Strong Growth Across Core Financial and

Operating Metrics; Revenue up 29% year-over-year, Bookings1 up 34%

year-over-year, record DAUs up 27% year-over-year and record Hours

Engaged up 29% year-over-year

Roblox Corporation (NYSE: RBLX), a global platform bringing

millions of people together through shared experiences, released

its third quarter 2024 financial and operational results and issued

its fourth quarter and updated full year 2024 guidance today.

Separately, Roblox posted a letter to shareholders and supplemental

materials on the Roblox investor relations website at

ir.roblox.com.

Third Quarter 2024 Financial, Operational, and Liquidity

Highlights

- Revenue was $919.0 million, up 29% year-over-year.

- Bookings1 were $1,128.5 million, up 34% year-over-year.

- Net loss attributable to common stockholders was $239.3

million, while consolidated net loss was $240.4 million.

- Adjusted EBITDA1 was $55.0 million, which excludes adjustments

for increases in deferred revenue and deferred cost of revenue of

$216.3 million and $(47.9) million, respectively, or a total change

in deferred of $168.4 million.

- Net cash and cash equivalents provided by operating activities

was $247.4 million, up 120% year-over-year, while free cash flow1

was $218.0 million, up 266% year-over-year.

- Average Daily Active Users (“DAUs”) were 88.9 million, up 27%

year-over-year.

- Average monthly unique payers were 19.1 million, up 30%

year-over-year, and average bookings per monthly unique payer was

$19.70.

- Hours engaged were 20.7 billion, up 29% year-over-year.

- Average bookings per DAU was $12.70, up 6% year-over-year.

- Cash and cash equivalents, short-term investments, and

long-term investments totaled $3.9 billion; net liquidity2 was $2.9

billion.

“Roblox’s exceptional Q3 results demonstrate the strength of our

platform and the effectiveness of our growth strategies. We’re

particularly proud of the progress we’ve made in empowering

creators, fostering social connections, and expanding our global

reach. As we look ahead, we remain committed to building the

world’s largest social platform for play, and we’re confident that

our continued innovation and focus on safety will drive long-term

value for our shareholders and the broader Roblox community,” said

David Baszucki, founder and CEO of Roblox.

“In the third quarter of 2024, our key financial and operating

metrics grew at high rates and in all cases were above the guidance

we delivered on our Q2 2024 earnings call with significant

year-over-year growth in revenue of 29%, bookings of 34%, DAUs of

27% and Hours engaged of 29%,” said Michael Guthrie, chief

financial officer of Roblox.

____________________

1

Bookings, Adjusted EBITDA, and

free cash flow are non-GAAP financial measures that we believe are

useful in evaluating our performance and are presented for

supplemental information purposes only and should not be considered

in isolation from, or as a substitute for, financial information

presented in accordance with GAAP. For further information, please

refer to definitions and reconciliations provided below and in our

annual and quarterly SEC filings.

2

Net liquidity represents cash and

cash equivalents, short-term investments, and long-term

investments, less long-term debt, net.

Forward Looking Guidance

Roblox provides its fourth quarter and updated full year 2024

GAAP and non-GAAP guidance:

Fourth Quarter 2024 Guidance

- Revenue between $935 million and $960 million.

- Bookings between $1,336 million and $1,361 million.

- Consolidated net loss between $(303) million and $(283)

million.

- Adjusted EBITDA between $10 million and $30 million, which

excludes adjustments for:

- Increase in deferred revenue of $406 million.

- Increase in deferred cost of revenue of $(86) million.

- The total of these changes in deferrals of $320 million.

- Net cash and cash equivalents provided by operating activities

between $170 million and $185 million.

- Capital expenditures and purchases of intangible assets of

$(70) million.

- Free cash flow between $100 million and $115 million.

Updated Full Year 2024 Guidance

- Revenue between $3,549 million and $3,574 million.

- Bookings between $4,343 million and $4,368 million.

