Coya Therapeutics, Inc. (Nasdaq: COYA) (“Coya” or the

“Company”), a clinical-stage biotechnology company developing

biologics intended to enhance regulatory T cell (Treg) function,

provides a corporate update and announces its financial results for

the quarter ended September 30, 2024.

Recent Corporate Highlights

- Announced positive results from an investigator initiated

double-blind study of low-dose interleukin-2 (LD IL-2) in patients

with mild to moderate Alzheimer’s Disease (AD) at the Clinical

Trials on Alzheimer’s Disease Conference (CTAD24) in Madrid

- Filed patents for COYA 301 in combination with Glucagon-Like

Peptide-1 (GLP-1) receptor agonists

- Promoted Arun Swaminathan, Ph.D. to Chief Executive Officer,

effective November 1, 2024, while Howard Berman has transitioned

from CEO to Executive Chairman

- Announced anti-inflammatory effects of COYA 302 in the brain

from a preclinical inflammatory mouse model of Parkinson’s disease

(PD)

- Aligned with FDA on the non-clinical data needed to support the

planned randomized, double-blind, placebo-controlled, Phase 2b

trial of COYA-302 in patients with Amyotrophic Lateral Sclerosis

(ALS).

- A Phase 1 investigator-initiated trial (IIT) combining LD IL-2

+ CTLA4-Ig began in patients with Frontotemporal Dementia

(FTD)

Upcoming Expected Catalysts for 2025

- Q1 2025: Additional clinical data to be released in the Phase 2

LD IL-2 investigator-initiated trial (IIT) study in patients with

AD. Publication and release of additional and comprehensive blood

immune panels and inflammatory cerebrospinal fluid (CSF) biomarkers

comparing LD IL-2 arms to placebo arm

- Q1/Q2 2025: COYA 301/GLP-1 combination data submission for

publication and additional intellectual property filings

- Q2 2025: Submission of additional data to support the start of

the COYA-302 Phase 2 trial in patients with ALS

- Upon IND acceptance and first patient dosing of COYA-302 in

ALS, eligible to receive milestone payments of $8.4 million from

strategic partner, Dr. Reddy’s Laboratories (DRL)

- Q2 2025: ALS Biomarker data. Publication of longitudinal data

on Neurofilament Light Chain (NfL) and oxidative stress markers in

patients with ALS

- 2H 2025: Top-line clinical data release for an

investigator-initiated trial combining LD IL-2 + CTLA4-Ig in

patients with FTD

- 2H 2025: Filing of IND for the COYA-302 Phase 2 trial in

patients with FTD* (*Clinical trial initiated upon FDA IND

approval)

“We are pleased with the constructive discussion we have had

with the FDA,” said Coya CMO, Dr. Fred Grossman. “We have clarity

on the non-clinical data needed to support the start of our Phase 2

study of COYA-302 in patients with ALS and we are fully aligned

with the FDA. We are confident in the path forward towards the

completion of this important potential pivotal trial. Following FDA

acceptance of the Coya 302 IND in ALS, we expect to submit the IND

for COYA 302 in FTD, likely in the second half of 2025.”

Coya CEO Arun Swaminathan, Ph.D. said:

“As the new CEO of Coya, I am very encouraged by our progress in

2024. I believe our progress opens a wide array of strategic

opportunities in 2025, both with existing and new partners. I will

be keenly focused on delivering shareholder value over the next

year.

“During the third quarter of 2024 we continued to advance our

pipeline of neurodegenerative treatments, all aimed at

neurodegenerative diseases with high unmet need, including AD, PD,

and ALS.

“Our drug candidates all target neuroinflammation, which we see

as a major contributing factor towards disease progression in the

neurological conditions we are addressing. Moreover, our approach

to potential combination therapies for treatment of these

neurodegenerative diseases differentiates us from other companies

and offers, what we believe, a new treatment paradigm that could

lead to the creation of meaningful shareholder value.

