Narrows Full Year Outlook for Organic Net

Sales(1)(2), Adjusted Operating Income(1)(2), and Adjusted

EPS(1)(2)

Third Quarter Highlights

- Net sales decreased 2.8%; Organic Net Sales(1) decreased

2.2%

- Gross profit margin increased 20 basis points to 34.2%;

Adjusted Gross Profit Margin(1) increased 30 basis points to

34.3%

- Operating income decreased 115.5%, driven by non-cash

impairment losses of $1.4 billion; Adjusted Operating Income(1)

increased 1.4%

- Diluted EPS was $(0.24), down 214.3%; Adjusted EPS(1) was

$0.75, up 4.2%

- Year-to-date net cash provided by operating activities was $2.8

billion, up 6.7%; Free Cash Flow(1) was $2.0 billion, up 9.7%

- Year-to-date return of capital to stockholders was $2.0

billion

The Kraft Heinz Company (Nasdaq: KHC) (“Kraft Heinz” or the

“Company”) today reported financial results for the third quarter

of 2024.

“In the third quarter, our top-line performance across two of

our strategic pillars, Global Away From Home and Emerging Markets,

grew in line with our expectations,” said Kraft Heinz CEO Carlos

Abrams-Rivera. “As we look forward, we are expecting continued

momentum in these two pillars. When we look at our U.S. Retail

business, we are expecting more of an elongated recovery, driven by

specific categories that continue to experience pressure.”

“We continue to make investments in marketing, research and

development, and technology as we look to bring solutions to the

table that both create value for our consumers and support future

top-line growth. We are supporting these investments by our proven

ability to sustainably unlock efficiencies and generate strong cash

flow.”

Abrams-Rivera continued, “While a recovery is taking longer than

originally anticipated, we are not losing sight of our long-term

strategy. We remain confident in our ability to drive profitable

growth, generate strong cash flow, and return capital to our

stockholders.”

Net Sales

In millions

Net Sales

Organic Net Sales(1)

September 28,

2024

September 30, 2023

% Chg vs PY

YoY Growth Rate

Price

Volume/ Mix

For the Three Months Ended

North America

$

4,826

$

4,995

(3.4)%

(3.2)%

1.2 pp

(4.4) pp

International Developed Markets

882

883

(0.2)%

(1.8)%

(1.0) pp

(0.8) pp

Emerging Markets(a)

675

692

(2.4)%

4.9%

3.8 pp

1.1 pp

Kraft Heinz

$

6,383

$

6,570

(2.8)%

(2.2)%

1.2 pp

(3.4) pp

Net Sales

In millions

Net Sales

Organic Net Sales(1)

September 28, 2024

September 30, 2023

% Chg vs PY

YoY Growth Rate

Price

Volume/ Mix

For the Nine Months Ended

North America

$

14,575

$

14,959

(2.6)%

(2.5)%

1.6 pp

(4.1) pp

International Developed Markets

2,622

2,675

(2.0)%

(2.4)%

(0.1) pp

(2.3) pp

Emerging Markets(a)

2,073

2,146

(3.4)%

4.6%

3.3 pp

1.3 pp

Kraft Heinz

$

19,270

$

19,780

(2.6)%

(1.7)%

1.6 pp

(3.3) pp

(a)

Emerging Markets represents the

aggregation of our West and East Emerging Markets (“WEEM”) and Asia

Emerging Markets (“AEM”) operating segments.

Net Income/(Loss) and Diluted

EPS

In millions, except per share

data

For the Three Months

Ended

For the Nine Months

Ended

September 28,

2024

September 30, 2023

% Chg vs PY

September 28, 2024

September 30, 2023

% Chg vs PY

Gross profit

$

2,186

$

2,235

(2.2)%

$

6,723

$

6,609

1.7%

Operating income/(loss)

(101)

653

(115.5)%

1,723

3,272

(47.3)%

Net income/(loss)

(290)

254

(214.2)%

614

2,089

(70.6)%

Net income/(loss) attributable to common

shareholders

(290)

262

(210.7)%

613

2,098

(70.8)%

Diluted EPS

$

(0.24)

$

0.21

(214.3)%

$

0.50

$

1.70

(70.6)%

Adjusted EPS(1)

0.75

0.72

4.2%

2.22

2.20

0.9%

Adjusted Operating Income(1)

$

1,330

$

1,312

1.4%

$

3,975

$

3,908

1.7%

Q3 2024 Financial Summary

- Net sales decreased 2.8 percent versus the year-ago

period to $6.4 billion, including a negative 0.4 percentage point

impact from foreign currency and a negative 0.2 percentage point

impact from divestitures. Organic Net Sales(1) decreased 2.2

percent versus the prior year period. Price increased 1.2

percentage points versus the prior year period, with increases in

the North America and Emerging Markets segments partially offset by

lower price in International Developed Markets. Favorable price was

primarily due to pricing taken in certain categories to mitigate

higher input costs. Volume/mix declined 3.4 percentage points

versus the prior year period, with declines in the North America

and International Developed Markets segments partially offset by

volume/mix growth in Emerging Markets. Unfavorable volume/mix was

primarily driven by continued shifts in consumer behavior due to

economic uncertainty and a decline in Lunchables.