- Consolidated net loss between $(1,023) million and $(1,003)

million.

- Adjusted EBITDA between $125 million and $145 million, which

excludes adjustments for:

- Increase in deferred revenue of $817 million.

- Increase in deferred cost of revenue of $(186) million.

- The total of these changes in deferrals of $631 million.

- Net cash and cash equivalents provided by operating activities

between $808 million and $823 million.

- Capital expenditures and purchases of intangible assets of

$(187) million.

- Free cash flow between $621 million and $636 million.

Earnings Q&A Session

Roblox will host a live Q&A session to answer questions

regarding its third quarter 2024 results on Thursday, October 31,

2024 at 5:30 a.m. Pacific Time/8:30 a.m. Eastern Time. The webcast

will be open to the public at ir.roblox.com or by clicking

here.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding our vision to connect one billion global

DAUs, our vision to reach 10% of the global gaming software market,

our efforts to improve the Roblox Platform, our investments to

pursue the highest standards of trust and safety on our platform,

our immersive and video advertising efforts, including our ads

manager and independent measurement partnerships, our efforts to

provide a safe online environment for children, our efforts

regarding content curation, live operations and platform-wide

events, our efforts regarding real-world shopping, the use of

artificial intelligence (“AI”) on our platform, our economy and

product efforts related to creator earnings and platform

monetization, our sponsored experiences, branding and new

partnerships and our roadmap with respect to each, our business,

product, strategy and user growth, our investment strategy,

including our opportunities for and expectations of improvements in

financial and operating metrics, including operating leverage,

margin, free cash flow, operating expenses and capital

expenditures, our expectation of successfully executing such

strategies and plans, disclosures regarding the seasonality of our

business, disclosures and future growth rates, benefits from

agreements with third-party cloud providers, disclosures about our

infrastructure efficiency initiatives, changes to our estimated

average lifetime of a paying user and the resulting effect on

revenue, cost of revenue, deferred revenue and deferred cost of

revenue, our expectations of future net losses and net cash and

cash equivalents provided by operating activities, statements by

our Chief Executive Officer and Chief Financial Officer, and our

outlook and guidance for fourth quarter and full year 2024, and

future periods. These forward-looking statements are made as of the

date they were first issued and were based on current plans,

expectations, estimates, forecasts, and projections as well as the

beliefs and assumptions of management. Words such as “expect,”

“vision,” “envision,” “evolving,” “drive,” “anticipate,” “intend,”

“maintain,” “should,” “believe,” “continue,” “plan,” “goal,”

“opportunity,” “estimate,” “predict,” “may,” “will,” “could,” and

“would,” and variations of these terms or the negative of these

terms and similar expressions are intended to identify these

forward-looking statements. Forward-looking statements are subject

to a number of risks and uncertainties, many of which involve

factors or circumstances that are beyond our control. Our actual

results could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including

but not limited to risks detailed in our filings with the

Securities and Exchange Commission (the “SEC”), including our

annual reports on Form 10-K, our quarterly reports on Form 10-Q and

other filings and reports we make with the SEC from time to time.

In particular, the following factors, among others, could cause

results to differ materially from those expressed or implied by

such forward-looking statements: our ability to successfully

execute our business and growth strategy; the sufficiency of our

cash and cash equivalents to meet our liquidity needs, including

the repayment of our senior notes; the demand for our platform in

general; our ability to retain and increase our number of users,

developers, and creators; the impact of inflation and global

economic conditions on our operations; the impact of changing legal

and regulatory requirements on our business, including the use of

verified parental consent; our ability to develop enhancements to

our platform, and bring them to market in a timely manner; our

ability to develop and protect our brand and build new

partnerships; any misuse of user data or other undesirable activity

by third parties on our platform; our ability to maintain the

security and availability of our platform; our ability to detect

and minimize unauthorized use of our platform; and the impact of AI

on our platform, users, creators, and developers. Additional

information regarding these and other risks and uncertainties that

could cause actual results to differ materially from our

expectations is included in the reports we have filed or will file

with the SEC, including our annual reports on Form 10-K and our

quarterly reports on Form 10-Q.

