Regulatory News:

SFL (Paris:FLY):

EPRA earnings per share: €1.40

(up 12.9%)

Portfolio value (excluding

transfer costs): €7,406m (up 1.0% vs. end-2023, as

reported)

Occupancy rate: 99.8% (100%

for offices)

EPRA NTA: €85.0 per

share

The consolidated financial statements for the six months ended

30 June 2024 were approved by the Board of Directors of Société

Foncière Lyonnaise (“SFL”) on 23 July 2024, at its meeting chaired

by Pere Viňolas Serra.

These financial statements reflect sharp growth in operating

profit, stable portfolio appraisal values and a significant

increase in EPRA earnings. The occupancy rate remained at an

exceptionally high 99.8% and properties let during the period

commanded increasingly high rents, attesting to the attractiveness

of prime Paris office properties and the quality of SFL's business

model.

“This is a very interesting time in the market – our appraisal

values are holding firm after falling steadily over the past 18

months and our rental income is rising. These encouraging

performances, in a still very uncertain environment, can be put

down to a number of differentiating factors: our rigorous property

selection processes, our commitment to ensuring that redevelopment

projects comply with the highest technical and environmental

standards, and finally our determination to constantly improve the

satisfaction of our tenants and their staff.

SFL will be celebrating its 145th anniversary this year: this

remarkable longevity means that we have to adapt our products to

the trends and expectations of employees in the Paris region, and

always question ourselves. I believe this is testament to our

legacy as builders of a portfolio of exceptional properties, and an

illustration of our determination to play our part in a

fast-changing world, in our segment of choice, the Paris prime

office market”, said Dimitri Boulte, SFL's Chief Executive

Officer.

The auditors have completed their review of the financial

statements and issued their report on the interim financial

information, which does not contain any qualifications or emphasis

of matter.

Consolidated data (€

millions)

H1 2023

H1 2024

Change

Revenue*

111.4

127.0

+14.0%

Rental income

111.4

121.6

+9.2%

Adjusted operating profit**

97.2

109.8

+12.9%

Attributable net

profit/(loss)

(177.5)

76.7

n/a

EPRA earnings

53.2

60.1

+13.0%

per share

€1.24

€1.40

+12.9%

* Including the cancellation of a

rent accrual in an amount of €5.4 million in the first half of the

year

** Operating profit before

disposal gains and losses and fair value adjustments

31/12/2023

30/06/2024

Change

Attributable equity

3,540

3,527

-0.4%

Consolidated portfolio value

excluding transfer costs

7,332

7,406

+1.0%

Consolidated portfolio value

including transfer costs

7,817

7,899

+1.0%

EPRA NTA

3,752

3,649

-2.7%

per share

€87.5

€85.0

-2.9%

EPRA NDV

3,673

3,673

0.0%

-0.2%

per share

€85.7

€85.5

Strong revenue growth in a still uncertain

environment

Rental income up 7.4%

like-for-like

Revenue came to €127 million in the first half of 2024,

including €121.6 million in rental income and the cancellation of a

rent accrual in an amount of €5.4 million.

Rental income for the period was up by a strong €10.2 million

(up 9.2%) compared with the first half of 2023. The

period-on-period change can be explained as follows:

- On a like-for-like basis

(revenue-generating properties, excluding all changes in the

portfolio affecting period-on-period comparisons), rental income

was €8.1 million higher (up 7.4%), including the €4.6 million

impact of rent indexation clauses and the contribution from new

leases signed in 2023 and 2024 (with long‑standing tenants such as

Infravia, Havea and Fast Retailing, and new tenants such as a

leading luxury goods company and Brunswick). These new leases drove

significant growth in rental income from the Washington Plaza,

Cézanne Saint-Honoré and #cloud.paris complexes.

- Rental income from spaces being redeveloped

during the periods under review rose by €10.1 million. This

included the €7.8 million contribution for the whole of first-half

2024 from the retail area of the Louvre Saint-Honoré project, which

was delivered in July 2023 to the Cartier Foundation upon

completion of the lessor-funded redevelopment work, and the €3.3

million contribution of the new Adidas flagship store on the

Champs-Elysées.

- The decision by a tenant to break their

lease led to the cancellation of the related rent accrual in the

IFRS financial statements, which was partly offset by a provision

reversal, and the recognition of a lease termination penalty paid

by the tenant. The net impact on rental income was a negative €1.9

million.

Adjusted operating profit (i.e., operating profit before

disposal gains and losses and fair value adjustments to investment

property) rose by a strong 12.9% to €109.8 million in first‑half

2024, from €97.2 million in the year‑earlier period.

Stable appraisal values against a backdrop

of ongoing uncertainty

The portfolio’s appraisal value rose by 1.0% over the six months

to 30 June 2024 on a comparable basis, leading to positive fair

value adjustments to investment property of €27.4 million for the

period versus negative adjustments of €327.8 million in first-half

2023.

