Reports GAAP loss of $38.0 million and record

non-GAAP income of $2.4 million

Delivers record adjusted EBITDA of $13.3

million

Fastly, Inc. (NYSE: FSLY), a leader in global edge cloud

platforms, today announced financial results for its third quarter

ended September 30, 2024.

“Fastly delivered significant upside on our revenue guidance in

Q3 along with record non-GAAP net income and adjusted EBITDA,” said

Todd Nightingale, CEO of Fastly. “This was driven by

better-than-expected strength in some of our largest customers,

continued share gains outside of our top ten customers, and

faster-than-projected execution of our restructuring.”

“Our transformation initiatives are helping us focus on the

broader market with revenue outside of our ten largest customers

growing 20% year-over-year,” continued Nightingale. “This

diversification of our revenue base will drive more reliable,

predictable long-term growth, enabling us to invest in continued

edge cloud innovation and go-to-market reach.”

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Revenue

$

137,206

$

127,816

$

403,097

$

368,211

Gross margin

GAAP gross margin

54.5

%

51.7

%

54.8

%

51.8

%

Non-GAAP gross margin

57.7

%

55.9

%

58.3

%

56.0

%

Operating loss

GAAP operating loss

$

(40,590

)

$

(58,342

)

$

(133,584

)

$

(155,444

)

Non-GAAP operating loss

$

(520

)

$

(12,552

)

$

(22,857

)

$

(34,411

)

Net income (loss) per share

GAAP net loss per common share — basic and

diluted

$

(0.27

)

$

(0.42

)

$

(0.91

)

$

(0.86

)

Non-GAAP net income (loss) per common

share — basic and diluted

$

0.02

$

(0.06

)

$

(0.10

)

$

(0.18

)

For a reconciliation of non-GAAP financial measures to their

corresponding GAAP measures, please refer to the reconciliation

table at the end of this press release.

Third Quarter 2024 Financial Summary

- Total revenue of $137.2 million, representing 7% year-over-year

growth. Network services revenue of $107.4 million, representing 5%

year-over-year growth. Security revenue of $26.2 million,

representing 12% year-over-year growth. Other revenue of $3.6

million, representing 85% year-over-year growth. Network services

revenue includes solutions designed to improve performance of

websites, apps, APIs, and digital media. Security revenue includes

products designed to protect websites, apps, APIs, and users. Other

revenue includes Compute and Observability solutions.

- GAAP gross margin of 54.5%, compared to 51.7% in the third

quarter of 2023. Non-GAAP gross margin of 57.7%, compared to 55.9%

in the third quarter of 2023.

- GAAP net loss of $38.0 million, compared to $54.3 million in

the third quarter of 2023. Non-GAAP net income of $2.4 million,

compared to non-GAAP net loss of $8.0 million in the third quarter

of 2023.

- GAAP net loss per basic and diluted share of $0.27, compared to

$0.42 in the third quarter of 2023. Non-GAAP net income per diluted

share of $0.02, compared to non-GAAP net loss per basic and diluted

share of $0.06 in the third quarter of 2023.

Key Metrics

- Enterprise customer1 count was 576 in the third quarter, down

25 from the second quarter of 2024. Total customer count1 was 3,638

in the third quarter, up 343 from the second quarter of 2024.

- Fastly's top ten customers accounted for 33% of revenue in the

third quarter compared to 40% in the third quarter of 2023. Revenue

from the top ten customers declined 11% year-over-year compared to

revenue growth of 20% year-over-year from customers outside the top

ten.

- Last 12-month net retention rate (LTM NRR)2 decreased to 105%

in the third quarter from 110% in the second quarter of 2024.

- Remaining performance obligations (RPO)3 were $235 million, up

6% from $223 million in the second quarter of 2024.

Third Quarter Business and Product Highlights

- Fastly Threat Insights Report revealed 91% of cyberattacks now

target multiple organizations using mass scanning.

- Fastly’s “Bots Wars: How Bad Bots are Hurting Businesses”

research revealed 59% of organizations reported an increase in bot

attacks over the past year, with significant attacks costing

organizations $2.9 million on average.

- Hosted Xcelerate Sydney, a curated customer event bringing

together thought leaders and industry pioneers for a jam-packed day

of innovation.

