- Reported earnings of $4.5 billion; cash flow from operations of

$9.7 billion

- Returned record $7.7 billion cash to shareholders

- Started up key U.S. Gulf of Mexico projects

- Optimizing portfolio with announced $6.5 billion sale of

Canadian assets

Chevron Corporation (NYSE: CVX) reported earnings of $4.5

billion ($2.48 per share - diluted) for third quarter 2024,

compared with $6.5 billion ($3.48 per share - diluted) in third

quarter 2023. Foreign currency effects decreased earnings by $44

million. Adjusted earnings of $4.5 billion ($2.51 per share -

diluted) in third quarter 2024 compared to adjusted earnings of

$5.7 billion ($3.05 per share - diluted) in third quarter 2023. See

Attachment 4 for a reconciliation of adjusted earnings.

Earnings & Cash Flow Summary

YTD

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Total Earnings / (Loss)

$ MM

$

4,487

$

4,434

$

6,526

$

14,422

$

19,110

Upstream

$ MM

$

4,589

$

4,470

$

5,755

$

14,298

$

15,852

Downstream

$ MM

$

595

$

597

$

1,683

$

1,975

$

4,990

All Other

$ MM

$

(697

)

$

(633

)

$

(912

)

$

(1,851

)

$

(1,732

)

Earnings Per Share - Diluted

$/Share

$

2.48

$

2.43

$

3.48

$

7.88

$

10.14

Adjusted Earnings (1)

$ MM

$

4,531

$

4,677

$

5,721

$

14,624

$

18,240

Adjusted Earnings Per Share - Diluted

(1)

$/Share

$

2.51

$

2.55

$

3.05

$

7.99

$

9.68

Cash Flow From Operations (CFFO)

$ B

$

9.7

$

6.3

$

9.7

$

22.8

$

23.2

CFFO Excluding Working Capital (1)

$ B

$

8.3

$

8.7

$

8.9

$

25.0

$

27.4

(1) See non-GAAP reconciliation in

attachments

“We delivered strong financial and operational results, started

up key projects in the U.S. Gulf of Mexico and returned record cash

to shareholders this quarter,” said Mike Wirth, Chevron’s chairman

and chief executive officer. Worldwide net oil-equivalent

production increased 7 percent from last year as U.S. and Permian

Basin production set another quarterly record. Chevron started up

key projects in Anchor, Jack/St. Malo and Tahiti fields this

quarter. These projects, combined with additional project start-ups

through 2025, are expected to grow U.S. Gulf of Mexico production

to 300,000 barrels of net oil-equivalent per day by 2026.

“We are also taking steps to optimize our portfolio and reduce

operating costs to deliver superior long-term value to

shareholders,” Wirth concluded. The company expects to close asset

sales in Canada, Congo and Alaska in fourth quarter 2024, as part

of its plan to divest $10-15 billion of assets by 2028.

Additionally, cost reduction efforts are underway, and the company

is targeting $2-3 billion of structural cost reductions from 2024

by the end of 2026.

Financial and Business Highlights

YTD

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Return on Capital Employed (ROCE)

%

10.1

%

9.9

%

14.5

%

10.8

%

14.0

%

Capital Expenditures (Capex)

$ B

$

4.1

$

4.0

$

4.7

$

12.1

$

11.5

Affiliate Capex

$ B

$

0.6

$

0.6

$

0.8

$

1.8

$

2.7

Free Cash Flow (1)

$ B

$

5.6

$

2.3

$

5.0

$

10.7

$

11.7

Free Cash Flow ex. working capital (1)

$ B

$

4.2

$

4.8

$

4.2

$

12.9

$

15.9

Debt Ratio (end of period)

%

14.2

%

12.7

%

11.1

%

14.2

%

11.1

%

Net Debt Ratio (1) (end of period)

%

11.9

%

10.7

%

8.1

%

11.9

%

8.1

%

Net Oil-Equivalent Production

MBOED

3,364

3,292

3,146

3,334

3,028

(1) See non-GAAP reconciliation in

attachments

Financial Highlights

- Third quarter 2024 earnings decreased compared to last year

primarily due to lower margins on refined product sales, lower

realizations and the absence of prior year favorable tax

items.