The forward-looking statements included in this press release

represent our views as of the date of this press release. We

anticipate that subsequent events and developments will cause our

views to change. However, we undertake no intention or obligation

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Special Note Regarding Operating Metrics

Additional information regarding our core financial and

operating metrics disclosed above is included in the reports we

have filed or will file with the SEC, including our annual reports

on Form 10-K and our quarterly reports on Form 10-Q. We encourage

investors and others to review these reports in their entirety.

ROBLOX CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

values)

(unaudited)

As of

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

602,631

$

678,466

Short-term investments

1,720,323

1,514,808

Accounts receivable—net of allowances

385,591

505,769

Prepaid expenses and other current

assets

70,702

74,549

Deferred cost of revenue, current

portion

588,915

501,821

Total current assets

3,368,162

3,275,413

Long-term investments

1,558,846

1,043,399

Property and equipment—net

642,637

695,360

Operating lease right-of-use assets

626,486

665,107

Deferred cost of revenue, long-term

295,894

283,326

Intangible assets, net

38,486

53,060

Goodwill

142,236

142,129

Other assets

15,215

10,284

Total assets

$

6,687,962

$

6,168,078

Liabilities and Stockholders’ equity

Current liabilities:

Accounts payable

$

42,842

$

60,087

Accrued expenses and other current

liabilities

273,694

271,121

Developer exchange liability

330,271

314,866

Deferred revenue—current portion

2,792,396

2,406,292

Total current liabilities

3,439,203

3,052,366

Deferred revenue—net of current

portion

1,397,803

1,373,250

Operating lease liabilities

620,257

646,506

Long-term debt, net

1,006,023

1,005,000

Other long-term liabilities

46,218

22,330

Total liabilities

6,509,504

6,099,452

Stockholders’ equity

Common stock, $0.0001 par value; 5,000,000

authorized as of September 30, 2024 and December 31, 2023, 656,132

and 631,221 shares issued and outstanding as of September 30, 2024

and December 31, 2023, respectively; Class A common stock—4,935,000

shares authorized as of September 30, 2024 and December 31, 2023,

607,454 and 581,135 shares issued and outstanding as of September

30, 2024 and December 31, 2023, respectively; Class B common

stock—65,000 shares authorized as of September 30, 2024 and

December 31, 2023, 48,678 and 50,086 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively

62

61

Additional paid-in capital

3,949,491

3,134,946

Accumulated other comprehensive

income/(loss)

16,416

1,536

Accumulated deficit

(3,776,064

)

(3,060,253

)

Total Roblox Corporation Stockholders’

equity

189,905

76,290

Noncontrolling interest

(11,447

)

(7,664

)

Total Stockholders’ equity

178,458

68,626

Total Liabilities and Stockholders’

equity

$

6,687,962

$

6,168,078

ROBLOX CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2024

2023

2024

2023

Revenue(1)

$

918,953

$

713,225

$

2,613,796

$

2,049,335

Cost and expenses:

Cost of revenue(1)(2)

204,998

163,581

582,421

477,451

Developer exchange fees

231,536

170,719

642,211

519,002

Infrastructure and trust & safety

244,598

218,968

692,596

655,051

Research and development

365,424

321,613

1,089,173

912,469

General and administrative

98,733

97,508

302,184

291,279

Sales and marketing

52,592

40,874

124,416

97,957

Total cost and expenses

1,197,881

1,013,263

3,433,001

2,953,209

Loss from operations

(278,928

)

(300,038

)

(819,205

)

(903,874

)

Interest income

46,718

36,442

133,271

102,288

Interest expense

(10,286

)

(10,268

)

(30,853

)

(30,409

)

