NEWS SUMMARY

- Third-quarter revenue of $13.3 billion.

- Third-quarter GAAP earnings (loss) per share (EPS) attributable

to Intel was $(3.88); non-GAAP EPS attributable to Intel was

$(0.46).

- $(3.89) impact to GAAP EPS attributable to Intel from $15.9

billion of impairment charges and $2.8 billion of restructuring

charges; $(0.63) impact to non-GAAP EPS attributable to Intel from

$3.1 billion of impairment charges.

- Making significant progress on plan to deliver $10 billion in

cost reductions in 2025.

- Forecasting fourth-quarter 2024 revenue of $13.3 billion to

$14.3 billion; expecting fourth-quarter GAAP EPS attributable to

Intel of $(0.24); non-GAAP EPS attributable to Intel of $0.12.

Intel Corporation today reported third-quarter 2024 financial

results.

“Our Q3 results underscore the solid progress we are making

against the plan we outlined last quarter to reduce costs, simplify

our portfolio and improve organizational efficiency. We delivered

revenue above the midpoint of our guidance, and are acting with

urgency to position the business for sustainable value creation

moving forward,” said Pat Gelsinger, Intel CEO. “The momentum we

are building across our product portfolio to maximize the value of

our x86 franchise, combined with the strong interest Intel 18A is

attracting from foundry customers, reflects the impact of our

actions and the opportunities ahead.”

“Restructuring charges meaningfully impacted Q3 profitability as

we took important steps toward our cost reduction goal,” said David

Zinsner, Intel CFO. “The actions we took this quarter position us

for improved profitability and enhanced liquidity as we continue to

execute our strategy. We are encouraged by improved underlying

trends, reflected in our Q4 guidance.”

Q3 2024 Financial Highlights

GAAP

Non-GAAP

Q3 2024

Q3 2023

vs. Q3 2023

Q3 2024

Q3 2023

vs. Q3 2023

Revenue ($B)

$13.3

$14.2

down 6%

Gross Margin

15.0%

42.5%

down 27.5 ppts

18.0%

45.8%

down 27.8 ppts

R&D and MG&A ($B)

$5.4

$5.2

up 4%

$4.8

$4.6

up 4%

Operating Margin

(68.2)%

(0.1)%

down 68.1 ppts

(17.8)%

13.6%

down 31.4 ppts

Tax Rate

(87.0)%

696.2%

n/m*

13.0%

13.0%

—

Net Income (loss) Attributable to Intel

($B)

$(16.6)

$0.3

n/m*

$(2.0)

$1.7

n/m*

Earnings (loss) Per Share Attributable to

Intel

$(3.88)

$0.07

n/m*

$(0.46)

$0.41

n/m*

In the third quarter, the company generated $4.1 billion in cash

from operations and paid dividends of $0.5 billion.

*Not meaningful

Q3 2024 Restructuring and Impairment

Charges

In the third quarter, the company made significant progress on

its $10 billion cost reduction plan. The plan aims to drive

operational efficiency and agility, accelerate profitable growth

and create capacity for ongoing strategic investment in technology

and manufacturing leadership. These initiatives include structural

and operating realignment across the company, alongside reductions

in headcount, operating expenses and capital expenditures. As a

result of these actions, the company recognized $2.8 billion in

restructuring charges in Q3 2024, $528 million of which are

non-cash charges and $2.2 billion of which will be cash settled in

the future.

Intel's third quarter results were also materially impacted by

the following charges:

- $3.1 billion of charges, substantially all of which were

recognized in cost of sales, related to non-cash impairments and

the acceleration of depreciation for certain manufacturing assets,

a substantial majority of which related to the Intel 7 process

node, based upon an evaluation of current process technology node

capacities relative to projected market demand for Intel products

and services;

- $2.9 billion of non-cash charges associated with the impairment

of goodwill for certain reporting units – primarily the Mobileye

reporting unit – as well as certain acquired intangible assets;

and

- $9.9 billion of non-cash charges related to the establishment

of a valuation allowance against U.S. deferred tax assets.

The restructuring charges of $2.8 billion and the asset

impairment charges, including the allowance against our deferred

tax assets, and accelerated depreciation of $15.9 billion increased

GAAP loss per share attributable to Intel by $3.89. The

restructuring charges, impairments of goodwill and intangible

assets, and deferred tax asset valuation allowance had no impact on

non-GAAP loss per share attributable to Intel. The impairment

charges and accelerated depreciation for certain manufacturing

assets of $3.1 billion increased GAAP and non-GAAP loss per share

attributable to Intel by $0.57 and $0.63 per share, respectively.

These charges were not incorporated into the guidance Intel

provided for the third quarter of 2024.

