Results Reflect Challenged Customer Experience;

Management is Developing a Plan to Get Back to Starbucks Q4

Consolidated Net Revenues Down 3% to $9.1 Billion; Frequency

Declined Across Customer Segments Q4 GAAP and Non-GAAP EPS of

$0.80; Traffic Focused Investments Further Pressured Results Q4

Active U.S. Starbucks® Rewards Membership Totals 33.8 Million, Up

4% Over Prior Year

Starbucks Corporation (Nasdaq: SBUX) today reported financial

results for its 13-week fiscal fourth quarter and 52-week fiscal

year ended September 29, 2024. GAAP results in fiscal 2024 and

fiscal 2023 include items that are excluded from non-GAAP results.

Please refer to the reconciliation of GAAP measures to non-GAAP

measures at the end of this release for more information.

Q4 Fiscal Year 2024

Highlights

- Global comparable store sales declined 7%, driven by an 8%

decline in comparable transactions, partially offset by a 2%

increase in average ticket

- North America and U.S. comparable store sales declined 6%,

driven by a 10% decline in comparable transactions, partially

offset by a 4% increase in average ticket

- International comparable store sales declined 9%, driven by a

5% decline in average ticket and a 4% decline in comparable

transactions; China comparable store sales declined 14%, driven by

an 8% decline in average ticket and a 6% decline in comparable

transactions

- The company opened 722 net new stores in Q4, ending the period

with 40,199 stores: 52% company-operated and 48% licensed

- At the end of Q4, stores in the U.S. and China comprised 61% of

the company’s global portfolio, with 16,941 and 7,596 stores in the

U.S. and China, respectively

- Consolidated net revenues declined 3%, including on a constant

currency basis, to $9.1 billion

- GAAP operating margin contracted 380 basis points

year-over-year to 14.4%, primarily driven by deleverage,

investments in store partner wages and benefits, and increased

promotional activity. This contraction was partially offset by

pricing and in-store operational efficiencies.

- Non-GAAP operating margin contracted 380 basis points

year-over-year to 14.4%, or contracted 370 basis points on a

constant currency basis

- GAAP earnings per share of $0.80 declined 25% over prior year

- Non-GAAP earnings per share of $0.80 declined 25% over prior

year, or declined 24% on a constant currency basis

- Starbucks Rewards loyalty program 90-day active members in the

U.S. totaled 33.8 million, up 4% year-over-year and flat

quarter-over-quarter

Full Fiscal Year 2024

Highlights

- Global comparable store sales declined 2%, driven by a 4%

decline in comparable transactions, partially offset by a 2%

increase in average ticket

- North America and U.S. comparable store sales declined 2%,

driven by a 5% decline in comparable transactions, partially offset

by a 4% increase in average ticket

- International comparable store sales declined 4%, driven by a

4% decline in average ticket; China comparable store sales declined

8%, driven by an 8% decline in average ticket

- Consolidated net revenues increased 1%, including on a constant

currency basis, to $36.2 billion

- GAAP operating margin contracted 130 basis points

year-over-year to 15.0%, primarily driven by investments in store

partner wages and benefits, deleverage, and increased promotional

activity. This contraction was partially offset by pricing and

in-store operational efficiencies.

- Non-GAAP operating margin contracted 110 basis points

year-over-year, including on a constant currency basis, to

15.0%

- GAAP earnings per share of $3.31 declined 8% over prior year

- Non-GAAP earnings per share of $3.31 declined 6% over prior

year, including on a constant currency basis

“As shared in our Press Release last week, our results do not

reflect the strength of our brand,” commented Rachel Ruggeri, chief

financial officer. “I have seen what Starbucks is capable of when

we focus on what we do best. I have confidence in our ability to

turn around our business and expect we will return to long-term

growth,” Ruggeri added.

“It is clear we need to fundamentally change our strategy to win

back customers. ‘Back to Starbucks’ is that fundamental change,”

commented Brian Niccol, chairman and chief executive officer. “My

experience tells me that when we get back to our core identity and

consistently deliver a great experience, our customers will come

back. We have a clear plan and are moving quickly to return

Starbucks to growth,” Niccol added.

Q4 North America Segment

Results

Quarter Ended

($ in millions)

Sep 29, 2024

Oct 1, 2023

Change (%)

Change in Comparable Store Sales (1)

(6)%

8%

Change in Transactions

(10)%

2%

Change in Ticket

4%

6%

Store Count

18,424

17,810

3%

Revenues

$6,691.9

$6,900.0

(3)%

Operating Income

$1,253.5

$1,601.4

(22)%

Operating Margin

18.7%

23.2%

(450) bps

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude the

effects of fluctuations in foreign currency exchange rates and

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours remain in comparable store sales while

stores identified for permanent closure have been removed.

Net revenues for the North America segment decreased 3% over Q4

FY23 to $6.7 billion in Q4 FY24, primarily due to a 6% decline in

comparable store sales, driven by a 10% decline in comparable

transactions, partially offset by a 4% increase in average ticket,

as well as a decline in our licensed store business. This decrease

was partially offset by net new company-operated store growth of 5%

over the past 12 months.