- Operating Income decreased 115.5 percent versus the

year-ago period to $(0.1) billion, as a result of non-cash

impairment losses of $1.4 billion in the current year period. This

impairment charge was due to an intangible asset impairment largely

on the Lunchables brand and a goodwill impairment related to the

Continental Europe reporting unit. Excluding the impact of these

non-cash impairment losses, operating income increased $12 million

due to factors noted in Adjusted Operating Income. Adjusted

Operating Income(1) increased 1.4 percent versus the year-ago

period to $1.3 billion, primarily driven by higher pricing, the

beneficial impact from our efficiency initiatives mostly in

procurement, and lower variable compensation expense. These factors

more than offset unfavorable volume/mix, increased manufacturing

expenses due in part to increased labor costs, and an unfavorable

impact from foreign currency (0.2 pp).

- Diluted EPS decreased 214.3 percent versus the prior

year period to $(0.24), driven by non-cash impairment losses in the

current year period. Adjusted EPS(1) was $0.75, up 4.2

percent versus the prior year period, primarily driven by higher

Adjusted Operating Income, fewer shares outstanding, and lower

taxes on adjusted earnings.

- Year-to-date net cash provided by/(used for) operating

activities was $2.8 billion, up 6.7 percent versus the year-ago

period. This increase was primarily due to favorable changes in

working capital driven by accounts payable and the lapping of prior

year cash payments associated with the settlement of the

consolidated securities class action lawsuit, which were partially

offset by higher cash outflows from inventory and variable

compensation in the 2024 period compared to the 2023 period.

Further, net cash by operating activities was favorably impacted by

increased Adjusted Operating Income. Free Cash Flow(1) was

$2.0 billion, up 9.7 percent versus the prior year period, driven

by the same net cash provided by/(used for) operating activities

discussed above.

- Capital Return: Year to date, the Company paid $1.5

billion in cash dividends and repurchased $538 million of common

stock. Of the $538 million in share repurchases in 2024, $350

million were repurchased under the Company’s publicly announced

share repurchase program and $188 million were purchased to offset

the dilutive effect of equity-based compensation. As of Sept. 28,

2024, the Company had remaining authorization to repurchase

approximately $2.4 billion of common stock under the publicly

announced share repurchase program.

Outlook

For fiscal year 2024, the Company now expects:

- Organic Net Sales(2) to be at the low end of the

previous guidance range of down 2 percent to flat versus the prior

year.

- Adjusted Operating Income(2) growth to be at the low end

of the previous guidance range of 1 to 3 percent versus the prior

year. This also contemplates expected Adjusted Gross Profit

Margin(1)(2) expansion at the lower end of the previous range of 75

to 125 basis points versus the prior year.

- Adjusted EPS(2) growth to be at the low end of the

previous guidance range of 1 to 3 percent, or in the range of $3.01

to $3.07. The Company expects an effective tax rate on Adjusted EPS

to be approximately 21 percent. Additionally, the Company expects

interest expense and other expense/(income) to be relatively flat

versus the prior year. This guidance does not reflect any impact

from future potential share repurchases.

End Notes

(1)

Organic Net Sales, Adjusted Gross

Profit, Adjusted Gross Profit Margin, Adjusted Operating Income,

Adjusted EPS, and Free Cash Flow are non-GAAP financial measures.

Please see discussion of non-GAAP financial measures and the

reconciliations at the end of this press release for more

information.

(2)

Guidance for Organic Net Sales,

Adjusted Gross Profit Margin, Adjusted Operating Income, and

Adjusted EPS is provided on a non-GAAP basis only because certain

information necessary to calculate the most comparable GAAP measure

is unavailable due to the uncertainty and inherent difficulty of

predicting the occurrence and the future financial statement impact

of such items impacting comparability, including, but not limited

to, the impact of currency, acquisitions and divestitures,

divestiture-related license income, restructuring activities, deal

costs, unrealized losses/(gains) on commodity hedges, impairment

losses, certain non-ordinary course legal and regulatory matters,

equity award compensation expense, nonmonetary currency

devaluation, and debt prepayment and extinguishment

(benefit)/costs, among other items. Therefore, as a result of the

uncertainty and variability of the nature and amount of future

adjustments, which could be significant, the Company is unable to

provide a reconciliation of these measures without unreasonable

effort.

Earnings Discussion and Webcast Information

A pre-recorded management discussion of The Kraft Heinz

Company's third quarter 2024 earnings is available at ir.kraftheinzcompany.com. The Company will host a

live question-and-answer session beginning today at 9:00 a.m.

Eastern Daylight Time. A webcast of the session will be accessible

at ir.kraftheinzcompany.com.

ABOUT THE KRAFT HEINZ COMPANY

We are driving transformation at The Kraft Heinz Company

(Nasdaq: KHC), inspired by our Purpose, Let’s Make Life Delicious.

