

)

Proceeds from borrowings

(3,039

)

3,039

198,500

—

Principal payments on term loan

borrowings

(4,333

)

(4,217

)

(1,381

)

—

Issuance costs associated with debt

financing

(37

)

(416

)

(730

)

(3,645

)

Payments under finance leases

(863

)

(846

)

(65

)

(232

)

Repayment of notes payable

(1,456

)

(855

)

(216

)

—

Dividends and distributions

(25,271

)

(24,168

)

(21,005

)

(27,158

)

Net cash provided by (used in)

financing activities

(34,999

)

(27,463

)

175,103

(33,684

)

Net decrease in cash and cash

equivalents

(26,086

)

(82,397

)

(23,054

)

(77,136

)

Cash and cash equivalents, beginning of

period

104,723

187,120

210,174

341,674

Cash and cash equivalents, end of

period

$

78,637

$

104,723

$

187,120

$

264,538

Atlas Energy Solutions

Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

As of

As of

September 30, 2024

December 31, 2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

78,637

$

210,174

Accounts receivable, including related

parties

179,924

71,170

Inventories, prepaid expenses and other

current assets

57,952

37,342

Total current assets

316,513

318,686

Property, plant and equipment, net

1,449,540

934,660

Right-of-use assets

19,647

4,151

Goodwill

75,219

—

Intangible assets

109,281

1,767

Other long-term assets

3,290

2,422

Total assets

$

1,973,490

$

1,261,686

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable, including related

parties

125,005

61,159

Accrued liabilities and other current

liabilities

96,948

31,433

Current portion of long-term debt

36,219

—

Total current liabilities

258,172

92,592

Long-term debt, net of discount and

deferred financing costs

439,043

172,820

Deferred tax liabilities

207,182

121,529

Other long-term liabilities

22,912

6,921

Total liabilities

927,309

393,862

Total stockholders' and members'

equity

1,046,181

867,824

Total liabilities and stockholders’

equity

$

1,973,490

$

1,261,686

Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Free Cash

Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash Flow

Conversion and Maintenance Capital Expenditures are non-GAAP

supplemental financial measures used by our management and by

external users of our financial statements such as investors,

research analysts and others, in the case of Adjusted EBITDA, to

assess our operating performance on a consistent basis across

periods by removing the effects of development activities, provide

views on capital resources available to organically fund growth

projects and, in the case of Adjusted Free Cash Flow, assess the

financial performance of our assets and their ability to sustain

dividends or reinvest to organically fund growth projects over the

long term without regard to financing methods, capital structure,

or historical cost basis.

These measures do not represent and should not be considered

alternatives to, or more meaningful than, net income, income from

operations, net cash provided by operating activities or any other

measure of financial performance presented in accordance with GAAP

as measures of our financial performance. Adjusted EBITDA and

Adjusted Free Cash Flow have important limitations as analytical

tools because they exclude some but not all items that affect net

income, the most directly comparable GAAP financial measure. Our

computation of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted

Free Cash Flow, Adjusted Free Cash Flow Margin, Adjusted Free Cash

Flow Conversion and Maintenance Capital Expenditures may differ

from computations of similarly titled measures of other

companies.

Non-GAAP Measure

Definitions:

- We define Adjusted EBITDA as net income before

depreciation, depletion and accretion, amortization expense of

acquired intangible assets, interest expense, income tax expense,

stock and unit-based compensation, loss on extinguishment of debt,

loss on disposal of assets, insurance recovery (gain), unrealized

commodity derivative gain (loss), other acquisition related costs,

and other non-recurring costs. Management believes Adjusted EBITDA

is useful because it allows management to more effectively evaluate

the Company’s operating performance and compare the results of its

operations from period to period and against our peers without

regard to financing method or capital structure. We exclude the

items listed above from net income in arriving at Adjusted EBITDA

because these amounts can vary substantially from company to

company within our industry depending upon accounting methods and

book values of assets, capital structures and the method by which

the assets were acquired. Certain prior period non-recurring costs

of goods sold are now included as an add-back to adjusted EBITDA in

order to conform to the current period presentation and to more

accurately describe the Company’s operating performance and results

period over period.

- We define Adjusted EBITDA Margin as Adjusted EBITDA

divided by total sales.

- We define Adjusted Free Cash Flow as Adjusted EBITDA

less Maintenance Capital Expenditures. Management believes that

Adjusted Free Cash Flow is useful to investors as it provides a

measure of the ability of our business to generate cash.

- We define Adjusted Free Cash Flow Margin as Adjusted

Free Cash Flow divided by total sales.

- We define Adjusted Free Cash Flow Conversion as Adjusted

Free Cash Flow divided by Adjusted EBITDA.

- We define Maintenance Capital Expenditures as capital

expenditures excluding growth capital expenditures and

reconstruction of previously incurred growth capital

expenditures.