Operating income decreased to $1.3 billion in Q4 FY24 compared

to $1.6 billion in Q4 FY23. Operating margin of 18.7% contracted

from 23.2% in the prior year, primarily driven by deleverage,

investments in store partner wages and benefits, and increased

promotional activity. This contraction was partially offset by

pricing, and in-store operational efficiencies.

Q4 International Segment

Results

Quarter Ended

($ in millions)

Sep 29, 2024

Oct 1, 2023

Change (%)

Change in Comparable Store Sales (1)

(9)%

5%

Change in Transactions

(4)%

6%

Change in Ticket

(5)%

(1)%

Store Count

21,775

20,228

8%

Revenues

$1,893.2

$1,979.9

(4)%

Operating Income

$282.9

$301.3

(6)%

Operating Margin

14.9%

15.2%

(30) bps

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude the

effects of fluctuations in foreign currency exchange rates and

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours remain in comparable store sales while

stores identified for permanent closure have been removed.

Net revenues for the International segment declined 4% over Q4

FY23 to $1.9 billion in Q4 FY24, primarily due to a 9% decline in

comparable store sales, driven by a 5% decline in average ticket

and a 4% decline in comparable transactions, as well as a decline

in our licensed store business. Another factor was an approximate

1% unfavorable impact from foreign currency translation. This

decline was partially offset by net new company-operated store

growth of 10% over the past 12 months.

Operating income decreased to $282.9 million in Q4 FY24 compared

to $301.3 million in Q4 FY23. Operating margin of 14.9% contracted

from 15.2% in the prior year, primarily driven by increased

promotional activity and investments in store partner wages and

benefits. This contraction was partially offset by in-store

operational efficiencies and pricing.

Q4 Channel Development Segment

Results

Quarter Ended

($ in millions)

Sep 29, 2024

Oct 1, 2023

Change (%)

Revenues

$465.4

$486.1

(4)%

Operating Income

$264.7

$271.2

(2)%

Operating Margin

56.9%

55.8%

110 bps

Net revenues for the Channel Development segment declined 4%

over Q4 FY23 to $465.4 million in Q4 FY24, primarily due to a

decline in revenue in the Global Coffee Alliance from SKU

optimization. This decline was partially offset by an increase in

global ready-to-drink revenue.

Operating income decreased to $264.7 million in Q4 FY24 compared

to $271.2 million in Q4 FY23. Operating margin of 56.9% expanded

from 55.8% in the prior year, primarily driven by sales mix shift

and lower product costs related to the Global Coffee Alliance. This

expansion was partially offset by the higher costs in our North

American Coffee Partnership joint venture income.

Fiscal Year 2025 Financial

Targets

As stated in our October 22, 2024 announcement, given the

company’s ceo transition coupled with the current state of the

business, guidance is suspended for full fiscal year 2025. We

believe this will allow ample opportunity to complete an assessment

of the business and solidify key strategies, while stabilizing and

positioning the business for long-term growth. The company will

provide initial information regarding its new strategies during its

Q4 and full fiscal year 2024 earnings conference call starting

today at 2:00 p.m. Pacific Time. Our October 22, 2024 announcement

and accompanying prepared remarks from our chairman and ceo can be

accessed on the company's Investor Relations website. The company

uses its website as a tool to disclose important information about

the company and comply with its disclosure obligations under

Regulation Fair Disclosure.

Company Update

- In August, the company announced that Brian Niccol had been

appointed chief executive officer and chairman of the Starbucks

Board of Directors (the "Board"), effective September 9, 2024.

Mellody Hobson, former chairman of the Board, became the lead

independent director of the Board. Laxman Narasimhan, former chief

executive officer and member of the Board, stepped down from his

position effective August 12, 2024, with the Board appointing

Rachel Ruggeri, chief financial officer, as interim chief executive

officer.

- In September, Brian Niccol shared an open letter of his early

observations and commitment to getting "Back to Starbucks," a

welcoming coffeehouse where people gather and where we serve the

finest coffee, handcrafted by our skilled baristas. Niccol also

shared his initial four key areas of focus.

- In September, the company announced Michael Conway, chief

executive officer, North America, would retire from the company

effective November 30, 2024.

- In September, the company announced Molly Liu as executive vice

president and chief executive officer of Starbucks China, and

Belinda Wong as chairwoman of Starbucks China, each effective

September 30, 2024.

- In October, the company announced the addition of two new

coffee innovation farms located in Guatemala and Costa Rica, with

future farm investments in Africa and Asia. The expansion of its

collaborative coffee innovation network further connects farmers

from around the world with resources to protect the future of

coffee for all.

- On October 22, 2024, the company shared preliminary Q4 and full

fiscal year 2024 results, reflecting a challenged customer

experience and reiterating a fundamental change to our

strategy.

- The Board declared a cash dividend of $0.61 per share, payable

on November 29, 2024, to shareholders of record on November 15,

2024. The company had 58 consecutive quarters of dividend payouts

with CAGR of approximately 20% over that time period, demonstrating

the company's commitment to consistent value creation for

shareholders.