- Worldwide net oil-equivalent production was up 7 percent from a

year ago primarily due to record production in the Permian Basin

and the acquisition of PDC Energy, Inc. (PDC).

- Capex in third quarter 2024 was down from last year largely due

to the absence of the third quarter 2023 acquisition of a majority

stake in ACES Delta, LLC.

- Cash flow from operations was in line with the year ago period

mainly as lower earnings and a one-time payment for ceased

operations were offset by higher dividends from equity affiliates

and favorable working capital effects.

- The company returned a record $7.7 billion of cash to

shareholders during the quarter, including share repurchases of

$4.7 billion and dividends of $2.9 billion.

- The company’s Board of Directors declared a quarterly dividend

of one dollar and sixty-three cents ($1.63) per share, payable

December 10, 2024, to all holders of common stock as shown on the

transfer records of the corporation at the close of business on

November 18, 2024.

Business Highlights and Milestones

- Started production at the Anchor project in the U.S. Gulf of

Mexico, marking successful delivery of an industry-first

high-pressure deepwater technology.

- Began water injection operations to boost production from

company operated Jack/St. Malo and Tahiti fields in the U.S. Gulf

of Mexico.

- Achieved start-up of the final pressure boost compressor at the

Wellhead Pressure Management Project at the company’s affiliate

Tengizchevroil (TCO) in Kazakhstan.

- Completed major turnarounds at TCO’s Complex Technology Line

(KTL-1) and Gorgon’s Train 2 plants ahead of schedule.

- Announced a $6.5 billion sale of the company’s interest in the

Athabasca Oil Sands Project and Duvernay shale assets in Canada

that is expected to close in fourth quarter 2024.

- Cleared Federal Trade Commission antitrust review of the

company’s pending merger with Hess Corporation, satisfying a key

closing condition for the transaction.

- Realized approximately 30 percent greater-than-projected

capital expenditure and cost synergies since acquiring PDC. These

assets, along with our other assets in Colorado, are among the

lowest carbon intensity in the industry.

- Successfully extended the Meji field offshore Nigeria with a

near-field discovery.

- Announced the establishment of an engineering and innovation

center in India to provide technical and digital solutions for the

enterprise.

- Received an offshore Australia greenhouse gas assessment

permit, covering an area of approximately 8,467 km2, to assess

future CO2 storage.

Segment Highlights

Upstream

YTD

U.S. Upstream

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Earnings / (Loss)

$ MM

$

1,946

$

2,161

$

2,074

$

6,182

$

5,495

Net Oil-Equivalent Production

MBOED

1,605

1,572

1,407

1,584

1,265

Liquids Production

MBD

1,156

1,132

1,028

1,139

941

Natural Gas Production

MMCFD

2,694

2,643

2,275

2,665

1,947

Liquids Realization

$/BBL

$

54.86

$

59.85

$

62.42

$

57.33

$

59.40

Natural Gas Realization

$/MCF

$

0.55

$

0.76

$

1.39

$

0.85

$

1.69

- U.S. upstream earnings were slightly lower than the year-ago

period as lower realizations and higher depreciation, depletion and

amortization, mainly from higher production, were nearly offset by

higher sales volumes and lower operating expenses.

- U.S. net oil-equivalent production was up 198,000 barrels per

day from a year earlier and set a new quarterly record, primarily

due to record high production in the Permian Basin and the

acquisition of PDC, partly offset by hurricane impacts in the U.S.

Gulf of Mexico that reduced production by 17,000 barrels per

day.