- Enhanced Fastly Next-Gen WAF with new capabilities that reduced

the time to activate the product, enriched detection signals, and

provided additional context to data with Country and IP Corp/Site

lists.

- Updated Fastly Bot Management with new bot analysis capability

to provide customers with visibility and control of their bot

management expenses, while also enabling customers to provide logos

for bot challenges.

- Enhanced the Fastly trials experience with access to combined

trials for full product lines, helping customers discover new tools

and unlock the full value of the Fastly Edge Cloud Platform.

- Added the Fastly Support Portal to the Fastly single sign-on

experience, allowing customers to seamlessly navigate across the

Fastly Control Panel, Next-Gen WAF Console and Support Portal.

Fourth Quarter and Full Year 2024 Guidance

Q4 2024

Full Year 2024

Total Revenue (millions)

$136.0 - $140.0

$539.0 - $543.0

Non-GAAP Operating Loss

(millions)

($5.0) - ($1.0)

($28.0) - ($24.0)

Non-GAAP Net Income (Loss) per share

(4)(5)

($0.02) - $0.02

($0.12) - ($0.08)

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty of expenses that may be

incurred in the future and cannot be reasonably determined or

predicted at this time, although it is important to note that these

factors could be material to Fastly’s future GAAP financial

results.

Conference Call Information

Fastly will host an investor conference call to discuss its

results at 1:30 p.m. PT / 4:30 p.m. ET on Wednesday, November 6,

2024.

Date: Wednesday, November 6, 2024 Time: 1:30 p.m. PT / 4:30 p.m.

ET Webcast: https://investors.fastly.com Dial-in: 888-330-2022

(US/CA) or 646-960-0690 (Intl.) Conf. ID#: 7543239

Please dial in at least 10 minutes prior to the 1:30 p.m. PT

start time. A live webcast of the call will be available at

https://investors.fastly.com where listeners may log on to the

event by selecting the webcast link under the “Quarterly Results”

section.

A telephone replay of the conference call will be available at

approximately 5:00 p.m. PT, November 6 through November 20, 2024 by

dialing 800-770-2030 or 647-362-9199 and entering the passcode

7543239.

About Fastly, Inc.

Fastly’s powerful and programmable edge cloud platform helps the

world’s top brands deliver online experiences that are fast, safe,

and engaging through edge compute, delivery, security, and

observability offerings that improve site performance, enhance

security, and empower innovation at global scale. Compared to other

providers, Fastly’s powerful, high-performance, and modern platform

architecture empowers developers to deliver secure websites and

apps with rapid time-to-market and demonstrated, industry-leading

cost savings. Organizations around the world trust Fastly to help

them upgrade the internet experience, including Reddit, Neiman

Marcus, Universal Music Group, and SeatGeek. Learn more about

Fastly at https://www.fastly.com, and follow us @fastly.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on our beliefs and assumptions and on information

currently available to us on the date of this press release.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements regarding

our future financial and operating performance, including our

outlook and guidance, our operating performance, our ability to

innovate, the success of our products and product enhancements,

investment in continued edge cloud innovation, the capabilities of

Fastly Next-Gen WAF, the capabilities of Fastly Bot Management,

expectations regarding customer experiences with the Fastly trials

experience and Support Portal, our customer acquisition and

go-to-market efforts, our ability to monetize, expectations

regarding customer mix and diversification of our revenue base, and

our ability to deliver on our long-term strategy. Except as

required by law, we assume no obligation to update these

forward-looking statements publicly or to update the reasons actual

results could differ materially from those anticipated in the

forward-looking statements, even if new information becomes

available in the future. Important factors that could cause our

actual results to differ materially are detailed from time to time

in the reports Fastly files with the Securities and Exchange

Commission (“SEC”), including those more fully described in

Fastly’s Annual Report on Form 10-K for the year ended December 31,

2023, in our Quarterly Report on Form 10-Q for the quarter ended

March 31, 2024, and in our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024. Additional information will also be

set forth in our Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024. Copies of reports filed with the SEC are

posted on Fastly’s website and are available from Fastly without

charge.