Conference Call

Starbucks will hold a conference call today at 2:00 p.m. Pacific

Time, which will be hosted by Brian Niccol, chairman and ceo, and

Rachel Ruggeri, cfo. The call will be webcast and can be accessed

at http://investor.starbucks.com. A replay of the webcast will be

available until end of day Friday, December 13, 2024.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to

ethically sourcing and roasting high-quality arabica coffee. Today,

with more than 40,000 stores worldwide, the company is the premier

roaster and retailer of specialty coffee in the world. Through our

unwavering commitment to excellence and our guiding principles, we

bring the unique Starbucks Experience to life for every customer

through every cup. To share in the experience, please visit us in

our stores or online at stories.starbucks.com or

www.starbucks.com.

Forward-Looking

Statements

Certain statements contained herein and in our investor

conference call related to these results are “forward-looking”

statements within the meaning of applicable securities laws and

regulations. Generally, these statements can be identified by the

use of words such as “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “feel,” “forecast,” “intend,” “may,”

“outlook,” “plan,” “potential,” “predict,” “project,” “seek,”

“should,” “will,” “would,” and similar expressions intended to

identify forward-looking statements, although not all

forward-looking statements contain these identifying words. By

their nature, forward-looking statements involve risks,

uncertainties, and other factors (many beyond our control) that

could cause our actual results to differ materially from our

historical experience or from our current expectations or

projections. Our forward-looking statements, and the risks and

uncertainties related thereto, include, but are not limited to,

those described under the “Risk Factors” and “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” sections of the company’s most recently filed periodic

reports on Form 10-K and Form 10-Q and in other filings with the

SEC, as well as, among others:

- our ability to preserve, grow, and leverage our brands,

including the risk of negative responses by consumers (such as

boycotts or negative publicity campaigns), governmental actors

(such as retaliatory legislative treatment), or other third parties

who object to certain actions taken or not taken by the Company,

which responses could adversely affect our brand value;

- the impact of our marketing strategies, promotional and

advertising plans, pricing strategies, platforms, reformulations,

innovations, or customer experience initiatives or

investments;

- the costs and risks associated with, and the successful

execution and effects of, our existing and any future business

opportunities, expansions, initiatives, strategies, investments,

and plans, including our "Back to Starbucks" plan;

- changes in consumer preferences, demand, consumption, or

spending behavior, including due to shifts in demographic or health

and wellness trends, reduction in discretionary spending and price

increases, and our ability to anticipate or react to these

changes;

- the ability of our business partners, suppliers and third-party

providers to fulfill their responsibilities and commitments;

- the potential negative effects of incidents involving food or

beverage-borne illnesses, tampering, adulteration, contamination or

mislabeling;

- our ability to open new stores and efficiently maintain the

attractiveness of our existing stores;

- our dependence on the financial performance of our North

America operating segment, and our increasing dependence on certain

international markets;

- our anticipated operating expenses, including our anticipated

total capital expenditures;

- inherent risks of operating a global business including

changing conditions in our markets, local factors affecting store

openings, protectionist trade or foreign investment policies,

economic or trade sanctions, compliance with local laws and other

regulations, and local labor policies and conditions, including

labor strikes and work stoppages;

- higher costs, lower quality, or unavailability of coffee,

dairy, cocoa, energy, water, raw materials, or product

ingredients;

- the potential impact on our supply chain of adverse weather

conditions, natural disasters, or significant increases in

logistics costs;

- the ability of our supply chain to meet current or future

business needs and our ability to scale and improve our

forecasting, planning, production, and logistics management;

- a worsening in the terms and conditions upon which we engage

with our manufacturers and source suppliers, whether resulting from

broader local or global conditions, or dynamics specific to our

relationships with such parties;

- the impact of unfavorable global or regional economic

conditions and related economic slowdowns or recessions, low

consumer confidence, high unemployment, weak credit or capital

markets, budget deficits, burdensome government debt, austerity

measures, higher interest rates, higher taxes, international trade

disputes, government restrictions, geopolitical instability, higher

inflation, or deflation;

- failure to meet our announced guidance or market expectations

and the impact thereof;

- failure to attract or retain key executive or partner talent or

successfully transition executives;

- the impacts of partner investments and changes in the

availability and cost of labor including any union organizing

efforts and our responses to such efforts;

- the impact of foreign currency translation, particularly a

stronger U.S. dollar;

- the impact of, and our ability to respond to, substantial

competition from new entrants, consolidations by competitors, and

other competitive activities, such as pricing actions (including

price reductions, promotions, discounting, couponing, or free

goods), marketing, category expansion, product introductions, or

entry or expansion in our geographic markets;

- potential impacts of climate change;

- evolving corporate governance and public disclosure regulations

and expectations;

- the potential impact of activist shareholder actions or

tactics;

- failure to comply with applicable laws and changing legal and

regulatory requirements;

- the impact or likelihood of significant legal disputes and

proceedings, or government investigations;

- potential negative effects of, and our ability to respond to, a

material failure, inadequacy or interruption of our information

technology systems or those of our third-party business partners or

service providers, or failure to comply with data protection laws;

and

- our ability to adequately protect our intellectual property or

adequately ensure that we are not infringing the intellectual

property of others.

In addition, many of the foregoing risks and uncertainties are,

or could be, exacerbated by any worsening of the global business

and economic environment. A forward-looking statement is neither a

prediction nor a guarantee of future events or circumstances, and

those future events or circumstances may not occur. You should not

place undue reliance on the forward-looking statements, which speak

only as of the date of this report. We are under no obligation to

update or alter any forward-looking statements, whether as a result

of new information, future events, or otherwise.