YTD

International Upstream

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Earnings / (Loss) (1)

$ MM

$

2,643

$

2,309

$

3,681

$

8,116

$

10,357

Net Oil-Equivalent Production

MBOED

1,759

1,720

1,739

1,750

1,763

Liquids Production

MBD

834

823

803

832

826

Natural Gas Production

MMCFD

5,550

5,378

5,616

5,513

5,621

Liquids Realization

$/BBL

$

70.59

$

74.92

$

75.64

$

72.70

$

70.78

Natural Gas Realization

$/MCF

$

7.46

$

6.86

$

6.96

$

7.20

$

7.81

(1) Includes foreign currency effects

$ MM

$

13

$

(237

)

$

584

$

(202

)

$

538

- International upstream earnings were lower than a year ago

primarily due to the absence of prior year favorable tax effects

and absence of prior year favorable foreign currency effects.

- Net oil-equivalent production during the quarter was up 20,000

barrels per day from a year earlier primarily due to entitlement

effects.

Downstream

YTD

U.S. Downstream

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Earnings / (Loss)

$ MM

$

146

$

280

$

1,376

$

879

$

3,434

Refinery Crude Unit Inputs

MBD

995

900

980

925

965

Refined Product Sales

MBD

1,312

1,327

1,303

1,296

1,283

- U.S. downstream earnings were lower compared to last year

primarily due to lower margins on refined product sales, partly

offset by higher earnings from the 50 percent-owned affiliate,

CPChem.

- Refinery crude unit inputs, including crude oil and other

inputs, increased 2 percent from the year-ago period primarily due

to the absence of planned turnaround at the Richmond, California

refinery, partly offset by hurricane impacts at the Pasadena, Texas

refinery.

- Refined product sales increased 1 percent compared to the

year-ago period primarily due to higher demand for gasoline.

YTD

International Downstream

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Earnings / (Loss) (1)

$ MM

$

449

$

317

$

307

$

1,096

$

1,556

Refinery Crude Unit Inputs

MBD

628

650

637

643

637

Refined Product Sales

MBD

1,507

1,485

1,431

1,473

1,448

(1) Includes foreign currency effects

$ MM

$

(55

)

$

(1

)

$

24

$

—

$

46

- International downstream earnings were higher compared to a

year ago primarily due to higher margins on refined product sales,

partly offset by higher operating expenses and unfavorable foreign

currency effects.

- Refinery crude unit inputs, including crude oil and other

inputs, decreased 1 percent from the year-ago period primarily due

to higher planned turnarounds.

- Refined product sales increased 5 percent from the year-ago

period primarily due to higher demand for gasoline and jet

fuel.

All Other

YTD

All Other

Unit

3Q 2024

2Q 2024

3Q 2023

3Q 2024

3Q 2023

Net charges (1)

$ MM

$

(697

)

$

(633

)

$

(912

)

$

(1,851

)

$

(1,732

)

(1) Includes foreign currency effects

$ MM

$

(2

)

$

(5

)

$

(323

)

$

—

$

(329

)

- All Other consists of worldwide cash management and debt

financing activities, corporate administrative functions, insurance

operations, real estate activities and technology companies.

- Net charges decreased compared to a year ago primarily due to

the absence of prior year unfavorable foreign currency effects,

partly offset by higher interest expense and lower interest

income.

Chevron is one of the world’s leading integrated energy

companies. We believe affordable, reliable and ever-cleaner energy

is essential to enabling human progress. Chevron produces crude oil

and natural gas; manufactures transportation fuels, lubricants,

petrochemicals and additives; and develops technologies that

enhance our business and the industry. We aim to grow our oil and

gas business, lower the carbon intensity of our operations and grow

lower carbon businesses in renewable fuels, carbon capture and

offsets, hydrogen and other emerging technologies. More information

about Chevron is available at www.chevron.com.

NOTICE

Chevron’s discussion of third quarter 2024 earnings with

security analysts will take place on Friday, November 1, 2024, at

8:00 a.m. PT. A webcast of the meeting will be available in a

listen-only mode to individual investors, media, and other

interested parties on Chevron’s website at www.chevron.com under

the “Investors” section. Prepared remarks for today’s call,

additional financial and operating information and other

complementary materials will be available prior to the call at

approximately 3:30 a.m. PT and located under “Events and

Presentations” in the “Investors” section on the Chevron

website.