Business Unit Summary

In October 2022, Intel announced an internal foundry operating

model, which took effect in the first quarter of 2024 and created a

foundry relationship between its Intel Products business

(collectively CCG, DCAI and NEX) and its Intel Foundry business

(including Foundry Technology Development, Foundry Manufacturing

and Supply Chain and Foundry Services, formerly IFS). The foundry

operating model is designed to reshape operational dynamics and

drive greater transparency, accountability, and focus on costs and

efficiency. In furtherance of Intel's internal foundry operating

model, Intel announced in the third quarter of 2024 its intent to

establish Intel Foundry as an independent subsidiary. The company

also previously announced its intent to operate Altera® as a

standalone business beginning in the first quarter of 2024. Altera

was previously included in DCAI's segment results. As a result of

these changes, the company modified its segment reporting in the

first quarter of 2024 to align to this new operating model. All

prior-period segment data has been retrospectively adjusted to

reflect the way the company internally receives information and

manages and monitors its operating segment performance starting in

fiscal year 2024. There are no changes to Intel’s consolidated

financial statements for any prior periods.

Business Unit Revenue and

Trends

Q3 2024

vs. Q3 2023

Intel Products:

Client Computing Group (CCG)

$7.3 billion

down

7%

Data Center and AI (DCAI)

$3.3 billion

up

9%

Network and Edge (NEX)

$1.5 billion

up

4%

Total Intel Products revenue

$12.2 billion

down

2%

Intel Foundry

$4.4 billion

down

8%

All other:

Altera

$412 million

down

44%

Mobileye

$485 million

down

8%

Other

$142 million

down

24%

Total all other revenue

$1,039 million

down

28%

Intersegment eliminations

$(4.3) billion

Total net revenue

$13.3 billion

down

6%

Intel Products Highlights

- Intel announced plans with AMD to create the x86 Ecosystem

Advisory Group, bringing together leaders from across the industry

to help shape the future of x86. The Ecosystem Advisory Group is

focused on simplifying software development, ensuring

interoperability and interface consistency across vendors and

providing developers with standard architectural tools and

instructions. Broadcom, Dell, Google, HPE, HP Inc., Lenovo, Meta,

Microsoft, Oracle, Red Hat have signed on as founding members.

- CCG: Intel continues to lead the AI PC category and is

on track to ship more than 100 million AI PCs by the end of 2025.

In September, Intel launched its Intel® Core™ Ultra 200V series

processors, code-named Lunar Lake, delivering several more hours of

battery life and gains in performance, graphics and AI. This month,

Intel launched the new Intel® Core™ Ultra 200S processors,

code-named Arrow Lake, that will scale AI PC capabilities to

desktop platforms and usher in the first enthusiast desktop AI

PCs.

- DCAI: Intel launched Intel® Xeon®, doubling the

performance of the prior generation with increased core counts,

memory bandwidth, and embedded AI acceleration. Intel also launched

its Intel® Gaudi® 3 AI accelerators, delivering twice the

networking bandwidth and 1.5x the memory bandwidth of its

predecessor for large language model efficiency. IBM and Intel

announced a global collaboration to deploy Intel Gaudi 3 AI

accelerators as a service on IBM Cloud, aiming to help more

cost-effectively scale enterprise AI and drive innovation

underpinned with security and resiliency.

- NEX: Intel achieved a significant design win earlier

this month with KDDI, a major global telecom, announcing its

selection of Samsung's vRAN 3.0 solution powered by 4th Gen Intel®

Xeon® Scalable processors with Intel vRAN Boost.

Intel Foundry Highlights

- Intel’s fifth node in four years, Intel 18A, will complete a

historic pace of design and process innovation, returning Intel to

process leadership. Intel 18A is healthy and continues to progress

well, and the company’s two lead products, Panther Lake for client

and Clearwater Forest for servers, have met early Intel 18A

milestones ahead of next year's launches.

- Intel and Amazon Web Services (AWS) are finalizing a

multi-year, multi-billion-dollar commitment to expand the

companies' existing partnership to include a new custom Xeon 6 chip

for AWS on Intel 3 and a new AI fabric chip for AWS on Intel

18A.

- The Biden-Harris Administration announced that Intel was

awarded up to $3 billion in direct funding under the CHIPS and

Science Act for the Secure Enclave program. The program is designed

to expand the trusted manufacturing of leading-edge semiconductors

for the U.S. government and fortify the domestic semiconductor

supply chain.

- Intel announced its intention to establish Intel Foundry as an

independent subsidiary. This structure provides clearer separation

for external foundry customers and suppliers between Intel Foundry

and Intel Products. It also gives Intel future flexibility to

evaluate independent sources of funding and optimize the capital

structure of Intel Foundry and Intel Products.