Consumers are at the center of everything we do. With 2023 net

sales of approximately $27 billion, we are committed to growing our

iconic and emerging food and beverage brands on a global scale. We

leverage our scale and agility to unleash the full power of Kraft

Heinz across a portfolio of eight consumer-driven product

platforms. As global citizens, we’re dedicated to making a

sustainable, ethical impact while helping feed the world in

healthy, responsible ways. Learn more about our journey by visiting

www.kraftheinzcompany.com or following us on LinkedIn.

Forward-Looking Statements

This press release contains a number of forward-looking

statements. Words such as “accelerate,” “anticipate,” “believe,”

“commit,” “continue,” “expect,” “will,” “guidance,” and “outlook,”

and variations of such words and similar future or conditional

expressions are intended to identify forward-looking statements.

Examples of forward-looking statements include, but are not limited

to, statements regarding the Company's plans, impacts of accounting

standards and guidance, growth, legal matters, taxes, costs and

cost savings, impairments, dividends, expectations, investments,

innovations, opportunities, capabilities, execution, initiatives,

and pipeline. These forward-looking statements reflect management's

current expectations and are not guarantees of future performance

and are subject to a number of risks and uncertainties, many of

which are difficult to predict and beyond the Company's

control.

Important factors that may affect the Company's business and

operations and that may cause actual results to differ materially

from those in the forward-looking statements include, but are not

limited to, operating in a highly competitive industry; the

Company’s ability to correctly predict, identify, and interpret

changes in consumer preferences and demand, to offer new products

to meet those changes, and to respond to competitive innovation;

changes in the retail landscape or the loss of key retail

customers; changes in the Company's relationships with significant

customers or suppliers, or in other business relationships; the

Company’s ability to maintain, extend, and expand its reputation

and brand image; the Company’s ability to leverage its brand value

to compete against private label products; the Company’s ability to

drive revenue growth in its key product categories or platforms,

increase its market share, or add products that are in

faster-growing and more profitable categories; product recalls or

other product liability claims; climate change and legal or

regulatory responses; the Company’s ability to identify, complete,

or realize the benefits from strategic acquisitions, divestitures,

alliances, joint ventures, or investments; the Company's ability to

successfully execute its strategic initiatives; the impacts of the

Company's international operations; the Company's ability to

protect intellectual property rights; the Company’s ability to

realize the anticipated benefits from prior or future streamlining

actions to reduce fixed costs, simplify or improve processes, and

improve its competitiveness; the influence of the Company's largest

stockholder; the Company's level of indebtedness, as well as our

ability to comply with covenants under our debt instruments;

additional impairments of the carrying amounts of goodwill or other

indefinite-lived intangible assets; foreign exchange rate

fluctuations; volatility in commodity, energy, and other input

costs; volatility in the market value of all or a portion of the

commodity derivatives we use; compliance with laws and regulations

and related legal claims or regulatory enforcement actions; failure

to maintain an effective system of internal controls; a downgrade

in the Company's credit rating; the impact of sales of the

Company's common stock in the public market; the impact of the

Company’s share repurchases or any change in the Company’s share

repurchase activity; the Company’s ability to continue to pay a

regular dividend and the amounts of any such dividends; disruptions

in the global economy caused by geopolitical conflicts,

unanticipated business disruptions and natural events in the

locations in which the Company or the Company's customers,

suppliers, distributors, or regulators operate; economic and

political conditions in the United States and in various other

nations where the Company does business (including inflationary

pressures, instability in financial institutions, general economic

slowdown, recession, or a potential U.S. federal government

shutdown); changes in the Company's management team or other key

personnel and the Company's ability to hire or retain key personnel

or a highly skilled and diverse global workforce; our dependence on

information technology and systems, including service

interruptions, misappropriation of data, or breaches of security;

increased pension, labor, and people-related expenses; changes in

tax laws and interpretations and the final determination of tax

audits, including transfer pricing matters, and any related

litigation; volatility of capital markets and other macroeconomic

factors; and other factors. For additional information on these and

other factors that could affect the Company's forward-looking

statements, see the Company's risk factors, as they may be amended

from time to time, set forth in its filings with the Securities and

Exchange Commission (“SEC”). The Company disclaims and does not

undertake any obligation to update, revise, or withdraw any

forward-looking statement in this press release, except as required

by applicable law or regulation.

We use our investor relations website, ir.kraftheinzcompany.com, as a routine channel for

distribution of important, and often material, information about

Kraft Heinz, including quarterly and annual earnings results and

presentations, press releases and other announcements, webcasts,

analyst presentations, investor days, sustainability initiatives,

financial information, and corporate governance practices, as well

as archives of past presentations and events. We encourage you to

follow our investor relations website in addition to our filings

with the SEC to receive timely information about the Company. The

information on our website is not part of this press release and

shall not be deemed to be incorporated by reference into any

filings we make with the SEC.

Non-GAAP Financial Measures

The non-GAAP financial measures provided in this press release

should be viewed in addition to, and not as an alternative for,

results prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”).

