The Manitowoc Company, Inc. (NYSE: MTW) (the “Company” or

“Manitowoc”) today reported a third-quarter net loss of $7.0

million, or $0.20 per diluted share. Third-quarter adjusted net

loss(1) was $2.9 million, or $0.08 per diluted share.

Orders in the third quarter were $424.7 million, a 20.0%

decrease from the prior year, resulting in backlog at the end of

the third quarter of $742.1 million. Net sales in the third quarter

were flat year-over-year at $524.8 million, and adjusted EBITDA(1)

was $26.2 million, a decrease of 21.3% from the prior year.

“During the quarter, we made good progress on our CRANES+50

strategy; non-new machine sales reached a new high of $617.5

million for the trailing twelve-months. Demand, however, for new

cranes slowed as customers await the outcome of the U.S. election

and further interest rate cuts. Given the soft results in the third

quarter, we are expecting our full year adjusted EBITDA to be at

the low end of our guidance. Strengthening our balance sheet with a

focus on working capital remains our top financial priority,”

commented Aaron H. Ravenscroft, President and Chief Executive

Officer of The Manitowoc Company, Inc.

“Looking longer term, we are optimistic as central banks

continue to cut interest rates, monies from the Infrastructure and

CHIPS bills begin to flow, activity in the Middle East remains

strong, and crane fleets age to historic levels. As we continue to

launch new machines and execute our CRANES+50 strategy, we are well

positioned to capitalize on these trends,” concluded

Ravenscroft.

Investor Conference Call

The Manitowoc Company will host a conference call for security

analysts and institutional investors to discuss its third-quarter

2024 earnings results on Thursday, October 31, 2024, at 10:00 a.m.

ET (9:00 a.m. CT). A live audio webcast of the call, along with the

related presentation, will be available via webcast on the

Manitowoc website at http://ir.manitowoc.com in the "Events &

Presentations" section. A replay of the conference call will also

be available at the same location on the website.

About The Manitowoc Company, Inc.

The Manitowoc Company was founded in 1902 and has over a

120-year tradition of providing high-quality, customer-focused

products and support services to its markets. Headquartered in

Milwaukee, Wisconsin, United States, Manitowoc is one of the

world's leading providers of engineered lifting solutions.

Manitowoc, through its wholly-owned subsidiaries, designs,

manufactures, markets, distributes, and supports comprehensive

product lines of mobile hydraulic cranes, lattice-boom crawler

cranes, boom trucks, and tower cranes under the Aspen Equipment,

Grove, Manitowoc, MGX Equipment Services, National Crane, Potain,

and Shuttlelift brand names.

Footnote

(1)Adjusted net income (loss), adjusted diluted net income

(loss) per share (“Adjusted DEPS”), EBITDA, adjusted EBITDA,

adjusted operating income, adjusted return on invested capital

("Adjusted ROIC"), and free cash flows are financial measures that

are not in accordance with U.S. GAAP. For definitions and a

reconciliation to the most comparable U.S. GAAP numbers, please see

the schedule of “Non-GAAP Financial Measures” at the end of this

press release.

Forward-looking Statements

This press release includes “forward-looking statements”

intended to qualify for the safe harbor from liability under the

Private Securities Litigation Reform Act of 1995. Any statements

contained in this press release that are not historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are

based on the current expectations of the management of the Company

and are subject to uncertainty and changes in circumstances.

Forward-looking statements include, without limitation, statements

typically containing words such as “intends,” “expects,”

“anticipates,” “targets,” “estimates,” and words of similar import.