As used in this news release, the term “Chevron” and such terms

as “the company,” “the corporation,” “our,” “we,” “us” and “its”

may refer to Chevron Corporation, one or more of its consolidated

subsidiaries, or to all of them taken as a whole. All of these

terms are used for convenience only and are not intended as a

precise description of any of the separate companies, each of which

manages its own affairs. Structural cost reductions describe

decreases in operating expenses from operational efficiencies,

divestments, and other cost saving measures that are expected to be

sustainable compared with 2024 levels.

Please visit Chevron’s website and Investor Relations page at

www.chevron.com and www.chevron.com/investors, LinkedIn:

www.linkedin.com/company/chevron, X: @Chevron, Facebook:

www.facebook.com/chevron, and Instagram: www.instagram.com/chevron,

where Chevron often discloses important information about the

company, its business, and its results of operations.

Non-GAAP Financial Measures - This news release includes

adjusted earnings/(loss), which reflect earnings or losses

excluding significant non-operational items including impairment

charges, write-offs, decommissioning obligations from previously

sold assets, severance costs, gains on asset sales, unusual tax

items, effects of pension settlements and curtailments, foreign

currency effects and other special items. We believe it is useful

for investors to consider this measure in comparing the underlying

performance of our business across periods. The presentation of

this additional information is not meant to be considered in

isolation or as a substitute for net income (loss) as prepared in

accordance with U.S. GAAP. A reconciliation to net income (loss)

attributable to Chevron Corporation is shown in Attachment 4.

This news release also includes cash flow from operations

excluding working capital, free cash flow and free cash flow

excluding working capital. Cash flow from operations excluding

working capital is defined as net cash provided by operating

activities less net changes in operating working capital, and

represents cash generated by operating activities excluding the

timing impacts of working capital. Free cash flow is defined as net

cash provided by operating activities less capital expenditures and

generally represents the cash available to creditors and investors

after investing in the business. Free cash flow excluding working

capital is defined as net cash provided by operating activities

excluding working capital less capital expenditures and generally

represents the cash available to creditors and investors after

investing in the business excluding the timing impacts of working

capital. The company believes these measures are useful to monitor

the financial health of the company and its performance over time.

Reconciliations of cash flow from operations excluding working

capital, free cash flow and free cash flow excluding working

capital are shown in Attachment 3.

This news release also includes net debt ratio. Net debt ratio

is defined as total debt less cash and cash equivalents, time

deposits and marketable securities as a percentage of total debt

less cash and cash equivalents, time deposits and marketable

securities, plus Chevron Corporation stockholders’ equity, which

indicates the company’s leverage, net of its cash balances. The

company believes this measure is useful to monitor the strength of

the company’s balance sheet. A reconciliation of net debt ratio is

shown in Attachment 2.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION FOR THE PURPOSE OF “SAFE HARBOR”

PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995

This news release contains forward-looking statements relating

to Chevron’s operations and lower carbon strategy that are based on

management’s current expectations, estimates, and projections about

the petroleum, chemicals, and other energy-related industries.

Words or phrases such as “anticipates,” “expects,” “intends,”

“plans,” “targets,” “advances,” “commits,” “drives,” “aims,”

“forecasts,” “projects,” “believes,” “approaches,” “seeks,”

“schedules,” “estimates,” “positions,” “pursues,” “progress,”

“may,” “can,” “could,” “should,” “will,” “budgets,” “outlook,”

“trends,” “guidance,” “focus,” “on track,” “goals,” “objectives,”

“strategies,” “opportunities,” “poised,” “potential,” “ambitions,”

