Election Uncertainty May Lead To Choppy Trading On Wall Street

04 Novembro 2024 - 11:04AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Monday, with stocks likely to show a lack of direction

in early trading.

Traders may be reluctant to make significant moves ahead of the

U.S. elections on Tuesday, as Vice President Kamala Harris faces

off against former President Donald Trump.

With polls showing an extremely tight race between Harris and

Trump, the outcome of the presidential election may not be known on

Election Day.

The results of House and Senate races are also likely to be in

focus, as the makeup of Congress could affect how much the next

president can accomplish.

Traders are also looking ahead to the Federal Reserve’s monetary

policy decision, which is due to be announced on Thursday.

The Fed is widely expected to lower interest rates by another 25

basis points, but traders will be looking to the accompanying

statement for clues about the likelihood of future rate cuts.

Following the sell-off seen during Thursday’s session, stocks

showed a strong move back to the upside in early trading on Friday.

The major averages gave back some ground over the course of the

trading day but remained firmly in positive territory.

The tech-heavy Nasdaq led the way higher, advancing 144.77

points or 0.8 percent to 18,239.92 after moving sharply lower over

two previous sessions. The Dow also climbed 288.73 points or 0.7

percent to 42,052.19, bouncing off its lowest closing level in over

a month, while the S&P 500 rose 23.35 points or 0.4 percent to

5,728.80.

Despite the rebound on the day, the major averages all moved to

the downside for the week. The Dow dipped by 0.2 percent, while the

S&P 500 and the Nasdaq slumped by 1.4 percent and 1.5 percent,

respectively.

The rebound on Wall Street partly reflected a positive reaction

to upbeat earnings news from big-name companies like Intel

(NASDAQ:INTC) and Amazon (NASDAQ:AMZN).

Semiconductor giant Intel soared by 7.8 percent after reporting

better than expected third quarter results and providing strong

guidance.

Shares of Amazon also spiked by 6.2 percent after the online

retail giant reported third quarter results that exceeded analyst

estimates on both the top and bottom lines.

On the other hand, shares of Apple (NASDAQ:AAPL) moved to the

downside even though the tech giant reported better than expected

fiscal fourth quarter results.

Traders were also digesting the Labor Department’s closely

watched report, which showed much weaker than expected job growth

in the month of October.

The Labor Department said non-farm payroll employment crept up

by 12,000 jobs in October after jumping by a downwardly revised

223,000 jobs in September.

Economists had expected employment to climb by 113,000 jobs

compared to the surge of 254,000 jobs originally reported for the

previous month.

Meanwhile, the report said the unemployment rate came in at 4.1

percent in October, unchanged from September and in line with

economist estimates.

While the data raised some concerns about the strength of the

economy, the report also led to renewed optimism about the outlook

for interest rates.

However, due the impact of Hurricanes Helene and Milton and the

Boeing (NYSE:BA) strike, the report may not affect the Federal

Reserve’s plan to gradually lower rates.

Retail stocks moved sharply higher on the heels of the upbeat

results from Amazon, driving the Dow Jones U.S. Retail Index up by

2.6 percent to a record closing high.

Considerable strength was also visible among biotechnology

stocks, as reflected by the 2.2 percent jump by the NYSE Arca

Biotechnology Index.

Airline, networking and computer hardware stocks also saw

significant strength, while notable weakness emerged among

utilities and natural gas stocks.

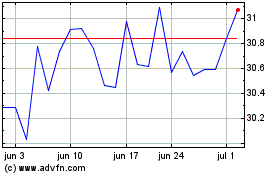

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Intel (NASDAQ:INTC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025