Use of Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with accounting

principles generally accepted in the United States (“GAAP”), the

Company uses the following non-GAAP measures of financial

performance: non-GAAP gross profit, non-GAAP gross margin, non-GAAP

operating loss, non-GAAP net income (loss), non-GAAP basic and

diluted net income (loss) per common share, non-GAAP research and

development, non-GAAP sales and marketing, non-GAAP general and

administrative, free cash flow and adjusted EBITDA. The

presentation of this additional financial information is not

intended to be considered in isolation from, as a substitute for,

or superior to, the financial information prepared and presented in

accordance with GAAP. These non-GAAP measures have limitations in

that they do not reflect all of the amounts associated with our

results of operations as determined in accordance with GAAP. In

addition, these non-GAAP financial measures may be different from

the non-GAAP financial measures used by other companies. These

non-GAAP measures should only be used to evaluate our results of

operations in conjunction with the corresponding GAAP measures.

Management compensates for these limitations by reconciling these

non-GAAP financial measures to the most comparable GAAP financial

measures within our earnings releases.

Non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating

loss, non-GAAP net income (loss) and non-GAAP basic and diluted net

loss per common share, non-GAAP research and development, non-GAAP

sales and marketing, and non-GAAP general and administrative differ

from GAAP in that they exclude stock-based compensation expense,

amortization of acquired intangible assets, net gain on

extinguishment of debt, impairment expense and amortization of debt

discount and issuance costs.

Adjusted EBITDA: excludes stock-based compensation

expense, depreciation and other amortization expenses, amortization

of acquired intangible assets, executive transition costs, interest

income, interest expense, including amortization of debt discount

and issuance costs, net gain on extinguishment of debt, impairment

expense, other income (expense), net, and income taxes.

Amortization of Acquired Intangible Assets: consists of

non-cash charges that can be affected by the timing and magnitude

of asset purchases and acquisitions. Management considers its

operating results without this activity when evaluating its ongoing

non-GAAP performance and its adjusted EBITDA performance because

these charges are non-cash expenses that can be affected by the

timing and magnitude of asset purchases and acquisitions and may

not be reflective of our core business, ongoing operating results,

or future outlook.

Amortization of Debt Discount and Issuance Costs:

consists primarily of amortization expense related to our debt

obligations. Management considers its operating results without

this activity when evaluating its ongoing non-GAAP net income

(loss) performance and its adjusted EBITDA performance because it

is not believed by management to be reflective of our core

business, ongoing operating results or future outlook. These are

included in our total interest expense.

Capital Expenditures: consists of cash used for purchases

of property and equipment, net of proceeds from sale of property

and equipment, capitalized internal-use software and payments on

finance lease obligations, as reflected in our statement of cash

flows.

Depreciation and Other Amortization Expense: consists of

non-cash charges that can be affected by the timing and magnitude

of asset purchases. Management considers its operating results

without this activity when evaluating its ongoing adjusted EBITDA

performance because these charges are non-cash expenses that can be

affected by the timing and magnitude of asset purchases and may not

be reflective of our core business, ongoing operating results, or

future outlook.

Executive Transition Costs: consists of one-time cash and

non-cash charges recognized with respect to changes in our

executive’s employment status. Management considers its operating

results without this activity when evaluating its ongoing non-GAAP

net income (loss) performance and its adjusted EBITDA performance

because it is not believed by management to be reflective of our

core business, ongoing operating results or future outlook.

Free Cash Flow: calculated as net cash used in operating

activities less purchases of property and equipment, net of

proceeds from sale of property and equipment, principal payments of

finance lease liabilities, capitalized internal-use software costs

and advance payments made related to capital expenditures.

Management specifically identifies adjusting items in the

reconciliation of GAAP to non-GAAP financial measures. Management

considers non-GAAP free cash flow to be a profitability and

liquidity measure that provides useful information to management

and investors about the amount of cash generated by the business

that can possibly be used for investing in Fastly's business and

strengthening its balance sheet, but it is not intended to

represent the residual cash flow available for discretionary

expenditures. The presentation of non-GAAP free cash flow is also

not meant to be considered in isolation or as an alternative to

cash flows from operating activities as a measure of liquidity.

Impairment Expense: consists of charges related to our

long-lived assets. Management considers its operating results

without this activity when evaluating its ongoing non-GAAP net

income (loss) performance and its adjusted EBITDA performance

because it is not believed by management to be reflective of our

core business, ongoing operating results or future outlook.