“We anticipate 2025 will be a busy and productive year filled

with multiple milestones, clinical data and catalysts. In Q1 of

2025, we will be presenting additional clinical data from the

investigator-initiated phase 2 trial in AD and later in the year

clinical data from another investigator-initiated clinical trial in

FTD, this time with the combination of LD IL-2 and CTLA-4 Ig. We

are also excited to begin our Coya sponsored phase 2 trials for our

combination biologic COYA 302 in both ALS and FTD.

“During the CTAD conference in Madrid at the end of October,

encouraging Phase 2 data was presented from an

investigator-initiated trial that highlighted the benefits of LD

IL-2 in treating patients with mild to moderate Alzheimer’s

disease. This data increased our confidence in our combination drug

candidate, COYA 302, which combines COYA 301, our proprietary LD

IL-2 candidate, with the fusion protein CTLA4-Ig, or Abatacept for

the potential treatment of neurodegenerative diseases, such as ALS

and FTD. We believe LD IL-2 enhances and restores Treg function,

lowering inflammation, while CTLA4-Ig inhibits other inflammatory

cell types and so may sustain and create more durable Treg

functionality. While we were encouraged with the promising LD IL-2

monotherapy data in AD, we believe that our combination approach

with CTLA-4 Ig provides numerous advantages by targeting multiple

immune pathways which are critical in these complex diseases.

“We also believe there is potential for strategic opportunities

combining COYA-301 with other therapeutic agents as potential

therapeutics for patients with AD or other neurodegenerative and

autoimmune diseases.

“Finally, our recent capital raise provides additional

flexibility and cushion for us to execute on our corporate,

clinical, and regulatory goals. As of October 31, 2024, our interim

cash and cash equivalents (unaudited) was $39.8 million. We

continue to be in discussions with our partners and potential

partners looking for opportunities to reach our goals quicker and

in the best way possible. I look forward to sharing additional

corporate, clinical, and regulatory progress as appropriate,”

concluded Swaminathan.

Unaudited Financial Results

As of September 30, 2024, Coya had cash and cash equivalents of

$31.1 million.

Research and development expenses were $2.2 million for the

three months ended September 30, 2024, compared to $1.6 million for

the three months ended September 30, 2023. The increase was due to

a $0.3 million increase in our preclinical expenses primarily due

to our preclinical advancement of COYA 302 in ALS and a $0.3

million increase in internal research and development expenses.

General and administrative expenses were $2.2 million for the

three months ended September 30, 2024, and $2.0 million for the

three months ended September 30, 2023, a change of approximately

$0.2 million. The increase was primarily due to a $0.4 million

increase in stock-based compensation and employee headcount,

partially offset by a $0.2 million decrease in corporate fees.

Net loss was $4.0 million for the three months ended September

30, 2024, compared to net loss of $3.4 million for the three months

ended September 30, 2023.

About Coya Therapeutics, Inc.

Headquartered in Houston, TX, Coya Therapeutics, Inc. (Nasdaq:

COYA) is a clinical-stage biotechnology company developing

proprietary treatments focused on the biology and potential

therapeutic advantages of regulatory T cells (“Tregs”) to target

systemic inflammation and neuroinflammation. Dysfunctional Tregs

underlie numerous conditions, including neurodegenerative,

metabolic, and autoimmune diseases, and this cellular dysfunction

may lead to sustained inflammation and oxidative stress resulting

in lack of homeostasis of the immune system.

Coya’s investigational product candidate pipeline leverages

multiple therapeutic modalities aimed at restoring the

anti-inflammatory and immunomodulatory functions of Tregs. Coya’s

therapeutic platforms include Treg-enhancing biologics,

Treg-derived exosomes, and autologous Treg cell therapy.