Key Metrics

We believe the company's financial results and long-term growth

model will continue to be driven by new store openings, comparable

store sales growth and operating margin management. We believe

these key operating metrics are useful to investors because

management uses these metrics to assess the growth of our business

and the effectiveness of our marketing and operational

strategies.

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF

EARNINGS

(unaudited, in millions, except

per share data)

Quarter Ended

Quarter Ended

Sep 29, 2024

Oct 1, 2023

% Change

Sep 29, 2024

Oct 1, 2023

As a % of total net

revenues

Net revenues:

Company-operated stores

$

7,442.1

$

7,679.9

(3.1

)%

82.0

%

81.9

%

Licensed stores

1,129.5

1,187.5

(4.9

)

12.4

12.7

Other

502.4

506.2

(0.8

)

5.5

5.4

Total net revenues

9,074.0

9,373.6

(3.2

)

100.0

100.0

Product and distribution costs

2,810.3

2,933.1

(4.2

)

31.0

31.3

Store operating expenses

3,881.7

3,721.3

4.3

42.8

39.7

Other operating expenses

138.7

145.2

(4.5

)

1.5

1.5

Depreciation and amortization expenses

395.0

351.4

12.4

4.4

3.7

General and administrative expenses

644.8

635.8

1.4

7.1

6.8

Total operating expenses

7,870.5

7,786.8

1.1

86.7

83.1

Income from equity investees

103.4

119.4

(13.4

)

1.1

1.3

Operating income

1,306.9

1,706.2

(23.4

)

14.4

18.2

Interest income and other, net

26.8

30.1

(11.0

)

0.3

0.3

Interest expense

(140.0

)

(143.2

)

(2.2

)

(1.5

)

(1.5

)

Earnings before income taxes

1,193.7

1,593.1

(25.1

)

13.2

17.0

Income tax expense

284.1

373.8

(24.0

)

3.1

4.0

Net earnings including noncontrolling

interests

909.6

1,219.3

(25.4

)

10.0

13.0

Net earnings attributable to

noncontrolling interests

0.3

0.0

nm

0.0

0.0

Net earnings attributable to

Starbucks

$

909.3

$

1,219.3

(25.4

)

10.0

%

13.0

%

Net earnings per common share -

diluted

$

0.80

$

1.06

(24.5

)%

Weighted avg. shares outstanding -

diluted

1,137.3

1,149.4

Cash dividends declared per share

$

0.61

$

0.57

Supplemental Ratios:

Store operating expenses as a % of

company-operated store revenues

52.2

%

48.5

%

Effective tax rate including

noncontrolling interests

23.8

%

23.5

%

Year Ended

Year Ended

Sep 29, 2024

Oct 1, 2023

% Change

Sep 29, 2024

Oct 1, 2023

As a % of total net

revenues

Net revenues:

Company-operated stores

$

29,765.9

$

29,462.3

1.0

%

82.3

%

81.9

%

Licensed stores

4,505.1

4,512.7

(0.2

)

12.5

12.5

Other

1,905.2

2,000.6

(4.8

)

5.3

5.6

Total net revenues

36,176.2

35,975.6

0.6

100.0

100.0

Product and distribution costs

11,180.6

11,409.1

(2.0

)

30.9

31.7

Store operating expenses

15,286.5

14,720.3

3.8

42.3

40.9

Other operating expenses

565.6

539.4

4.9

1.6

1.5

Depreciation and amortization expenses

1,512.6

1,362.6

11.0

4.2

3.8

General and administrative expenses

2,523.3

2,441.3

3.4

7.0

6.8

Restructuring and impairments

—

21.8

nm

—

0.1

Total operating expenses

31,068.6

30,494.5

1.9

85.9

84.8

Income from equity investees

301.2

298.4

0.9

0.8

0.8

Gain from sale of assets

—

91.3

nm

—

0.3

Operating income

5,408.8

5,870.8

(7.9

)

15.0

16.3

Interest income and other, net

122.8

81.2

51.2

0.3

0.2

Interest expense

(562.0

)

(550.1

)

2.2

(1.6

)

(1.5

)

Earnings before income taxes

4,969.6

5,401.9

(8.0

)

13.7

15.0

Income tax expense

1,207.3

1,277.2

(5.5

)

3.3

3.6

Net earnings including noncontrolling

interests

3,762.3

4,124.7

(8.8

)

10.4

11.5

Net earnings attributable to

noncontrolling interests

1.4

0.2

600.0

0.0

0.0

Net earnings attributable to

Starbucks

$

3,760.9

$

4,124.5

(8.8

)

10.4

%

11.5

%

Net earnings per common share -

diluted

$

3.31

$

3.58

(7.5

)%

Weighted avg. shares outstanding -

diluted

1,137.3

1,151.3

Cash dividends declared per share

$

2.32

$

2.16

Supplemental Ratios:

Store operating expenses as a % of

company-operated store revenues

51.4

%

50.0

%

Effective tax rate including

noncontrolling interests

24.3

%

23.6

%

Segment Results (in

millions)

North America

Sep 29, 2024

Oct 1, 2023

% Change

Sep 29, 2024

Oct 1, 2023

Quarter

Ended

As a % of North America

total net revenues

Net revenues:

Company-operated stores

$

6,018.0

$

6,211.5

(3.1

)%

89.9

%

90.0

%

Licensed stores

673.4

685.9

(1.8

)

10.1

9.9

Other

0.5

2.6

(80.8

)

0.0

0.0

Total net revenues

6,691.9

6,900.0

(3.0

)

100.0

100.0

Product and distribution costs

1,854.5

1,905.7

(2.7

)

27.7

27.6

Store operating expenses

3,150.8

2,986.0

5.5

47.1

43.3

Other operating expenses

67.0

67.1

(0.1

)

1.0

1.0

Depreciation and amortization expenses

278.2

236.6

17.6

4.2

3.4

General and administrative expenses

87.9

103.2

(14.8

)

1.3

1.5

Total operating expenses

5,438.4

5,298.6

2.6

81.3

76.8

Operating income

$

1,253.5

$

1,601.4

(21.7

)%

18.7

%

23.2

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

52.4

%

48.1

%

Year

Ended

Net revenues:

Company-operated stores

$

24,258.7

$

23,905.4

1.5

%

89.8

%

90.0

%

Licensed stores

2,747.4

2,659.1

3.3

10.2

10.0

Other

3.4

5.1

(33.3

)

0.0

0.0

Total net revenues

27,009.5

26,569.6

1.7

100.0

100.0

Product and distribution costs

7,478.0

7,530.4

(0.7

)

27.7

28.3

Store operating expenses

12,467.1

11,959.2

4.2

46.2

45.0

Other operating expenses

280.9

263.8

6.5

1.0

1.0

Depreciation and amortization expenses

1,052.4

910.1

15.6

3.9

3.4

General and administrative expenses

375.8

389.7

(3.6

)

1.4

1.5

Restructuring and impairments

—

20.7

nm

—

0.1

Total operating expenses

21,654.2

21,073.9

2.8

80.2

79.3

Operating income

$

5,355.3

$

5,495.7

(2.6

)%

19.8

%

20.7

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

51.4

%

50.0

%

International

Sep 29, 2024

Oct 1, 2023

% Change

Sep 29, 2024

Oct 1, 2023

Quarter

Ended

As a % of International total

net revenues

Net revenues:

Company-operated stores

$

1,424.1

$

1,468.4

(3.0

)%

75.2

%

74.2

%

Licensed stores

456.1

501.6

(9.1

)

24.1

25.3

Other

13.0

9.9

31.3

0.7

0.5

Total net revenues

1,893.2

1,979.9

(4.4

)

100.0

100.0

Product and distribution costs

651.6

704.7

(7.5

)

34.4

35.6

Store operating expenses

730.9

735.3

(0.6

)

38.6

37.1

Other operating expenses

56.3

64.0

(12.0

)

3.0

3.2

Depreciation and amortization expenses

87.3

84.3

3.6

4.6

4.3

General and administrative expenses

84.9

91.0

(6.7

)

4.5

4.6

Total operating expenses

1,611.0

1,679.3

(4.1

)

85.1

84.8

Income from equity investees

0.7

0.7

—

0.0

0.0

Operating income

$

282.9

$

301.3

(6.1

)%

14.9

%

15.2

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

51.3

%

50.1

%

Year

Ended

Net revenues:

Company-operated stores

$

5,507.2

$

5,556.9

(0.9

)%

75.0

%

74.2

%

Licensed stores

1,757.7

1,853.6

(5.2

)

24.0

24.8

Other

74.0

77.1

(4.0

)

1.0

1.0

Total net revenues

7,338.9

7,487.6

(2.0

)

100.0

100.0

Product and distribution costs

2,575.2

2,608.4

(1.3

)

35.1

34.8

Store operating expenses

2,819.4

2,761.1

2.1

38.4

36.9

Other operating expenses

225.1

219.0

2.8

3.1

2.9

Depreciation and amortization expenses

338.3

335.1

1.0

4.6

4.5

General and administrative expenses

338.8

335.8

0.9

4.6

4.5

Total operating expenses

6,296.8

6,259.4

0.6

85.8

83.6

Income from equity investees

3.6

2.7

33.3

0.0

0.0

Operating income

$

1,045.7

$

1,230.9

(15.0

)%

14.2

%

16.4

%

Supplemental Ratio:

Store operating expenses as a % of

company-operated store revenues

51.2

%

49.7

%

Channel Development

Sep 29, 2024

Oct 1, 2023

% Change

Sep 29, 2024

Oct 1, 2023

Quarter

Ended

As a % of Channel

Development total net revenues

Net revenues

$

465.4

$

486.1

(4.3

)%

Product and distribution costs

286.1

317.3

(9.8

)

61.5

%

65.3

%

Other operating expenses

15.3

14.0

9.3

3.3

2.9

Depreciation and amortization expenses

—

0.0

nm

—

0.0

General and administrative expenses

2.0

2.3

(13.0

)

0.4

0.5

Total operating expenses

303.4

333.6

(9.1

)

65.2

68.6

Income from equity investees

102.7

118.7

(13.5

)

22.1

24.4

Operating income

$

264.7

$

271.2

(2.4

)%

56.9

%

55.8

%

Year

Ended

Net revenues

$

1,769.8

$

1,893.8

(6.5

)%

Product and distribution costs

1,075.4

1,250.1

(14.0

)

