JBT Corporation (NYSE: JBT), a leading global technology

solutions provider to high-value segments of the food and beverage

industry, today announced that the Financial Supervisory Authority

of the Central Bank of Iceland (FSA) has granted an extension of

the expiration of JBT’s voluntary takeover offer to acquire all

issued and outstanding shares of Marel hf. (ICL: Marel).

The extension was granted to accommodate the regulatory reviews

by the European Commission (E.C.) and Australian Competition and

Consumer Commission (ACCC). On October 23, 2024, following the

completion of pre-notification information exchanges with the E.C.,

JBT formally notified the E.C. under EU Merger Regulation of JBT’s

proposed acquisition of Marel. The E.C. is now formally reviewing

the notification, and the standard 25 working day Phase 1 review

period comes to an end on November 28, 2024. Accordingly, JBT

anticipates receiving regulatory approval from the E.C. in late

November and is targeting to receive regulatory approval from the

ACCC during a similar timeframe to the E.C. approval.

The voluntary takeover offer, which was scheduled to expire on

November 11, 2024, will now expire on December 20, 2024, unless

such offer period is further extended in accordance with applicable

laws and the terms of the definitive agreement between JBT and

Marel. Shareholders that have previously tendered their Marel

shares do not need to re-tender their Marel shares or take any

other action in response to the extension of the voluntary takeover

offer.

Provided JBT achieves a minimum acceptance by Marel

shareholders, representing at least 90 percent of all Marel shares,

JBT plans to settle the offer consideration to Marel shareholders

within 5 Icelandic business days from the new expiration date of

the offer period (based on a planned amendment to the offer

document, extending the settlement period from 3 to 5 business

days). The settlement of the transaction is therefore expected to

close no later than January 3, 2025, taking into account all bank

holidays in the Icelandic market.

Transaction Advisors

Goldman Sachs Co LLC is acting as JBT’s financial advisor and

Kirkland & Ellis LLP and LEX are serving as JBT’s legal

counsel. Arion banki hf. is acting as JBT’s lead manager for the

Icelandic offer and advising on the Icelandic listing, and ABN AMRO

Bank N.V. is acting as JBT’s Euronext Amsterdam Exchange agent.

About JBT Corporation

JBT Corporation (NYSE: JBT) is a leading global technology

solutions provider to high-value segments of the food &

beverage industry. JBT designs, produces and services sophisticated

products and systems for a broad range of end markets, generating

roughly one-half of its annual revenue from recurring parts,

service, rebuilds and leasing operations. JBT employs approximately

5,100 people worldwide and operates sales, service, manufacturing

and sourcing operations in more than 25 countries. For more

information, please visit www.jbtc.com.

Forward-Looking Statements

This release contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

JBT’s ability to control. These forward-looking statements include,

among others, statements relating to our business and our results

of operations, a potential transaction with Marel, our strategic

plans, our restructuring plans and expected cost savings from those

plans, and our liquidity. The factors that could cause our actual

results to differ materially from expectations include, but are not

limited to, the following factors: the occurrence of any event,

change or other circumstances that could give rise to the

termination or abandonment of the voluntary takeover offer (the

“Offer"); the expected timing and likelihood of completion of the

proposed transaction with Marel, including the timing, receipt and

terms and conditions of any required governmental and regulatory

approvals for the Offer that could reduce anticipated benefits or

cause the parties to abandon the transaction; the risk that Marel

and/or JBT may not be able to satisfy the conditions to the Offer

in a timely manner or at all; the risk that the Offer and its

announcement could have an adverse effect on the ability of JBT and

Marel to retain customers and retain and hire key personnel and

maintain relationships with their suppliers and customers, and on

their operating results and businesses generally; the risk that

problems may arise in successfully integrating the businesses of

Marel and JBT, which may result in the combined company not

operating as effectively and efficiently as expected; the risk that

the combined company may be unable to achieve cost-cutting

synergies or that it may take longer than expected to achieve those

synergies; fluctuations in our financial results; unanticipated

delays or accelerations in our sales cycles; deterioration of

economic conditions, including impacts from supply chain delays and

reduced material or component availability; inflationary pressures,

including increases in energy, raw material, freight and labor

costs; disruptions in the political, regulatory, economic and

social conditions of the countries in which we conduct business;

changes to trade regulation, quotas, duties or tariffs;