Other income/(expense), net

2,352

(4,262

)

(1,309

)

(1,425

)

Loss before income taxes

(240,144

)

(278,126

)

(718,096

)

(833,420

)

Provision for/(benefit from) income

taxes

303

682

1,466

177

Consolidated net loss

(240,447

)

(278,808

)

(719,562

)

(833,597

)

Net loss attributable to noncontrolling

interest

(1,123

)

(1,650

)

(3,751

)

(5,349

)

Net loss attributable to common

stockholders

$

(239,324

)

$

(277,158

)

$

(715,811

)

$

(828,248

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.37

)

$

(0.45

)

$

(1.11

)

$

(1.35

)

Weighted-average shares used in computing

net loss per share attributable to common stockholders—basic and

diluted

650,961

619,350

642,977

612,938

(1)

Beginning April 1, 2024, the

estimated average lifetime of a payer changed from 28 months to 27

months. Based on the carrying amount of deferred revenue and

deferred cost of revenue as of March 31, 2024, the change resulted

in an increase in revenue and cost of revenue during the three

months ended September 30, 2024 of $26.4 million and $5.4 million,

respectively, and $85.3 million and $17.8 million, respectively,

during the nine months ended September 30, 2024. This change will

increase our fiscal year 2024 revenue and cost of revenue by $98.0

million and $20.4 million, respectively. Refer to “Basis of

Presentation and Summary of Significant Accounting Policies —

Revenue Recognition” as described in the Company’s consolidated

financial statements and related notes included in the Company’s

Annual Report on Form 10-K for further background on the Company’s

process to estimate the average lifetime of a payer.

(2)

Depreciation of servers and

infrastructure equipment included in infrastructure and trust &

safety.

ROBLOX CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash flows from operating

activities:

Consolidated net loss

$

(240,447

)

$

(278,808

)

$

(719,562

)

$

(833,597

)

Adjustments to reconcile net loss

including noncontrolling interest to net cash and cash equivalents

provided by operations:

Depreciation and amortization expense

68,613

53,600

175,126

153,611

Stock-based compensation expense

265,165

220,022

757,558

617,288

Operating lease non-cash expense

31,104

26,048

88,592

70,801

(Accretion)/amortization on marketable

securities, net

(20,909

)

(20,474

)

(60,442

)

(52,219

)

Amortization of debt issuance costs

344

331

1,023

982

Impairment expense, (gain)/loss on

investment and other asset sales, and other, net

1,907

1,578

2,350

7,747

Changes in operating assets and

liabilities, net of effect of acquisitions:

Accounts receivable

(40,585

)

(29,454

)

119,460

93,174

Prepaid expenses and other current

assets

16,295

4,298

3,340

(1,861

)

Deferred cost of revenue

(46,876

)

(23,477

)

(99,491

)

(62,074

)

Other assets

1,744

502

(4,922

)

(6,189

)

Accounts payable

4,424

2,279

(4,404

)

3,855

Accrued expenses and other current

liabilities

8,238

19,745

(15,278

)

(2,599

)

Developer exchange liability

(18

)

18,880

15,405

7,724

Deferred revenue

212,159

130,943

409,809

360,098

Operating lease liabilities

(25,292

)

(15,994

)

(54,621

)

(46,837

)

Other long-term liabilities

11,564

2,685

23,882

4,971

Net cash and cash equivalents provided by

operating activities

247,430

112,704

637,825

314,875

Cash flows from investing

activities:

Acquisition of property and equipment

(29,405

)

(53,196

)

(115,786

)

(255,470

)

Payments related to business combination,

net of cash acquired

(840

)

(3,859

)

(2,840

)

(3,859

)

Purchases of intangible assets

—

—

(1,370

)

(13,500

)

Purchases of investments

(1,607,405

)

(761,151

)

(3,474,187

)

(3,803,911

)