The stabilisation of appraisal values reflected the application

of rent escalation clauses and the sharp rise in rental values in

the prime segment of the Paris property market. The discount rate

declined (by an average of 2 bps), while the average exit

capitalisation rate continued to rise (by an average of 3 bps).

Higher net profit despite the increase in

finance costs

Net finance costs stood at €28.3 million in first-half 2024,

versus €26.1 million in the same period of 2023, representing an

increase of €2.2 million. Excluding non-recurring items, the

increase was €4.7 million, reflecting the impact on recurring

finance costs of higher interest rates and the increase in average

debt.

After taking account of these key items, EPRA earnings came in

at €60.1 million in first-half 2024 versus €53.2 million in the

year-earlier period.

EPRA earnings per share stood at €1.4 in first-half 2024, up

12.9% from €1.24 in first-half 2023.

The Group ended the period with attributable net profit of €76.7

million, versus a loss of €177.5 million in first-half 2023.

Occupancy rate kept at a record high of 99.8%

SFL's strategic positioning means it can take full advantage of

the very positive momentum in the Paris property rental market and

particularly higher market rents. The physical occupancy rate

remained at a record high of 99.8% at 30 June 2024 (99.7% at 31

December 2023). The EPRA vacancy rate was 0.2% (unchanged from 31

December 2023).

SFL signed leases on around 12,000 sq.m. in the first half,

including 11,300 sq.m. of office space, mainly with new

tenants.

This sustained rental activity primarily concerned the following

properties:

- #cloud.paris, with 3,500 sq.m. let for a non-cancellable period

of nine years to an international fund management company;

- Cézanne Saint-Honoré, with 2,700 sq.m. let for a

non-cancellable period of nine years to an international law

firm;

- Edouard VII, with 1,230 sq.m. let for a non-cancellable period

of six years to Brunswick;

- 103 Grenelle, with 1,315 sq.m. let for a non-cancellable period

of ten years to Beau de Loménie;

- office space in the Washington Plaza and 176 Charles de Gaulle

properties;

- residential units representing around 500 sq.m. and retail

units representing 200 sq.m.

Average nominal rents for the new office leases rose sharply to

€998 per sq.m., corresponding to an effective rent of €883 per

sq.m., for an average non-cancellable period of 8.7 years. These

lease terms attest to the attractiveness of the Group’s

properties.

Efficiently managed pipeline offering a €31.4 million annual

reversionary potential

Properties undergoing redevelopment at 30 June 2024 represented

10% of the total portfolio. They include the Scope office building

(formerly Rives de Seine) on the Quai de la Râpée in Paris (around

23,000 sq.m.). Site clearance and asbestos removal work has now

been completed, and the works contract with the general contractor

was signed on 17 June, with delivery still scheduled for

mid-2026.

Capitalised work carried out in first-half 2024 amounted to

€27.5 million, including the Scope project for a total of €6.3

million and floor‑by‑floor renovations, primarily in the Edouard

VII complex.

No acquisitions/disposals

No properties were purchased or sold during first-half 2024.

Disciplined and resolutely green financing

During first-half 2024, the Group rolled over its €100 million

credit line with BNP Paribas. The new facility agreement includes a

spread adjustment mechanism based on the achievement of three

ambitious targets concerning carbon emissions reduction,

environmental certification of assets and Global Real Estate

Sustainability Benchmark (GRESB) rating.

The five-year facility (with two one-year extension options)

replaces the existing credit line.

The €300 million Term Loan and the €835 million RCF were

extended by one year, increasing the average maturity of debt to

3.6 years.

Net debt at 30 June 2024 amounted to €2,688 million compared to

€2,539 million at 31 December 2023, representing a loan-to-value

ratio of 34.0% including transfer costs. At the same date, the

average cost of debt after hedging was 2.1% and the Interest

Coverage Ratio (ICR) was 3.5x.

At 30 June 2024, the Group had access to €1,570 million in

undrawn confirmed lines of credit.

EPRA Net Asset Value stable overall, taking into account a

dividend payout of €2.40/share

The portfolio’s consolidated appraisal value at 30 June 2024 was

€7,406 million excluding transfer costs, up 1.0% from €7,332

million at 31 December 2023.

The average EPRA topped-up Net Initial Yield (NIY) was 3.8% at

30 June 2024, unchanged from 31 December 2023.

At 30 June 2024, EPRA Net Tangible Assets (NTA) stood at €85.0

per share (€3,649 million in total, down 2.9% over the first half

of the year) and EPRA Net Disposal Value (NDV) was €85.5 per share

(€3,673 million, unchanged from 31 December 2023), after payment of

a dividend of €2.40 per share in April 2024.

