Regulatory News:

Antin Infrastructure Partners (Paris:ANTIN):

AUM

€32.3bn

+4.7% over the LTM

+1.9% vs. 2Q 2024

Fee-Paying AUM

€21.0bn

+5.2% over the LTM

+2.2% vs. 2Q 2024

HIGHLIGHTS

- AUM at €32.3bn, up +4.7% year on year. Fee-Paying AUM at

€21.0bn, up +5.2%

- Flagship Fund V reached €9.8bn in commitments at the end of 3Q

2024, close to the fund’s target size of €10bn

- Exit activity resumed with the sale of the last investment held

by Flagship Fund II, Grandi Stazioni Retail. At closing, Fund II is

expected to generate a top quartile Gross Multiple of 2.6x

- All funds continued to perform well

- 2024 outlook confirmed

- Interim cash dividend of €0.34 per share to be paid on 14

November 2024

Fundraising

Sep-2024 LTM

€1.3bn

Investments

Sep-2024 LTM

€2.6bn

Gross Exits

Sep-2024 LTM

€0.4bn

ALAIN RAUSCHER, Chairman and CEO, declared:

“Antin posted a solid performance in the third quarter, with

continued growth in AUM and exit activity resuming with the sale of

Grandi Stazioni Retail at good returns. Following closing of the

transaction, Fund II will be fully realised with a Gross Multiple

of 2.6x, which is a great outcome for our fund investors and

testament to our commitment to performance.

I am also pleased about the progress made in fundraising with

commitments for Fund V reaching €9.8bn. We are working on the

conversion of our remaining prospects and expect the fund’s final

closing before year-end. I am confident in our ability to achieve

or pass the fund’s target size of €10bn and meet our outlook for

the year.”

FUNDRAISING

- Fundraising amounted to €0.4bn in 3Q 2024 and totalled

€1.3bn over the last twelve months

- Flagship Fund V reached €9.8bn in commitments in 3Q

2024, close to the fund’s target size of €10bn. The upsizing of the

fund above Flagship Fund IV stood at ~50% at the end of 3Q 2024 and

is expected to reach 54% at target size, making it one of the

largest fund size increases among large cap infrastructure funds

globally. The fund is expected to hold its final closing before

year-end

INVESTMENT ACTIVITY

- Investments totalled €2.6bn over the last twelve months,

with four investments announced across Flagship (Consilium

Safety, Portakabin and Proxima) and NextGen (GTL Leasing)

- Flagship Fund V was ~38% committed as of 30 September 2024,

based on the fund’s target size of €10 billion. Mid Cap Fund I was

~50% committed as of 30 September 2024. NextGen Fund I was ~59%

committed as of 30 September 2024

EXIT ACTIVITY

- Exit activity resumed with the announcement on 6 August

2024 of the sale of Grandi Stazioni Retail (GSR) from

Flagship Fund II to a consortium of infrastructure investors led by

OMERS and DWS. GSR is the operator of the long-term leasehold

providing exclusive rights to the commercial leasing and

advertising spaces of 14 Italian railway stations. The transaction

is expected to close in 4Q 2024

- Flagship Fund III and Fund III-B were 37% and 26% realised

respectively as of 30 September 2024. Flagship Fund II was 91%

realised at the end of 3Q 2024 and will be fully realised following

the closing of the GSR exit

FUND PERFORMANCE

- All funds continued to perform either on or above plan. Mid Cap

Fund I and Flagship Fund V were stable at 1.3x and 1.0x

respectively, while NextGen I increased to 1.1x. These funds are

building their portfolio. Flagship Funds III and IV and Fund III-B

are fully invested and continue to advance the implementation of

value creation plans. Their Gross Multiples stood at 1.9x, 1.3x and

1.7x respectively as of 30 September 2024

- The Gross Multiple of Flagship Fund II stood at 2.6x as of 30

September 2024. With the exit of Grandi Stazioni Retail expected to

close in 4Q 2024, Flagship Fund II is expected to generate a top

quartile realised Gross Multiple of 2.6x, significantly exceeding

the fund’s target return(1)