Income Taxes: consists primarily of expenses recognized

related to state and foreign income taxes. Management considers its

operating results without this activity when evaluating its ongoing

adjusted EBITDA performance because it is not believed by

management to be reflective of our core business, ongoing operating

results or future outlook.

Interest Expense: consists primarily of interest expense

related to our debt instruments, including amortization of debt

discount and issuance costs. Management considers its operating

results without this activity when evaluating its ongoing non-GAAP

net income (loss) performance and its adjusted EBITDA performance

because it is not believed by management to be reflective of our

core business, ongoing operating results or future outlook.

Interest Income: consists primarily of interest income

related to our marketable securities. Management considers its

operating results without this activity when evaluating its ongoing

non-GAAP net income (loss) performance and its adjusted EBITDA

performance because it is not believed by management to be

reflective of our core business, ongoing operating results or

future outlook.

Net Gain on Debt Extinguishment: relates to net gain on

the partial repurchase of our outstanding convertible debt.

Management considers its operating results without this activity

when evaluating its ongoing non-GAAP net income (loss) performance

and its adjusted EBITDA performance because it is not believed by

management to be reflective of our core business, ongoing operating

results or future outlook.

Other Income (Expense), Net: consists primarily of

foreign currency transaction gains and losses. Management considers

its operating results without this activity when evaluating its

ongoing adjusted EBITDA performance because it is not believed by

management to be reflective of our core business, ongoing operating

results or future outlook.

Restructuring Charges: consists primarily of

employee-related severance and termination benefits related to

management's restructuring plan that resulted in a reduction in our

workforce. Management considers its operating results without this

activity when evaluating its ongoing non-GAAP net income (loss)

performance and its adjusted EBITDA performance because it is not

believed by management to be reflective of our core business,

ongoing operating results or future outlook.

Stock-Based Compensation Expense: consists of expenses

for stock options, restricted stock units, performance awards,

restricted stock awards and Employee Stock Purchase Plan ("ESPP")

under our equity incentive plans. Although stock-based compensation

is an expense for the Company and is viewed as a form of

compensation, management considers its operating results without

this activity when evaluating its ongoing non-GAAP net income

(loss) performance and its adjusted EBITDA performance, primarily

because it is a non-cash expense not believed by management to be

reflective of our core business, ongoing operating results, or

future outlook. In addition, the value of some stock-based

instruments is determined using formulas that incorporate

variables, such as market volatility, that are beyond our

control.

Management believes these non-GAAP financial measures and

adjusted EBITDA serve as useful metrics for our management and

investors because they enable a better understanding of the

long-term performance of our core business and facilitate

comparisons of our operating results over multiple periods and to

those of peer companies, and when taken together with the

corresponding GAAP financial measures and our reconciliations,

enhance investors' overall understanding of our current financial

performance.

In the financial tables below, the Company provides a

reconciliation of the most comparable GAAP financial measure to the

historical non-GAAP financial measures used in this press

release.

Key Metrics

1 Our number of customers is calculated based on the number of

separate identifiable operating entities with which we have a

billing relationship in good standing, from which we recognized

revenue during the current quarter. Our enterprise customers are

defined as those with annualized current quarter revenue in excess

of $100,000. This is calculated by taking the revenue for each

customer within the quarter and multiplying it by four.

2 We calculate LTM Net Retention Rate by dividing the total

customer revenue for the prior twelve-month period (“prior 12-month

period”) ending at the beginning of the last twelve-month period

(“LTM period”) minus revenue contraction due to billing decreases

or customer churn, plus revenue expansion due to billing increases

during the LTM period from the same customers by the total prior

12-month period revenue. We believe the LTM Net Retention Rate is

supplemental as it removes some of the volatility that is inherent

in a usage-based business model.

3 Remaining performance obligations include future committed

revenue for periods within current contracts with customers, as

well as deferred revenue arising from consideration invoiced for

which the related performance obligations have not been

satisfied.

4 Non-GAAP Net Income (Loss) per share is calculated as Non-GAAP

Net Income (Loss) divided by weighted average basic shares for

2024.

5 Assumes weighted average basic shares outstanding of 141.0

million in Q4 2024 and 137.5 million for the full year 2024.