Lastly, during the period, Pargal SAS elected to be taxed as an

SIIC, with retroactive effect from 1 January 2024. The election had

the effect of reducing EPRA NTA by €48.1 million and increasing

EPRA NDV by €21.1 million.

EPRA indicators

H1 2023

H1 2024

EPRA Earnings (€m)

53.2

60.1

/share

€1.24

€1.40

EPRA Cost Ratio (including vacancy

costs)

13.7%

12.0%

EPRA Cost Ratio (excluding vacancy

costs)

12.7%

11.5%

31/12/2023

30/06/2024

EPRA NRV (€m)

4,173

4,076

/share

€97.3

€94.9

EPRA NTA (€m)

3,752

3,649

/share

€87.5

€85.0

EPRA NDV (€m)

3,673

3,673

/share

€85.7

€85.5

EPRA Net Initial Yield (NIY)

2.6%

2.5%

EPRA topped-up NIY

3.8%

3.8%

EPRA Vacancy Rate

0.2%

0.2%

31/12/2023

30/06/2024

LTV

32.5%

34.0%

100%, including transfer costs

EPRA LTV (including transfer

costs)

100%

34.3%

35.5%

Attributable to SFL

39.6%

41.0%

EPRA LTV (excluding transfer

costs)

100%

36.6%

37.9%

Attributable to SFL

42.2%

43.6%

Alternative Performance Indicators (APIs)

EPRA Earnings API

€ millions

H1 2023

H1 2024

Attributable net

profit/(loss)

(177.5)

76.7

Less:

Fair value adjustments to

investment property

327.8

(27.4)

Profit on asset disposals

0.2

0.0

Fair value adjustments to

financial instruments, discounting adjustments to debt and related

costs

0.6

(1.8)

Tax on the above items

(12.0)

(4.8)

SIIC exit tax

0

(21.1)

Non-controlling interests in the

above items

(85.9)

38.5

EPRA earnings

53.2

60.1

Average number of shares

(thousands)

42,879

42,918

EPRA earnings per

share

€1.24

€1.40

EPRA NRV/NTA/NDV APIs:

€ millions

31/12/2023

30/06/2024

Attributable equity

3,540

3,527

Treasury shares

0

0

Fair value adjustments to owner-occupied

property

34

34

Unrealised capital gains on intangible

assets

4

4

Elimination of financial instruments at

fair value

6

(7)

Elimination of deferred taxes

173

97

Transfer costs

416

421

EPRA NRV (Net Reinstatement

Value)

4,173

4,076

Elimination of intangible assets

(1)

(2)

Elimination of unrealised gains on

intangible assets

(4)

(4)

Elimination of transfer costs*

(416)

(421)

EPRA NTA (Net Tangible Assets)

3,752

3,649

Intangible assets

1

2

Financial instruments at fair value

(6)

7

Fixed-rate debt at fair value

98

112

Deferred taxes

(173)

(97)

EPRA NDV (Net Disposal Value)

3,673

3,673

* Transfer costs are included at their amount as determined in

accordance with IFRS (i.e., 0).

Net debt API

€ millions

31/12/2023

30/06/2024

Long-term borrowings and derivative

instruments

1,983

1,480

Short-term borrowings and other

interest-bearing debt

644

1,217

Debt in the consolidated statement of

financial position

2,628

2,697

Less:

Accrued interest and deferred recognition

of debt arranging fees

8

23

Cash and cash equivalents

(97)

(33)

Net debt

2,539

2,688

More information is available at

www.fonciere-lyonnaise.com/en/publications/results

About SFL

A benchmark player in the prime segment of the Parisian

commercial real estate market, Société Foncière Lyonnaise stands

out for the quality of its property portfolio, which is valued at

€7.4 billion and is focused on the Central Business District of

Paris (#cloud.paris, Edouard VII, Washington Plaza, etc.), and for

the quality of its client portfolio, which is composed of

prestigious companies. As France’s oldest property company, SFL

demonstrates year after year an unwavering commitment to its

strategy focused on creating a high value in use for users and,

ultimately, substantial appraisal values for its properties. With

its sights firmly set on the future, SFL is committed to

sustainable real estate with the aim of building the city of

tomorrow and helping to reduce carbon emissions in its sector.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723691638/en/

SFL - Thomas Fareng - T +33 (0)1 42 97 27 00 -

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

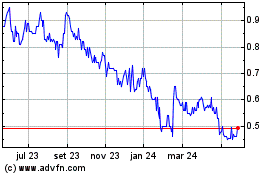

Flyht Aerospace Solutions (TSXV:FLY)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

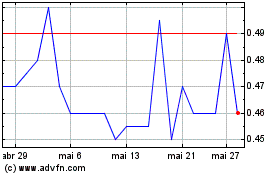

Flyht Aerospace Solutions (TSXV:FLY)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025