By their nature, forward-looking statements are not guarantees of

future performance or results and involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. Factors

that could cause actual results and developments to differ

materially include, among others:

- Macroeconomic conditions, including inflation, high interest

rates and recessionary concerns, as well as continuing global

supply chain constraints, labor constraints, logistics constraints

and cost pressures such as changes in raw material and commodity

costs, have had, and may continue to have, a negative impact on

Manitowoc’s ability to convert backlog into revenue which could,

and has, impacted its financial condition, cash flows, and results

of operations (including future uncertain impacts);

- actions of competitors;

- changes in economic or industry conditions generally or in the

markets served by Manitowoc;

- geopolitical events, including the ongoing conflicts in Ukraine

and in the Middle East, other political and economic conditions and

risks and other geographic factors, has had and may continue to

lead to market disruptions, including volatility in commodity

prices (including oil and gas), raw material and component costs,

energy prices, inflation, consumer behavior, supply chain, and

credit and capital markets, and could result in the impairment of

assets;

- changes in customer demand, including changes in global demand

for high-capacity lifting equipment, changes in demand for lifting

equipment in emerging economies and changes in demand for used

lifting equipment including changes in government approval and

funding of projects;

- the ability to convert backlog, orders and order activity into

sales and the timing of those sales;

- failure to comply with regulatory requirements related to the

products and aftermarket services the Company sells;

- the ability to capitalize on key strategic opportunities and

the ability to implement Manitowoc’s long-term initiatives;

- impairment of goodwill and/or intangible assets;

- changes in revenues, margins and costs;

- the ability to increase operational efficiencies across

Manitowoc and to capitalize on those efficiencies;

- the ability to generate cash and manage working capital

consistent with Manitowoc’s stated goals;

- work stoppages, labor negotiations, labor rates and labor

costs;

- the Company’s ability to attract and retain qualified

personnel;

- changes in the capital and financial markets;

- the ability to complete and appropriately integrate

acquisitions, strategic alliances, joint ventures or other

significant transactions;

- issues associated with the availability and viability of

suppliers;

- the ability to significantly improve profitability;

- realization of anticipated earnings enhancements, cost savings,

strategic options and other synergies, and the anticipated timing

to realize those savings, synergies and options;

- the ability to focus on customers, new technologies and

innovation;

- uncertainties associated with new product introductions, the

successful development and market acceptance of new and innovative

products that drive growth;

- the replacement cycle of technologically obsolete

products;

- risks associated with high debt leverage;

- foreign currency fluctuation and its impact on reported

results;

- the ability of Manitowoc's customers to receive financing;

- risks associated with data security and technological systems

and protections;

- the ability to direct resources to those areas that will

deliver the highest returns;

- risks associated with manufacturing or design defects;

- natural disasters, other weather events, pandemics and other

public health crises disrupting commerce in one or more regions of

the world;

- issues relating to the ability to timely and effectively

execute on manufacturing strategies, general efficiencies and

capacity utilization of the Company’s facilities;

- the ability to focus and capitalize on product and service

quality and reliability;

- issues associated with the quality of materials, components and

products sourced from third parties and the ability to successfully

resolve those issues;

- issues related to workforce reductions and potential subsequent

rehiring;

- changes in laws throughout the world, including governmental

regulations on climate change;

- the inability to defend against potential infringement claims

on intellectual property rights;

- the ability to sell products and services through distributors

and other third parties;

- issues affecting the effective tax rate for the year;

- acts of terrorism; and

- other risks and factors detailed in Manitowoc's 2023 Annual

Report on Form 10-K and its other filings with the United States

Securities and Exchange Commission.

Manitowoc undertakes no obligation to update or revise

forward-looking statements, whether as a result of new information,

future events, or otherwise. Forward-looking statements only speak

as of the date on which they are made. Information on the potential

factors that could affect the Company's actual results of

operations is included in its filings with the Securities and

Exchange Commission, including but not limited to its Annual Report

on Form 10-K for the fiscal year ended December 31, 2023.