To supplement the financial information provided, the Company

has presented Organic Net Sales, Adjusted Operating Income,

Constant Currency Adjusted Operating Income, Adjusted Gross Profit,

Adjusted Gross Profit Margin, Adjusted Net Income/(Loss), Adjusted

EPS, Free Cash Flow, and Net Leverage which are considered non-GAAP

financial measures. The non-GAAP financial measures presented may

differ from similarly titled non-GAAP financial measures presented

by other companies, and other companies may not define these

non-GAAP financial measures in the same way. These measures are not

substitutes for their comparable GAAP financial measures, such as

net sales, net income/(loss), gross profit, diluted earnings per

share (“EPS”), net cash provided by/(used for) operating

activities, or other measures prescribed by GAAP, and there are

limitations to using non-GAAP financial measures.

Management uses these non-GAAP financial measures to assist in

comparing the Company’s performance on a consistent basis for

purposes of business decision making by removing the impact of

certain items that management believes do not directly reflect the

Company’s underlying operations. The Company believes:

- Organic Net Sales, Adjusted Operating Income, Constant Currency

Adjusted Operating Income, Adjusted Gross Profit, Adjusted Gross

Profit Margin, Adjusted Net Income/(Loss), and Adjusted EPS provide

important comparability of underlying operating results, allowing

investors and management to assess the Company’s operating

performance on a consistent basis; and

- Free Cash Flow and Net Leverage provide measures of the

Company’s core operating performance, the cash-generating

capabilities of the Company’s business operations, and are factors

used in determining the Company’s borrowing capacity and the amount

of cash available for debt repayments, dividends, acquisitions,

share repurchases, and other corporate purposes.

Management believes that presenting the Company’s non-GAAP

financial measures is useful to investors because it (i) provides

investors with meaningful supplemental information regarding

financial performance by excluding certain items, (ii) permits

investors to view performance using the same tools that management

uses to budget, make operating and strategic decisions, and

evaluate historical performance, and (iii) otherwise provides

supplemental information that may be useful to investors in

evaluating the Company’s results. The Company believes that the

presentation of these non-GAAP financial measures, when considered

together with the corresponding GAAP financial measures and the

reconciliations to those measures, provides investors with

additional understanding of the factors and trends affecting the

Company’s business than could be obtained absent these

disclosures.

Definitions

Organic Net Sales is defined as net sales excluding, when

they occur, the impact of currency, acquisitions and divestitures,

and a 53rd week of shipments. The Company calculates the impact of

currency on net sales by holding exchange rates constant at the

previous year's exchange rate, with the exception of highly

inflationary subsidiaries, for which the Company calculates the

previous year's results using the current year's exchange rate.

Adjusted Operating Income is defined as operating

income/(loss) excluding, when they occur, the impacts of

restructuring activities, deal costs, unrealized gains/(losses) on

commodity hedges (the unrealized gains and losses are recorded in

general corporate expenses until realized; once realized, the gains

and losses are recorded in the applicable segment’s operating

results), impairment losses, and certain non-ordinary course legal

and regulatory matters. The Company also presents Adjusted

Operating Income on a constant currency basis (Constant Currency

Adjusted Operating Income). The Company calculates the impact

of currency on Adjusted Operating Income by holding exchange rates

constant at the previous year's exchange rate, with the exception

of highly inflationary subsidiaries, for which it calculates the

previous year's results using the current year's exchange rate.

Adjusted Gross Profit, Adjusted Net Income/(Loss), and

Adjusted EPS are defined as gross profit, net income/(loss),

and diluted earnings per share, respectively, excluding, when they

occur, the impacts of restructuring activities, deal costs,

unrealized losses/(gains) on commodity hedges, impairment losses,

certain non-ordinary course legal and regulatory matters,

losses/(gains) on the sale of a business, other losses/(gains)

related to acquisitions and divestitures (e.g., tax and hedging

impacts), nonmonetary currency devaluation (e.g., remeasurement

gains and losses), debt prepayment and extinguishment

(benefit)/costs, and certain significant discrete income tax items

(e.g., U.S. and non-U.S. tax reform), and including when they

occur, adjustments to reflect preferred stock dividend payments on

an accrual basis. Adjusted Gross Profit Margin is defined as

Adjusted Gross Profit divided by net sales.

Net Leverage is defined as debt less cash, cash

equivalents and short-term investments divided by Adjusted EBITDA.

Adjusted EBITDA is defined as net income/(loss) from

continuing operations before interest expense, other

expense/(income), provision for/(benefit from) income taxes, and

depreciation and amortization (excluding restructuring activities);

in addition to these adjustments, the Company excludes, when they

occur, the impacts of divestiture-related license income,

restructuring activities, deal costs, unrealized losses/(gains) on

commodity hedges, impairment losses, certain non-ordinary course

legal and regulatory matters, and equity award compensation expense

(excluding restructuring activities).

Free Cash Flow is defined as net cash provided by/(used

for) operating activities less capital expenditures. The use of

this non-GAAP measure does not imply or represent the residual cash

flow for discretionary expenditures since the Company has certain

non-discretionary obligations such as debt service that are not

deducted from the measure.