“aspires” and similar expressions, and variations or negatives of

these words, are intended to identify such forward-looking

statements, but not all forward-looking statements include such

words. These statements are not guarantees of future performance

and are subject to numerous risks, uncertainties and other factors,

many of which are beyond the company’s control and are difficult to

predict. Therefore, actual outcomes and results may differ

materially from what is expressed or forecasted in such

forward-looking statements. The reader should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this news release. Unless legally required, Chevron

undertakes no obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Among the important factors that could cause actual results to

differ materially from those in the forward-looking statements are:

changing crude oil and natural gas prices and demand for the

company’s products, and production curtailments due to market

conditions; crude oil production quotas or other actions that might

be imposed by the Organization of Petroleum Exporting Countries and

other producing countries; technological advancements; changes to

government policies in the countries in which the company operates;

public health crises, such as pandemics and epidemics, and any

related government policies and actions; disruptions in the

company’s global supply chain, including supply chain constraints

and escalation of the cost of goods and services; changing

economic, regulatory and political environments in the various

countries in which the company operates; general domestic and

international economic, market and political conditions, including

the military conflict between Russia and Ukraine, the conflict in

Israel and the global response to these hostilities; changing

refining, marketing and chemicals margins; the company’s ability to

realize anticipated cost savings and efficiencies associated with

enterprise structural cost reduction initiatives; actions of

competitors or regulators; timing of exploration expenses; timing

of crude oil liftings; the competitiveness of alternate-energy

sources or product substitutes; development of large carbon capture

and offset markets; the results of operations and financial

condition of the company’s suppliers, vendors, partners and equity

affiliates; the inability or failure of the company’s joint-venture

partners to fund their share of operations and development

activities; the potential failure to achieve expected net

production from existing and future crude oil and natural gas

development projects; potential delays in the development,

construction or start-up of planned projects; the potential

disruption or interruption of the company’s operations due to war,

accidents, political events, civil unrest, severe weather, cyber

threats, terrorist acts, or other natural or human causes beyond

the company’s control; the potential liability for remedial actions

or assessments under existing or future environmental regulations

and litigation; significant operational, investment or product

changes undertaken or required by existing or future environmental

statutes and regulations, including international agreements and

national or regional legislation and regulatory measures related to

greenhouse gas emissions and climate change; the potential

liability resulting from pending or future litigation; the risk

that regulatory approvals and clearances with respect to the Hess

Corporation (Hess) transaction are not obtained or are obtained

subject to conditions that are not anticipated by the company and

Hess; potential delays in consummating the Hess transaction,

including as a result of the ongoing arbitration proceedings

regarding preemptive rights in the Stabroek Block joint operating

agreement; risks that such ongoing arbitration is not

satisfactorily resolved and the potential transaction fails to be

consummated; uncertainties as to whether the potential transaction,

if consummated, will achieve its anticipated economic benefits,

including as a result of risks associated with third party

contracts containing material consent, anti-assignment, transfer or

other provisions that may be related to the potential transaction

that are not waived or otherwise satisfactorily resolved; the

company’s ability to integrate Hess’ operations in a successful

manner and in the expected time period; the possibility that any of

the anticipated benefits and projected synergies of the potential

transaction will not be realized or will not be realized within the

expected time period; the company’s future acquisitions or

dispositions of assets or shares or the delay or failure of such

transactions to close based on required closing conditions; the

potential for gains and losses from asset dispositions or

impairments; government mandated sales, divestitures,

recapitalizations, taxes and tax audits, tariffs, sanctions,

changes in fiscal terms or restrictions on scope of company

operations; foreign currency movements compared with the U.S.

dollar; higher inflation and related impacts; material reductions

in corporate liquidity and access to debt markets; changes to the

company’s capital allocation strategies; the effects of changed

accounting rules under generally accepted accounting principles

promulgated by rule-setting bodies; the company’s ability to

identify and mitigate the risks and hazards inherent in operating

in the global energy industry; and the factors set forth under the

heading “Risk Factors” on pages 20 through 26 of the company’s 2023

Annual Report on Form 10-K and in subsequent filings with the U.S.

Securities and Exchange Commission. Other unpredictable or unknown

factors not discussed in this news release could also have material

adverse effects on forward-looking statements.