Business Outlook

Intel's guidance for the fourth quarter of 2024 includes both

GAAP and non-GAAP estimates as follows:

Q4 2024

GAAP

Non-GAAP

Revenue

$13.3-14.3 billion

Gross Margin

36.5%

39.5%

Tax Rate

(50)%

13%

Earnings (Loss) Per Share Attributable to

Intel—Diluted

$(0.24)

$0.12

Reconciliations between GAAP and non-GAAP financial measures are

included below. Actual results may differ materially from Intel’s

business outlook as a result of, among other things, the factors

described under “Forward-Looking Statements” below. The gross

margin and EPS outlook are based on the mid-point of the revenue

range.

Earnings Webcast

Intel will hold a public webcast at 2 p.m. PDT today to discuss

the results for its third quarter of 2024. The live public webcast

can be accessed on Intel's Investor Relations website at

www.intc.com. The corresponding earnings presentation and webcast

replay will also be available on the site.

Forward-Looking Statements

This release contains forward-looking statements that involve a

number of risks and uncertainties. Words such as "accelerate",

"achieve", "aim", "ambitions", "anticipate", "believe",

"committed", "continue", "could", "designed", "estimate", "expect",

"forecast", "future", "goals", "grow", "guidance", "intend",

"likely", "may", "might", "milestones", "next generation",

"objective", "on track", "opportunity", "outlook", "pending",

"plan", "position", "possible", "potential", "predict", "progress",

"ramp", "roadmap", "seek", "should", "strive", "targets", "to be",

"upcoming", "will", "would", and variations of such words and

similar expressions are intended to identify such forward-looking

statements, which may include statements regarding:

- our business plans and strategy and anticipated benefits

therefrom, including with respect to our IDM 2.0 strategy, Smart

Capital strategy, partnerships with Apollo and Brookfield, internal

foundry model, updated reporting structure, and AI strategy;

- projections of our future financial performance, including

future revenue, gross margins, capital expenditures, and cash

flows;

- projected costs and yield trends;

- future cash requirements, the availability, uses, sufficiency,

and cost of capital resources, and sources of funding, including

for future capital and R&D investments and for returns to

stockholders, such as stock repurchases and dividends, and credit

ratings expectations;

- future products, services, and technologies, and the expected

goals, timeline, ramps, progress, availability, production,

regulation, and benefits of such products, services, and

technologies, including future process nodes and packaging

technology, product roadmaps, schedules, future product

architectures, expectations regarding process performance, per-watt

parity, and metrics, and expectations regarding product and process

leadership;

- investment plans and impacts of investment plans, including in

the US and abroad;

- internal and external manufacturing plans, including future

internal manufacturing volumes, manufacturing expansion plans and

the financing therefor, and external foundry usage;

- future production capacity and product supply;

- supply expectations, including regarding constraints,

limitations, pricing, and industry shortages;

- plans and goals related to Intel's foundry business, including

with respect to anticipated customers, future manufacturing

capacity and service, technology, and IP offerings;

- expected timing and impact of acquisitions, divestitures, and

other significant transactions, including the sale of our NAND

memory business;

- expected completion and impacts of restructuring activities and

cost-saving or efficiency initiatives;

- future social and environmental performance goals, measures,

strategies, and results;

- our anticipated growth, future market share, and trends in our

businesses and operations;

- projected growth and trends in markets relevant to our

businesses;

- anticipated trends and impacts related to industry component,

substrate, and foundry capacity utilization, shortages, and

constraints;

- expectations regarding government incentives;

- future technology trends and developments, such as AI;

- future macro environmental and economic conditions;

- geopolitical tensions and conflicts and their potential impact

on our business;

- tax- and accounting-related expectations;

- expectations regarding our relationships with certain

sanctioned parties; and

- other characterizations of future events or circumstances.

Such statements involve many risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied, including those associated with:

- the high level of competition and rapid technological change in

our industry;

- the significant long-term and inherently risky investments we

are making in R&D and manufacturing facilities that may not

realize a favorable return;

- the complexities and uncertainties in developing and

implementing new semiconductor products and manufacturing process

technologies;

- our ability to time and scale our capital investments

appropriately and successfully secure favorable alternative

financing arrangements and government grants;

- implementing new business strategies and investing in new

businesses and technologies;

- changes in demand for our products;

- macroeconomic conditions and geopolitical tensions and

conflicts, including geopolitical and trade tensions between the US

and China, the impacts of Russia's war on Ukraine, tensions and

conflict affecting Israel and the Middle East, and rising tensions

between mainland China and Taiwan;

- the evolving market for products with AI capabilities;

- our complex global supply chain, including from disruptions,

delays, trade tensions and conflicts, or shortages;