Schedule 1

The Kraft Heinz Company

Condensed Consolidated Statements

of Income

(in millions, except per share

data)

(Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Net sales

$

6,383

$

6,570

$

19,270

$

19,780

Cost of products sold

4,197

4,335

12,547

13,171

Gross profit

2,186

2,235

6,723

6,609

Selling, general and administrative

expenses, excluding impairment losses

859

920

2,718

2,675

Goodwill impairment losses

707

510

1,561

510

Intangible asset impairment losses

721

152

721

152

Selling, general and administrative

expenses

2,287

1,582

5,000

3,337

Operating income/(loss)

(101)

653

1,723

3,272

Interest expense

230

228

685

683

Other expense/(income)

(48)

(35)

(56)

(94)

Income/(loss) before income taxes

(283)

460

1,094

2,683

Provision for/(benefit from) income

taxes

7

206

480

594

Net income/(loss)

(290)

254

614

2,089

Net income/(loss) attributable to

noncontrolling interest

—

(8)

1

(9)

Net income/(loss) attributable to common

shareholders

$

(290)

$

262

$

613

$

2,098

Basic shares outstanding

1,210

1,229

1,212

1,228

Diluted shares outstanding

1,210

1,235

1,217

1,235

Per share data applicable to common

shareholders:

Basic earnings/(loss) per share

$

(0.24)

$

0.21

$

0.51

$

1.71

Diluted earnings/(loss) per share

(0.24)

0.21

0.50

1.70

Schedule 2

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Three Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions and

Divestitures

Organic Net Sales

Price

Volume/Mix

September 28, 2024

North America

$

4,826

$

(8)

$

—

$

4,834

International Developed Markets

882

15

—

867

Emerging Markets

675

(23)

—

698

Kraft Heinz

$

6,383

$

(16)

$

—

$

6,399

September 30, 2023

North America

$

4,995

$

—

$

—

$

4,995

International Developed Markets

883

—

—

883

Emerging Markets

692

11

16

665

Kraft Heinz

$

6,570

$

11

$

16

$

6,543

Year-over-year growth rates

North America

(3.4)%

(0.2) pp

0.0 pp

(3.2)%

1.2 pp

(4.4) pp

International Developed Markets

(0.2)%

1.6 pp

0.0 pp

(1.8)%

(1.0) pp

(0.8) pp

Emerging Markets

(2.4)%

(4.9) pp

(2.4) pp

4.9%

3.8 pp

1.1 pp

Kraft Heinz

(2.8)%

(0.4) pp

(0.2) pp

(2.2)%

1.2 pp

(3.4) pp

Schedule 3

The Kraft Heinz Company

Reconciliation of Net Sales to

Organic Net Sales

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Net Sales

Currency

Acquisitions and

Divestitures

Organic Net Sales

Price

Volume/Mix

September 28, 2024

North America

$

14,575

$

(15)

$

—

$

14,590

International Developed Markets

2,622

10

—

2,612

Emerging Markets(a)

$

2,073

$

(69)

$

12

$

2,130

Kraft Heinz

$

19,270

$

(74)

$

12

$

19,332

September 30, 2023

North America

$

14,959

$

—

$

—

$

14,959

International Developed Markets

2,675

—

—

2,675

Emerging Markets(a)

$

2,146

$

59

$

50

$

2,037

Kraft Heinz

$

19,780

$

59

$

50

$

19,671

Year-over-year growth rates

North America

(2.6)%

(0.1) pp

0.0 pp

(2.5)%

1.6 pp

(4.1) pp

International Developed Markets

(2.0)%

0.4 pp

0.0 pp

(2.4)%

(0.1) pp

(2.3) pp

Emerging Markets(a)

(3.4)%

(6.1) pp

(1.9) pp

4.6%

3.3 pp

1.3 pp

Kraft Heinz

(2.6)%

(0.7) pp

(0.2) pp

(1.7)%

1.6 pp

(3.3) pp

(a)

Emerging Markets represents the

aggregation of our WEEM and AEM operating segments.

Schedule 4

The Kraft Heinz Company

Reconciliation of Operating

Income/(Loss) to Adjusted Operating Income

(dollars in millions)

(Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Operating income/(loss)

$

(101)

$

653

1,723

3,272

Restructuring activities

—

45

—

25

Unrealized losses/(gains) on commodity

hedges

3

(48)

(30)

(53)

Impairment losses

1,428

662

2,282

662

Certain non-ordinary course legal and

regulatory matters

—

—

—

2

Adjusted Operating Income

$

1,330

$

1,312

$

3,975

$

3,908

Segment Adjusted Operating Income:

North America

$

1,237

$

1,245

$

3,793

$

3,701

International Developed Markets

135

129

397

376

Total Segment Adjusted Operating

Income

1,372

1,374

4,190

4,077

Emerging Markets Segment Adjusted

Operating Income(a)

84

88

232

286

General corporate expenses

(126)

(150)

(447)

(455)

Adjusted Operating Income

$

1,330

$

1,312

$

3,975

$

3,908

(a)

Segment Adjusted Operating Income

for Emerging Markets, which represents the combination of our WEEM

and AEM operating segments, is defined and presented consistently

with the Segment Adjusted Operating Income of our reportable

segments - North America and International Developed Markets.