Condensed Consolidated Statements of

Operations

(in thousands, except per share

amounts, unaudited)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Revenue

$

137,206

$

127,816

$

403,097

$

368,211

Cost of revenue(1)

62,466

61,730

182,222

177,657

Gross profit

74,740

66,086

220,875

190,554

Operating expenses:

Research and development(1)

31,884

39,068

105,238

113,920

Sales and marketing(1)

45,994

51,043

148,560

143,111

General and administrative(1)

27,173

30,001

87,245

84,651

Impairment expense

559

4,316

3,696

4,316

Restructuring charges

9,720

—

9,720

—

Total operating expenses

115,330

124,428

354,459

345,998

Loss from operations

(40,590

)

(58,342

)

(133,584

)

(155,444

)

Net gain on extinguishment of debt

—

—

—

36,760

Interest income

3,819

4,908

11,604

13,602

Interest expense

(473

)

(862

)

(1,516

)

(3,307

)

Other expense, net

(317

)

(16

)

(213

)

(1,069

)

Loss before income tax expense

(37,561

)

(54,312

)

(123,709

)

(109,458

)

Income tax expense (benefit)

455

(1

)

1,463

244

Net loss

$

(38,016

)

$

(54,311

)

$

(125,172

)

$

(109,702

)

Net loss per share attributable to

common stockholders, basic and diluted

$

(0.27

)

$

(0.42

)

$

(0.91

)

$

(0.86

)

Weighted-average shares used in

computing net loss per share attributable to common stockholders,

basic and diluted

139,237

129,873

137,097

127,735

__________

(1) Includes stock-based

compensation expense as follows:

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Cost of revenue

$

1,911

$

2,860

$

6,734

$

8,378

Research and development

7,378

12,122

25,684

35,808

Sales and marketing

7,113

9,061

22,014

25,643

General and administrative

8,614

11,670

28,553

31,027

Total

$

25,016

$

35,713

$

82,985

$

100,856

Reconciliation of GAAP to Non-GAAP

Financial Measures

(in thousands, unaudited)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Gross profit

GAAP gross profit

$

74,740

$

66,086

$

220,875

$

190,554

Stock-based compensation

1,911

2,860

6,734

8,378

Amortization of acquired intangible

assets

2,475

2,475

7,425

7,425

Non-GAAP gross profit

$

79,126

$

71,421

$

235,034

$

206,357

GAAP gross margin

54.5

%

51.7

%

54.8

%

51.8

%

Non-GAAP gross margin

57.7

%

55.9

%

58.3

%

56.0

%

Research and development

GAAP research and development

$

31,884

$

39,068

$

105,238

$

113,920

Stock-based compensation

(7,378

)

(10,426

)

(25,684

)

(34,112

)

Executive transition costs

—

(2,406

)

—

(2,406

)

Non-GAAP research and

development

$

24,506

$

26,236

$

79,554

$

77,402

Sales and marketing

GAAP sales and marketing

$

45,994

$

51,043

$

148,560

$

143,111

Stock-based compensation

(7,113

)

(9,061

)

(22,014

)

(25,643

)

Amortization of acquired intangible

assets

(2,300

)

(2,576

)

(6,901

)

(7,726

)

Non-GAAP sales and marketing

$

36,581

$

39,406

$

119,645

$

109,742

General and administrative

GAAP general and administrative

$

27,173

$

30,001

$

87,245

$

84,651

Stock-based compensation

(8,614

)

(11,670

)

(28,553

)

(31,027

)

Non-GAAP general and

administrative

$

18,559

$

18,331

$

58,692

$

53,624

Operating loss

GAAP operating loss

$

(40,590

)

$

(58,342

)

$

(133,584

)

$

(155,444

)

Stock-based compensation

25,016

34,017

82,985

99,160

Restructuring charges

9,720

—

9,720

—

Executive transition costs

—

2,406

—

2,406

Amortization of acquired intangible

assets

4,775

5,051

14,326

15,151

Impairment expense

559

4,316

3,696

4,316

Non-GAAP operating loss

$

(520

)

$

(12,552

)

$

(22,857

)

$

(34,411

)

Net loss

GAAP net loss

$

(38,016

)

$

(54,311

)

$

(125,172

)

$

(109,702

)

Stock-based compensation

25,016

34,017

82,985

99,160

Restructuring charges

9,720

—

9,720

—

Executive transition costs

—

2,406

—

2,406

Amortization of acquired intangible

assets

4,775

5,051

14,326

15,151

Net gain on extinguishment of debt

—

—

—

(36,760

)