60.8

%

66.0

%

Other operating expenses

58.4

54.6

7.0

3.3

2.9

Depreciation and amortization expenses

0.0

0.1

nm

0.0

0.0

General and administrative expenses

7.7

8.4

(8.3

)

0.4

0.4

Total operating expenses

1,141.5

1,313.2

(13.1

)

64.5

69.3

Income from equity investees

297.6

295.7

0.6

16.8

15.6

Gain from sale of assets

—

91.3

nm

—

4.8

Operating income

$

925.9

$

967.6

(4.3

)%

52.3

%

51.1

%

Corporate and Other

Sep 29, 2024

Oct 1, 2023

% Change

Quarter

Ended

Net revenues

$

23.5

$

7.6

209.2

%

Product and distribution costs

18.1

5.4

235.2

Other operating expenses

0.1

0.1

0.0

Depreciation and amortization expenses

29.5

30.5

(3.3

)

General and administrative expenses

470.0

439.3

7.0

Total operating expenses

517.7

475.3

8.9

Operating loss

$

(494.2

)

$

(467.7

)

5.7

%

Year

Ended

Net revenues

$

58.0

$

24.6

135.8

%

Product and distribution costs

52.0

20.2

157.4

Other operating expenses

1.2

2.0

(40.0

)

Depreciation and amortization expenses

121.9

117.3

3.9

General and administrative expenses

1,801.0

1,707.4

5.5

Restructuring and impairments

—

1.1

nm

Total operating expenses

1,976.1

1,848.0

6.9

Operating loss

$

(1,918.1

)

$

(1,823.4

)

5.2

%

STARBUCKS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(unaudited, in millions, except

per share data)

Sep 29, 2024

Oct 1, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

3,286.2

$

3,551.5

Short-term investments

257.0

401.5

Accounts receivable, net

1,213.8

1,184.1

Inventories

1,777.3

1,806.4

Prepaid expenses and other current

assets

313.1

359.9

Total current assets

6,847.4

7,303.4

Long-term investments

276.0

247.4

Equity investments

463.9

439.9

Property, plant and equipment, net

8,665.5

7,387.1

Operating lease, right-of-use asset

9,286.2

8,412.6

Deferred income taxes, net

1,766.7

1,769.8

Other long-term assets

617.0

546.5

Other intangible assets

100.9

120.5

Goodwill

3,315.7

3,218.3

TOTAL ASSETS

$

31,339.3

$

29,445.5

LIABILITIES AND SHAREHOLDERS’

EQUITY/(DEFICIT)

Current liabilities:

Accounts payable

$

1,595.5

$

1,544.3

Accrued liabilities

2,194.7

2,145.1

Accrued payroll and benefits

786.6

828.3

Current portion of operating lease

liability

1,463.1

1,275.3

Stored value card liability and current

portion of deferred revenue

1,781.2

1,700.2

Short-term debt

—

33.5

Current portion of long-term debt

1,248.9

1,818.6

Total current liabilities

9,070.0

9,345.3

Long-term debt

14,319.5

13,547.6

Operating lease liability

8,771.6

7,924.8

Deferred revenue

5,963.6

6,101.8

Other long-term liabilities

656.2

513.8

Total liabilities

38,780.9

37,433.3

Shareholders’ deficit:

Common stock ($0.001 par value) —

authorized, 2,400.0 shares; issued and outstanding, 1,133.5 and

1,142.6 shares, respectively

1.1

1.1

Additional paid-in capital

322.6

38.1

Retained deficit

(7,343.8

)

(7,255.8

)

Accumulated other comprehensive

income/(loss)

(428.8

)

(778.2

)

Total shareholders’ deficit

(7,448.9

)

(7,994.8

)

Noncontrolling interests

7.3

7.0

Total deficit

(7,441.6

)

(7,987.8

)

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY/(DEFICIT)

$

31,339.3

$

29,445.5

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(unaudited, in millions)

Year Ended

Sep 29, 2024

Oct 1, 2023

Oct 2, 2022

OPERATING ACTIVITIES:

Net earnings including noncontrolling

interests

$

3,762.3

$

4,124.7

$

3,283.4

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

1,592.4

1,450.3

1,529.4

Deferred income taxes, net

(13.8

)

(59.4

)

(37.8

)

Income earned from equity method

investees

(306.4

)

(301.8

)

(268.7

)

Distributions received from equity method

investees

333.3

222.8

231.2

Gain on sale of assets

—

(91.3

)

—

Stock-based compensation

308.3

302.7

271.5

Non-cash lease costs

1,314.9

1,365.9

1,497.7

Loss on retirement and impairment of

assets

121.5

101.4

91.4

Other

31.9

26.8

(67.8

)

Cash provided by/(used in) changes in

operating assets and liabilities:

Accounts receivable

18.4

(4.1

)

(326.1

)

Inventories

42.8

366.4

(641.0

)

Income taxes payable

(61.9

)

52.5

(149.6

)

Accounts payable

28.0

100.1

345.5

Deferred revenue

(72.2

)

(110.8

)

(75.8

)

Operating lease liability

(1,294.9

)

(1,443.8

)

(1,625.6

)