Schedule 5

The Kraft Heinz Company

Reconciliation of Adjusted

Operating Income to Constant Currency Adjusted Operating Income

For the Three Months Ended

(dollars in millions)

(Unaudited)

Adjusted Operating

Income

Currency

Constant Currency Adjusted

Operating Income

September 28, 2024

North America

$

1,237

$

(3)

$

1,240

International Developed Markets

135

3

132

Emerging Markets

84

(1)

85

General corporate expenses

(126)

—

(126)

Kraft Heinz

$

1,330

$

(1)

$

1,331

September 30, 2023

North America

$

1,245

$

—

$

1,245

International Developed Markets

129

—

129

Emerging Markets

88

2

86

General corporate expenses

(150)

—

(150)

Kraft Heinz

$

1,312

$

2

$

1,310

Year-over-year growth rates

North America

(0.6)%

(0.2) pp

(0.4)%

International Developed Markets

4.2%

2.2 pp

2.0%

Emerging Markets

(4.5)%

(3.5) pp

(1.0)%

General corporate expenses

(15.9)%

0.3 pp

(16.2)%

Kraft Heinz

1.4%

(0.2) pp

1.6%

Schedule 6

The Kraft Heinz Company

Reconciliation of Adjusted

Operating Income to Constant Currency Adjusted Operating Income

For the Nine Months Ended

(dollars in millions)

(Unaudited)

Adjusted Operating

Income

Currency

Constant Currency

Adjusted Operating

Income

September 28, 2024

North America

$

3,793

$

(4)

$

3,797

International Developed Markets

397

7

390

Emerging Markets

232

(9)

241

General corporate expenses

(447)

(1)

(446)

Kraft Heinz

$

3,975

$

(7)

$

3,982

September 30, 2023

North America

$

3,701

$

—

$

3,701

International Developed Markets

376

—

376

Emerging Markets

286

11

275

General corporate expenses

(455)

—

(455)

Kraft Heinz

$

3,908

$

11

$

3,897

Year-over-year growth rates

North America

2.5%

(0.1) pp

2.6%

International

5.6%

1.7 pp

3.9%

Emerging Markets

(19.0)%

(6.5) pp

(12.5)%

General corporate expenses

(1.8)%

0.3 pp

(2.1)%

Kraft Heinz

1.7%

(0.5) pp

2.2%

Schedule

7

The Kraft Heinz Company

Reconciliation of GAAP Results to

Non-GAAP Results

(dollars in millions)

(Unaudited)

For the Three Months

Ended

September 28, 2024

Gross profit

Selling, general and

administrative expenses

Operating income/

(loss)

Interest expense

Other expense/

(income)

Income/ (loss) before income

taxes

Provision for/ (benefit from)

income taxes

Net income/ (loss)

Net income/ (loss)

attributable to noncontrolling interest

Net income/ (loss)

attributable to common shareholders

Diluted EPS

GAAP Results

$

2,186

$

2,287

$

(101)

$

230

$

(48)

$

(283)

$

7

$

(290)

$

—

$

(290)

$

(0.24)

Items Affecting Comparability

Restructuring activities

—

—

—

—

7

(7)

(2)

(5)

—

(5)

—

Unrealized losses/(gains) on commodity

hedges

3

—

3

—

—

3

1

2

—

2

—

Impairment losses

—

(1,428)

1,428

—

—

1,428

229

1,199

—

1,199

0.99

Losses/(gains) on sale of business

—

—

—

—

—

—

(4)

4

—

4

—

Nonmonetary currency devaluation

—

—

—

—

(3)

3

—

3

—

3

—

Adjusted Non-GAAP Results

$

2,189

$

1,330

$

913

$

0.75

Schedule

8

The Kraft Heinz Company

Reconciliation of GAAP Results to

Non-GAAP Results

(dollars in millions)

(Unaudited)

For the Three Months

Ended

September 30, 2023

Gross profit

Selling, general and

administrative expenses

Operating income/

(loss)

Interest expense

Other expense/

(income)

Income/ (loss) before income

taxes

Provision for/ (benefit from)

income taxes

Net income/ (loss)

Net income/ (loss)

attributable to noncontrolling interest

Net income/ (loss)

attributable to common shareholders

Diluted EPS

GAAP Results

$

2,235

$

1,582

$

653

$

228

$

(35)

$

460

$

206

$

254

$

(8)

$

262

$

0.21

Items Affecting Comparability

Restructuring activities

44

(1)

45

—

—

45

8

37

—

37

0.03

Unrealized losses/(gains) on commodity

hedges

(48)

—

(48)

—

—

(48)

(12)

(36)

—

(36)

(0.03)

Impairment losses

—

(662)

662

—

—

662

36

626

6

620

0.50

Nonmonetary currency devaluation

—

—

—

—

(9)

9

—

9

—

9

0.01

Adjusted Non-GAAP Results

$

2,231

$

1,312

$

890

$

0.72

Schedule

9

The Kraft Heinz Company

Reconciliation of GAAP Results to

Non-GAAP Results

(dollars in millions)