Attachment 1

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars, Except

Per-Share Amounts)

(unaudited)

CONSOLIDATED STATEMENT OF

INCOME

Three Months Ended

September 30,

Nine Months Ended

September 30,

REVENUES AND OTHER INCOME

2024

2023

2024

2023

Sales and other operating revenues

$

48,926

$

51,922

$

145,080

$

147,980

Income (loss) from equity affiliates

1,261

1,313

3,908

4,141

Other income (loss)

482

845

1,578

1,648

Total Revenues and Other Income

50,669

54,080

150,566

153,769

COSTS AND OTHER DEDUCTIONS

Purchased crude oil and products

30,450

32,328

89,058

90,719

Operating expenses (1)

7,935

7,553

23,236

21,717

Exploration expenses

154

301

546

660

Depreciation, depletion and

amortization

4,214

4,025

12,309

11,072

Taxes other than on income

1,263

1,021

3,575

3,158

Interest and debt expense

164

114

395

349

Total Costs and Other

Deductions

44,180

45,342

129,119

127,675

Income (Loss) Before Income Tax

Expense

6,489

8,738

21,447

26,094

Income tax expense (benefit)

1,993

2,183

6,957

6,926

Net Income (Loss)

4,496

6,555

14,490

19,168

Less: Net income (loss) attributable to

noncontrolling interests

9

29

68

58

NET INCOME (LOSS) ATTRIBUTABLE TO

CHEVRON CORPORATION

$

4,487

$

6,526

$

14,422

$

19,110

(1) Includes operating expense, selling,

general and administrative expense, and other components of net

periodic benefit costs.

PER SHARE OF

COMMON STOCK

Net Income (Loss) Attributable to

Chevron Corporation

- Basic

$

2.49

$

3.48

$

7.91

$

10.18

- Diluted

$

2.48

$

3.48

$

7.88

$

10.14

Weighted Average Number of Shares

Outstanding (000's)

- Basic

1,800,336

1,870,963

1,822,770

1,876,532

- Diluted

1,807,030

1,877,104

1,829,776

1,884,407

Note: Shares outstanding (excluding 14

million associated with Chevron’s Benefit Plan Trust) were 1,783

million and 1,851 million at September 30, 2024, and December 31,

2023, respectively.

EARNINGS BY MAJOR

OPERATING AREA

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Upstream

United States

$

1,946

$

2,074

$

6,182

$

5,495

International

2,643

3,681

8,116

10,357

Total Upstream

4,589

5,755

14,298

15,852

Downstream

United States

146

1,376

879

3,434

International

449

307

1,096

1,556

Total Downstream

595

1,683

1,975

4,990

All Other

(697

)

(912

)

(1,851

)

(1,732

)

NET INCOME (LOSS) ATTRIBUTABLE TO

CHEVRON CORPORATION

$

4,487

$

6,526

$

14,422

$

19,110

Attachment 2

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars)

(unaudited)

SELECTED BALANCE

SHEET ACCOUNT DATA (Preliminary)

September 30,

2024

December 31,

2023

Cash and cash equivalents

$

4,699

$

8,178

Time Deposits

$

4

$

—

Marketable securities

$

—

$

45

Total assets

$

259,232

$

261,632

Total debt

$

25,841

$

20,836

Total Chevron Corporation stockholders’

equity

$

156,202

$

160,957

Noncontrolling interests

$

828

$

972

SELECTED

FINANCIAL RATIOS

Total debt plus total stockholders’

equity

$

182,043

$

181,793

Debt ratio (Total debt / Total debt

plus stockholders’ equity)

14.2

%

11.5

%

Adjusted debt (Total debt less cash and

cash equivalents, time deposits and marketable securities)

$

21,138

$

12,613

Adjusted debt plus total stockholders’

equity

$

177,340

$

173,570

Net debt ratio (Adjusted debt /

Adjusted debt plus total stockholders’ equity)