Other operating assets and liabilities

291.0

(93.7

)

339.6

Net cash provided by operating

activities

6,095.6

6,008.7

4,397.3

INVESTING ACTIVITIES:

Purchases of investments

(627.5

)

(610.5

)

(377.9

)

Sales of investments

10.3

2.5

72.6

Maturities and calls of investments

768.2

616.9

67.3

Additions to property, plant and

equipment

(2,777.5

)

(2,333.6

)

(1,841.3

)

Proceeds from sale of assets

—

110.0

—

Net proceeds from the divestiture of

certain operations

—

—

59.3

Other

(72.7

)

(56.1

)

(126.3

)

Net cash used in investing activities

(2,699.2

)

(2,270.8

)

(2,146.3

)

FINANCING ACTIVITIES:

Net (payments)/proceeds from issuance of

commercial paper

—

(175.0

)

175.0

Net proceeds from issuance of short-term

debt

123.8

114.6

36.6

Repayments of short-term debt

(157.5

)

(78.8

)

(36.6

)

Net proceeds from issuance of long-term

debt

1,995.3

1,497.8

1,498.1

Repayments of long-term debt

(1,825.1

)

(1,000.0

)

(1,000.0

)

Proceeds from issuance of common stock

108.0

167.4

101.6

Cash dividends paid

(2,585.0

)

(2,431.8

)

(2,263.3

)

Repurchase of common stock

(1,266.7

)

(984.4

)

(4,013.0

)

Minimum tax withholdings on share-based

awards

(100.4

)

(89.3

)

(127.2

)

Other

(10.6

)

(11.1

)

(9.2

)

Net cash used in financing activities

(3,718.2

)

(2,990.6

)

(5,638.0

)

Effect of exchange rate changes on cash

and cash equivalents

56.5

(14.2

)

(250.3

)

Net increase/(decrease) in cash and cash

equivalents

(265.3

)

733.1

(3,637.3

)

CASH AND CASH EQUIVALENTS:

Beginning of period

3,551.5

2,818.4

6,455.7

End of period

$

3,286.2

$

3,551.5

$

2,818.4

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the period for:

Interest, net of capitalized interest

$

570.7

$

524.3

$

474.7

Income taxes

$

1,373.3

$

1,294.2

$

1,157.6

Supplemental

Information

The following supplemental information is provided for

historical and comparative purposes.

U.S. Supplemental Data

Quarter Ended

($ in millions)

Sep 29, 2024

Oct 1, 2023

Change (%)

Revenues

$6,245.1

$6,425.0

(3)%

Change in Comparable Store Sales (1)

(6)%

8%

Change in Transactions

(10)%

2%

Change in Ticket

4%

6%

Store Count

16,941

16,352

4%

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours remain in comparable store sales while

stores identified for permanent closure have been removed.

China Supplemental Data

Quarter Ended

($ in millions)

Sep 29, 2024

Oct 1, 2023

Change (%)

Revenues

$783.7

$840.6

(7)%

Change in Comparable Store Sales (1)

(14)%

5%

Change in Transactions

(6)%

8%

Change in Ticket

(8)%

(3)%

Store Count

7,596

6,806

12%

(1)

Includes only Starbucks® company-operated

stores open 13 months or longer. Comparable store sales exclude the

effects of fluctuations in foreign currency exchange rates and

Siren Retail stores. Stores that are temporarily closed or

operating at reduced hours remain in comparable store sales while

stores identified for permanent closure have been removed.

Store Data

Net stores opened/(closed) and

transferred during the period

Quarter Ended

Year Ended

Stores open as of

Sep 29, 2024

Oct 1, 2023

Sep 29, 2024

Oct 1, 2023

Sep 29, 2024

Oct 1, 2023

North America:

Company-operated stores

221

176

533

412

11,161

10,628

Licensed stores

5

42

81

103

7,263

7,182

Total North America

226

218

614

515

18,424

17,810

International:

Company-operated stores

331

384

893

927

9,857

8,964

Licensed stores

165

214

654

885

11,918

11,264

Total International

496

598

1,547

1,812

21,775

20,228

Total Company

722

816

2,161

2,327

40,199

38,038

Non-GAAP Disclosure

In addition to the GAAP results provided in this release, the

company provides certain non-GAAP financial measures that are not

in accordance with, or alternatives for, generally accepted

accounting principles in the United States (GAAP). When provided to

investors, our non-GAAP financial measures of non-GAAP general and

administrative expenses (G&A), non-GAAP operating income,

non-GAAP operating income growth (loss), non-GAAP operating margin,

non-GAAP effective tax rate and non-GAAP earnings per share exclude

the below-listed items and their related tax impacts, as management

does not believe they contribute to a meaningful evaluation of the

company’s future operating performance or comparisons to the

company's past operating performance. The GAAP measures most

directly comparable to non-GAAP G&A, non-GAAP operating income,

non-GAAP operating income growth (loss), non-GAAP operating margin,

non-GAAP effective tax rate and non-GAAP earnings per share are

G&A, operating income, operating income growth (loss),

operating margin, effective tax rate and diluted net earnings per

share, respectively.

Non-GAAP

Exclusion

Rationale

Restructuring and impairment costs

Management excludes restructuring and

impairment costs for reasons discussed above. These expenses are

anticipated to be completed within a finite period of time.