Atlas Energy Solutions Inc. –

Supplemental Information

Reconciliation of Adjusted

EBITDA and Adjusted Free Cash Flow to Net Income

(unaudited, in thousands)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Net income

$

3,918

$

14,837

$

26,787

$

56,327

Depreciation, depletion and accretion

expense

26,972

25,886

18,007

10,746

Amortization expense of acquired

intangible assets

3,744

3,768

1,061

—

Interest expense

11,831

12,014

6,976

4,673

Income tax expense

415

3,066

7,935

7,637

EBITDA

$

46,880

$

59,571

$

60,766

$

79,383

Stock and unit-based compensation

6,289

5,466

4,206

1,414

Loss on disposal of assets (2)

8,574

11,098

—

—

Insurance recovery (gain)(3)

—

(10,000)

—

—

Other non-recurring costs (4)

6,918

7,049

368

3,281

Other acquisition related costs (1)

2,390

5,888

10,203

—

Adjusted EBITDA

$

71,051

$

79,072

$

75,543

$

84,078

Maintenance Capital Expenditures (5)

$

12,382

$

5,418

$

4,460

$

15,557

Adjusted Free Cash Flow

$

58,669

$

73,654

$

71,083

$

68,521

Atlas Energy Solutions Inc. –

Supplemental Information

Reconciliation of Adjusted

Free Cash Flow to Net Cash Provided by Operating Activities

(unaudited, in thousands, except

percentages)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Net cash provided by operating

activities

$

85,189

$

60,856

$

39,562

$

55,406

Current income tax expense

(benefit)(5)

261

308

414

(1,795

)

Change in operating assets and

liabilities

(35,277

)

3,414

18,500

22,781

Cash interest expense (5)

10,664

10,813

6,491

4,363

Maintenance capital expenditures (5)

(12,382

)

(5,418

)

(4,460

)

(15,557

)

Other non-recurring costs (4)

6,918

7,049

368

3,281

Other acquisition related costs (1)

2,390

5,888

10,203

—

Insurance recovery (gain)(3)

—

(10,000

)

—

—

Other

906

744

5

42

Adjusted Free Cash Flow

$

58,669

$

73,654

$

71,083

$

68,521

Adjusted EBITDA Margin

23

%

28

%

39

%

53

%

Adjusted Free Cash Flow Margin

19

%

26

%

37

%

43

%

Adjusted Free Cash Flow Conversion

83

%

93

%

94

%

81

%

(1)

Represents Hi-Crush transaction costs

include fees paid to finance, legal, accounting and other advisors,

employee retention and benefit costs, and other operational and

corporate costs.

(2)

Represents loss on disposal of one of the

Company's dredge mining assets at its Kermit facility and loss on

disposal of assets as a result of the fire at one of the Kermit

plants that caused damage to the physical condition of the Kermit

asset group.

(3)

Represents insurance recovery (gain)

deemed collectible and legally enforceable as of June 30, 2024

related to the fire at one of the Kermit plants. Cash was

subsequently received as of September 30, 2024.

(4)

Other non-recurring costs includes costs

incurred during our Up-C simplification transaction, temporary

loadout, and other infrequent and unusual costs.

(5)

A reconciliation of the adjustment of

these items used to calculate Adjusted Free Cash Flow to the

Consolidated Financial Statements is included below.

Atlas Energy Solutions Inc. –

Supplemental Information

Reconciliation of Maintenance

Capital Expenditures to Purchase of Property, Plant and

Equipment

(unaudited, in thousands)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Maintenance Capital

Expenditures, accrual basis reconciliation:

Purchases of property, plant and

equipment

$

86,276

$

115,790

$

95,486

$

98,858

Changes in operating assets and

liabilities associated with investing activities (1)

(5,389

)

16,134

(2,575

)

40,153

Less: Growth capital expenditures and

reconstruction of previously incurred growth capital

expenditures

(68,505

)

(126,506

)

(88,451

)

(123,454

)

Maintenance Capital Expenditures,

accrual basis

$

12,382

$

5,418

$

4,460

$

15,557

(1)

Positive working capital changes reflect

capital expenditures in the current period that will be paid in a

future period. Negative working capital changes reflect capital

expenditures incurred in a prior period but paid during the period

presented.

Atlas Energy Solutions Inc. –

Supplemental Information

Reconciliation of Current

Income Tax Expense to Income Tax Expense

(unaudited, in thousands)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Current tax expense

reconciliation:

Income tax expense

$

415

$

3,066

$

7,935

$

7,637

Less: deferred tax expense

(154

)

(2,758

)

(7,521

)

(9,432

)

Current income tax expense

(benefit)

$

261

$

308

$

414

$

(1,795

)

Atlas Energy Solutions Inc. –

Supplemental Information

Cash Interest Expense to

Income Expense, Net

(unaudited, in thousands)

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

September 30, 2023

Cash interest

expense reconciliation:

Interest expense, net

$

11,193

$

10,458

$

4,978

$

1,496

Less: Amortization of debt discount

(1,045

)

(1,083

)

(407

)

(231

)

Less: Amortization of deferred financing

costs

(122

)

(118

)

(78

)

(79

)

Less: Interest income

638

1,556

1,998

3,177

Cash interest expense

$

10,664

$

10,813

$

6,491

$

4,363

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241028196431/en/

Investor Contact Kyle Turlington 5918 W Courtyard Drive,

Suite #500 Austin, Texas 78730 United States T: 512-220-1200

IR@atlas.energy

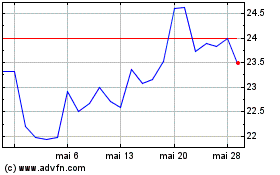

New Atlas Holdco (NYSE:AESI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

New Atlas Holdco (NYSE:AESI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024