11.9

%

7.3

%

RETURN ON CAPITAL

EMPLOYED (ROCE)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Total reported earnings

$

4,487

$

6,526

$

14,422

$

19,110

Noncontrolling interest

9

29

68

58

Interest expense (A/T)

146

104

358

321

ROCE earnings

4,642

6,659

14,848

19,489

Annualized ROCE earnings

18,568

26,636

19,797

25,985

Average capital employed (1)

183,159

183,810

182,818

185,194

ROCE

10.1

%

14.5

%

10.8

%

14.0

%

(1) Capital employed is the sum of Chevron

Corporation stockholders’ equity, total debt and noncontrolling

interest. Average capital employed is computed by averaging the sum

of capital employed at the beginning and the end of the period.

Three Months Ended

September 30,

Nine Months Ended

September 30,

CAPEX BY

SEGMENT

2024

2023

2024

2023

United States

Upstream

$

2,349

$

3,020

$

7,126

$

7,234

Downstream

349

408

1,116

1,118

Other

93

97

274

218

Total United States

2,791

3,525

8,516

8,570

International

Upstream

1,212

1,080

3,462

2,742

Downstream

47

66

124

144

Other

5

2

8

12

Total International

1,264

1,148

3,594

2,898

CAPEX

$

4,055

$

4,673

$

12,110

$

11,468

AFFILIATE CAPEX (not included

above)

Upstream

$

329

$

539

$

1,110

$

1,793

Downstream

236

300

704

891

AFFILIATE CAPEX

$

565

$

839

$

1,814

$

2,684

Attachment 3

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Billions of Dollars)

(unaudited)

SUMMARIZED

STATEMENT OF CASH FLOWS (Preliminary)(1)

Three Months Ended

September 30,

Nine Months Ended

September 30,

OPERATING ACTIVITIES

2024

2023

2024

2023

Net Income (Loss)

$

4.5

$

6.6

$

14.5

$

19.2

Adjustments

Depreciation, depletion and

amortization

4.2

4.0

12.3

11.1

Distributions more (less) than income from

equity affiliates

0.1

(0.9

)

(0.5

)

(2.3

)

Loss (gain) on asset retirements and

sales

(0.2

)

(0.1

)

(0.2

)

(0.1

)

Net foreign currency effects

0.2

(0.2

)

0.1

(0.1

)

Deferred income tax provision

0.4

(0.1

)

1.5

1.3

Net decrease (increase) in operating

working capital

1.4

0.8

(2.2

)

(4.2

)

Other operating activity

(1.0

)

(0.3

)

(2.8

)

(1.7

)

Net Cash Provided by Operating

Activities

$

9.7

$

9.7

$

22.8

$

23.2

INVESTING ACTIVITIES

Acquisition of businesses, net of cash

acquired

—

0.1

—

0.1

Capital expenditures (Capex)

(4.1

)

(4.7

)

(12.1

)

(11.5

)

Proceeds and deposits related to asset

sales and returns of investment

0.4

0.1

0.6

0.4

Other investing activity

—

0.1

(0.1

)

(0.2

)

Net Cash Used for Investing

Activities

$

(3.7

)

$

(4.4

)

$

(11.6

)

$

(11.2

)

FINANCING ACTIVITIES

Net change in debt

2.6

(2.4

)

5.0

(4.1

)

Cash dividends — common stock

(2.9

)

(2.9

)

(8.9

)

(8.5

)

Shares issued for share-based

compensation

—

0.1

0.2

0.2

Shares repurchased

(4.7

)

(3.4

)

(10.7

)

(11.5

)

Distributions to noncontrolling

interests

(0.2

)

—

(0.2

)

—

Net Cash Provided by (Used for)

Financing Activities

$

(5.3

)

$

(8.6

)

$

(14.7

)

$

(23.9

)

EFFECT OF EXCHANGE RATE CHANGES ON

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

0.1

—

—

(0.2

)

NET CHANGE IN CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

$

0.8

$

(3.4

)

$

(3.5

)

$

(12.1

)