COYA 302 – the Company’s lead biologic investigational product

or "Pipeline in a Product" – is a proprietary combination of COYA

301 (Coya’s proprietary LD IL-2) and CTLA4-Ig for subcutaneous

administration with a unique dual mechanism of action that is now

being developed for the treatment of Amyotrophic Lateral Sclerosis,

Frontotemporal Dementia, Parkinson’s Disease, and Alzheimer’s

Disease. Its multi-targeted approach enhances the number and

anti-inflammatory function of Tregs and simultaneously lowers the

expression of activated microglia and the secretion of

pro-inflammatory mediators. This synergistic mechanism may lead to

the re-establishment of immune balance and amelioration of

inflammation in a sustained and durable manner that may not be

achieved by either low-dose IL-2 or CTLA4-Ig alone.

For more information about Coya, please visit

www.coyatherapeutics.com.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on our management’s beliefs and assumptions and on

information currently available to management. Forward-looking

statements include all statements other than statements of

historical fact contained in this presentation, including

information concerning our current and future financial

performance, business plans and objectives, current and future

clinical and preclinical development activities, timing and success

of our ongoing and planned clinical trials and related data, the

timing of announcements, updates and results of our clinical trials

and related data, our ability to obtain and maintain regulatory

approval, the potential therapeutic benefits and economic value of

our product candidates, competitive position, industry environment

and potential market opportunities. The words “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

and similar expressions are intended to identify forward-looking

statements.

Forward-looking statements are subject to known and unknown

risks, uncertainties, assumptions and other factors including, but

not limited to, those related to risks associated with the impact

of COVID-19; the success, cost and timing of our product candidate

development activities and ongoing and planned clinical trials; our

plans to develop and commercialize targeted therapeutics; the

progress of patient enrollment and dosing in our preclinical or

clinical trials; the ability of our product candidates to achieve

applicable endpoints in the clinical trials; the safety profile of

our product candidates; the potential for data from our clinical

trials to support a marketing application, as well as the timing of

these events; our ability to obtain funding for our operations;

development and commercialization of our product candidates; the

timing of and our ability to obtain and maintain regulatory

approvals; the rate and degree of market acceptance and clinical

utility of our product candidates; the size and growth potential of

the markets for our product candidates, and our ability to serve

those markets; our commercialization, marketing and manufacturing

capabilities and strategy; future agreements with third parties in

connection with the commercialization of our product candidates;

our expectations regarding our ability to obtain and maintain

intellectual property protection; our dependence on third party

manufacturers; the success of competing therapies or products that

are or may become available; our ability to attract and retain key

scientific or management personnel; our ability to identify

additional product candidates with significant commercial potential

consistent with our commercial objectives; and our estimates

regarding expenses, future revenue, capital requirements and needs

for additional financing.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our financial condition, results of

operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. Moreover, we

operate in a very competitive and rapidly changing environment, and

new risks may emerge from time to time. It is not possible for our

management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and

assumptions, the forward-looking events and circumstances discussed

herein may not occur and actual results could differ materially and

adversely from those anticipated or implied in the forward-looking

statements. Although our management believes that the expectations

reflected in our forward-looking statements are reasonable, we

cannot guarantee that the future results, levels of activity,

performance or events and circumstances described in the

forward-looking statements will be achieved or will occur. We

undertake no obligation to publicly update any forward-looking

statements, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise.

CONDENSED BALANCE

SHEETS

September 30,

December 31,

2024

2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

31,057,395

$

32,626,768

Collaboration receivable

-

7,500,000

Prepaids and other current assets

4,449,006

1,069,557

Total current assets

35,506,401

41,196,325

Fixed assets, net

45,429

65,949

Total assets

$

35,551,830

$

41,262,274

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

336,722

$

1,155,656

Accrued expenses

1,409,235

2,973,215

Deferred collaboration revenue

573,089

923,109

Total current liabilities

2,319,046

5,051,980

Deferred collaboration revenue

1,222,596

574,685

Total liabilities

3,541,642

5,626,665

Stockholders' equity:

Series A convertible preferred stock,

$0.0001 par value: 10,000,000 shares authorized, none issued or

outstanding as of September 30, 2024 or December 31, 2023

-

-

Common stock, $0.0001 par value;

200,000,000 shares authorized; 15,221,308 and 14,405,325 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively

1,523

1,441

Additional paid-in capital

69,830,059

61,501,801

Subscription receivable

-

(11,250

)

Accumulated deficit

(37,821,394

)

(25,856,383

)

Total stockholders' equity

32,010,188

35,635,609

Total liabilities and stockholders'

equity

$

35,551,830

$

41,262,274

CONDENSED UNAUDITED INTERIM

STATEMENTS OF OPERATIONS

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Collaboration revenue

$

—

$

—

$

3,552,109

$

—

Operating expenses:

Research and development

2,223,903

1,592,232

9,928,214

3,891,896

In-process research and development

—

—

25,000

350,000

General and administrative

2,219,545

1,964,990

6,747,790

5,456,087

Depreciation

6,841

6,841

20,521

20,521

Total operating expenses

4,450,289

3,564,063

16,721,525

9,718,504

Loss from operations

(4,450,289

)

(3,564,063

)

(13,169,416

)

(9,718,504

)

Other income:

Other income

428,871

142,089

1,204,405

464,693

Net loss

$

(4,021,418

)

$

(3,421,974

)

$

(11,965,011

)

$

(9,253,811

)

Per share information:

Net loss per share of common stock, basic

and diluted

$

(0.26

)

$

(0.34

)

$

(0.80

)

$

(0.94

)

Weighted-average shares of common stock

outstanding, basic and diluted

15,221,308

9,947,915

14,866,089

9,873,387

CONDENSED UNAUDITED INTERIM

STATEMENTS OF CASH FLOWS

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(11,965,011

)

$

(9,253,811

)

Adjustment to reconcile net loss to net

cash used in operating activities:

Depreciation

20,521

20,521

Stock-based compensation, including the

issuance of restricted stock

1,872,990

634,249

Acquired in-process research and

development assets

25,000

350,000

Changes in operating assets and

liabilities:

Collaboration receivable

7,500,000

-

Prepaids and other current assets

(3,379,449

)

314,910

Accounts payable

(773,956

)

(177,911

)

Accrued expenses

(1,477,041

)

(835,689

)

Deferred collaboration revenue

297,891

-

Net cash used in operating activities

(7,879,055

)

(8,947,731

)

Cash flows from investing

activities:

Purchase of in-process research and

development assets

(25,000

)

(350,000

)

Net cash used in investing activities

(25,000

)

(350,000

)

Cash flows from financing

activities:

Proceeds from sale of common stock upon

initial public offering, net of offering costs

-

14,250,311

Proceeds from sale of common stock, net of

offering costs

4,943,668

-

Proceeds from subscription receivable

11,250

-

Payment of financing costs related to the

2023 Private Placement

(131,918

)

-

Proceeds from the exercise of stock

options

1,975

-

Proceeds from the exercise of warrants

1,509,707

-

Net cash provided by financing

activities

6,334,682

14,250,311

Net increase in cash and cash

equivalents

(1,569,373

)

4,952,580

Cash and cash equivalents as of beginning

of the period

32,626,768

5,933,702

Cash and cash equivalents as of end of the

period

$

31,057,395

$

10,886,282

Supplemental disclosures of non-cash

financing activities:

Conversion of convertible preferred stock

upon initial public offering

$

-

$

8,793,637

Conversion of convertible promissory notes

upon initial public offering

$

-

$

12,965,480

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106135734/en/

Investor Contact David

Snyder david@coyatherapeutics.com

CORE IR Bret Shapiro

brets@coreir.com 561-479-8566

Media Contact Kati

Waldenburg media@coyatherapeutics.com 212-655-0924

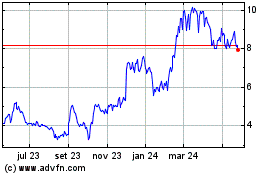

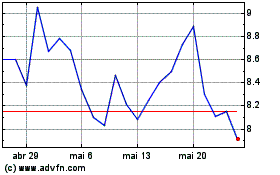

Coya Therapeutics (NASDAQ:COYA)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Coya Therapeutics (NASDAQ:COYA)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024