2024 OUTLOOK CONFIRMED

- Growth. Antin's objective is to achieve over-the-cycle

Fee-Paying AUM growth in excess of the private infrastructure

market. In 2024, Antin’s objective is to complete the fundraising

of Flagship Fund V above its target size of €10bn

- EBITDA. Underlying EBITDA in 2024 expected to be at or

above prior year level of ~€175m

- Distribution to shareholders. Majority of cash earnings

to be distributed with the absolute quantum of annual dividends

expected to grow over time. Distributions paid in two instalments

per year, one in autumn and the second after the Annual

Shareholders' Meeting

APPENDIX

DEVELOPMENT OF FEE-PAYING AUM OVER THE LAST TWELVE

MONTHS

(€bn)

Fee-Paying AUM

Beginning of period, 30 September

2023

20.0

Gross inflows

1.4

Step-downs

-

Realisations

(0.3)

End of period, 30 September

2024

21.0

Change in %

+5.2%

QUARTERLY DEVELOPMENT OF FEE-PAYING AUM

(€bn)

Fee-Paying AUM

Beginning of period, 30 June

2024

20.6

Gross inflows

0.5

Step-downs

-

Realisations

-

End of period, 30 September

2024

21.0

Change in %

+2.2%

ACTIVITY REPORT

(€bn)

Sep-2024

last twelve months

Sep-2023

last twelve months

AUM

32.3

30.8

Fee-Paying AUM

21.0

20.0

Fundraising

1.3

3.5

Investments(2)

2.6

1.1

Gross exits

0.4

-

KEY STATS BY FUND

Fund

Vintage

AUM €bn

FPAUM €bn

Committed Capital €bn

% Committed

% Realised

Gross Multiple

Expectation

Flagship

Fund II

2013

0.6

0.3

1.8

87%

91%

2.6x

Above plan

Fund III (3)

2016

5.9

2.0

3.6

89%

37%

1.9x

Above plan

Fund IV

2019

10.5

4.7

6.5

86%

-

1.3x

On plan

Fund III-B

2020

1.5

0.8

1.2

88%

26%

1.7x

On plan

Fund V (4)

2022

10.1

9.8

9.8

38%

-

1.0x

On plan

Mid Cap

Fund I

2021

2.3

2.2

2.2

50%

-

1.3x

On plan

NextGen

Fund I

2021

1.4

1.2

1.2

59%

-

1.1x

On plan

(€bn)

COST OF INVESTMENTS

VALUE OF INVESTMENTS

Fund

Vintage

FPAUM

Committed Capital

Total

Realised

Remaining

Total

Realised

Remaining

Flagship

Fund II

2013

0.3

1.8

1.6

1.3

0.3

4.2

3.8

0.4

Fund III (3)

2016

2.0

3.6

2.9

0.7

2.3

6.1

2.0

4.1

Fund IV

2019

4.7

6.5

4.7

-

4.7

6.3

-

6.3

Fund III-B

2020

0.8

1.2

1.1

0.3

0.8

1.9

0.5

1.4

Fund V (4)

2022

9.8

9.8

2.9

-

2.9

3.0

-

3.0

Mid Cap

Fund I

2021

2.2

2.2

0.9

-

0.9

1.2

-

1.2

NextGen

Fund I

2021

1.2

1.2

0.4

-

0.4

0.4

-

0.4

DEFINITIONS

Antin: Umbrella term for Antin Infrastructure Partners

S.A.

Antin Funds: Investment vehicles managed by Antin

Infrastructure Partners SAS or Antin Infrastructure Partners UK

Assets Under Management (AUM): Operational performance

measure representing the assets managed by Antin from which it is

entitled to receive management fees, undrawn commitments, the

assets from co-investment vehicles which do not generate management

fees or carried interest, and the net value appreciation on current

investments

Carried Interest: A form of investment income that Antin

and other carried interest investors are contractually entitled to

receive directly or indirectly from the Antin Funds, which is

inherently variable and fully dependent on the performance of the

relevant Antin Fund(s) and its/their underlying investments

% Committed: Measures the share of a fund’s total

commitments that has been deployed. Calculated as the sum of (i)

closed and/or signed investments (ii) any earn-outs and/or purchase

price adjustments, (iii) funds approved by the Investment Committee

for add-on transactions, (iv) less any expected syndication, as a %

of a fund’s committed capital at a given time

Committed Capital: The total amounts that fund investors

agree to make available to a fund during a specified time

period

Fee-Paying Assets Under Management (FPAUM): The portion

of AUM from which Antin is entitled to receive management fees

across all of the Antin Funds at a given time

Gross Exits: Value amount of realisation of investments

through a sale or write-off of an investment made by an Antin Fund.

