CION Ares Diversified Credit Fund Announces $6 Billion Total Assets Under Management Milestone

29 Outubro 2024 - 10:30AM

Business Wire

CION Ares Management LLC (“CAM”), a joint venture between

affiliates of CION Investments (“CION”), a leading manager and

distributor of alternative investment solutions for individual

investors, and Ares Management Corporation (“Ares”), a leading

global alternative investment manager, announced that CION Ares

Diversified Credit Fund (“CADC” or the “Fund”) recently surpassed

$6 billion in total assets under management.

CION co-CEO Michael Reisner noted, "We introduced a diversified

credit strategy in an interval fund structure in 2017 because we

believed that individual investors, through their financial

advisors, should have access to the benefits that the private

markets can bring in achieving long-term investment goals. We were

ahead of the curve in finding the right structure to offer

alternatives to individuals, and the Fund’s growth is a testament

to the commitment we’ve made to the space, and the partnerships

we’ve built. CADC can offer the opportunity for income, stability

and lower portfolio volatility through diversification away from

public markets, and we believe financial advisors are increasingly

seeking these assets as a differentiator in their clients’

portfolios.”

CADC invests in a diversified pool of illiquid and liquid credit

investments, seeking superior risk-adjusted returns across various

market cycles in a continuously offered interval fund structure.

The Fund employs a dynamic asset allocation framework, leveraging

the extensive operational resources, infrastructure and origination

network of Ares. The Fund is currently distributed through a broad

universe of RIAs, independent broker-dealers, and wirehouses.

Mark Gatto, CION co-CEO added, “We’ve been careful and

consistent throughout CADC’s history to prudently manage the fund

and grow in a thoughtful way that prioritizes the semi-liquid

nature of the structure. Our strong net capital raise reflects a

consistently low redemption percentage, and we are thankful for the

level of loyalty we’ve enjoyed with the financial advisor community

and their clients. We continue to believe that offering robust

advisor and investor education and a high level of service, along

with performance, are key to maintaining the growth of the

Fund.”

ABOUT CION INVESTMENTS

CION Investments is a leading open-source provider of

alternative investments designed to redefine the way individual

investors can build their portfolios and meet their long-term

investment goals. CION Investments currently sponsors, among other

products, CION Investment Corporation (NYSE: CION), a leading

publicly listed business development company that currently manages

approximately $2.0 billion in assets, and also sponsors, through

CION Ares Management, the CION Ares Diversified Credit Fund, a

globally diversified interval fund that currently manages

approximately $6.0 billion in assets.

For more information, please visit www.cioninvestments.com.

ABOUT ARES MANAGEMENT CORPORATION

Ares Management Corporation (NYSE: ARES) is a leading global

alternative investment manager offering clients complementary

primary and secondary investment solutions across the credit, real

estate, private equity and infrastructure asset classes. We seek to

provide flexible capital to support businesses and create value for

our stakeholders and within our communities. By collaborating

across our investment groups, we aim to generate consistent and

attractive investment returns throughout market cycles. As of June

30, 2024, Ares Management Corporation's global platform had over

$447 billion of assets under management with more than 2,950

employees operating across North America, Europe, Asia Pacific and

the Middle East. For more information, please visit

www.aresmgmt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029047769/en/

For more information, please contact:

Susan Armstrong Head of Marketing E:

sarmstrong@cioninvestments.com

StreetCred PR E: cion@streetcredpr.com

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

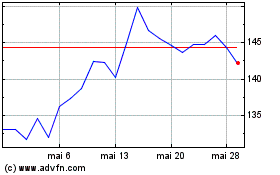

Ares Management (NYSE:ARES)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024