Maturities of investments

842,450

632,000

2,431,770

956,010

Sales of investments

161,547

117,487

394,853

346,766

Net cash and cash equivalents used in

investing activities

(633,653

)

(68,719

)

(767,560

)

(2,773,964

)

Cash flows from financing

activities:

Proceeds from issuance of common stock

19,949

16,209

57,196

47,316

Proceeds from debt issuances

—

—

—

14,700

Financing payments related to

acquisitions

—

—

(4,450

)

(750

)

Net cash and cash equivalents provided by

financing activities

19,949

16,209

52,746

61,266

Effect of exchange rate changes on cash

and cash equivalents

2,499

(409

)

1,154

398

Net increase/(decrease) in cash and cash

equivalents

(363,775

)

59,785

(75,835

)

(2,397,425

)

Cash and cash equivalents

Beginning of period

966,406

520,264

678,466

2,977,474

End of period

$

602,631

$

580,049

$

602,631

$

580,049

Non-GAAP Financial Measures

This press release and the accompanying tables contain the

non-GAAP financial measure bookings, Adjusted EBITDA, and free cash

flow.

We use this non-GAAP financial information to evaluate our

ongoing operations and for internal planning and forecasting

purposes. We believe that this non-GAAP financial information may

be helpful to investors because it provides consistency and

comparability with past financial performance.

Bookings is defined as revenue plus the change in deferred

revenue during the period and other non-cash adjustments.

Substantially all of our bookings are generated from sales of

virtual currency, which can ultimately be converted to virtual

items on the Roblox Platform. Sales of virtual currency reflected

as bookings include one-time purchases and monthly subscriptions

purchased via payment processors or through prepaid cards. Bookings

also include an insignificant amount from advertising and licensing

arrangements. We believe bookings provide a timelier indication of

trends in our operating results that are not necessarily reflected

in our revenue as a result of the fact that we recognize the

majority of revenue over the estimated average lifetime of a paying

user. The change in deferred revenue constitutes the vast majority

of the reconciling difference from revenue to bookings. By removing

these non-cash adjustments, we are able to measure and monitor our

business performance based on the timing of actual transactions

with our users and the cash that is generated from these

transactions. Adjusted EBITDA represents our GAAP consolidated net

loss, excluding interest income, interest expense, other

income/(expense), provision for/(benefit from) income taxes,

depreciation and amortization expense, stock-based compensation

expense, and certain other nonrecurring adjustments. We believe

that, when considered together with reported GAAP amounts, Adjusted

EBITDA is useful to investors and management in understanding our

ongoing operations and ongoing operating trends. Our definition of

Adjusted EBITDA may differ from the definition used by other

companies and therefore comparability may be limited. Free cash

flow represents the net cash and cash equivalents provided by

operating activities less purchases of property, equipment, and

intangible assets acquired through asset acquisitions. We believe

that free cash flow is a useful indicator of our unit economics and

liquidity that provides information to management and investors

about the amount of cash generated from our core operations that,

after the purchases of property, equipment, and intangible assets

acquired through asset acquisitions, can be used for strategic

initiatives.

Non-GAAP financial measures have limitations in their usefulness

to investors because they have no standardized meaning prescribed

by GAAP and are not prepared under any comprehensive set of

accounting rules or principles. In addition, other companies,

including companies in our industry, may calculate similarly titled

non-GAAP financial measures differently or may use other measures

to evaluate their performance, all of which could reduce the

usefulness of our non-GAAP financial information as a tool for

comparison. As a result, our non-GAAP financial information is

presented for supplemental informational purposes only and should

not be considered in isolation from, or as a substitute for

financial information presented in accordance with GAAP.

Reconciliation tables of the most comparable GAAP financial

measure to the non-GAAP financial measure used in this press

release are included below. We encourage investors and others to

review our business, results of operations, and financial

information in their entirety, not to rely on any single financial

measure, and to view these non-GAAP measures in conjunction with

the most directly comparable GAAP financial measures.