THE MANITOWOC COMPANY,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In millions, except per share

and share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net sales

$

524.8

$

520.9

$

1,582.0

$

1,632.0

Cost of sales

437.2

424.1

1,302.2

1,305.9

Gross profit

87.6

96.8

279.8

326.1

Operating costs and expenses:

Engineering, selling and administrative

expenses

78.9

77.4

238.6

240.1

Amortization of intangible assets

0.7

0.7

2.2

2.4

Restructuring expense

0.5

0.7

3.4

1.0

Total operating costs and expenses

80.1

78.8

244.2

243.5

Operating income

7.5

18.0

35.6

82.6

Other income (expense):

Interest expense

(9.6

)

(8.4

)

(28.4

)

(25.5

)

Amortization of deferred financing

fees

(0.3

)

(0.3

)

(1.0

)

(1.0

)

Other income (expense) - net

(4.9

)

1.1

(3.9

)

(10.0

)

Total other expense

(14.8

)

(7.6

)

(33.3

)

(36.5

)

Income (loss) before income taxes

(7.3

)

10.4

2.3

46.1

Provision (benefit) for income taxes

(0.3

)

—

3.2

(1.0

)

Net income (loss)

$

(7.0

)

$

10.4

$

(0.9

)

$

47.1

Per Share Data and Share

Amounts:

Basic net income (loss) per common

share

$

(0.20

)

$

0.30

$

(0.03

)

$

1.34

Diluted net income (loss) per common

share

$

(0.20

)

$

0.29

$

(0.03

)

$

1.31

Weighted average shares outstanding -

basic

35,123,015

35,080,037

35,251,847

35,095,211

Weighted average shares outstanding -

diluted

35,123,015

35,787,704

35,251,847

35,836,672

THE MANITOWOC COMPANY,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In millions, except par value

and share amounts)

September 30, 2024

December 31, 2023

Assets

Current Assets:

Cash and cash equivalents

$

22.9

$

34.4

Accounts receivable, less allowances of

$6.0 and $6.1, respectively

272.6

278.8

Inventories — net

769.9

666.5

Other current assets

38.6

53.3

Total current assets

1,104.0

1,033.0

Property, plant and equipment — net

366.0

366.1

Operating lease right-of-use assets

57.4

59.7

Goodwill

80.0

79.6

Other intangible assets — net

123.8

125.6

Other non-current assets

45.5

42.7

Total assets

$

1,776.7

$

1,706.7

Liabilities and Stockholders'

Equity

Current Liabilities:

Accounts payable and accrued expenses

$

445.6

$

457.4

Customer advances

17.6

19.2

Short-term borrowings and current portion

of long-term debt

40.5

13.4

Product warranties

38.5

47.1

Other liabilities

18.9

26.2

Total current liabilities

561.1

563.3

Non-Current Liabilities:

Long-term debt

426.7

358.7

Operating lease liabilities

44.5

47.2

Deferred income taxes

7.6

7.5

Pension obligations

51.6

55.8

Postretirement health and other benefit

obligations

5.3

5.6

Long-term deferred revenue

21.0

24.1

Other non-current liabilities

51.3

41.2

Total non-current liabilities

608.0

540.1

Stockholders' Equity:

Preferred stock (authorized 3,500,000

shares of $.01 par value; none outstanding)

—

—

Common stock (75,000,000 shares

authorized, 40,793,983 shares issued, 35,126,894 and 35,094,993

shares outstanding, respectively)

0.4

0.4

Additional paid-in capital

612.4

613.1

Accumulated other comprehensive loss

(80.6

)

(86.4

)

Retained earnings

142.6

143.5

Treasury stock, at cost (5,667,089 and

5,698,990 shares, respectively)

(67.2

)

(67.3

)

Total stockholders' equity

607.6

603.3

Total liabilities and stockholders'

equity

$

1,776.7

$

1,706.7

THE MANITOWOC COMPANY,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In millions)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash Flows from Operating

Activities:

Net income (loss)

$

(7.0

)

$

10.4

$

(0.9

)

$

47.1

Adjustments to reconcile net income (loss)

to cash provided by (used for) operating activities:

Depreciation expense

14.9

13.7

44.2

41.8

Amortization of intangible assets

0.7

0.7

2.2

2.4

Stock-based compensation expense

2.4

2.4

8.0

7.8

Amortization of deferred financing

fees

0.3

0.3

1.0

1.0

Loss on debt extinguishment

1.1

—

1.1

—

Loss (gain) on sale of property, plant and

equipment

(0.4

)

0.2

(0.1

)

—

Deferred income tax benefit

—

—

—

(14.0

)

Loss on foreign currency translation

adjustments

—

—

—

9.3

Changes in operating assets and

liabilities

Accounts receivable

(11.0

)

18.6

5.9

11.5

Inventories

1.0

(6.9

)

(103.2

)

(114.3

)

Notes receivable

1.0

1.9

3.1

5.8

Other assets

1.2

(2.7

)

11.2

5.2

Accounts payable

(32.9

)

(34.4

)

(0.6

)

(14.9

)

Accrued expenses and other liabilities

(14.9

)

22.1

(35.1

)

34.5

Net cash provided by (used for) operating

activities

(43.6

)

26.3

(63.2

)

23.2

Cash Flows from Investing

Activities:

Capital expenditures

(9.3

)

(23.6

)

(34.4

)

(59.9

)

Proceeds from sale of fixed assets

1.8

0.2

5.3

5.3

Net cash used for investing activities

(7.5

)

(23.4

)

(29.1

)

(54.6

)

Cash Flows from Financing

Activities:

Payments on revolving credit facility

—

—

—

(10.0

)

Proceeds from revolving credit

facility

19.9

(12.0

)

67.4

—

Payments on long-term debt

300.0

—

300.00

—

Proceeds from long-term debt

(300.0

)

—

(300.00

)

—

Proceeds from other debt - net

22.1

23.8

32.2

22.6

Debt issuance costs

(5.5

)

—

(6.2

)

—

Exercise of stock options

—

—

—

0.3

Common stock repurchases

—

—

(5.7

)

(5.5

)

Other financing activities

(1.2

)

—

(6.7

)

—

Net cash provided by financing

activities

35.3

11.8

81.0

7.4

Effect of exchange rate changes on cash

and cash equivalents

0.6

(0.6

)

(0.2

)

(0.4

)

Net increase (decrease) in cash and cash

equivalents

(15.2

)

14.1

(11.5

)

(24.4

)

Cash and cash equivalents at beginning of

period

38.1

25.9

34.4

64.4

Cash and cash equivalents at end of

period

$

22.9

$

40.0

$

22.9

$

40.0

Non-GAAP Financial Measures

Adjusted net income (loss), Adjusted DEPS, EBITDA, adjusted

EBITDA, adjusted operating income, Adjusted ROIC, and free cash

flows are financial measures that are not in accordance with U.S.

GAAP. Manitowoc believes these non-GAAP financial measures provide

important supplemental information to both management and investors

regarding financial and business trends used in assessing its

results of operations. Manitowoc believes excluding specified items

provides a more meaningful comparison to the corresponding

reporting periods and internal budgets and forecasts, assists

investors in performing analysis that is consistent with financial

models developed by investors and research analysts, provides

management with a more relevant measure of operating performance,

and is more useful in assessing management performance.

Adjusted Net Income (Loss) and Adjusted DEPS

The Company defines adjusted net income (loss) as net income

(loss) plus the addback or subtraction of restructuring and other

non-recurring items. Adjusted DEPS is defined as adjusted net

income (loss) divided by diluted weighted average shares

outstanding. Diluted weighted average common shares outstanding are

adjusted for the effect of dilutive stock awards when there is net

income (loss) on an adjusted basis, as applicable. The

reconciliation of net income (loss) and diluted net income (loss)

per share to adjusted net income (loss) and Adjusted DEPS for the

three and nine months ended September 30, 2024 and 2023 are

summarized as follows. All dollar amounts are in millions, except

per share data and share amounts.