- product defects, errata and other product issues, particularly

as we develop next-generation products and implement

next-generation manufacturing process technologies;

- potential security vulnerabilities in our products;

- increasing and evolving cybersecurity threats and privacy

risks;

- IP risks including related litigation and regulatory

proceedings;

- the need to attract, retain, and motivate key talent;

- strategic transactions and investments;

- sales-related risks, including customer concentration and the

use of distributors and other third parties;

- our significantly reduced return of capital in recent

years;

- our debt obligations and our ability to access sources of

capital;

- complex and evolving laws and regulations across many

jurisdictions;

- fluctuations in currency exchange rates;

- changes in our effective tax rate;

- catastrophic events;

- environmental, health, safety, and product regulations;

- our initiatives and new legal requirements with respect to

corporate responsibility matters; and

- other risks and uncertainties described in this release, our

2023 Form 10-K, and our other filings with the SEC.

Given these risks and uncertainties, readers are cautioned not

to place undue reliance on such forward-looking statements. Readers

are urged to carefully review and consider the various disclosures

made in this release and in other documents we file from time to

time with the SEC that disclose risks and uncertainties that may

affect our business.

Unless specifically indicated otherwise, the forward-looking

statements in this release do not reflect the potential impact of

any divestitures, mergers, acquisitions, or other business

combinations that have not been completed as of the date of this

filing. In addition, the forward-looking statements in this release

are based on management's expectations as of the date of this

release, unless an earlier date is specified, including

expectations based on third-party information and projections that

management believes to be reputable. We do not undertake, and

expressly disclaim any duty, to update such statements, whether as

a result of new information, new developments, or otherwise, except

to the extent that disclosure may be required by law.

About Intel

Intel (Nasdaq: INTC) is an industry leader, creating

world-changing technology that enables global progress and enriches

lives. Inspired by Moore’s Law, we continuously work to advance the

design and manufacturing of semiconductors to help address our

customers’ greatest challenges. By embedding intelligence in the

cloud, network, edge and every kind of computing device, we unleash

the potential of data to transform business and society for the

better. To learn more about Intel’s innovations, go to

newsroom.intel.com and intel.com.

© Intel Corporation. Intel, the Intel logo, and other Intel

marks are trademarks of Intel Corporation or its subsidiaries.

Other names and brands may be claimed as the property of

others.

Intel Corporation

Consolidated Condensed Statements

of Income and Other Information

Three Months Ended

(In Millions, Except Per Share Amounts;

Unaudited)

Sep 28, 2024

Sep 30, 2023

Net revenue

$

13,284

$

14,158

Cost of sales

11,287

8,140

Gross margin

1,997

6,018

Research and development

4,049

3,870

Marketing, general, and administrative

1,383

1,340

Restructuring and other charges

5,622

816

Operating expenses

11,054

6,026

Operating income (loss)

(9,057

)

(8

)

Gains (losses) on equity investments,

net

(159

)

(191

)

Interest and other, net

130

147

Income (loss) before taxes

(9,086

)

(52

)

Provision for (benefit from) taxes

7,903

(362

)

Net income (loss)

(16,989

)

310

Less: net income (loss) attributable to

non-controlling interests

(350

)

13

Net income (loss) attributable to

Intel

$

(16,639

)

$

297

Earnings (loss) per share attributable

to Intel—basic

$

(3.88

)

$

0.07

Earnings (loss) per share attributable

to Intel—diluted

$

(3.88

)

$

0.07

Weighted average shares of common stock

outstanding:

Basic

4,292

4,202

Diluted

4,292

4,229

Three Months Ended

(In Millions; Unaudited)

Sep 28, 2024

Sep 30, 2023

Earnings per share of common stock

information:

Weighted average shares of common stock

outstanding—basic

4,292

4,202

Dilutive effect of employee equity

incentive plans

—

27

Weighted average shares of common stock

outstanding—diluted

4,292

4,229

Other information:

(In Thousands; Unaudited)

Sep 28, 2024

Jun 29, 2024

Sep 30, 2023

Employees

Intel

115.0

116.5

116.6

Mobileye and other subsidiaries

5.4

5.3

4.8

NAND1

3.7

3.5

3.8

Total Intel

124.1

125.3

125.2

1 Employees of the NAND memory business,

which we divested to SK hynix on completion of the first closing on

December 29, 2021 and fully deconsolidated in Q1 2022. Upon

completion of the second closing of the divestiture, which remains

pending and subject to closing conditions, the NAND employees will

be excluded from the total Intel employee number.