fluctuations in currency exchange rates; changes in food

consumption patterns; impacts of pandemic illnesses, food borne

illnesses and diseases to various agricultural products; weather

conditions and natural disasters; the impact of climate change and

environmental protection initiatives; acts of terrorism or war,

including the ongoing conflicts in Ukraine and the Middle East;

termination or loss of major customer contracts and risks

associated with fixed-price contracts, particularly during periods

of high inflation; customer sourcing initiatives; competition and

innovation in our industries; our ability to develop and introduce

new or enhanced products and services and keep pace with

technological developments; difficulty in developing, preserving

and protecting our intellectual property or defending claims of

infringement; catastrophic loss at any of our facilities and

business continuity of our information systems; cyber-security

risks such as network intrusion or ransomware schemes; loss of key

management and other personnel; potential liability arising out of

the installation or use of our systems; our ability to comply with

U.S. and international laws governing our operations and

industries; increases in tax liabilities; work stoppages;

fluctuations in interest rates and returns on pension assets; a

systemic failure of the banking system in the United States or

globally impacting our customers' financial condition and their

demand for our goods and services; availability of and access to

financial and other resource; the risk factors discussed in our

proxy statement/prospectus filed pursuant to Rule 424(b) under the

Securities Act of 1933, as amended (File No. 333-279438), on June

25, 2024, forming part of the Registration Statement on Form S-4,

initially filed by us on May 15, 2024 and declared effective on

June 25, 2024; and other factors described under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in JBT’s most recent Annual

Report on Form 10-K filed with the Securities and Exchange

Commission (the "SEC") and in any subsequently filed Quarterly

Reports on Form 10-Q. JBT cautions shareholders and prospective

investors that actual results may differ materially from those

indicated by the forward-looking statements. JBT undertakes no

obligation to publicly update or revise any forward-looking

statements whether as a result of new information, future

developments, subsequent events or changes in circumstances or

otherwise.

Important Notices

This release is not intended to and does not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. In particular, this release is not an offer of

securities for sale in the United States, Iceland, the Netherlands

or Denmark.

Note to U.S. Shareholders

It is important that U.S. shareholders understand that the Offer

and any related offer documents are subject to disclosure and

takeover laws and regulations in Iceland and other European

jurisdictions, which may be different from those of the United

States. The Offer will be made in compliance with the U.S. tender

offer rules, including Regulation 14E under the Securities Exchange

Act of 1934 as amended (the "Exchange Act"), and any exemption

available to JBT in respect of securities of foreign private

issuers provided by Rule 14d-1(d) under the Exchange Act.

Important Additional Information

No offer of JBT securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption from registration, and

applicable European regulations, including the Icelandic Prospectus

Act no. 14/2020 and the Icelandic Takeover Act no. 108/2007 on

takeovers. In connection with the Offer, JBT filed with the SEC a

registration statement on Form S-4 (File No. 333-279438) (the

“Registration Statement”) that included a proxy

statement/prospectus (the “Proxy Statement/Prospectus”). The

Registration Statement was declared effective by the SEC on June

25, 2024. Additionally, JBT filed with the Financial Supervisory

Authority of the Central Bank of Iceland (the “FSA”) an offer

document and a prospectus, which have been approved by the FSA and

which have been published.

SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS,

THE PROSPECTUS, AND THE OFFER DOCUMENT, AS APPLICABLE, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC OR THE FSA CAREFULLY AND IN

THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION.

Shareholders may obtain a free copy of the Proxy

Statement/Prospectus, as well as other filings containing

information about JBT, without charge, at the SEC’s website at

www.sec.gov, and on JBT’s website at

https://ir.jbtc.com/overview/default.aspx. You may obtain a free

copy of the prospectus on the FSA’s website at www.fme.is and on

JBT’s website at https://www.jbtc.com/jbt-marel-offer-launch/ as

well as a free copy of the offer document.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030517556/en/

Investors & Media: Marlee Spangler (312) 861-5789

marlee.spangler@jbtc.com

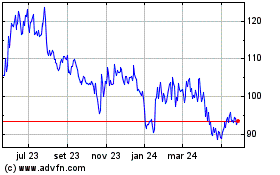

John Bean Technologies (NYSE:JBT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

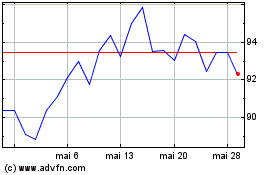

John Bean Technologies (NYSE:JBT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024