(Unaudited)

For the Nine Months

Ended

September 28, 2024

Gross profit

Selling, general and

administrative expenses

Operating income/

(loss)

Interest expense

Other expense/

(income)

Income/ (loss) before income

taxes

Provision for/ (benefit from)

income taxes

Net income/ (loss)

Net income/ (loss)

attributable to noncontrolling interest

Net income/ (loss)

attributable to common shareholders

Diluted EPS

GAAP Results

$

6,723

$

5,000

$

1,723

$

685

$

(56)

$

1,094

$

480

$

614

$

1

$

613

$

0.50

Items Affecting Comparability

Restructuring activities

2

2

—

—

8

(8)

(2)

(6)

—

(6)

—

Unrealized losses/(gains) on commodity

hedges

(30)

—

(30)

—

—

(30)

(8)

(22)

—

(22)

(0.02)

Impairment losses

—

(2,282)

2,282

—

—

2,282

229

2,053

—

2,053

1.69

Losses/(gains) on sale of business

—

—

—

—

(78)

78

21

57

—

57

0.05

Nonmonetary currency devaluation

—

—

—

—

(7)

7

—

7

—

7

—

Adjusted Non-GAAP Results

$

6,695

$

3,975

$

2,703

$

2.22

Schedule

10

The Kraft Heinz Company

Reconciliation of GAAP Results to

Non-GAAP Results

(dollars in millions)

(Unaudited)

For the Nine Months

Ended

September 30, 2023

Gross profit

Selling, general and

administrative expenses

Operating income/

(loss)

Interest expense

Other expense/

(income)

Income/ (loss) before income

taxes

Provision for/ (benefit from)

income taxes

Net income/ (loss)

Net income/ (loss)

attributable to noncontrolling interest

Net income/ (loss)

attributable to common shareholders

Diluted EPS

GAAP Results

$

6,609

$

3,337

$

3,272

$

683

$

(94)

$

2,683

$

594

$

2,089

$

(9)

$

2,098

$

1.70

Items Affecting Comparability

Restructuring activities

44

19

25

—

(2)

27

5

22

—

22

0.02

Unrealized losses/(gains) on commodity

hedges

(53)

—

(53)

—

—

(53)

(13)

(40)

—

(40)

(0.03)

Impairment losses

—

(662)

662

—

—

662

36

626

6

620

0.50

Certain non-ordinary course legal and

regulatory matters

—

(2)

2

—

—

2

—

2

—

2

—

Losses/(gains) on sale of business

—

—

—

—

(2)

2

—

2

—

2

—

Nonmonetary currency devaluation

—

—

—

—

(27)

27

—

27

—

27

0.02

Certain significant discrete income tax

items

—

—

—

—

—

—

17

(17)

—

(17)

(0.01)

Adjusted Non-GAAP Results

$

6,600

$

3,908

$

2,711

$

2.20

Schedule

11

The Kraft Heinz Company

Adjusted Gross Profit Margin

(dollars in millions)

(Unaudited)

For the Three Months

Ended

For the Nine Months

Ended

September 28, 2024

September 30, 2023

September 28, 2024

September 30, 2023

Adjusted Gross Profit

$

2,189

$

2,231

$

6,695

$

6,600

Net sales

6,383

6,570

19,270

19,780

Adjusted Gross Profit Margin

34.3%

34.0%

34.7%

33.4%

Schedule

12

The Kraft Heinz Company

Key Drivers of Change in Adjusted

EPS

(Unaudited)

For the Three Months

Ended

September 28, 2024

September 30, 2023

$ Change

Key drivers of change in Adjusted EPS:

Results of operations(a)(b)

$

0.84

$

0.83

$

0.01

Interest expense

(0.15)

(0.15)

—

Other expense/(income)

0.04

0.04

—

Effective tax rate

0.01

—

0.01

Effect of share repurchases

0.01

—

0.01

Adjusted EPS

$

0.75

$

0.72

$

0.03

(a)

Includes non-cash amortization of

definite-lived intangible assets, which accounted for a negative

impact to Adjusted EPS from results of operations of $0.04 for the

three months ended September 28, 2024 and September 30, 2023.

(b)

Includes divestiture-related

license income, which accounted for a benefit to Adjusted EPS from

results of operations of $0.01 for the three months ended September

28, 2024 and September 30, 2023.

Schedule

13

The Kraft Heinz Company

Key Drivers of Change in Adjusted

EPS

(Unaudited)

For the Nine Months

Ended

September 28, 2024

September 30, 2023

$ Change

Key drivers of change in Adjusted EPS:

Results of operations(a)(b)

$

2.60

$

2.56

$

0.04

Interest expense

(0.45)

(0.45)

—

Other expense/(income)

0.09

0.09

—

Effective tax rate

(0.05)

—

(0.05)

Effect of share repurchases

0.03

—

0.03

Adjusted EPS

$

2.22

$

2.20

$

0.02

(a)

Includes non-cash amortization of

definite-lived intangible assets, which accounted for a negative

impact to Adjusted EPS from results of operations of $0.13 for the

nine months ended September 28, 2024 and $0.12 for the nine months

ended September 30, 2023.