RECONCILIATION OF

NON-GAAP MEASURES (1)

Net Cash Provided by Operating

Activities

$

9.7

$

9.7

$

22.8

$

23.2

Less: Net decrease (increase) in operating

working capital

1.4

0.8

(2.2

)

(4.2

)

Cash Flow from Operations Excluding

Working Capital

$

8.3

$

8.9

$

25.0

$

27.4

Net Cash Provided by Operating

Activities

$

9.7

$

9.7

$

22.8

$

23.2

Less: Capital expenditures

4.1

4.7

12.1

11.5

Free Cash Flow

$

5.6

$

5.0

$

10.7

$

11.7

Less: Net decrease (increase) in operating

working capital

1.4

0.8

(2.2

)

(4.2

)

Free Cash Flow Excluding Working

Capital

$

4.2

$

4.2

$

12.9

$

15.9

(1) Totals may not match sum of parts due

to presentation in billions.

Attachment 4

CHEVRON CORPORATION -

FINANCIAL REVIEW

(Millions of Dollars)

(unaudited)

RECONCILIATION OF

NON-GAAP MEASURES

Three Months Ended

September 30, 2024

Three Months Ended

September 30, 2023

Nine Months Ended

September 30, 2024

Nine Months Ended

September 30, 2023

REPORTED

EARNINGS

Pre- Tax

Income Tax

After- Tax

Pre- Tax

Income Tax

After- Tax

Pre- Tax

Income

Tax

After- Tax

Pre- Tax

Income Tax

After- Tax

U.S. Upstream

$

1,946

$

2,074

$

6,182

$

5,495

Int'l Upstream

2,643

3,681

8,116

10,357

U.S. Downstream

146

1,376

879

3,434

Int'l Downstream

449

307

1,096

1,556

All Other

(697

)

(912

)

(1,851

)

(1,732

)

Net Income (Loss) Attributable to

Chevron

$

4,487

$

6,526

$

14,422

$

19,110

SPECIAL

ITEMS

Int'l Upstream

Tax items

$

—

$

—

$

—

$

—

$

560

$

560

$

—

$

—

$

—

$

—

$

655

$

655

All Other

Pension settlement costs

—

—

—

(53

)

13

(40

)

—

—

—

(53

)

13

(40

)

Total Special Items

$

—

$

—

$

—

$

(53

)

$

573

$

520

$

—

$

—

$

—

$

(53

)

$

668

$

615

FOREIGN CURRENCY

EFFECTS

Int'l Upstream

$

13

$

584

$

(202

)

$

538

Int'l Downstream

(55

)

24

—

46

All Other

(2

)

(323

)

—

(329

)

Total Foreign Currency Effects

$

(44

)

$

285

$

(202

)

$

255

ADJUSTED

EARNINGS/(LOSS) (1)

U.S. Upstream

$

1,946

$

2,074

$

6,182

$

5,495

Int'l Upstream

2,630

2,537

8,318

9,164

U.S. Downstream

146

1,376

879

3,434

Int'l Downstream

504

283

1,096

1,510

All Other

(695

)

(549

)

(1,851

)

(1,363

)

Total Adjusted Earnings/(Loss)

$

4,531

$

5,721

$

14,624

$

18,240

Total Adjusted Earnings/(Loss) per

share

$

2.51

$

3.05

$

7.99

$

9.68

(1) Adjusted Earnings/(Loss) is defined as

Net Income (loss) attributable to Chevron Corporation excluding

special items and foreign currency effects.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101432378/en/

Randy Stuart -- +1 713-283-8609

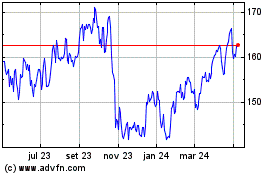

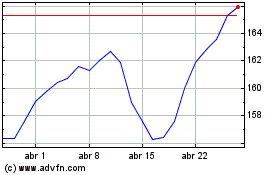

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Chevron (NYSE:CVX)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024