Refers to signed realisations in a given period

Gross Inflow: New commitments through fundraising

activities or increased investment in funds charging fees after the

investment period

Gross Multiple: Calculated by dividing (i) the sum of (a)

the total cash distributed to the Antin Fund from the portfolio

company and (b) the total residual value (excluding provision for

carried interest) of the Fund’s investments by (ii) the capital

invested by the Fund (including fees and expenses but excluding

carried interest). Total residual value of an investment is defined

as the fair market value together with any proceeds from the

investment that have not yet been realised. Gross Multiple is used

to evaluate the return on an Antin Fund in relation to the initial

amount invested.

Investments: Signed investments by an Antin Fund

Realisations: Cost amount of realisation of investments

through a sale or write-off of an investment made by an Antin Fund.

Refers to signed realisations in a given period

% Realised: Measures the share of a fund’s total value

creation that has been realised. Calculated as realised value over

the sum of realised value and remaining value at a given time

Realised Value / (Realised Cost): Value (cost) of an

investment, or parts of an investment, that at the time has been

realised

Remaining Value / (Remaining Costs): Value (cost) of an

investment, or parts of an investment, currently owned by Antin

Funds (including investments for which an exit has been announced

but not yet completed)

Step-Downs: Normally resulting from the end of the

investment period in an existing fund, or when a subsequent fund

begins to invest

Underlying EBITDA: Earnings before interest, taxes,

depreciation, and amortisation, excluding any non-recurring

effects

Underlying Profit: Net profit excluding post-tax

non-recurring effects

ABOUT ANTIN INFRASTRUCTURE PARTNERS

Antin Infrastructure Partners is a leading private equity firm

focused on infrastructure. With over €32bn in Assets under

Management across its Flagship, Mid Cap and NextGen investment

strategies, Antin targets investments in the energy and

environment, digital, transport and social infrastructure sectors.

With offices in Paris, London, New York, Singapore, Seoul and

Luxembourg, Antin employs over 240 professionals dedicated to

growing, improving and transforming infrastructure businesses while

delivering long-term value to portfolio companies and investors.

Majority owned by its partners, Antin is listed on compartment A of

the regulated market of Euronext Paris (Ticker: ANTIN – ISIN:

FR0014005AL0).

https://shareholders.antin-ip.com/

FINANCIAL CALENDAR

Full Year 2024 Results

5 March 2025

1Q 2025 Activity Update

29 April 2025

2025 Annual Shareholders’

Meeting

11 June 2025

Half-Year 2025 Results

11 September 2025

3Q 2025 Activity Update

6 November 2025

___________________________________ (1) Based on Preqin ranking

as of 29 October 2024 (2) Sep-2023 LTM adjusted for the syndication

of a portion of the investment in OPDEnergy to co-investors (3) %

realised and Value of investments include the partial sale of

portfolio companies from Flagship Fund III to Fund III-B (4)

Fundraising ongoing. % invested calculated based on the Fund’s

target commitments of €10bn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029003160/en/

SHAREHOLDER RELATIONS Ludmilla Binet Head of

Shareholder Relations

Email: shareholders@antin-ip.com

MEDIA Nicolle Graugnard Communication Director

Email: media@antin-ip.com

BRUNSWICK Email: antinip@brunswickgroup.com

Tristan Roquet Montegon +33 (0) 6 37 00 52 57

Gabriel Jabès +33 (0) 6 40 87 08 14

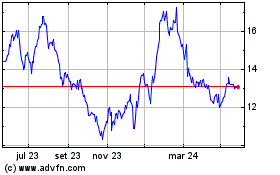

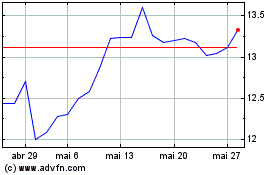

Antin Infrastructure Par... (EU:ANTIN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Antin Infrastructure Par... (EU:ANTIN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025