Intel Corporation

Consolidated Condensed Balance

Sheets

(In Millions; Unaudited)

Sep 28, 2024

Dec 30, 2023

Assets

Current assets:

Cash and cash equivalents

$

8,785

$

7,079

Short-term investments

15,301

17,955

Accounts receivable, net

3,121

3,402

Inventories

Raw materials

1,434

1,166

Work in process

6,971

6,203

Finished goods

3,657

3,758

12,062

11,127

Other current assets

6,868

3,706

Total current assets

46,137

43,269

Property, plant, and equipment,

net

104,248

96,647

Equity investments

5,496

5,829

Goodwill

24,680

27,591

Identified intangible assets,

net

3,975

4,589

Other long-term assets

9,006

13,647

Total assets

$

193,542

$

191,572

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

11,074

8,578

Accrued compensation and benefits

5,015

3,655

Short-term debt

3,765

2,288

Income taxes payable

2,440

1,107

Other accrued liabilities

12,865

12,425

Total current liabilities

35,159

28,053

Debt

46,471

46,978

Other long-term liabilities

7,048

6,576

Stockholders’ equity:

Common stock and capital in excess of par

value, 4,309 issued and outstanding (4,228 issued and outstanding

as of December 30, 2023)

50,665

36,649

Accumulated other comprehensive income

(loss)

(185

)

(215

)

Retained earnings

49,052

69,156

Total Intel stockholders'

equity

99,532

105,590

Non-controlling interests

5,332

4,375

Total stockholders' equity

104,864

109,965

Total liabilities and stockholders’

equity

$

193,542

$

191,572

Intel Corporation

Consolidated Condensed Statements

of Cash Flows

Nine Months Ended

(In Millions; Unaudited)

Sep 28, 2024

Sep 30, 2023

Cash and cash equivalents, beginning of

period

$

7,079

$

11,144

Cash flows provided by (used for)

operating activities:

Net income (loss)

(19,080

)

(985

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation

7,651

5,753

Share-based compensation

2,759

2,433

Restructuring and other charges

3,626

718

Amortization of intangibles

1,081

1,336

(Gains) losses on equity investments,

net

75

47

Deferred taxes

6,368

(1,376

)

Impairments and net (gain) loss on

retirement of property, plant, and equipment

2,290

(87

)

Changes in assets and liabilities:

Accounts receivable

282

1,290

Inventories

(969

)

1,758

Accounts payable

566

(1,082

)

Accrued compensation and benefits

1,384

(1,171

)

Income taxes

(930

)

(1,300

)

Other assets and liabilities

20

(487

)

Total adjustments

24,203

7,832

Net cash provided by (used for)

operating activities

5,123

6,847

Cash flows provided by (used for)

investing activities:

Additions to property, plant, and

equipment

(18,110

)

(19,054

)

Proceeds from capital-related government

incentives

725

649

Purchases of short-term investments

(31,519

)

(37,287

)

Maturities and sales of short-term

investments

34,268

36,725

Other investing

144

244

Net cash provided by (used for)

investing activities

(14,492

)

(18,723

)

Cash flows provided by (used for)

financing activities:

Issuance of commercial paper, net of

issuance costs

7,349

—

Repayment of commercial paper

(7,349

)

(3,944

)

Payments on finance leases

—

(96

)

Partner contributions

12,278

1,106

Proceeds from sales of subsidiary

shares

—

2,423

Issuance of long-term debt, net of

issuance costs

2,975

11,391

Repayment of debt

(2,288

)

(423

)

Proceeds from sales of common stock

through employee equity incentive plans

986

1,037

Payment of dividends to stockholders

(1,599

)

(2,561

)

Other financing

(1,277

)

(580

)

Net cash provided by (used for)

financing activities

11,075

8,353

Net increase (decrease) in cash and

cash equivalents

1,706

(3,523

)

Cash and cash equivalents, end of

period

$

8,785

$

7,621

Intel Corporation

Supplemental Operating Segment

Results

Three Months Ended

(In Millions)

Sep 28, 2024

Sep 30, 2023

Operating segment revenue:

Intel Products:

Client Computing Group

Desktop

$

2,070

$

2,753

Notebook

4,888

4,503

Other

372

611

7,330

7,867

Data Center and AI

3,349

3,076

Network and Edge

1,511

1,450

Total Intel Products revenue

$

12,190

$

12,393

Intel Foundry

$

4,352

$

4,732

All other

Altera

412

735

Mobileye

485

530

Other

142

187

Total all other revenue

1,039

1,452

Total operating segment revenue

$

17,581

$

18,577

Intersegment eliminations

(4,297

)

(4,419

)

Total net revenue

$

13,284

$

14,158

Segment operating income

(loss):

Intel Products:

Client Computing Group

$

2,722

$

2,780

Data Center and AI

347

391

Network and Edge

268

100

Total Intel Products operating income

(loss)

