Proposed Merger of Société Foncière Lyonnaise and Inmobiliaria Colonial

06 Novembro 2024 - 2:45PM

Business Wire

Regulatory News:

The Boards of Directors of Inmobiliaria Colonial, and its

98.24%-owned subsidiary Société Foncière Lyonnaise (Paris:FLY),

have decided to examine in detail a proposal to merge SFL into

Colonial.

The potential merger would be part of the ongoing strategy to

simplify the Group's structure, one of the pivotal stages of which

was Colonial's public exchange offer in August 2021. It would

strengthen further cohesion between SFL and Colonial, which has

been SFL’s majority shareholder since 2004. For over twenty years,

the two companies have shared the deeply held belief that the key

to creating long-term value lies in developing prime urban assets

and building a unique mixed-use portfolio in Paris, Madrid and

Barcelona.

The potential transaction would consist of merging Société

Foncière Lyonnaise into Inmobiliaria Colonial and exchanging all

SFL shares tendered for newly-issued Inmobiliaria Colonial shares.

The exchange ratio would be determined based on a multi-criteria

valuation and would be subject to the opinion of the merger

auditor.

If it proceeds, it is probable that the merger agreement between

Colonial and SFL would be signed in the first quarter of 2025,

after consulting employee representative bodies about the project,

with completion of the merger being subject to the usual conditions

precedent.

About SFL

A benchmark player in the prime segment of the Parisian

commercial real estate market, Société Foncière Lyonnaise stands

out for the quality of its property portfolio, which is valued at

€7.4 billion and is focused on the Central Business District of

Paris (#cloud.paris, Edouard VII, Washington Plaza, etc.), and for

the quality of its client portfolio, which is composed of

prestigious companies. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties. With

its sights firmly set on the future, SFL is committed to

sustainable real estate with the aim of building the city of

tomorrow and helping to reduce carbon emissions in its sector.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

About Inmobiliaria Colonial

Inmobiliaria Colonial is the leading platform in the prime

commercial Real Estate market in Europe, present in the main

business areas of Barcelona, Madrid and Paris with a unique

commercial real estate portfolio totalling more than 1 million sqm

and a market value of more than €11.3billion. The Group has a

long-term focused dedicated strategy on value creation through a

top-quality client portfolio and asset repositioning. Regarding the

future, the Colonial Group will continue to lead the urban

transformation of the city centres in the European market,

recognized by its experience and professionalism, its strength and

profitability, providing excellent sustainable Real Estate

solutions tailored to the needs of customers.

BME Madrid ISIN ES0139140174 – Bloomberg: COL:SM – Reuters:

COL.MC

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106836551/en/

SFL - Thomas Fareng - T +33 (0)1 42 97 27 00 -

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

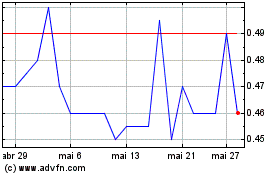

Flyht Aerospace Solutions (TSXV:FLY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

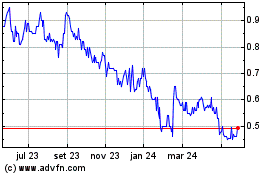

Flyht Aerospace Solutions (TSXV:FLY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024