Impairment expense

559

4,316

3,696

4,316

Amortization of debt discount and issuance

costs

358

502

1,061

2,021

Non-GAAP net income (loss)

$

2,412

$

(8,019

)

$

(13,384

)

$

(23,408

)

Non-GAAP net income (loss) per common

share — basic and diluted

$

0.02

$

(0.06

)

$

(0.10

)

$

(0.18

)

Weighted average basic common

shares

139,237

129,873

137,097

127,735

Weighted average diluted common

shares

143,415

129,873

137,097

127,735

Reconciliation of GAAP to Non-GAAP

Financial Measures

(in thousands, unaudited)

(continued)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Reconciliation of GAAP to Non-GAAP

diluted shares

GAAP diluted shares

139,237

129,873

137,097

127,735

Other dilutive equity awards

4,178

—

—

—

Non-GAAP diluted shares

143,415

129,873

137,097

127,735

Non-GAAP diluted net income (loss) per

share

$

0.02

$

(0.06

)

$

(0.10

)

$

(0.18

)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Adjusted EBITDA

GAAP net loss

$

(38,016

)

$

(54,311

)

$

(125,172

)

$

(109,702

)

Stock-based compensation

25,016

34,017

82,985

99,160

Restructuring charges

9,720

—

9,720

—

Executive transition costs

—

2,406

—

2,406

Net gain on extinguishment of debt

—

—

—

(36,760

)

Impairment expense

559

4,316

3,696

4,316

Depreciation and other amortization

13,781

13,202

40,624

38,412

Amortization of acquired intangible

assets

4,775

5,051

14,326

15,151

Amortization of debt discount and issuance

costs

358

502

1,061

2,021

Interest income

(3,819

)

(4,908

)

(11,604

)

(13,602

)

Interest expense

115

360

455

1,286

Other expense, net

317

16

213

1,069

Income tax expense (benefit)

455

(1

)

1,463

244

Adjusted EBITDA

$

13,261

$

650

$

17,767

$

4,001

Condensed Consolidated Balance

Sheets

(in thousands, unaudited)

As of

September 30, 2024

As of

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

217,514

$

107,921

Marketable securities, current

90,733

214,799

Accounts receivable, net of allowance for

credit losses

116,800

120,498

Prepaid expenses and other current

assets

28,011

20,455

Total current assets

453,058

463,673

Property and equipment, net

180,288

176,608

Operating lease right-of-use assets,

net

47,700

55,212

Goodwill

670,356

670,356

Intangible assets, net

47,776

62,475

Marketable securities, non-current

—

6,088

Other assets

72,576

90,779

Total assets

$

1,471,754

$

1,525,191

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

11,354

$

5,611

Accrued expenses

40,854

61,818

Finance lease liabilities, current

4,882

15,684

Operating lease liabilities, current

23,857

24,042

Other current liabilities

33,261

40,539

Total current liabilities

114,208

147,694

Long-term debt

344,498

343,507

Finance lease liabilities, non-current

—

1,602

Operating lease liabilities,

non-current

40,565

48,484

Other long-term liabilities

3,029

4,416

Total liabilities

502,300

545,703

Stockholders’ equity:

Common stock

3

3

Additional paid-in capital

1,929,397

1,815,245

Accumulated other comprehensive loss

(22

)

(1,008

)

Accumulated deficit

(959,924

)

(834,752

)

Total stockholders’ equity

969,454

979,488

Total liabilities and stockholders’

equity

$

1,471,754

$

1,525,191

Condensed Consolidated Statements of

Cash Flows

(in thousands, unaudited)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Cash flows from operating

activities:

Net loss

$

(38,016

)

$

(54,311

)

$

(125,172

)

$

(109,702

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation expense

13,656

13,055

40,251

38,015

Amortization of intangible assets

4,900

5,175

14,699

15,525

Non-cash lease expense

5,463

5,464

16,819

17,227

Amortization of debt discount and issuance

costs

358

501

1,061

2,020

Amortization of deferred contract

costs

4,773

4,082

13,877

11,253

Stock-based compensation

25,016

35,713

82,985

100,856

Deferred income taxes

339

—

900

—

Provision for credit losses

1,054

211

2,400

1,311

(Gain) loss on disposals of property and

equipment

—

(42

)