$

3,337

$

3,271

Intel Foundry

$

(5,844

)

$

(1,407

)

All Other

Altera

9

263

Mobileye

78

170

Other

(42

)

(198

)

Total all other operating income

(loss)

$

45

$

235

Total segment operating income

(loss)

$

(2,462

)

$

2,099

Intersegment eliminations

(79

)

5

Corporate unallocated expenses

(6,516

)

(2,112

)

Total operating income (loss)

$

(9,057

)

$

(8

)

For information about our operating segments, including the

nature of segment revenues and expenses, and a reconciliation of

our operating segment revenue and operating income (loss) to our

consolidated results, refer to our Form 10-K filed on January 26,

2024, Form 8-K furnished on April 2, 2024 and 10-Q filed on October

31, 2024.

Intel Corporation Explanation of Non-GAAP

Measures

In addition to disclosing financial results in accordance with

US GAAP, this document contains references to the non-GAAP

financial measures below. We believe these non-GAAP financial

measures provide investors with useful supplemental information

about our operating performance, enable comparison of financial

trends and results between periods where certain items may vary

independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. These

non-GAAP financial measures are used in our performance-based RSUs

and our cash bonus plans.

Our non-GAAP financial measures reflect adjustments based on one

or more of the following items, as well as the related effects to

income taxes and net income (loss) attributable to non-controlling

interests effects. Income tax effects are calculated using a fixed

long-term projected tax rate of 13% across all adjustments. We

project this long-term non-GAAP tax rate on at least an annual

basis using a five-year non-GAAP financial projection that excludes

the income tax effects of each adjustment. The projected non-GAAP

tax rate also considers factors such as our tax structure, our tax

positions in various jurisdictions, and key legislation in

significant jurisdictions where we operate. This long-term non-GAAP

tax rate may be subject to change for a variety of reasons,

including the rapidly evolving global tax environment, significant

changes in our geographic earnings mix, or changes to our strategy

or business operations. Management uses this non-GAAP tax rate in

managing internal short- and long-term operating plans and in

evaluating our performance; we believe this approach facilitates

comparison of our operating results and provides useful evaluation

of our current operating performance. Non-GAAP adjustments

attributable to non-controlling interests are calculated by

adjusting for the minority stockholder portion of non-GAAP

adjustments we make for relevant acquisition-related costs,

share-based compensation, restructuring and other charges, and

income tax effects, as applicable to each majority-owned

subsidiary.

Our non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the financial results calculated in

accordance with US GAAP and reconciliations from these results

should be carefully evaluated.

Non-GAAP adjustment or

measure

Definition

Usefulness to management and

investors

Acquisition-related adjustments

Amortization of acquisition-related

intangible assets consists of amortization of intangible assets

such as developed technology, brands, and customer relationships

acquired in connection with business combinations. Charges related

to the amortization of these intangibles are recorded within both

cost of sales and MG&A in our US GAAP financial statements.

Amortization charges are recorded over the estimated useful life of

the related acquired intangible asset, and thus are generally

recorded over multiple years.

We exclude amortization charges for our

acquisition-related intangible assets for purposes of calculating

certain non-GAAP measures because these charges are inconsistent in

size and are significantly impacted by the timing and valuation of

our acquisitions. These adjustments facilitate a useful evaluation

of our current operating performance and comparison to our past

operating performance and provide investors with additional means

to evaluate cost and expense trends.

Share-based compensation

Share-based compensation consists of

charges related to our employee equity incentive plans.

We exclude charges related to share-based

compensation for purposes of calculating certain non-GAAP measures

because we believe these adjustments provide comparability to peer

company results and because these charges are not viewed by

management as part of our core operating performance. We believe

these adjustments provide investors with a useful view, through the

eyes of management, of our core business model, how management

currently evaluates core operational performance, and additional

means to evaluate expense trends, including in comparison to other

peer companies.

Restructuring and other charges

Restructuring charges are costs associated

with a restructuring plan and are primarily related to employee

severance and benefit arrangements. Q3 2024 includes charges

associated with the 2024 Restructuring Plan primarily comprised of

cash-based employee severance and benefit arrangements, and cash

and non-cash charges related to real estate exits and

consolidations, as well as non-cash construction in progress asset

impairments resulting from business exit activities. Other charges

include periodic goodwill and asset impairments, and other costs

associated with certain non-core activities. Q3 2024 includes

non-cash charges resulting from the impairment of goodwill and

certain acquired intangible assets. Q3 2023 includes two legal

related fees, which we do not expect to recur, relating to an

EC-imposed fine and a termination fee relating to Tower.

We exclude restructuring and other

charges, including any adjustments to charges recorded in prior

periods, for purposes of calculating certain non-GAAP measures

because these costs do not reflect our core operating performance.