Three Months Ended September

30,

2024

2023

As reported

Adjustments

Adjusted

As reported

Adjustments

Adjusted

Gross profit

$

87.6

$

—

$

87.6

$

96.8

$

—

$

96.8

Engineering, selling and administrative

expenses (1)

(78.9

)

2.6

(76.3

)

(77.4

)

0.2

(77.2

)

Amortization of intangible assets

(0.7

)

—

(0.7

)

(0.7

)

—

(0.7

)

Restructuring expense (2)

(0.5

)

0.5

—

(0.7

)

0.7

—

Operating income

7.5

3.1

10.6

18.0

0.9

18.9

Interest expense

(9.6

)

—

(9.6

)

(8.4

)

—

(8.4

)

Amortization of deferred financing

fees

(0.3

)

—

(0.3

)

(0.3

)

—

(0.3

)

Other income (expense) - net (3)

(4.9

)

1.1

(3.8

)

1.1

—

1.1

Income (loss) before income

taxes

(7.3

)

4.2

(3.1

)

10.4

0.9

11.3

(Provision) benefit for income taxes

(4)

0.3

(0.1

)

0.2

—

(3.3

)

(3.3

)

Net income (loss)

$

(7.0

)

$

4.1

$

(2.9

)

$

10.4

$

(2.4

)

$

8.0

Diluted weighted average common shares

outstanding

35,123,015

35,123,015

35,787,704

35,787,704

Diluted net income (loss) per share

$

(0.20

)

$

(0.08

)

$

0.29

$

0.22

(1)

The adjustment in 2024 represents $2.6

million of costs associated with a legal matter with the U.S. EPA.

The adjustment in 2023 represents $0.2 million of one-time

costs.

(2)

The adjustment in 2024 and 2023 represents

the addback of restructuring expense.

(3)

The adjustment in 2024 represents $1.1

million of non-cash losses associated with the refinancing of the

Company’s $300.0 million senior secured second lien notes (the

“2026 Notes”).

(4)

The adjustment in 2024 represents the net

loss tax impacts of items (1), (2), and (3). The adjustment in 2023

represents the net income tax impact of items (1) and (2) and the

removal of a $3.2 million benefit from the favorable settlement of

a tax matter.

Nine Months Ended September

30,

2024

2023

As reported

Adjustments

Adjusted

As reported

Adjustments

Adjusted

Gross profit

$

279.8

$

—

$

279.8

$

326.1

$

—

$

326.1

Engineering, selling and administrative

expenses (1)

(238.6

)

8.1

(230.5

)

(240.1

)

11.0

(229.1

)

Amortization of intangible assets

(2.2

)

—

(2.2

)

(2.4

)

—

(2.4

)

Restructuring expense (2)

(3.4

)

3.4

—

(1.0

)

1.0

—

Operating income

35.6

11.5

47.1

82.6

12.0

94.6

Interest expense

(28.4

)

—

(28.4

)

(25.5

)

—

(25.5

)

Amortization of deferred financing

fees

(1.0

)

—

(1.0

)

(1.0

)

—

(1.0

)

Other income (expense) - net (3)

(3.9

)

1.1

(2.8

)

(10.0

)

9.3

(0.7

)

Income before income taxes

2.3

12.6

14.9

46.1

21.3

67.4

(Provision) benefit for income taxes

(4)

(3.2

)

(0.7

)

(3.9

)

1.0

(17.3

)

(16.3

)

Net income (loss)

$

(0.9

)

$

11.9

$

11.0

$

47.1

$

4.0

$

51.1

Diluted weighted average common shares

outstanding

35,251,847

35,750,656

35,836,672

35,836,672

Diluted net income (loss) per share

$

(0.03

)

$

0.31

$

1.31

$

1.43

(1)

The adjustment in 2024 represents $7.9

million of costs associated with a legal matter with the U.S. EPA

and $0.2 million of one-time costs. The adjustment in 2023

represents $10.8 million of costs associated with a legal matter

with the U.S. EPA and $0.2 million of one-time costs.