GAAP to Non-GAAP Financial Measures Reconciliations

The following table presents a reconciliation of revenue, the

most directly comparable financial measure calculated in accordance

with GAAP, to bookings, for each of the periods presented (in

thousands, unaudited):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of revenue to

bookings:

Revenue

$

918,953

$

713,225

$

2,613,796

$

2,049,335

Add (deduct):

Change in deferred revenue

216,325

130,957

410,657

360,112

Other

(6,758

)

(4,729

)

(16,998

)

(15,489

)

Bookings

$

1,128,520

$

839,453

$

3,007,455

$

2,393,958

The following table presents a reconciliation of consolidated

net loss, the most directly comparable financial measure calculated

in accordance with GAAP, to Adjusted EBITDA, for each of the

periods presented (in thousands, unaudited):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of consolidated net loss

to Adjusted EBITDA:

Consolidated net loss

$

(240,447

)

$

(278,808

)

$

(719,562

)

$

(833,597

)

Add (deduct):

Interest income

(46,718

)

(36,442

)

(133,271

)

(102,288

)

Interest expense

10,286

10,268

30,853

30,409

Other (income)/expense, net

(2,352

)

4,262

1,309

1,425

Provision for/(benefit from) income

taxes

303

682

1,466

177

Depreciation and amortization

expense(A)

68,613

53,600

175,126

153,611

Stock-based compensation expense

265,165

220,022

757,558

617,288

RTO severance charge(B)

108

—

1,101

—

Other non-cash charges(C)

—

—

—

6,988

Adjusted EBITDA

$

54,958

$

(26,416

)

$

114,580

$

(125,987

)

(A)

Includes a one-time charge of

$17.9 million related to the re-assessment of the estimated useful

life of certain software licenses, resulting in the acceleration of

their remaining depreciation within infrastructure and trust &

safety expenses.

(B)

Relates to cash severance costs

associated with the Company’s return-to-office (“RTO”) plan

announced in October 2023, which required a subset of the Company’s

remote employees to begin working from the San Mateo headquarters

for three days a week, beginning in the summer of 2024.

(C)

Includes impairment expenses

related to certain operating lease right-of-use assets and related

property and equipment.

The following table presents a reconciliation of net cash and

cash equivalents provided by operating activities, the most

directly comparable financial measure calculated in accordance with

GAAP, to free cash flow, for each of the periods presented (in

thousands, unaudited):

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of net cash and cash

equivalents provided by operating activities to free cash

flow:

Net cash and cash equivalents provided by

operating activities

$

247,430

$

112,704

$

637,825

$

314,875

Deduct:

Acquisition of property and equipment

(29,405

)

(53,196

)

(115,786

)

(255,470

)

Purchases of intangible assets

—

—

(1,370

)

(13,500

)

Free cash flow

$

218,025

$

59,508

$

520,669

$

45,905

Forward Looking Guidance3: GAAP to Non-GAAP Financial

Measures Reconciliations

The following table presents a reconciliation of revenue, the

most directly comparable financial measure calculated in accordance

with GAAP, to bookings, for each of the periods presented (in

thousands):

Guidance

Updated Guidance

Three Months Ended December

31, 2024

Twelve Months Ended December

31, 2024

Low

High

Low

High

Reconciliation of revenue to

bookings:

Revenue

$

935,000

$

960,000

$

3,548,796

$

3,573,796

Add (deduct):

Change in deferred revenue

406,000

406,000

816,657

816,657

Other

(5,000

)

(5,000

)

(21,998

)

(21,998

)

Bookings

$

1,336,000

$

1,361,000

$

4,343,455

$

4,368,455

The following table presents a reconciliation of consolidated

net loss, the most directly comparable financial measure calculated

in accordance with GAAP, to Adjusted EBITDA, for each of the

periods presented (in thousands):