These adjustments facilitate a useful evaluation of our core

operating performance and comparisons to past operating results and

provide investors with additional means to evaluate expense

trends.

(Gains) losses on equity investments,

net

(Gains) losses on equity investments, net

consists of ongoing mark-to-market adjustments on marketable equity

securities, observable price adjustments on non-marketable equity

securities, related impairment charges, and the gains (losses) from

the sale of equity investments and other.

We exclude these non-operating gains and

losses for purposes of calculating certain non-GAAP measures

because it provides comparability between periods. The exclusion

reflects how management evaluates the core operations of the

business.

(Gains) losses from divestiture

(Gains) losses are recognized at the close

of a divestiture, or over a specified deferral period when deferred

consideration is received at the time of closing. Based on our

ongoing obligation under the NAND wafer manufacturing and sale

agreement entered into in connection with the first closing of the

sale of our NAND memory business on December 29, 2021, a portion of

the initial closing consideration was deferred and will be

recognized between first and second closing.

We exclude gains or losses resulting from

divestitures for purposes of calculating certain non-GAAP measures

because they do not reflect our current operating performance.

These adjustments facilitate a useful evaluation of our current

operating performance and comparisons to past operating

results.

Deferred tax assets valuation

allowances

A non-cash charge recorded to provision

for (benefit from) income taxes related to a discreet valuation

allowance recorded against our US deferred tax assets.

We excluded a discrete non-cash charge in

Q3 2024 related to a valuation allowance established against our US

deferred tax assets due to a historical cumulative loss for GAAP

purposes. We excluded the discreet valuation allowance when

calculating certain non-GAAP measures as there is no such

historical cumulative loss on a non-GAAP basis; and because of the

size of the charge, the adjustment facilitates a useful evaluation

of our core operating performance and comparisons to our past

operating results.

Adjusted free cash flow

We reference a non-GAAP financial measure

of adjusted free cash flow, which is used by management when

assessing our sources of liquidity, capital resources, and quality

of earnings. Adjusted free cash flow is operating cash flow

adjusted for (1) purchases of property, plant, and equipment,

including purchases where the vendor has extended payment terms to

us, net of proceeds from capital-related government incentives and

partner contributions, and (2) payments on finance leases.

This non-GAAP financial measure is helpful

in understanding our capital requirements and sources of liquidity

by providing an additional means to evaluate the cash flow trends

of our business.

Net capital spending

We reference a non-GAAP financial measure

of net capital spending, which is additions to property, plant, and

equipment, net of proceeds from capital-related government

incentives and partner contributions.

We believe this measure provides investors

with useful supplemental information about our capital investment

activities and capital offsets, and allows for greater transparency

with respect to a key metric used by management in operating our

business and measuring our performance.

Intel Corporation Supplemental Reconciliations

of GAAP Actuals to Non-GAAP Actuals

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the reconciliations from US GAAP to

Non-GAAP actuals should be carefully evaluated. Please refer to

"Explanation of Non-GAAP Measures" in this document for a detailed

explanation of the adjustments made to the comparable US GAAP

measures, the ways management uses the non-GAAP measures, and the

reasons why management believes the non-GAAP measures provide

useful information for investors.

Three Months Ended

(In Millions, Except Per Share

Amounts)

Sep 28, 2024

Sep 30, 2023

GAAP gross margin

$

1,997

$

6,018

Acquisition-related adjustments

224

301

Share-based compensation

172

164

Non-GAAP gross margin

$

2,393

$

6,483

GAAP gross margin percentage

15.0

%

42.5

%

Acquisition-related adjustments

1.7

%

2.1

%

Share-based compensation

1.3

%

1.2

%

Non-GAAP gross margin

percentage

18.0

%

45.8

%

GAAP R&D and MG&A

$

5,432

$

5,210

Acquisition-related adjustments

(42

)

(43

)

Share-based compensation

(628

)

(608

)

Non-GAAP R&D and MG&A

$

4,762

$

4,559

GAAP operating income (loss)

$

(9,057

)

$

(8

)

Acquisition-related adjustments

266

344

Share-based compensation

800

772

Restructuring and other charges

5,622

816

Non-GAAP operating income

(loss)

$

(2,369

)

$

1,924

GAAP operating margin

(68.2

)%

(0.1

)%

Acquisition-related adjustments

2.0

%

2.4

%

Share-based compensation

6.0

%

5.5

%

Restructuring and other charges

42.3

%

5.8

%

Non-GAAP operating margin

(17.8

)%

13.6

%

GAAP tax rate

(87.0

)%

696.2

%

Deferred tax assets valuation

allowance

121.0

%

—

%

Income tax effects

(21.0

)%

(683.2

)%

Non-GAAP tax rate

13.0

%

13.0

%

GAAP net income (loss) attributable to

Intel

$

(16,639

)