(2)

The adjustment in 2024 and 2023 represents

the addback of restructuring expense.

(3)

The adjustment in 2024 represents $1.1

million of non-cash losses associated with the refinancing of the

Company’s 2026 Notes. The adjustment in 2023 represents the

write-off of $9.3 million of non-cash foreign currency translation

adjustments from the curtailment of operations in Russia.

(4)

The adjustment in 2024 represents the net

loss tax impacts of items (1), (2), and (3). The adjustment in 2023

represents the net income tax impact of items (1), (2), and (3),

the removal of a $13.9 million benefit from the release of a

valuation allowance, and the removal of a $3.2 million benefit from

the favorable settlement of a tax matter.

Adjusted ROIC

The Company defines Adjusted ROIC as adjusted net operating

profit after tax (“Adjusted NOPAT”) for the trailing twelve-months

ended divided by the five-quarter average of invested capital.

Adjusted NOPAT is calculated for each quarter by taking operating

income plus the addback of amortization of intangible assets and

the addback or subtraction of restructuring expenses, other

non-recurring items - net, and provision for income taxes, which is

determined using a 15% tax rate. Invested capital is defined as net

total assets less cash and cash equivalents and income tax assets -

net plus short-term and long-term debt. Income taxes are defined as

income tax payables/receivables, net deferred tax

assets/liabilities, and uncertain tax positions.

The Company’s Adjusted ROIC as of September 30, 2024 was 6.2%.

Below is the calculation of Adjusted ROIC as of September 30,

2024.

Three Months Ended

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

Trailing Twelve Months

Operating income

$

7.5

$

12.9

$

15.2

$

9.8

$

45.4

Amortization of intangible assets

0.7

0.8

0.7

0.8

3.0

Restructuring expense

0.5

2.3

0.6

0.3

3.7

Other non-recurring items - net1

2.6

5.4

0.1

10.8

18.9

Adjusted operating income

11.3

21.4

16.6

21.7

71.0

Provision for income taxes

(1.7

)

(3.2

)

(2.5

)

(3.3

)

(10.7

)

Adjusted NOPAT

$

9.6

$

18.2

$

14.1

$

18.4

$

60.4

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

September 30, 2023

5-Quarter Average

Total assets

$

1,776.7

$

1,747.9

$

1,780.6

$

1,706.7

$

1,692.2

$

1,740.8

Total liabilities

(1,169.1

)

(1,155.6

)

(1,184.6

)

(1,103.4

)

(1,119.2

)

(1,146.4

)

Net total assets

607.6

592.3

596.0

603.3

573.0

594.4

Cash and cash equivalents

(22.9

)

(38.1

)

(31.5

)

(34.4

)

(40.0

)

(33.4

)

Short-term borrowings and current portion

of long-term debt

40.5

21.4

42.5

13.4

30.3

29.6

Long-term debt

426.7

406.3

372.7

358.7

368.5

386.6

Income tax assets - net

(10.1

)

(4.4

)

(3.4

)

(2.6

)

(4.3

)

(4.9

)

Invested capital

$

1,041.8

$

977.5

$

976.3

$

938.4

$

927.5

$

972.3

Adjusted ROIC

6.2

%

(1)

Other non-recurring items - net for the

three months ended September 30, 2024 relate to $2.6 million of

costs associated with a legal matter with the U.S. EPA. Other

non-recurring items – net for the trailing twelve months relate to

$18.3 million of costs associated with a legal matter with the U.S.

EPA and $0.6 million of one-time costs. Refer to the Company’s

previously filed Form 10-K and Form 10-Qs for a description of

other non-recurring items - net for the three months ended June 30,

2024, March 31, 2024, and December 31, 2023.