444

505

Amortization of premiums (discounts) on

investments

(1,064

)

(403

)

(3,466

)

344

Impairment of operating lease right-of-use

assets

371

401

371

588

Impairment expense

559

4,316

3,696

4,316

Net gain on extinguishment of debt

—

—

—

(36,760

)

Other adjustments

520

71

83

(257

)

Changes in operating assets and

liabilities:

Accounts receivable

(3,976

)

(20,538

)

1,298

(10,355

)

Prepaid expenses and other current

assets

(2,589

)

5,019

(7,420

)

4,602

Other assets

(2,705

)

(4,286

)

(7,729

)

(16,269

)

Accounts payable

4,754

314

4,514

1,258

Accrued expenses

2,707

340

(4,142

)

(6,253

)

Operating lease liabilities

(7,329

)

(4,505

)

(19,341

)

(16,937

)

Other liabilities

(3,789

)

1,033

(4,942

)

6,452

Net cash provided by (used in)

operating activities

5,002

(8,390

)

11,186

7,739

Cash flows from investing

activities:

Purchases of marketable securities

(37,902

)

(73,091

)

(155,099

)

(73,091

)

Sales of marketable securities

—

1

—

775

Maturities of marketable securities

113,032

86,030

289,709

428,125

Advance payment for purchase of property

and equipment

—

—

(790

)

—

Purchases of property and equipment

(1,996

)

(325

)

(5,361

)

(8,283

)

Proceeds from sale of property and

equipment

—

13

24

49

Capitalized internal-use software

(6,818

)

(4,951

)

(20,492

)

(15,390

)

Net cash provided by investing

activities

66,316

7,677

107,991

332,185

Cash flows from financing

activities:

Cash paid for debt extinguishment

—

—

—

(196,934

)

Repayments of finance lease

liabilities

(3,296

)

(6,041

)

(12,404

)

(21,243

)

Payment of deferred consideration for

business acquisitions

—

—

(3,771

)

(4,393

)

Proceeds from exercise of vested stock

options

19

1,137

310

2,008

Proceeds from employee stock purchase

plan

2,168

2,222

6,083

7,009

Net cash used in financing

activities

(1,109

)

(2,682

)

(9,782

)

(213,553

)

Effects of exchange rate changes on cash,

cash equivalents, and restricted cash

109

(47

)

48

538

Net increase (decrease) in cash, cash

equivalents, and restricted cash

70,318

(3,442

)

109,443

126,909

Cash, cash equivalents, and restricted

cash at beginning of period

147,196

273,892

108,071

143,541

Cash, cash equivalents, and restricted

cash at end of period

217,514

270,450

217,514

270,450

Reconciliation of cash, cash

equivalents, and restricted cash as shown in the statements of cash

flows:

Cash and cash equivalents

217,514

270,300

217,514

270,300

Restricted cash, current

—

150

—

150

Total cash, cash equivalents, and

restricted cash

$

217,514

$

270,450

$

217,514

$

270,450

Free Cash Flow

(in thousands, unaudited)

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Net cash provided by (used in) operating

activities

$

5,002

$

(8,390

)

$

11,186

$

7,739

Capital expenditures(1)

(12,110

)

(11,304

)

(38,233

)

(44,867

)

Advance payment for purchase of property

and equipment(2)

—

—

(790

)

—

Free Cash Flow

$

(7,108

)

$

(19,694

)

$

(27,837

)

$

(37,128

)

__________

(1)

Capital expenditures are defined

as cash used for purchases of property and equipment, net of

proceeds from sale of property and equipment, capitalized

internal-use software and payments on finance lease obligations, as

reflected in our statement of cash flows.

(2)

In the nine months ended

September 30, 2024, we received $11.9 million of capital equipment

that was prepaid prior to the current quarter, as reflected in the

supplemental disclosure of our statement of cash flows.

Source: Fastly, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106084057/en/

Investor Contact Vernon Essi, Jr. ir@fastly.com

Media Contact Spring Harris press@fastly.com

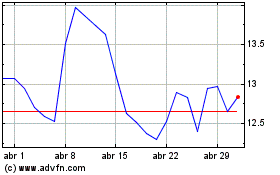

Fastly (NYSE:FSLY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Fastly (NYSE:FSLY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024