Guidance

Updated Guidance

Three Months Ended December

31, 2024

Twelve Months Ended December

31, 2024

Low

High

Low

High

Reconciliation of consolidated net loss

to Adjusted EBITDA:

Consolidated net loss

$

(303,000

)

$

(283,000

)

$

(1,022,562

)

$

(1,002,562

)

Add (deduct):

Interest income

(40,000

)

(40,000

)

(173,271

)

(173,271

)

Interest expense

11,000

11,000

41,853

41,853

Other (income)/expense, net

—

—

1,309

1,309

Provision for/(benefit from) income

taxes

2,000

2,000

3,466

3,466

Depreciation and amortization expense

55,000

55,000

230,126

230,126

Stock-based compensation expense

285,000

285,000

1,042,558

1,042,558

RTO severance charge(A)

—

—

1,101

1,101

Adjusted EBITDA

$

10,000

$

30,000

$

124,580

$

144,580

(A)

Relates to cash severance costs

associated with the Company’s RTO plan announced in October 2023,

which required a subset of the Company’s remote employees to begin

working from the San Mateo headquarters for three days a week,

beginning in the summer of 2024.

The following table presents a reconciliation of net cash and

cash equivalents provided by operating activities, the most

directly comparable financial measure calculated in accordance with

GAAP, to free cash flow, for each of the periods presented (in

thousands):

Guidance

Updated Guidance

Three Months Ended December

31, 2024

Twelve Months Ended December

31, 2024

Low

High

Low

High

Reconciliation of net cash and cash

equivalents provided by operating activities to free cash

flow:

Net cash and cash equivalents provided by

operating activities

$

170,000

$

185,000

$

807,825

$

822,825

Deduct:

Acquisition of property and equipment

(70,000

)

(70,000

)

(185,786

)

(185,786

)

Purchase of intangible assets

—

—

(1,370

)

(1,370

)

Free cash flow

$

100,000

$

115,000

$

620,669

$

635,669

____________________

3

Beginning April 1, 2024, the

estimated average lifetime of a payer changed from 28 months to 27

months, which is reflected in our fourth quarter and updated full

year 2024 GAAP and non-GAAP guidance. Based on the carrying amount

of deferred revenue and deferred cost of revenue as of March 31,

2024, the April 1, 2024 change in estimated average lifetime of a

payer will result in an increase in revenue and cost of revenue of

$12.7 and $2.6 million, respectively, during the fourth quarter of

2024 and an increase in revenue and cost of revenue of $98.0

million and $20.4 million, respectively, during the full year 2024.

Refer to “Basis of Presentation and Summary of Significant

Accounting Policies — Revenue Recognition” as described in the

Company’s consolidated financial statements and related notes

included in the Company’s Annual Report on Form 10-K for further

background on the Company’s process to estimate the average

lifetime of a payer.

About Roblox

Roblox is an immersive platform for connection and

communication. Every day, millions of people come to Roblox to

create, play, work, learn, and connect with each other in

experiences built by our global community of creators. Our vision

is to reimagine the way people come together – in a world that is

safe, civil, and optimistic. To achieve this vision, we are

building an innovative company that, together with the Roblox

community, has the ability to strengthen our social fabric and

support economic growth for people around the world. For more about

Roblox, please visit corp.roblox.com.

ROBLOX and the Roblox logo are among the registered and

unregistered trademarks of Roblox Corporation in the United States

and other countries. © 2024 Roblox Corporation. All rights

reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031953593/en/

Stefanie Notaney Roblox Corporate Communications

press@roblox.com

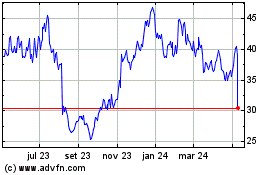

Roblox (NYSE:RBLX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

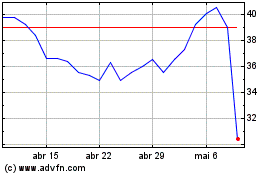

Roblox (NYSE:RBLX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025