Free Cash Flows

The Company defines free cash flows as net cash provided by

(used for) operating activities less cash outflow from investment

in capital expenditures. The reconciliation of net cash provided by

(used for) operating activities to free cash flows for the three

and nine months ended September 30, 2024 and 2023 are summarized as

follows. All dollar amounts are in millions.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net cash provided by (used for) operating

activities

$

(43.6

)

$

26.3

$

(63.2

)

$

23.2

Capital expenditures

(9.3

)

(23.6

)

(34.4

)

(59.9

)

Free cash flows

$

(52.9

)

$

2.7

$

(97.6

)

$

(36.7

)

EBITDA and Adjusted EBITDA

The Company defines EBITDA as net income (loss) before interest,

taxes, depreciation, and amortization. The Company defines adjusted

EBITDA as EBITDA plus the addback or subtraction of restructuring

expense, other (income) expense - net, and other non-recurring

items - net. The reconciliation of net income (loss) to EBITDA, and

further to adjusted EBITDA for the three and nine months ended

September 30, 2024 and 2023 and trailing twelve months are

summarized as follows. All dollar amounts are in millions.

Three Months Ended September

30,

Nine Months Ended September

30,

Trailing Twelve

2024

2023

2024

2023

Months

Net income (loss)

$

(7.0

)

$

10.4

$

(0.9

)

$

47.1

$

(8.8

)

Interest expense and amortization of

deferred financing fees

9.9

8.7

29.4

26.5

38.1

Provision (benefit) for income taxes

(0.3

)

—

3.2

(1.0

)

9.2

Depreciation expense

14.9

13.7

44.2

41.8

59.0

Amortization of intangible assets

0.7

0.7

2.2

2.4

3.0

EBITDA

18.2

33.5

78.1

116.8

100.5

Restructuring expense

0.5

0.7

3.4

1.0

3.7

Other non-recurring items - net (1)

2.6

0.2

8.1

11.0

18.9

Other (income) expense - net (2)

4.9

(1.1

)

3.9

10.0

6.9

Adjusted EBITDA

$

26.2

$

33.3

$

93.5

$

138.8

$

130.0

Adjusted EBITDA margin percentage

5.0

%

6.4

%

5.9

%

8.5

%

6.0

%

(1)

Other non-recurring items - net for the

three months ended September 30, 2024 relate to $2.6 million of

costs associated with a legal matter with the U.S. EPA. Other

non-recurring items - net for the nine months ended September 30,

2024 relate to $7.9 million of costs associated with a legal matter

with the U.S. EPA and $0.2 million of one-time costs. Other

non-recurring items - net for the three months ended September 30,

2023 relate to $0.2 million of one-time costs. Other non-recurring

items - net for the nine months ended September 30, 2023 relate to

$10.8 million of costs associated with a legal matter with the U.S.

EPA and $0.2 million of one-time costs. Other non-recurring items –

net for the trailing twelve months relate to $18.3 million of costs

associated with a legal matter with the U.S. EPA and $0.6 million

of one-time costs.

(2)

Other (income) expense - net includes net

foreign currency gains (losses), other components of net periodic

pension costs, and other items in the three, nine, and trailing

twelve months ended September 30, 2024 and the three and nine

months ended September 30, 2023. Other expense – net for the nine

and trailing twelve months ended September 30, 2023 includes a $9.3

million write-off of non-cash foreign currency translation

adjustments from the curtailment of operations in Russia.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030566930/en/

Ion Warner SVP, Marketing and Investor Relations +1

414-760-4805

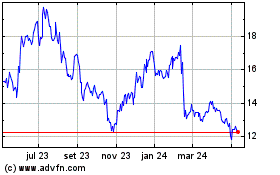

Manitowoc (NYSE:MTW)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

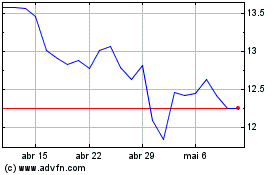

Manitowoc (NYSE:MTW)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024