$

297

Acquisition-related adjustments

266

344

Share-based compensation

800

772

Restructuring and other charges

5,622

816

(Gains) losses on equity investments,

net

159

191

(Gains) losses from divestiture

(39

)

(36

)

Adjustments attributable to

non-controlling interest

(344

)

(18

)

Deferred tax assets valuation

allowances

9,925

—

Income tax effects

(1,726

)

(627

)

Non-GAAP net income (loss) attributable

to Intel

$

(1,976

)

$

1,739

(In Millions, Except Per Share

Amounts)

Sep 28, 2024

Sep 30, 2023

GAAP earnings (loss) per share

attributable to Intel—diluted

$

(3.88

)

$

0.07

Acquisition-related adjustments

0.06

0.08

Share-based compensation

0.19

0.18

Restructuring and other charges

1.31

0.19

(Gains) losses on equity investments,

net

0.04

0.05

(Gains) losses from divestiture

(0.01

)

(0.01

)

Adjustments attributable to

non-controlling interest

(0.08

)

—

Deferred tax assets valuation

allowance

2.31

—

Income tax effects

(0.40

)

(0.15

)

Non-GAAP earnings (loss) per share

attributable to Intel—diluted

$

(0.46

)

$

0.41

GAAP net cash provided by (used for)

operating activities

$

4,054

$

5,824

Net purchase of property, plant, and

equipment

(6,756

)

(4,881

)

Payments on finance leases

—

—

Adjusted free cash flow

$

(2,702

)

$

943

GAAP net cash provided by (used for)

investing activities

$

(2,764

)

$

(7,394

)

GAAP net cash provided by (used for)

financing activities

$

(3,792

)

$

842

Intel Corporation Supplemental Reconciliations

of GAAP Outlook to Non-GAAP Outlook

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the financial outlook prepared in

accordance with US GAAP and the reconciliations from this Business

Outlook should be carefully evaluated. Please refer to "Explanation

of Non-GAAP Measures" in this document for a detailed explanation

of the adjustments made to the comparable US GAAP measures, the

ways management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors.

Q4 2024 Outlook1

Approximately

GAAP gross margin percentage

36.5

%

Acquisition-related adjustments

1.6

%

Share-based compensation

1.4

%

Non-GAAP gross margin

percentage

39.5

%

GAAP tax rate

(50

)%

Income tax effects

63

%

Non-GAAP tax rate

13

%

GAAP earnings (loss) per share

attributable to Intel—diluted

$

(0.24

)

Acquisition-related adjustments

0.06

Share-based compensation

0.17

Restructuring and other charges

0.08

(Gains) losses from divestiture

(0.01

)

Adjustments attributable to

non-controlling interest

—

Income tax effects

0.06

Non-GAAP earnings (loss) per share

attributable to Intel—diluted

$

0.12

1 Non-GAAP gross margin percentage and non-GAAP EPS outlook

based on the mid-point of the revenue range.

Intel Corporation Supplemental Reconciliations

of Other GAAP to Non-GAAP Forward-Looking Estimates

Set forth below are reconciliations of the non-GAAP financial

measure to the most directly comparable US GAAP financial measure.

These non-GAAP financial measures should not be considered a

substitute for, or superior to, financial measures calculated in

accordance with US GAAP, and the reconciliations should be

carefully evaluated. Please refer to "Explanation of Non-GAAP

Measures" in this document for a detailed explanation of the

adjustments made to the comparable US GAAP measures, the ways

management uses the non-GAAP measures, and the reasons why

management believes the non-GAAP measures provide useful

information for investors.

(In Billions)

Full-Year 2024

Full-Year 2025

Approximately

Approximately

GAAP additions to property, plant and

equipment (gross capital expenditures)

$

25.0

$20.0 - $23.0

Proceeds from capital-related government

incentives

(1.0

)

(4.0 - 6.0)

Partner contributions, net

(13.0

)

(4.0 - 5.0)

Non-GAAP net capital spending

$

11.0

$12.0 - $14.0

GAAP R&D and MG&A

$

20.0

Acquisition-related adjustments

(0.1

)

Share-based compensation

(2.4

)

Non-GAAP R&D and MG&A

$

17.5

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031830925/en/

Kylie Altman Investor Relations 1-916-356-0320

kylie.altman@intel.com

Sophie Won Media Relations 1-408-653-0475

sophie.won@intel.com

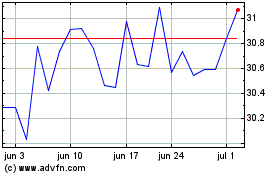

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024