(b)

Includes divestiture-related

license income, which accounted for a benefit to Adjusted EPS from

results of operations of $0.03 for the nine months ended September

28, 2024 and September 30, 2023.

Schedule 14

The Kraft Heinz Company

Condensed Consolidated Balance

Sheets

(in millions, except per share

data)

(Unaudited)

September 28, 2024

December 30, 2023

ASSETS

Cash and cash equivalents

$

1,284

$

1,400

Trade receivables, net

2,178

2,112

Inventories

3,872

3,614

Prepaid expenses

228

234

Other current assets

633

566

Assets held for sale

7

3

Total current assets

8,202

7,929

Property, plant and equipment, net

7,137

7,122

Goodwill

28,946

30,459

Intangible assets, net

41,802

42,448

Other non-current assets

2,479

2,381

TOTAL ASSETS

$

88,566

$

90,339

LIABILITIES AND EQUITY

Commercial paper and other short-term

debt

$

13

$

—

Current portion of long-term debt

695

638

Accounts payable

4,553

4,627

Accrued marketing

752

733

Interest payable

273

258

Income taxes payable

—

—

Other current liabilities

1,442

1,781

Liabilities held for sale

—

—

Total current liabilities

7,728

8,037

Long-term debt

19,383

19,394

Deferred income taxes

10,023

10,201

Accrued postemployment costs

140

143

Long-term deferred income

1,386

1,424

Other non-current liabilities

1,437

1,418

TOTAL LIABILITIES

40,097

40,617

Redeemable noncontrolling interest

6

34

Equity:

Common stock, $0.01 par value

12

12

Additional paid-in capital

52,106

52,037

Retained earnings/(deficit)

521

1,367

Accumulated other comprehensive

income/(losses)

(2,547)

(2,604)

Treasury stock, at cost

(1,764)

(1,286)

Total shareholders' equity

48,328

49,526

Noncontrolling interest

135

162

TOTAL EQUITY

48,463

49,688

TOTAL LIABILITIES AND EQUITY

$

88,566

$

90,339

Schedule 15

The Kraft Heinz Company

Condensed Consolidated Statements

of Cash Flows

(in millions)

(Unaudited)

For the Nine Months

Ended

September 28, 2024

September 30, 2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income/(loss)

$

614

$

2,089

Adjustments to reconcile net income/(loss)

to operating cash flows:

Depreciation and amortization

714

710

Amortization of postemployment benefit

plans prior service costs/(credits)

(6)

(10)

Divestiture-related license income

(41)

(41)

Equity award compensation expense

83

110

Deferred income tax

provision/(benefit)

(277)

(15)

Postemployment benefit plan

contributions

16

(18)

Goodwill and intangible asset impairment

losses

2,282

662

Nonmonetary currency devaluation

7

27

Loss/(gain) on sale of business

78

2

Other items, net

(39)

(44)

Changes in current assets and

liabilities:

Trade receivables

(83)

(16)

Inventories

(392)

(277)

Accounts payable

48

(221)

Other current assets

(129)

139

Other current liabilities

(79)

(477)

Net cash provided by/(used for) operating

activities

2,796

2,620

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(777)

(779)

Proceeds from sale of business, net of

cash disposed and working capital adjustments

5

—

Payments to acquire intangible assets

(140)

—

Other investing activities, net

63

41

Net cash provided by/(used for) investing

activities

(849)

(738)

CASH FLOWS FROM FINANCING ACTIVITIES:

Repayments of long-term debt

(607)

(823)

Proceeds from issuance of long-term

debt

594

657

Dividends paid

(1,452)

(1,474)

Repurchases of common stock

(538)

(150)

Other financing activities, net

(43)

(26)

Net cash provided by/(used for) financing

activities

(2,046)

(1,816)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(17)

(53)

Cash, cash equivalents, and restricted

cash

Net increase/(decrease)

(116)

13

Balance at beginning of period

1,404

1,041

Balance at end of period

$

1,288

$

1,054

Schedule 16

The Kraft Heinz Company

Reconciliation of Net Cash

Provided By/(Used For) Operating Activities to Free Cash Flow

(in millions)

(Unaudited)

For the Nine Months

Ended

September 28, 2024

September 30, 2023

Net cash provided by/(used for) operating

activities

$

2,796

$

2,620

Capital expenditures

(777)

(779)

Free Cash Flow

$

2,019

$

1,841

Adjusted Net Income/(Loss)

$

2,703

$

2,711

Free Cash Flow Conversion

75%

68%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030085196/en/

Alex Abraham (media) Alex.Abraham@kraftheinz.com

Anne-Marie Megela (investors)

anne-marie.megela@kraftheinz.com

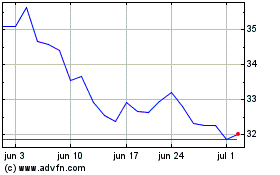

Kraft Heinz (NASDAQ:KHC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Kraft Heinz (NASDAQ:KHC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024