Transaction and integration-related

costs

Management excludes transaction and

integration costs for reasons discussed above. Additionally, we

incur certain costs associated with certain divestiture activities.

The majority of these costs will be recognized over a finite period

of time.

Gain on sale of assets

Management excludes the gain related to

the sale of assets to Nestlé, primarily consisting of intellectual

properties associated with the Seattle's Best Coffee brand, as

these items do not reflect future gains or tax impacts for reasons

discussed above.

The Company also presents constant currency information to

provide a framework for assessing how our underlying businesses

performed excluding the effect of foreign currency rate

fluctuations. To present the constant currency information, current

period results for entities reporting in currencies other than

United States dollars are converted into United States dollars

using the average monthly exchange rates from the comparative

period rather than the actual exchange rates in effect during the

respective periods, excluding related hedging activities. We

believe the presentation of results on a constant currency basis in

addition to GAAP results helps users better understand our

performance, because it excludes the effects of foreign currency

volatility that are not indicative of our underlying operating

results.

Non-GAAP G&A, non-GAAP operating income, non-GAAP operating

income growth (loss), non-GAAP operating margin, non-GAAP effective

tax rate, non-GAAP earnings per share and constant currency may

have limitations as analytical tools. These measures should not be

considered in isolation or as a substitute for analysis of the

company’s results as reported under GAAP. Other companies may

calculate these non-GAAP financial measures differently than the

company does, limiting the usefulness of those measures for

comparative purposes.

STARBUCKS CORPORATION

NET REVENUE CONSTANT CURRENCY

RECONCILIATION

(unaudited, in millions)

Quarter Ended

Consolidated

Revenue for the quarter ended Oct 1, 2023

as reported (GAAP)

$

9,373.6

Revenue for the quarter ended Sep 29, 2024

as reported (GAAP)

$

9,074.0

Change (%)

(3.2

)%

Constant Currency Impact (%)

0.3

%

Change in Constant Currency (%)

(2.9

)%

Year Ended

Consolidated

Revenue for the year ended Oct 1, 2023 as

reported (GAAP)

$

35,975.6

Revenue for the year ended Sep 29, 2024 as

reported (GAAP)

$

36,176.2

Change (%)

0.6

%

Constant Currency Impact (%)

0.7

%

Change in Constant Currency (%)

1.3

%

STARBUCKS CORPORATION

RECONCILIATION OF SELECTED

GAAP MEASURES TO NON-GAAP MEASURES

(unaudited, in millions, except

per share data)

Quarter Ended

Consolidated

Sep 29, 2024

Oct 1, 2023

Change

Constant Currency

Impact

Change in Constant

Currency

Operating income, as reported (GAAP)

$

1,306.9

$

1,706.2

(23.4)%

Non-GAAP operating income

$

1,306.9

$

1,706.2

(23.4)%

0.8%

(22.6)%

Operating margin, as reported (GAAP)

14.4

%

18.2

%

(380) bps

Non-GAAP operating margin

14.4

%

18.2

%

(380) bps

10 bps

(370) bps

Diluted net earnings per share, as

reported (GAAP)

$

0.80

$

1.06

(24.5)%

Non-GAAP EPS

$

0.80

$

1.06

(24.5)%

0.9%

(23.6)%

Year Ended

Consolidated

Sep 29, 2024

Oct 1, 2023

Change

Constant Currency

Impact

Change in Constant

Currency

Operating income, as reported (GAAP)

$

5,408.8

$

5,870.8

(7.9)%

Restructuring and impairment costs (1)

—

21.8

Transaction and integration-related costs

(2)

—

0.1

Gain on sale of assets

—

(91.3

)

Non-GAAP operating income

$

5,408.8

$

5,801.4

(6.8)%

1.1%

(5.7)%

Operating margin, as reported (GAAP)

15.0

%

16.3

%

(130) bps

Restructuring and impairment costs (1)

—

0.1

Transaction and integration-related costs

(2)

—

0.0

Gain on sales of assets

—

(0.3

)

Non-GAAP operating margin

15.0

%

16.1

%

(110) bps

— bps

(110) bps

Diluted net earnings per share, as

reported (GAAP)

$

3.31

$

3.58

(7.5)%

Restructuring and impairment costs (1)

—

0.02

Transaction and integration-related costs

(2)

—

0.00

Gain on sale of assets

—

(0.08

)

Income tax effect on Non-GAAP adjustments

(3)

—

0.02

Non-GAAP EPS

$

3.31

$

3.54

(6.5)%

0.9%

(5.6)%

(1)

Represents costs associated with our

restructuring efforts.

(2)

Fiscal 2023 includes transaction-related

expenses related to the sale of our Seattle's Best Coffee

brand.

(3)

Adjustments were determined based on the

nature of the underlying items and their relevant jurisdictional

tax rates.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030463090/en/

Starbucks Contact, Investor Relations: Tiffany Willis

investorrelations@starbucks.com

Starbucks Contact, Media: Emily Albright

press@starbucks.com

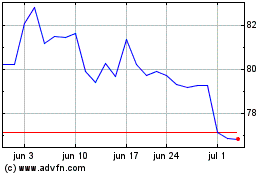

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Starbucks (NASDAQ:SBUX)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024